Summary:

- The return to The Walt Disney Company of former executives Kevin Mayer and Tom Staggs has sparked interest in the stock, but their presence alone won’t transform the company.

- Disney needs to move away from its old business model and find new sources of content to drive growth.

- Investors must consider whether they want to be associated with the current management and board, and whether they believe in their ability to navigate the challenges facing the industry.

JHVEPhoto

Stipulation: The two former The Walt Disney Company (NYSE:DIS) guys recruited by CEO Bob Iger to help him bootstrap a business recovery has triggered a bit of a spike in the stock. That reveals just how badly Mr. Market wants to see something happen here to move shares up. Nothing against the two firemen. They are fine guys, but their possible RXs won’t transform anything. What Disney needs is to be vaccinated against its self- created case of flu.

DIS earnings call: August 9th

For much too long, Disney has been in the old wine in new bottles business rather than prospecting for new veins of content gold. Far from a finger snap, change is tough yet near enough for fresh eyes and open minds to wrestle with and make a difference. There is still a lot undone.

As the next Disney earnings call approaches, Mr. Market’s panoply of sentiment bubbles in the cauldron. There are those who continue to see recovery resulting from cost cuts and restructuring of business units. Then there are also those who see any return to prior highs for the shares as a fool’s errand. Now we add those believers who find a ray of sunshine in the news of the reappearance of former Disney executives Kevin Mayer and Tom Staggs as newsworthy of buying into the stock now.

It’s all understandable. Beneath it is the conundrum investors must consider before decisions to buy, sell or hold: On the one hand, Disney should still have the creative chops to reorient its crumbling fortress of verticals to command a healthy recovery of product and subsequently return the stock to new highs. The fundamental question is: if Disney did not exist, would we need to invent it? Once true, no longer the case as the entertainment market has so balkanized over time. The entire industry is hostage to fortune as a dizzying confluence of new consumer habits and technology beset corporate decision makers as they try to figure it all out.

That prompts us to believe that Disney will endure long term for certain, but it can no longer can dominate on its past magic alone. In both children’s and adult entertainment, it faces the same starting point in the chase for eyeballs as its key competitors.

Yet on the other hand, there are serious questions as to whether the current management and board can fight their way out of the sector mess no matter who comes on the payroll. And, in the end, investors must answer this question:

Do you want to be in business with the current occupants of the c-suite, including the fire brigade by two good soldiers named Mayer and Staggs? It’s no easy question for investors.

Above: This man, a single-minded genius, sensed the end of 15-minute Mickey Mouse and Friends movie cartoons and reinvented the concept by betting the house on a full length Snow White in 1938. Again, in 1955, he made it all come alive with Disneyland. He acted before the model was broken.

You can find hope all over the place if you sift through the numbers that comprise the current status:

TTM Snapshot

Consensus Price Target (“PT”) of analysts: $117

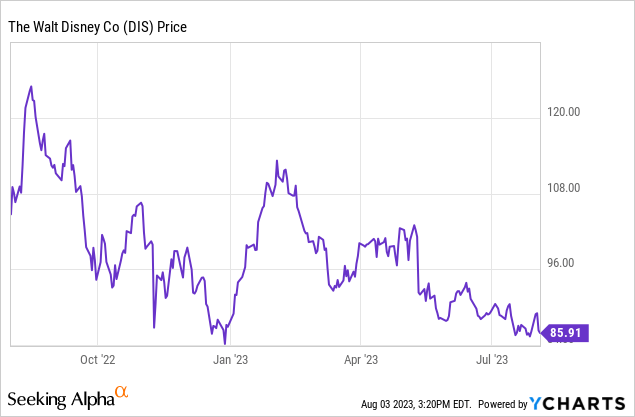

Our PT: We see a broad range anywhere between $69 to $93 by year’s end, depending not so much on forward earnings, but by what Mr. Market sees as smart, real world decisions on what the new Disney will present to investors. In other words, when and if Iger, his board, his c-suite associates and firemen Mayer and Staggs get religion and build a new machine as good as the old one was before it became a hostage to fortune.

Start now with a company grinding out an always impressive $84.4b ((TTM)) in annual revenues. Add annual earnings forecasts ranging between $2.23 to $3.00 way off all- time highs. Disney is facing possible negative sales growth between -5% to -7% resulting from macro headwinds aggravated by self-inflicted wounds over time.

Presumably, the re-appearance of Mayer and Staggs will provide the time and effort for deep dives into specific verticals like ESPN to a sensible endgame that somehow Iger has yet to discover on his own. His plate is full without question.

But the skeptic in me (mea culpa) cannot wonder whether the SOS to Mayer and Staggs is so much window dressing for Wall Street to give Iger coverage for what appears to be a lack of bolder moves to date. We polled our informal panel of ex-Disney people from back in the day about the Mayer-Staggs rescue committee move. All agreed these guys are in their way the real deal, but also believed that they would “fig leaf” decisions Iger appears to be hesitant to make that could indeed move the needle.

Stipulation: As we have always noted here, these opinions from former Disney people come mostly from middle management, from times past. But, they are people with some insight into how the great Disney machine worked. They did not sit in conference rooms of the c-suites, but do provide a peek into how and why the present situation evolved. Their consensus: Well-meaning arrogance mixed with what one old friend said was “It sometimes felt like they had a franchise from God to do business and make more money from anything they touched no matter what it was…”

Cost-cuts, layoffs and restructuring of units are fine, but unless you are a certified Disney pom pom twirler, you can’t believe that the announced Iger decisions will materially move the needle within the next several earnings periods that moves the shares back to anywhere near the blissful $150+ range.

The inescapable truths not yet recognized that the newly arrived firemen will either have to deal with or do some can kicking down the road

ESPN: A Winston Churchill quote about Russia is appropriate here. When asked about what Russia is, he responded, “It’s a riddle wrapped in a mystery inside an enigma…” We use it in an attempt to break down what is the true essence of ESPN inside the Disney portfolio—as the unit is today. We try to understand for what possible reason to date, that it does not yet appear obvious to Iger that the unit needs to be sold.

Cord-cutting, the principal culprit in ESPN subscriber declines, isn’t going anywhere soon. It will continue and there is little the network can do to stop it. In fact, Iger recently suggested the company may loosen it from cable and go subscriber streaming or perhaps take on a partner.

Next in the line of ESPN villains is escalating costs of sports rights. The land of limitless greed is populated by the minions of the NFL, NBA, MLB, and to an extent, the NHL. Add the gluttons of the NCAA and their Balkanized mish mosh of overpaid conferences and you have a certain recipe for a never satiated appetite for higher rights fees ahead.

Now put a pinch of the bloated salaries ESPN pays its army of blabber show hosts, so-called experts, and laughing hosts who populate the network between games and you further delve into the realm of medieval alchemy. Even the recent axe falling on many hosts doesn’t begin to scratch the surface of the kind of purge needed to get production costs down to sensible numbers and maintain viewership.

Ask any sports fan if it makes a dime’s worth of difference to them as to who calls the games or the show content that goes with it and the answer is probably no. Sports content for certain is among the few genres that attract demos that advertisers value. But there is only so much ad money available when the ever ballooning supply of content continues unabated. But ESPN generates $20b a year and its profitability continues to shrink for dozens of reasons. It also alienates a significant portion of the sports fan audience with its stubborn clinging to tired wokeism and lame high school locker room jokery in the face of diminishing returns. Like many big media outlets it meddling in politics is a form of corporate narcissism.

Yet ESPN’s estimated $20b in annual revenues tied to the shrinking cable universe can still be of real value to a company with a deep stake in the overall sports media world. And therein lies the mystery. What does ESPN do to bring increasing accretive earnings to the DIS bottom line? How does it fit into what Disney is about other than its failed business model of today? Our theory: It’s worth more on sale than as a long term contributor of growing EBITDA.

The answer is that it does not. ESPN came to Disney during a time when the mantra was: If it is visible, it is a viable business we should be in. So the remedies already shuffling around the corporate world and Wall Street conjectured by Iger represent in our view a one-way street to a cul-de-sac.

So, perhaps as Mayer and Staggs dig deep into the business, we should not be surprised that they too find a headscratcher and come to the table with a sensible plan and a for-sale sign. A trimmed down ESPN integrated into a company where it made business model sense is salable at a price that could gladden Wall Street hearts and help carve down the DIS interest expense of $1.653b last year ((TTM)).

Theme Parks

Here we take another mea culpa. In past articles on the Disney business model breakup, we suggested that there was no limit, no sacrifice, no tortured piggy banking parents would not endure in order to get their children at least one visit to a Disney theme park. And for that reason, it would remain a healthy viable business for the DIS parent forever no matter the punishing periodic tides of the macro economy.

No longer true. I have done a Power Law analysis among many other data sources, courtesy of some seminal thinking in that esoteric world of economics mastered by colleague and friend, Harold Vogel, Ph.D. (Ex top analyst at Merrill Lynch, among others). Boiled down at my level of understanding, was this inescapable conclusion: Where I thought demand for Disney theme parks was inelastic due to the enteral love of parents for their offspring no limit, I concluded that I was wrong.

Forced by inflation to raise park prices, trim head counts, etc., I found that now the parks face a new reality: Prices barriers are real here. Arrivals at the Disney parks have tailed off since the price rises. Visitors have cheaper options, for one.

But mostly, like so much consumer discretionary purchases in this runaway inflation (and no matter what the WH says it is still running away) parents have surrendered. The anti-Disney site mouse-hacking.com now estimates that a visit to the mouse house for a family of four in 2023 costs $6,235. That’s a lot of broken piggy banks. And for certain, for many families the cost could climb to $10,000. What percent of a Disney family target annual income would that demand?

An omen of this decline could be seen several months ago when Disney decided to close down its Star Wars Hotel experience and eat as much as a $1b loss. The reasoning: Not enough potential visitors had Jeff Bezos or Elon Musk as nice generous uncles to swipe the card for Disney. So that begged the question of whose bright idea had it been to begin with to build the place and believe that near $2,000 a night would bring on the minions to sell the place out? And why wasn’t there someone in the c-suite there to raise his or her hand to protest; Are we nuts here? Hasn’t what has made our company great our care and feeding of everyday folks?

Theme parks are truly organic to the best of what Disney has done, and will do at some point ahead when it finally figures out how to keep its attractions, pricing and service levels in a bandwidth that makes sense for average families.

Filmed Entertainment

Repurposing old animated hits to live action movies remains problematical. Currently Disney is feeling the pain of a succession of meh releases to out and out flops at the same time, Warner Bros. Discovery, Inc. (WBD) has struck gold with Barbie. Wokeist theming or casting has proven itself as tickets on overpriced trips to dead-end streets. This is not to say that Barbie was as woke-free as many apologists for the successive bombs ignited by Disney lately have suggested.

Nobody counsels that a return to the bad old days when content did not look more like America is a way to remedy the failure of a given film. But what is startling is that when box office results for films appealing to all people of all origins domestic and international out gross the wokeist movies and nobody in the c-suite says, hey guys, there’s a message here: We’re in business to make money for shareholders without bruising the sensibilities of anybody. Why is that so hard to understand?

Conclusion

The messers Mayer and Staggs arrival should not be underplayed or overplayed. In essence its a non-event. If they liberate Iger to wrestle with more problems, that’s something of a plus. My own experience in the c-suite is that when there is a fire, you can use all the firemen you can get who know where to aim the hose that helps stop the fire.

Yet I have also seen where it is on balance an act to give cover to management that makes the right noises but has little to move the needle. The business model of gigantism that engulfed the media/entertainment sector twenty years ago or more, is clearly broken and is not working. Creating a new one suggests to us, humble opinion notwithstanding, that a smaller, tighter, business focused on both enduring strengths and disposal of dead wood forests of verticals, sets the right direction ahead.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

For in-depth and deep dive research on the casino and gmaing sector, subscribe to The House Edge. New: Free excerpts from our book in progress “The Smartest ever Guide to Gaming Stocks” – free to existing members and new subscribers.