Summary:

- Nelson Peltz’s Trian Partners has recently launched a campaign to win a seat on The Walt Disney Company’s board.

- Trian alleges poor management and cost discipline at the media giant.

- We dive into Trian’s slide deck and go through their arguments.

- While the outcome is uncertain, Trian has a strong track record of turning around large companies.

FrozenShutter

Problems At The Top

For being the happiest place on Earth, The Walt Disney Company (NYSE:DIS) attracts an unusual amount of drama when it comes to the C-Suite. From the recent, high-profile dismissal of the short-tenured CEO Bob Chapek, to the return of Bob Iger and the very uncertain future the company faces in terms of long-term executive leadership, and the just-launched proxy battle last week from Trian, Disney appears to be at a major crossroads.

We should remind investors that C-suite succession planning is something that Disney has struggled with historically. As recounted by James B. Stewart in his excellent book, “Disney War,” the succession (or ouster, depending on your point of view) of Michael Eisner and installation of Bob Iger was rife with dramatic infighting at the company’s highest ranks. When it was time for the company to find a replacement for Iger, Iger did not exactly go quietly into the night. He reportedly drove around with a license plate reading “Is there life after Disney?” Even when the reins were formally turned over to Bob Chapek, Iger’s shadow loomed as a presence on the board.

Chapek’s short tenure also landed the company in hot water. Chapek ran afoul of Florida Governor Ron DeSantis with his response to the passage of Florida’s so-called “Don’t Say Gay” bill. His series of waffling responses also angered Disney employees. He was a man, it seemed, who could please no one, and the controversy ended with Disney losing its protected status as a near-sovereign state within Florida.

So it is unsurprising that Disney, with its long, storied history of executive dysfunction, has attracted the attention of activist investors. What is most surprising, we think, is the fact that it has taken so long to happen.

Enter The Activists

The particular activist that Disney has attracted is Trian Partners, a particularly formidable activist fund led by Nelson Peltz. This, we believe, is an exceptionally positive development for shareholders.

While there are several activist investors that generate large headlines for their aggressive, brawling tactics who are unafraid to drag boardrooms into street fights (think Paul Singer of Elliot), Trian generally takes a different approach, preferring to work with boards when possible. Trian is also uniquely suited for the sheer size of Disney–its previous successful activist battles include such enormous companies as Procter & Gamble (PG), Heinz (KHC), and DuPont (DD).

We note the significance of these previous campaigns because there are several other successful activists (think Jeff Smith of Starboard Value) who, if they were to take on Disney, would be taking on something a bit larger than ever before attempted. In summation, we view Trian as something of an elephant hunter among activist investors–and Disney seems to us (and them) a particularly attractive elephant.

Trian is looking for a board seat for its CEO, Nelson Peltz. Disney has outright rejected this idea, and we now have the stage set for a proxy battle. Trian has released an in-depth slide deck outlining its case for how it would help Disney.

A Trio of Concerns

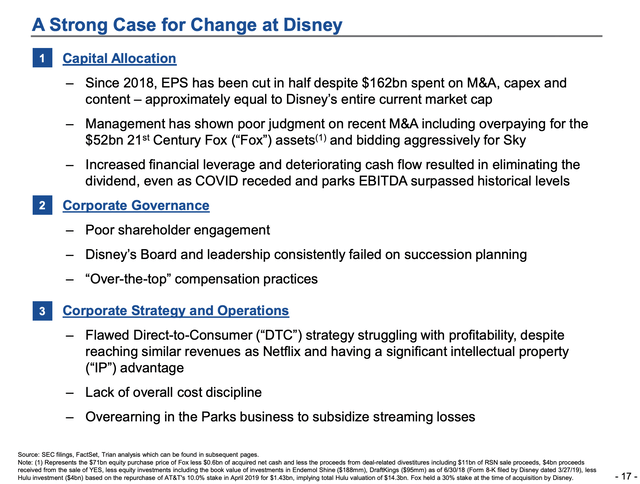

Trian alleges that there are three core areas where Disney would benefit from increased board intervention:

The first point of capital allocation is a shot across the bow at the C-Suite, whose job is to, well, propose major capital allocations to the board. The principal argument, made in detail in the deck, is that Disney’s leadership has consistently over-bid for media properties which, when combined with deteriorating macro conditions, have had a negative effect on cash flow and contributed meaningfully to the elimination of Disney’s 57-year dividend, which was cut in 2020 and seems unlikely to return anytime soon with the company’s current balance sheet condition.

Since we’ve already covered the second point in some detail (the company’s inability to execute succession plans), let’s turn our attention to the third point and dive into a part of the business that Trian believes is being particularly poorly run–Disney+.

The Stream(ing service) Runs Dry

Part of Trian’s core contention is that Disney lacks, for lack of a better term, good financial business sense. When Disney+ launched, many analysts believed that the streaming service would be a Netflix-killer. After all, Disney’s entertainment catalog is second-to-none, and it seemed to be a natural place for Disney to launch new content, as well as be a suitable 21st century replacement for Disney’s outdated ‘vault’ release system where certain movies were made available for sale via DVD.

The reality, though, has not been as rosy.

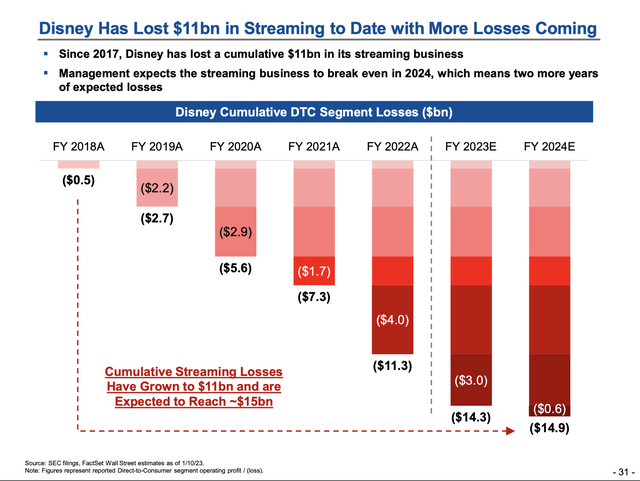

Disney’s Streaming Losses (Trian)

As Trian points out, Disney has lost $11 billion on its streaming business. On the face of it, this number seems exceptionally absurd. Disney, after all, is no media upstart–it is arguably a top-five most recognized brand worldwide, with a built-in fanbase of billions and media properties that are beloved.

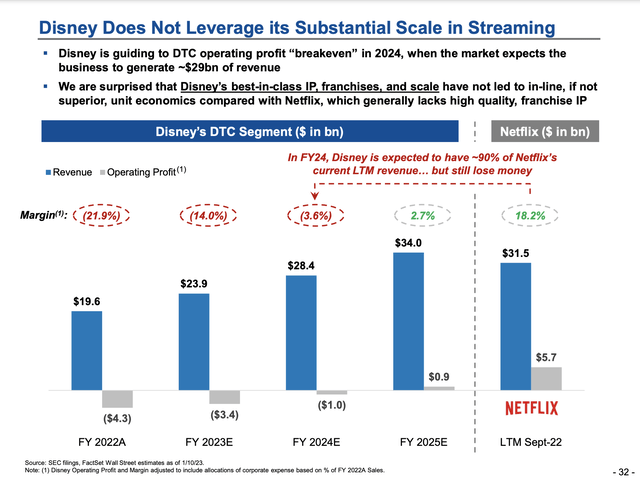

Disney Streaming vs. Netflix (Trian)

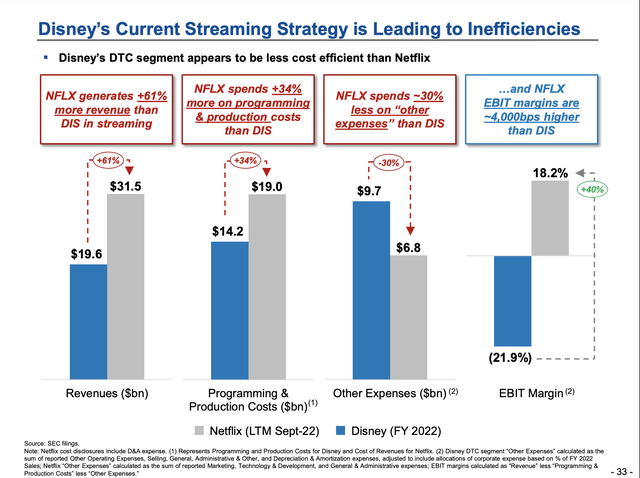

Trian finds this lack of success just as puzzling, and provides a start comparison between Disney and Netflix (NFLX). Netflix, we will remind investors, has virtually none of the built-in advantages for streaming that Disney has. It has to purchase its own content, has no historical vault of titles to draw from except what it buys, and as a result is in a quarter-to-quarter knife fight with other streaming services for dominance. Despite this, Disney+ has worse unit economics than Netflix.

Disney’s management does not expect that Disney+ will turn a profit until FY25. In that year they expect to pull in $34 billion in revenue and produce a profit of… $900 million. Trian compares this number to Netflix’s LTM numbers in which the streaming service has been able to generate $5.7 billion in profit against $31.5 billion in revenue. This begs the question–why the discrepancy?

Trian’s answer is that Disney is far less cost-efficient than its upstart rival. Netflix, by spending 30% less on expenses other than production costs, appears to run a much more lean operation. Netflix also invests 34% more than Disney does into its programming budget–although we admit this is to be expected given the fact that Netflix has no historical, cost-free content to draw from.

Regardless, the end result speaks for itself in that Netflix has EBIT margins 40% higher than Disney+. This tells the story of a company that lacks the ability to rein in its spending and to allocate capital effectively. The true cost of these inefficiencies are, sadly, paid by shareholders.

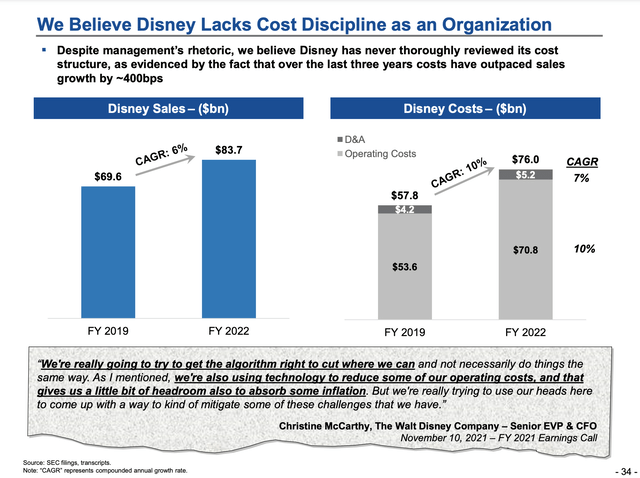

Trian points this out in the following slide, alleging that management has paid significant lip service to cost-cutting, but seemingly has failed to do so. While sales rose from FY19 to FY22 at a 6% CAGR, costs rose comparatively by 10% CAGR. Certainly, it can be said, in the last year inflation has played a part in rising costs. In Disney’s case, however, the costs that have risen appear to be largely within its control. Disney is, after all, notoriously stingy with labor compensation in its cash-cow parks. Tales of workers sleeping in cars and living in motels are not uncommon. It was recently reported that most Disney theme park workers wouldn’t even be able to afford admission at the very parks where they work. It seems unconvincing then that Disney’s rapidly rising costs could be contributed to labor.

The Shareholders Pay The Price

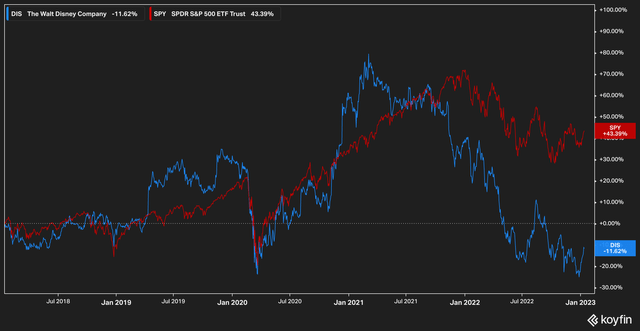

Disney, as Trian points out, has meaningfully underperformed against its peers and the S&P 500 Index (SPY) over multiple time horizons. Here, for reference, is Disney’s 5-year performance against the S&P.

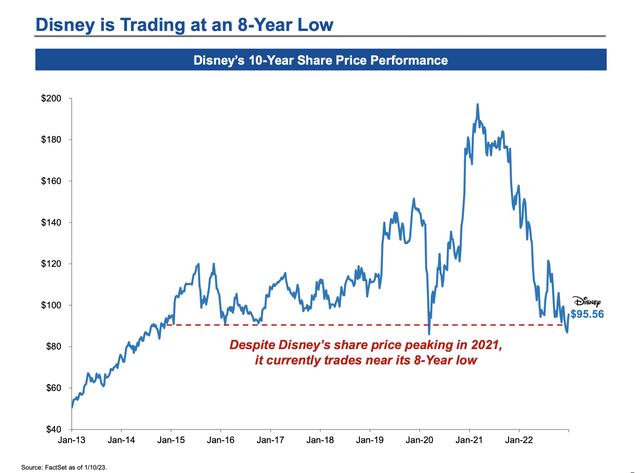

In a five-year time frame, SPY has returned 43% to Disney’s -11%. Other time frames reflect similar stories. This performance, Trian argues, is directly correlated to less than stellar management. Companies with reputations and assets such as Disney’s, they argue, should not make round trips in price like the one seen below:

This performance reflects shareholder disillusionment, and calls for a change, says Trian.

The Bottom Line

While we cannot predict whether or not Trian will be successful in its proxy battle with Disney, we can say that the activist appears to be constructive in its approach. The fund has stated several times that it wishes to work with Bob Iger in re-building the company and its credibility with investors, and that it has no intention of breaking up the company or enacting short-term fixes that will juice the stock price to the long-term detriment of investors.

We think these overtures are sincere. Trian’s reputation for taking on large companies and enacting meaningful, positive changes is not in dispute. The fund’s history of working with boards and producing results that are pleasing to shareholders is solid.

If Trian wins this fight, we believe that Peltz is likely to:

- Push for renewed cost discipline initiatives within Disney+.

- Review costs associated with the parks business (the company has recently announced ticket price reductions).

- Work with management to re-establish the dividend once cash flows are stabilized and historical debt ratios are restored.

We believe it is likely that Peltz will win his battle, despite the company’s overtures to investors to vote against him. Given that the company–and board–has already burned through so much goodwill with shareholders, it seems as though the odds are stacked against them, at least at this point in time.

Market participants also seem pleased at Peltz’s prospects–the stock has jumped 4% since Trian’s announcement. We believe that Disney, with its low current valuation and potential board shakeup on the horizon, presents an interesting scenario for long investors, and bears a close eye. We, along with the rest of the market, will be watching intently.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Disclaimer The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities. Before buying or selling any stock, you should do your own research and reach your own conclusion or consult a financial advisor. Investing includes risks, including loss of principal.