Summary:

- An earnings beat by The Walt Disney Company will undoubtedly unleash the pom pom twirlers with false hope and put a bit of a spike into the price short term.

- A miss will encourage the bears to ponder a short play or a sell.

- For most holders, earnings may just trigger a woeful shrug wondering if and when the big moves will be coming.

VladGans

“Patience is a virtue and I’m learning patience. It’s a tough lesson… – Elon Musk.

The short-term trading and options plays can earn one a living by betting on spikes and dips before and after earnings releases. Some traders have brought the practice to a high art, others have been hammered. Overall what we have seen is that the push button algorithms that trigger overnight spikes or dips come out of the “one swallow makes a summer” school of investing. A single earnings release, or in fact a series of them making, missing or beating consensus, brings the casino mentality-long a staple of stock market action into play every day. Press up your bets when you think the dice are hot after making a few passes in a row. As often as not, that can lead to bankroll ruin, as we say in the gaming industry.

Then there are those who apparently cannot fall out of love with a stock no matter the quarterly results because they believe in the long-term prospects of companies.

Yet, in general, what today’s markets show above all is that the distinct lack of patience among investors that manifests itself in knee-jerk responses to earnings releases has migrated to blanket most daily trading patterns. Add to that real macro news such as the gyrations of the FED, and you have what is often the total absence of patience, Blame institutional push button algos for sure. But the real culprit is an absence of attention span, which over time, has eroded belief in the time-tested theories of Messer’s Buffett and Munger.

In thirteen days, traders, holders, and long-time fans of The Walt Disney Company (NYSE:DIS) will demonstrate their belief, or lack of it, in the nostrums and policy shifts presumably already in place under Iger 2.0. Our contention here is that no matter the result, investors should be cautioned to keep their knees firmly planted against jerking. And neither buy nor pass up what clearly will be, on balance, an effort to put a sunny face on whatever earnings appear by Iger and his denizens. Fair is fair, it’s their job.

Having spent many decades in the c-suite, I have come to understand that some happy talk comes with the territory at earnings time even in chaos. The single most critical takeaway investors need to seek in earnings reports is this: Is management up to the task ahead? Do they get it? Or are they tone deaf?

One is reminded of the old Broadway musical of the 1930s called “Jumbo.” It was set appropriately at a circus. In one scene, set at midnight, the comedian Jimmy Durante is seen leading a real elephant across the stage from a tent to a gate. He is stopped by a guard who asks, “Hey, where are you going with that elephant?”

Nonplussed for an answer, Durante looks around and replies “What elephant?”

To an extent what we have learned thus far from Disney under siege is the same answer: What elephant? Yes, management acknowledges the current whirlpools and turbulent currents of the big media/ entertainment verticals. Iger’s most recent statements about those powerful currents relating to the writers and actor’s strikes were taken by the strikers as vintage tone deafness. What elephant indeed?’

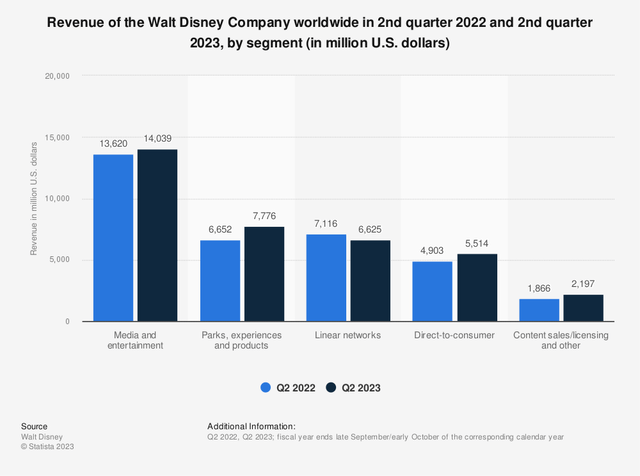

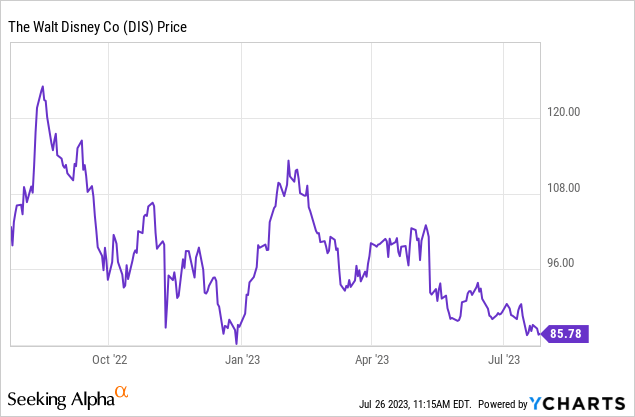

Above: Its going to take more time than a few earnings releases to get the stock back to anywhere near its pre-covid trading range.

Filmed entertainment

The seven Disney releases to date have led the industry box office with $1.184b in grosses. Of the seven, Guardians of the Galaxy appears to be the only one to knock it out of the park with $358m in grosses. The other six can best be described as so-so to not so so-so.

The Little Mermaid has grossed to date $296m, which according to our Hollywood sources, believe it will either a) come close to breakeven, b) breakeven c) Lose money. Black Panther-Wakanda Forever bombed, as did Strange World and Elemental.

Along came Barbie from Mattel/Warners, which appears headed to $300m in grosses, with some people we talked to believing it could leap as high as $400m when the run peters out, besting Guardians of the Galaxy and all Disney entries to date. The Little Mermaid cost $250m, Barbie, $140m. Although Barbie was hardly free of wokeist pokes here and there, TLM was an out-and-out woke product that was summarily rejected by the huge China market. Barbie didn’t do great there, either, but its numbers in the U.S. and EU nations made up for it.

What is clear here is that the Disney IP in its movies per date performed somewhat but is showing signs of age. The moviegoer market has not as yet returned to pre-covid attendance levels and may never do so. But the smash hit of Barbie did show that a fresh, IP persona can tickle audiences and bring in ticket sales.

Even Oppenheimer, a film for the mesa audiences, brilliant in every way, had its leftist slant and still did huge business considering its narrower appeal.

So the Disney true believers can well take away the fact that the company led in total dollar grosses. But, given its cost structure, that may not bring big time nets to the bottom line. On the other hand, bears will see a creative mojo at Disney that has faded. Remakes of animated classics steeped in woke can do okay, but not to acknowledge the elephant that is indeed wokeism, as Chinese moviegoers, racist or not, believe, should be a wake-up call for Disney.

Somewhere, one lone genius has to sit down with a sheet of blank paper and a pencil and find a way to make fresh content at a cost that brings joys to the company and its shareholders. And that can take years. Patience will pay. It’s hard to believe not a single creative genius can be found somewhere in mouse-land.

Theme Parks

This deepest and sturdiest tent pole in the Disney verticals reportedly showed some softening of daily attendance, according to several pieces in the WSJ. Historically, parents had to take kids there even if it took piggy banking quarters, halves and singles for a year to afford the Disney park visit. The recent price hikes in an effort to bring more bottom line bucks to the vertical against ballooning inflationary costs has clearly wounded attendance. That could continue a while. Hard decisions await Iger and company as to whether they are pivoting their park attendee base from a broad middle America to a far thinner niche market of upscale families who, despite current inflationary ills, can still stand the freight for a parks visits.

Whether the earnings release ahead will reflect this or we will get more tone deaf assurances that the parks have adjusted their price models to meet real world family budgets or not is another key investors need to look for in the months ahead.

Debt profile: $48.52 (mrq)

At height: $52b.

Now: $48.52.

Less cash on hand $10.4b.

Net debt: $38.16.

So Disney has cut around $4b from the high, which is good. But in context: unless there is a quantum leap in revenues from filmed entertainment, linear TV ads, theme park attendance, streaming subscriptions with relatively modest churn, cost saving promised ($5.5b) reduction of debt at a speedier pace cannot happen. In truth, if Disney is undergoing a revenue flatness or only slight revenue increase, the goal to get debt down faster cannot be met.

Let’s assume management targets a sustained repayment schedule of ~$1b annually. In plain arithmetic, that means a goal of halving its debt, say to $20b would take 20 years. Even servicing its current debt of (net of cash) at an average of 3.5%, that still takes ~$1b a year for 10 years to pare the debt down to ~$20b. This is no question of liquidity with Disney, of course, with a current ratio of 1.1. But what does count is the theoretical $20b Disney would pay out over 20 years in interest, money that could be diverted to productive, profit generating ventures, or at least, an improvement in accretive EBITDA that could become once-treasured Disney dividends.

ESPN, Hulu plus other fringe businesses

The debt reduction strategy could get an exponential boost if and when the company decided that the common sense decision would be to sell businesses, that in many ways, are not central to the Disney business model to come: entertainment for children first in theme parks, streaming and filmed entertainment, and secondly, solid movie content for adults free of wokeist tropes that annoy half the population.

The current thinking to convert ESPN to a streaming pay service is not without some core logic: Target true sports fans, diehards, willing to pay a monthly charge for the games, shows and presentations of ESPN assuming the charges are reasonable. No mention is made for the exposure of ESPN to what appears to be a never-ending acceleration of sports rights by leagues and teams with unlimited greed guiding their decisions.

Our view: While we see some logic here, we think, on balance, Disney as parent to ESPN is an ongoing fool’s errand. The fact is that another company, knee-deep in sports overall, could fit ESPN comfortably within a more coherent business model.

Latest estimates we have seen indicate ESPN could fetch up to $22b in a sale. And to a right buyer, even that acquisition price could be well worth its long-term capacity to pay out its cost and produce accretive EBITDA for such a buyer. I’m thinking of someone like Flutter Entertainment of the UK (PDYPY, PDYPF, FLTR:L) owners of FanDuel, planning to take that unit public at some time between year’s end and early next year.

What this would do for Disney is a palette of wonders:

A certain percentage of the proceeds go directly to debt reduction. No more worries about the gluttonous cravings of the sports leagues forever fatter rights fees. When you have, today, top NFL quarterbacks now making $50 million, NBA players earning monster long-term deals, MLB contracts at dizzying free agent deals that often crash, it’s a lot less Xanax needed for Disney executives.

Hulu: The glitch king of streamers

By any measure, Hulu is reputedly valued at $70b in total, with Disney’s holding probably worth near $50b. It is a streamer beset by customer complaints about errant functions like spontaneous scrolling, mis-labeled movies, and tons of worthless filler programming. Some sources we checked believe Hulu’s current ~50m subs could grow to 115m by 2027 to 30 which is estimable of course. Yet one must question if ever, Hulu will get out from under churn, rising costs for content, acquisitions of marginal programming and the fierce competition from Netflix and other major streamers that are going nowhere. Clearly, there is a school of thought that is convinced Hulu will always be a powerful presence in streaming and must be nurtured toward that big goal.

But the alternate school viewed from the reality of a Disney business model that is broken and needs a more cohesive set of verticals related to each other, that Hulu is expendable. The idea being sell it to minority shareholder Comcast. Some analysts believe Hulu could reach ~$27.5b in valuation by next year. If Disney sold is share to Comcast it could put ~$46b cash on the books. Again, a chunk of the proceeds to take another bite out of Disney’s debt.

A new Disney

Unless management fully recognizes that the core business model of all things to all people all the time is broken because a combination of technology and dramatic change in consumer habits triggered by covid has changed the rules of the game, Disney cannot recover.

A highly focused Disney in its prime strengths, shorn of its pretenses to have verticals in every possible media platform and its idiotic virtue messaging, with a fortress balance sheet, could command multiples that would really justify its price comfortable, shorn of its pretenses to have verticals in every possible media platform and its idiotic virtue messaging.

Whether Iger, the guy who built this Tinker-toy Disney, is the same guy to transform it is at best questionable given his moves thus far and some of his ill-conceived public statements. But he isn’t the total problem. It is him, his key people, and mostly his clueless board who must jointly share the blame of taking this once great company down a path to a dead-end street.

What to expect on August 9 th

Analysts estimates: PT: $101.

Earnings: $0.89 to $1.02.

Revenue: $19.92b to $20.32b.

EPS: $0.96 to $1.09.

Our point here is that if actuals rise above these expectations, we could see a spoke and some pomp pow twirling that the cavalry is on the way so BUY.

If they fall below expectations, we could see a bit of a selloff and many analysts changing BUY guidance to HOLD. Any balance of bull or bear reactions here is of little meaning. That is because there will not be any dramatic news, save the possibility of surprise asset sales announcements, to move the needle dramatically.

And the entire sector is, of course, currently living in the shade of the strikes which attach even more uncertainty to the entire picture.

Our takeaway

Quick in-and-out traders need no advice from me as to what strategy would be suggested by an earnings report that make, misses or beats consensus. My own sense of the situation based on my own data point trend studies plus input from my regular associates in the business, either recent job changers to retirees, suggests that we could be at least two years away from a new Disney, smarter, more nimble and dividend paying entity with a great future.

It can’t be an overnight cure found in a single earnings release, good, bad, or so so. It will take a long, patient process which, in a knee-jerk stock market, will take time to metabolize with spokes and dips in between.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

For in-depth and deep dive research on the casino and gaming sector, subscribe to The House Edge. New: Free excerpts from our book in progress "The Smartest ever Guide to Gaming Stocks" – free to existing members and new subscribers.