Summary:

- The Walt Disney Company’s stock is at nine-year lows, but I believe the stock is going lower and present 5 reasons.

- Free cash flow worry stands at the top of my 5 reasons.

- Change is not always good, especially when it deviates from a long-working but still successful formula.

- Consider selling cash-secured puts to be able to acquire the stock at much lower strike prices.

JHVEPhoto

Before we begin, let’s play a little game.

What’s the first thing (or word) that comes to your mind when I mention the subject of this article, The Walt Disney Company (NYSE:DIS)? Go.

You got 5 seconds. 5, 4, 3, 2, 1.

I’d bet these were some of the words you thought of: Mickey, Minnie, Entertainment, Disney+, Parade, Family Fun, Fireworks, Cruise.

Just the mention of the name/word “Disney” used to bring only smiles, joy, and wonderful memories for kids and adults alike for decades. However, it won’t be an overstatement to say Disney investors (like myself) have not had much joy or many reasons to smile about their investment in quite a while, as the stock is:

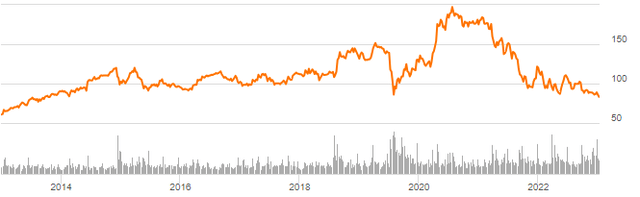

- At a nine-year low as Seeking Alpha has covered here

- Down 25% in the last 5 years

- Down 29% in the last year

- Down 6% YTD (when the S&P 500 is up about 15%)

- Down 17% in the last 6 months

As a contrarian investor, I tend to buy temporarily-hated stocks of fundamentally strong companies that I expect to last for decades on. I certainly do expect the Disney brand to live on for many decades. But I don’t believe the stock has seen its worst yet. I present 5 reasons why I believe Disney stock is going lower and how I recommend playing the decline. Let us get into the details.

Damaged Brand

I don’t intend to start a political dispute here but, I believe, at the core of the company’s recent woes is its political stance in recent times. I am not going to debate about which side is correct but as a public company with fiduciary responsibilities, some statements and actions by Disney have been oblivious to their supposed responsibilities towards shareholders. In my opinion, what made the brand famous was its family appeal and the iconic brands. Minnie Mouse getting a revamp reminded me of one of the most memorable marketing blunders ever when Coca-Cola (KO) messed with its tried and tested formula, literally.

It takes years and decades to build up a brand’s reputation but mere months or weeks to break it. I believe Disney has a long road ahead before it can at least position itself as a neutral, since taking one of the most aggressive stances I’ve seen from a public company.

Economic and Business Reality

And it does not help the company that while it is facing internal (largely, self-created) and political challenges, the economy in general is staring at a recession at worst or a soft landing at best. As much as kids love their characters and parents love to keep the kids gleeful, Disney has always been a (relatively) costly entertainment option. The 2009 recession did not spare Disney either, and I don’t believe any upcoming recession or soft landing will treat Disney any different.

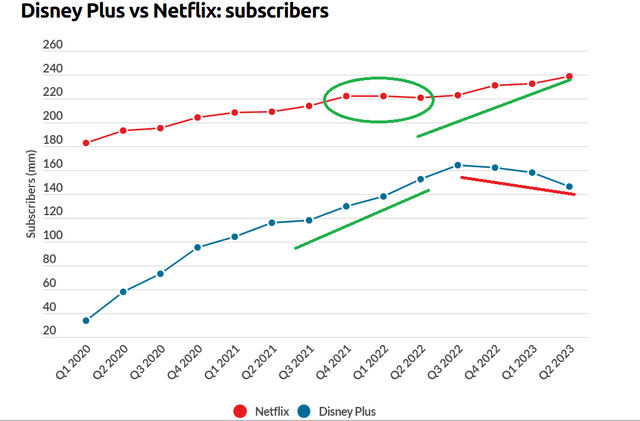

I don’t believe the chart below just happened by coincidence. Just as Disney was in the news for all the wrong reasons, Disney+ stopped its upward trajectory and reversed. And at the exact same time, Netflix, Inc. (NFLX) broke out of its flat-lining trajectory to resume its own upward trajectory. With the number of streaming options growing by the day, price increases may not be the right way to reverse this trend.

It was expected that Bob Iger would restore the magic upon his return, but the stock has gone nowhere since. At this point, Disney and its investors may as well be wishing for some real-life magic that its movies are famous for.

Disney+ vs NFLX (businessofapps.com)

Free Cash Flow Woes

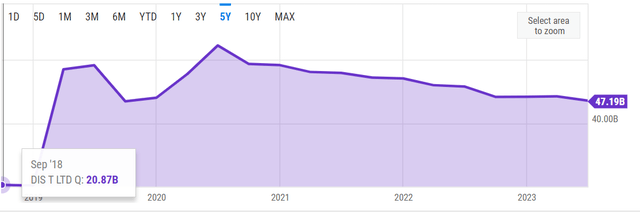

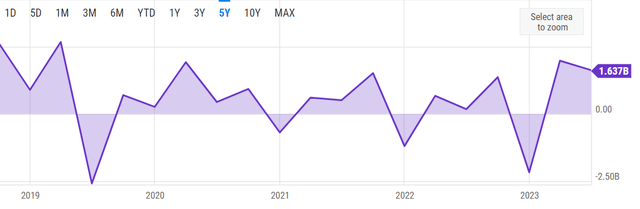

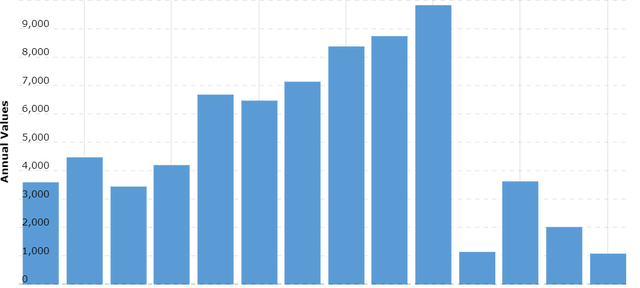

Disney’s Free Cash Flow (FCF) can be conveyed using the two charts shown below:

- The quarterly FCF chart is not exactly a model for consistency, with the range between the best quarter (March 2019) and the worst quarter (June 2019) being a staggering $5.25 billion.

- The 5-year average quarterly FCF of $625 million does not inspire much confidence either. And no, this wasn’t skewed by COVID alone as the average quarterly FCF between the March 2020 and September 2021 quarters was actually higher at about $750 million. I am using that time period because most companies showed a drop in FCF and earnings in the March 2020 quarter when the World was shutting down while September 2021 represented almost two full quarters after Disneyland reopened.

- The annual FCF chart shows the steep drop in Disney’s FCF, with the recent high in 2020 being about 1/3rd of the level in 2018.

The FCF situation is exacerbated when you consider:

- The company’s cost-cutting and price-increasing efforts have not made too much of an impact yet (although they may show up in the remaining quarters in 2023).

- The company is entertaining thoughts of reinstating its dividend. Consider the following data points:

- For the sake of argument, let’s say Disney reinstates the dividend at the previous level of 88 cents semiannually. That would represent a paltry yield of ~2% based on the current share price of $83.

- Disney has about 1.80 billion shares outstanding.

- At 1.80 billion shares and 88 cents semiannually, Disney needs to set aside nearly $1.58 billion semiannually for its dividend payment. That is, about $800 million per quarter, which is nearly 30% higher than the company’s average FCF over the last 5 years. In short, any dividend at this time is ill-advised.

Dis Qtrly FCF (YCharts.com) DIS Annual FCF (Macrotrends.net)

Worrying Debt Situation

Disney is #61 on a list of 137 companies (excluding those in the Financial sector) with the most debt. While some of the World’s best companies like Apple Inc. (AAPL) and Microsoft Corporation (MSFT) are on the list, Disney occupies #112 out of the 137 companies when the total debt is divided by trailing twelve months’ (TTM) net income.

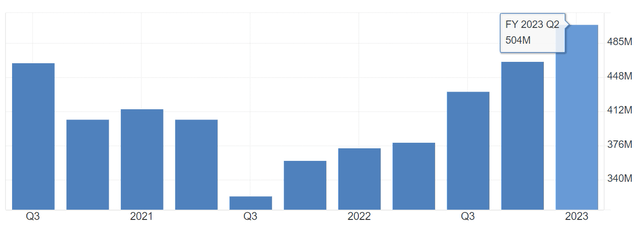

As much as Disney may be struggling, I don’t think anyone seriously believes the company is in danger of bankruptcy. In such situations, the company’s interest expense on debt is an important metric. Disney incurred $969 million in interest expense in H1 2023, which is 32% higher than the $735 million it had to pay in H1 2022.

Clearly, this is not an enviable position to be in when interest rates are showing no signs of slowing down.

DIS Interest Expense (tradingeconomics.com)

Technical Weakness

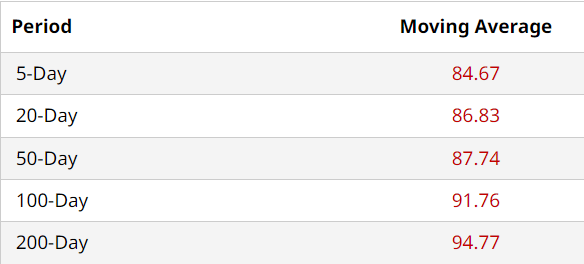

Disney’s stock is now trading below all the commonly used moving averages, with the 200-day moving average nearly 15% away. Each of the moving averages below are progressively lower, meaning the stock has not found a bottom yet.

DIS Moving Avgs (barchart.com)

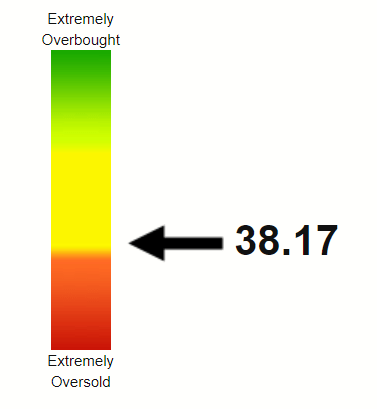

Given this price action, I was fully expecting the stock’s Relative Strength Index (RSI) to be well under the oversold level of 30, but it is close to 40 as of now. I’ve seen stocks with far less fundamental challenges go way below the oversold levels (say, RSI <20) and I firmly believe Disney’s stock will continue making lower lows with no catalyst in sight.

DIS RSI (stockrsi.com)

Conclusion

At some point, Disney’s stock will turn around. It is not a question of “if” but “when”. However, I believe the stock is not ready for a turnaround yet until we start seeing signs that the company has turned around. For example, Meta Platforms, Inc. (META), the company, turned around before its stock followed. Disney’s problem was not over-hiring but messing with tried and tested formulas to send political messages.

Until then, as a Disney long, I am considering selling covered calls at higher strike prices to net some additional returns through premiums. If you don’t have a position in the stock but are interested in making use of this 9-year low, I’d suggest selling cash-secured puts to be able to acquire the stock at a lower price.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AAPL, KO, META, MSFT, DIS either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.