Summary:

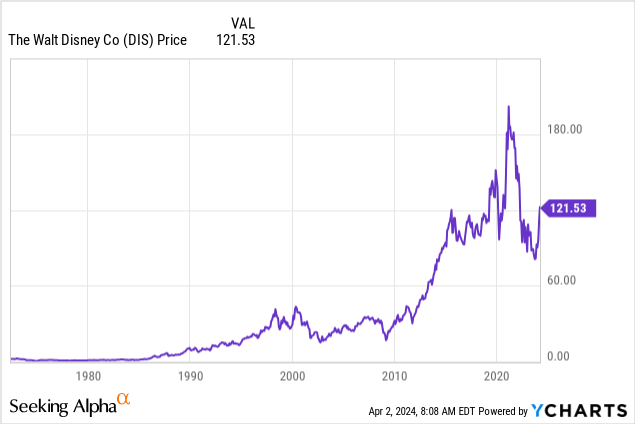

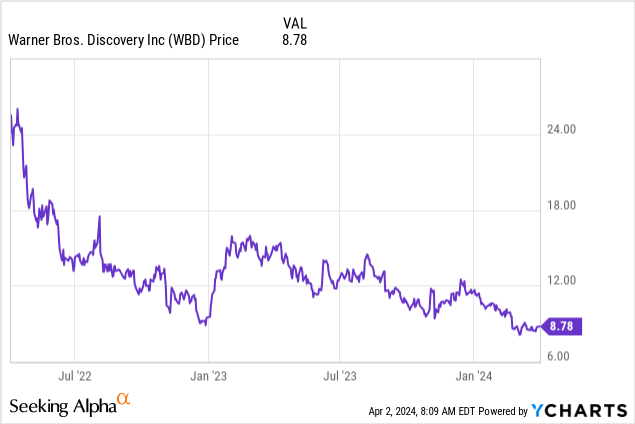

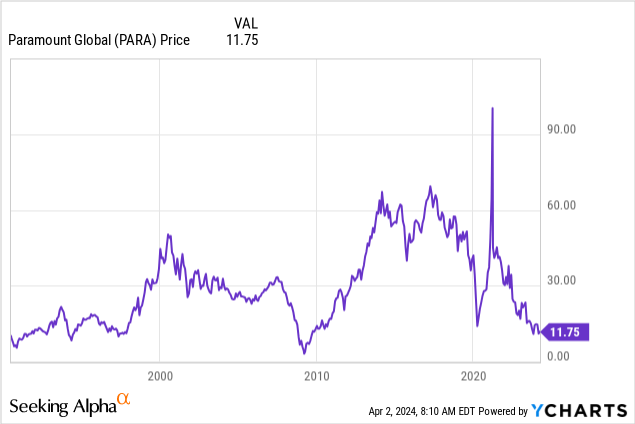

- Investors remain skeptical of the strategies implemented by media CEOs to improve earnings.

- I suggest that media conglomerates should value their business units and consider spinning off or selling parts to reduce debt.

- Specific questions are posed to CEOs of Disney, Warner Brothers Discovery, and Paramount regarding their strategies and financial outlook.

PorAbove: Team talk is fine, but as always, the buck stops at the desk of the CEO on major strategic decisions. Klaus Vedfelt

If there’s one palpable reality that investors can rely on in valuing stocks in the sector today, it’s the certain failure to date of the band aids that top managements have applied to the illness of the media sector: True believers who buy the c-suite mantra that ad support, bundling and cost cutting will ultimately prove to deliver the fat earnings of early sector promise. Skepticism still prevails among many investors, and for good reason.

Let’s stipulate first that we aim these questions to management due to what we believe may have long been missing in too many quarterly earnings call transcripts we have followed.

What every investor needs to know that needs clarity

I begin with illuminating witticism from golden age movie gangster/soldier of fortune actor George Raft (1901-1980). The great movie icon ended his career as a greeter at a Havana casino pre-Castro. In 1957 a reporter chanced upon him at the bar slamming bourbons between hosting sessions.

It’s instructive.

Reporter: George, you made millions. What happened to your money all those years?

Raft: I spent it on women, gambling and liquor… and wasted all the rest.

It seems to me that as of now, you’re spending time and money on indulgences which in effect kick the cans down the road until such times as they may find a new pathway that restores shareholder value at a faster pace.

For openers – managements seem to have clung to the same recipe for better results that appear to be old wine in new bottles. Investors are owed more. CEOs believe in their fixes — it’s to be hoped. But many investors may not be convinced yet by takeaways from earnings transcript Q&As.

The RXs offered we see: Shave production costs on IP, raise streaming prices, go to ad supported, make movies “our viewers will love,” pray for a staunching of rampant cord cutting, invest in parks, deep dive into digital, bundle, re-bundle, buy and sell content, keep costs down.

All this is the equivalent of Raft telling the reporter that his millions were joyfully spent having a good time and to hell with prudence. Hypnotizing oneself that the nostrums presented have thus far shared with investors will be bought as viable but seem to be dead-end streets. That’s because they seem to offer same old same old Captain Obvious kind of solutions.

Contented fan sector stocks continue to cheer lead. That’s fine and expected. Our thoughts here are with those who may differ. They may be numerous and inclined to agree. They deserve more. Some of them will show up on the Peltz side of the proxy vote. Win or lose, it’s a barometer.

Our modest proposal: Recognize the truth: Parts of DIS, WBD and PARA are definitely worth more than the whole.

Today’s media giants are much like the Austro-Hungarian Empire pre-World War I. A vast, diversity of multi-lingual cultures and ethnicities that no longer mean much in a changed world. They seem like empires that have lost whatever reason it may have had to exist to begin with. While media conglomerates today have related businesses within their portfolios, they fail the test of true synergy if it doesn’t show up in a stronger recovery of share prices. The assumption that a customer for one vertical is automatically one for another long longer applies with such a proliferation of choices.

Managements need to seriously value its business units and either spin off or sell the parts, use the cash windfall to massively reduce debt and apply to building value into the remaining verticals. And make a commitment to keep dividends as a key priority for shareholders to maintain shareholder value.

Disney: Questions for CEO Iger

How could revolving door successor Robert Chapek have lived up to the gushing glows of the press releases on his appointment? And then swiftly become the poster child of widespread corporate ills? How was he vetted and what impressed the board about him? What does this tell us about the succession planning process at DIS?

How does ESPN and ESPNBet fit with The Little Mermaid, Disney parks, Mickey Mouse t-shirts, odd cable sites and the ABC networks servicing low budget residual viewers as contrasted by streamer payments monthly?

More specifics on what Disney intends to spend on parks considering that inflation and the response to its pressures has made a trip to parks available for mostly the elite? It’s now a business that depends on families to piggy bank their nickels and dimes over time to save up for a once in a lifetime treat for the kids that could cost $7,000. That’s money these days needed to keep food on the table, the mortgage paid, and gas in the car to go to work. Will the expansion include budget attractions for the masses?

Or is the DIS parks customer now a money no object family, which is a considerably smaller, addressable market? So how does that square with a $60b capex expense ahead? Spend more money to attract a smaller audience does not appear to pass a logic test. The failure of the Star Wars hotel should echo as it clearly made poor assumptions about pricing for families.

Debt reduction moves to date are to be respected, of course. But this is not winning a war by applying a 75% solution. The only way to win is by 100% which is to generate cash by spin off or sale, reduce it and use the money to wipe out at least 40% to 50% of the debt in one fell swoop, otherwise the current debt load will continue to drain FCF that could be used far more efficiently or to add shareholder value by increasing dividends or investing in new IP. Clarity on this big of an investment is in order now.

The financial construct of the studio in an era where theatrical grosses may never recover to a pre-COVID level is flawed. More movies made for less money? Fewer movies made for more money?

We have not seen specific dollar values added to the business by Disney’s pursuit of certain content to the extent that virtue signaling may have its place, but it appears not to be a place on the bottom line.

Questions to David Zaslav of Warner Bros. Discovery

Due to the AT&T mess, the company inherited too many marginal cable networks still in the portfolio. Yet if offered as units, they could find viability to companies anxious to build content on a smaller scale.

WBD lucked out with Barbie. Congrats. But there’s no Barbie manufacturing machine in operation anywhere in the entertainment business. We ask the same question we did to Iger: What’s WBD’s realistic take on the studio business going forward?

Canceling product for tax loss values was a smart move. Are there any more possibilities here of moving product in progress into the tax loss dumper ahead? Or is that strategy no longer available for IP under development?

One question for Paramount’s Shari Redstone

It would appear that the company and its advisors have seen the very big writing on the wall that some peers have yet to see. What lies ahead for PARA is a scale down or a dead end street. Our question: What’s taking so long to find a price that fits a best-case under the circumstances for a deal?

Conclusion

We invite readers of this post to add their questions in the comments section below or challenge any assumptions made in this article. We have attempted to avoid some of the rabbit hole dives we have seen by some analysts on the values or ills of the sector stocks. Our attempt here tries to respect the attention spans of readers by posing these key questions only.

We acknowledge there are many questions investors are entitled to have answers to that do not really emerge in earnings calls. We have read earnings transcripts of these companies for three years for each quarter. Our conclusion: Very little feet is held to the fire during Q&A. That’s understandable given that analysts do need to behave to preserve access.

We share these questions out of observations, not judgments. Those final decisions lie with Mr. Market.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

The House Edge is widely recognized as the only marketplace service on the casino/gaming/online sports betting sectors, researched, written and available to SA readers by Howard Jay Klein, a 30 year c-suite veteran of the gaming industry. His inside out information and on the ground know how benefits from this unique perspective and his network of friends, former associates and colleagues in the industry contribute to a viewpoint has consistently produced superior returns. The House Edge consistently outperforms many standard analyst guidance with top returns.

According to TipRanks, Klein rates among the top 100 gaming analysts out of a global total of 10,000.