Summary:

- Disney’s financials show low levels of profitability and efficiency, with margins and profitability metrics still far from pre-pandemic levels.

- The company’s streaming business, Disney+, is accumulating losses but is expected to become profitable in Q4 of fiscal 2024.

- Separating ESPN from the rest of the platforms may attract more sports-focused subscribers but could lead to cannibalization and a decline in cable revenues.

Razvan

Introduction

I wanted to check on Disney’s (NYSE:DIS) performance over the last full year to see how its operations have progressed and what’s in store going forward. The company is nowhere near its former glory days, and it will take some time before it sees those numbers again, but it is getting there.

Since the last time I covered the company, the share price has outperformed the S&P 500 (SPY), which makes me think that many investors are hoping that the company’s efficiency and profitability will return sooner rather than later, however, I need proof and not hope that things are turning around. Therefore, I am keeping my hold rating until I get proof of substantial improvements to the bottom line.

Briefly on Financials

As of Q1 ´24, Disney had around $7.2B in cash and equivalents against $41B in long-term debt. From the year 2020, the company started to chip away at the debt levels slowly, but it is still quite a lot, however, I don’t think it’s an issue. The latest quarter shows EBIT to be around $2.9B while net interest expense stood at $246m, meaning, the company’s interest coverage ratio is around 11x. Many analysts deem a 2x to be healthy, however, I like to see at least a 5x ratio. This allows for major downturns in operations and still be able to cover its debt obligations. It is safe to say, DIS is at no risk of insolvency. Let’s look at how the company progressed throughout 2023. Starting with margins.

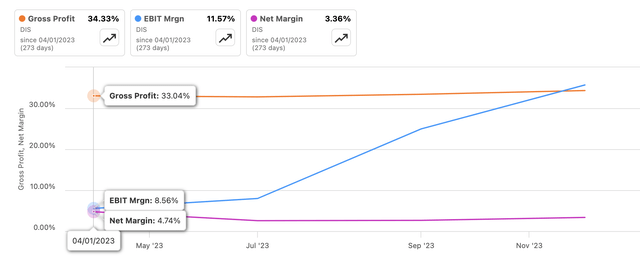

The company has been stagnating at very low levels of profitability ever since the pandemic. In the last year, margins have been a bit mixed, with gross and EBIT margins improving, while the bottom line has worsened. So, the company still has a way to go before returning to its glory days of double-digit bottom-line margins. Will it ever? We’ll dig deeper in the next section.

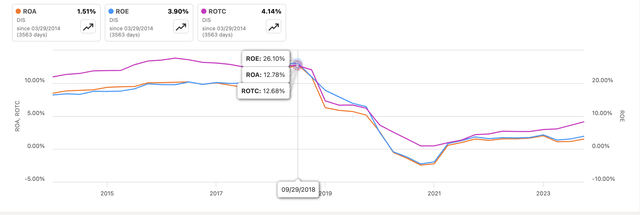

The same can be seen in the company’s profitability and efficiency metrics like ROA and ROE. These have been very low due to low net margins. These are also on a bit of a rise, but nowhere near where they used to be, and that is a problem. The company is not as efficient and profitable as I would like it to be, especially when we saw the glory days about 6 years ago. Furthermore, the company’s ROTC has been abysmal too, which is showing some kind of recovery but nowhere near where I would like it to be.

Efficiency and Profitability (SA)

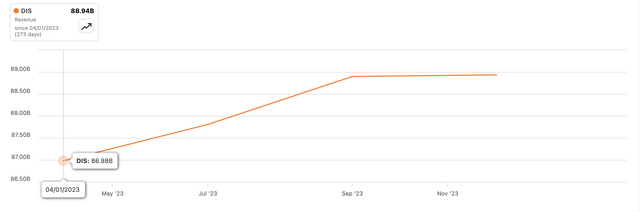

In terms of revenues, there is hardly any growth with better numbers achieved during the holiday season, and if we compare it to the previous holiday season, the company was flat. Disney needs to find a way to rejuvenate its top line because it is not looking good so far.

Overall, it seems to be taking much longer for the company to recover from the pandemic lows, while other companies already surpassed their pre-pandemic levels. And the question is will it ever return to those days? There’s a lot of work ahead for it and it’s going to be tough.

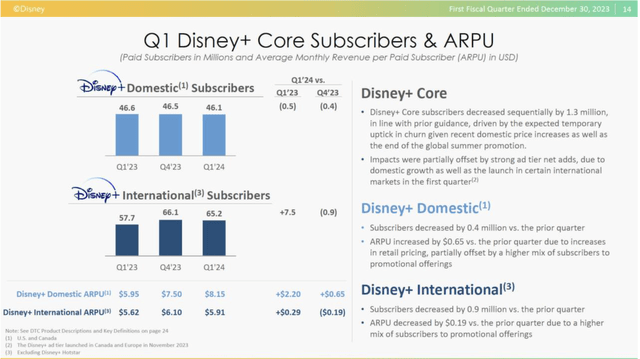

Comments on the Outlook

Ever since the company entered the streaming wars, it has been losing cash every quarter. The company is not giving up on it and will try hard to turn it around. This is a very tough business to break into, and while the company has a lot of great IPs, it may not be enough to turn it around just yet, especially if the IPs potential is being squandered and mismanaged. Disney+ has been accumulating losses ever since its inception, however, the company believes that heavy investment upfront will end up being beneficial and will eventually become a profitable business segment. This upfront investment is necessary to bring in a higher subscriber count. Domestically, this has been stagnating for a while and even saw declines in subscriber counts, while internationally, the company saw decent growth y/y. The lower subscriber count domestically was offset by higher average revenue per user or ARPU as the company increased its pricing and started to roll out ad-supported tiers in Europe and Canada.

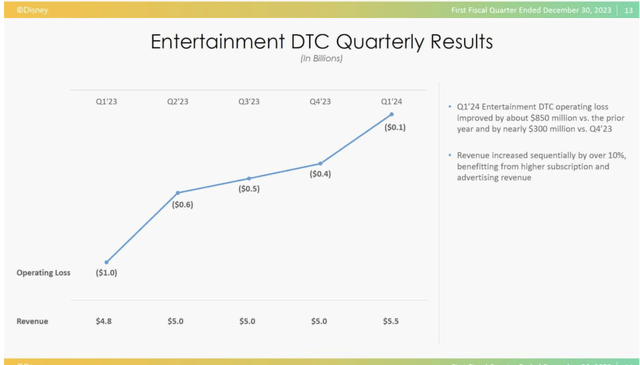

It is necessary to continue to invest heavily in the streaming platforms as it is too late to focus on anything else at this point. The company has already put in too many resources to put them on the back burner. It will eventually pay off and may lead to an increase in margins, but for now, it is too early to tell when will these platforms become profitable, however, we can see that the total operating loss on entertainment DTC has been trending upward and the losses are becoming minimal, which means the company may see positive operating income next quarter, as the new CFO Hugh Johnson says he expects streaming business to reach profitability in Q4 of fiscal 2024 (transcript).

The company will start to offer ESPN separately from the rest of the platforms sometime in 2025. I think this would be a good move but may also come with some drawbacks.

ESPN has a strong brand identity, which will attract many sports fans who are only looking to catch a couple of games a week without paying for the extra stuff that comes with right now. These fans according to research (although slightly outdated), would be willing to pay higher subscription fees if that means they would be able to get closer to their teams, and it has been observed that fans cancel the subscriptions because they “don’t see the value” and cite as price being the primary reason. This would be able to bring in the cord-cutters who are looking for a more affordable alternative to the cable. A separate ESPN platform would be able to accommodate more different sports and teams, which would be able to bring a lot more loyal subscriber base, and even be highly profitable if it works out.

On the other hand, the company may miss out on the opportunity to bundle ESPN with its other offerings, which may have attracted more subscribers, but seeing that the subscriber count has stagnated domestically, I think a separation would be a great way to attract more subscribers who are purely all about sports.

Cannibalization may occur which would bring down the company’s cable revenues as these people will be switching to the new ESPN platform.

I still think it is a good idea to separate the offering, and time will tell if it is going to be successful in attracting more subscribers in the end.

In terms of the company’s most profitable operating segment, the Experiences and Parks, there is very little to be excited about in my opinion. There aren’t any major new parks on the horizon that would attract better crowds, however, this segment of the company has been doing very well since the pandemic, and if it can continue to perform as it has, this will be a continual cash cow for the company, and then eventually the other segments will start to bear fruit after the heavy investments.

Overall, I expect the bottom line to keep improving once the streaming business starts to contribute to it, while a constant release of minor experiences in the current parks should bring a more stable cash flow, so I see a lot more good than bad right now. I would like to see how these improvements will turn to a much higher bottom line because as I said earlier, it is nowhere near where it used to be.

Valuation

It’s been a while since I did a model for DIS, so I went ahead and updated the company’s financials. This also allows me to update my assumptions once again to see how I feel about the company’s outlook.

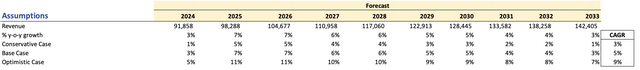

For revenues, analysts aren’t too optimistic about the company’s rejuvenation of the top line, and I tend to agree with them, mainly because the most recent reports are not showing spectacular growth in any of the company’s business segments. Therefore, I went with around 5% CAGR over the next decade, and to cover all my bases, I went ahead and modeled a more optimistic case, and a more conservative case. Below are those estimates, with their respective CAGRs.

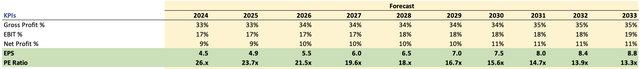

For margins and EPS, back in the good old days, the company’s gross margins were around 45%, EBIT margins reached 26%, and net margins were as high as 21%, so me being a more conservative person when it comes to the company’s potential, I decided that the company will see very little improvement in margins across the board. Margins across the board will improve by around 200bps, which I think is very conservative. Below are those estimates.

Margins and EPS assumptions (Author)

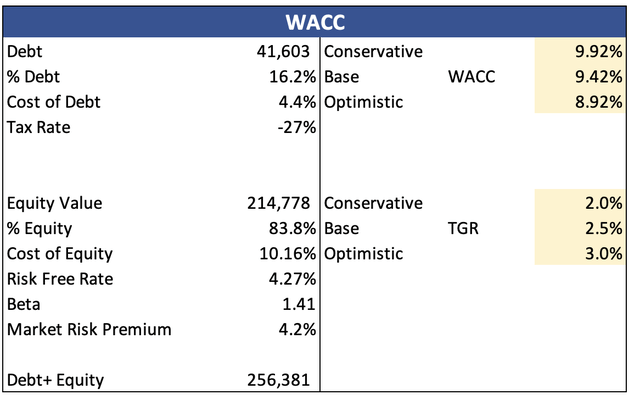

For the DCF model, I went with the company’s WACC as my discount rate, it is close to 10% currently as you can see in the image below, which is what I tend to use for all my models, and 2.5% terminal growth rate.

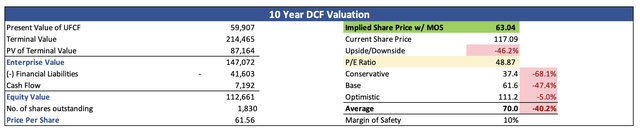

Furthermore, I think the company’s operational performance and balance sheet are in a good spot, therefore I added only another 10% discount to the final intrinsic value calculation. With that said, Disney’s intrinsic value is around $63 a share, which means the company is trading at a large premium to its fair value.

Closing Comments

So, it looks like the company is still not a good buy right now. Why is my model showing such a low price for the company? The reason is that my model only assumes a slight improvement in efficiency and profitability and the company’s high debt figure weighs its valuation down considerably. I couldn’t model that the company will be able to achieve the profitability it had just 6 years ago because I just don’t see this happening right now. The margins have been stagnating around these levels ever since the bottom of the pandemic lows. There’s no indication so far that these will start to trend up any time soon. I would say once the streaming business starts to contribute properly, we will see what kind of margins it will get, but for now, it is too early to tell.

The company’s current share price seems to be pricing in the company’s ability to return to those amazing margins, but I don’t invest in hopes, I would like to see these start to improve already to be convinced that Disney will return to its former glory days. There is still a lot of work to be done and I will continue to follow its performance over time, and once I see some positive trends, I will re-assess my model to reflect those news accordingly. For now, I will continue to be on the fence.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.