Summary:

- The Walt Disney Company reported a profitable combined streaming business in third quarter earnings.

- CEO Bob Iger expects continued DTC profitability in the last quarter of the fiscal year.

- Streaming business has significantly contributed to large profit improvements for Disney this fiscal year.

- The hit movies are a source of major profit improvements as well.

- The growth of the company should continue for years to come.

JHVEPhoto

The Walt Disney Company (NYSE:DIS) reported its fiscal third quarter earnings with the surprise announcement that the combined streaming business is now profitable.

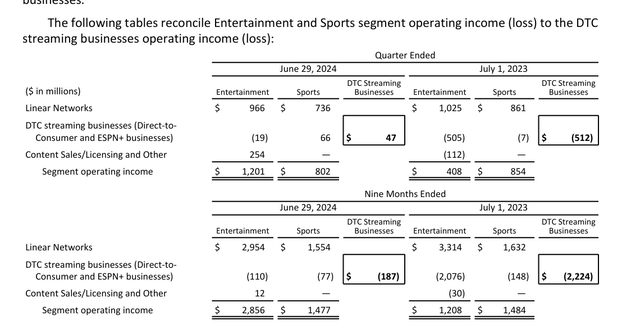

Disney Streaming Business Results Second Quarter 2024 (Disney Executive Commentary Second Quarter August 2024)

The overall profit improvement in this one area of the business is so large that it is worth pointing out before we talk about anything else. Obviously, both the quarterly improvement and the year-to-date improvement play a considerable part in the company’s results. Bob Iger, CEO, went on to state that this segment of the business was going to be profitable again in the last quarter of the fiscal year.

Note that Disney ends its fiscal year in what would be the third quarter for most companies. Next year, the combined streaming business is going to have some tough comparisons. But for this fiscal year, the streaming business has been a pleasant surprise that has enabled some large profit improvements for the company.

The Last Article

Previously, it was discussed how Disney was back on track. That was really about the movie business. But as shown above, the new emphasis on streaming profits has led to a sizable corporate improvement all by itself. Now the company has reported two blockbuster movies (as anticipated by the last article).

The executive commentary noted how a great movie flows through to all the other divisions. Now, Disney has two fantastic movies that are likely to generate profits for the next several quarters throughout the corporation.

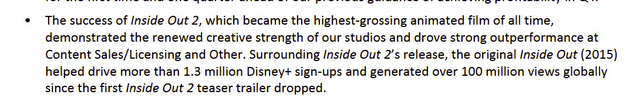

Below, the comment from the earnings press release gives some indication of what can be expected:

Disney Description Of Hit Movie’s Effect On The Rest Of The Corporate Business (Disney Earnings Press Release Third Quarter 2024)

One of the things noted is that Disney has more billion-dollar (grossing) movies than the rest of the industry put together. This fiscal year is demonstrating that the company still knows how to put out a huge hit movie or two.

Earnings

Streaming again made the headlines when Disney announced a subscription increase for streaming services. It was also mentioned in the conference call that there are plans underway to crack down on password sharing. That means still more streaming profit improvements are on the way.

One of the things that is expected to lower the churn rates for things like subscription increases is the presence of hit movies. One of the “side effects” is an increased demand to see previous movies already released for that franchise. It may be that the heightened interest in a franchise that the current hit movies bring overrules the usual churn rate increase that a price hike would normally be expected to bring.

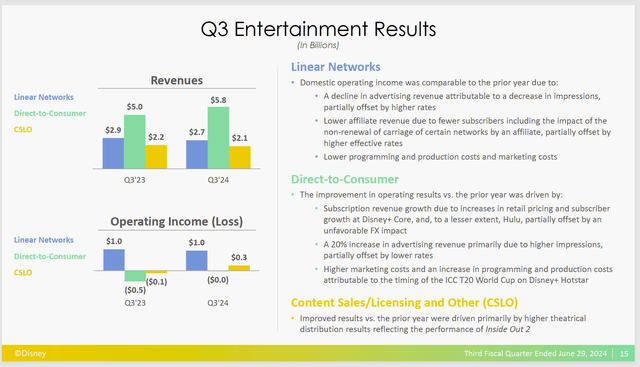

Disney Summary Of Entertainment Results Second Quarter 2024 (Disney Corporate Presentation Second Quarter 2024)

One of the things that was mentioned in the last article is that Linear, Streaming, and related activities are all under one decision maker with the general direction to grow the overall business, knowing that Linear is declining.

This attitude is reflected in the presentation above. Bob Iger, CEO, mentioned that cost discipline was the order of the day with a quality emphasis over quantity.

Notice that the specific reason that Content Sales (CSLO) improved was the first hit movie. The next quarter will have some effects from the hit movie mentioned above, plus a second movie. Clearly, the major idea to grow the business is working as planned, even though Linear is declining and is expected to decline.

While there was not much growth in subscribers when compared to the previous quarter, the typical quarterly subscriber comparison with the previous year did show growth.

What appears to be the new emphasis with the DTC business is that any growth be profitable growth. It would appear that growth here will be linked to hit movies in the future. Now, once Disney has the customer, the future results may show some “stickiness” in that the reported churn rates are low.

Some other areas like Parks generally show growth after each price increase, as the company only rarely builds a new part. But they are a great source of cash flow that can be used elsewhere to benefit shareholders.

Summary

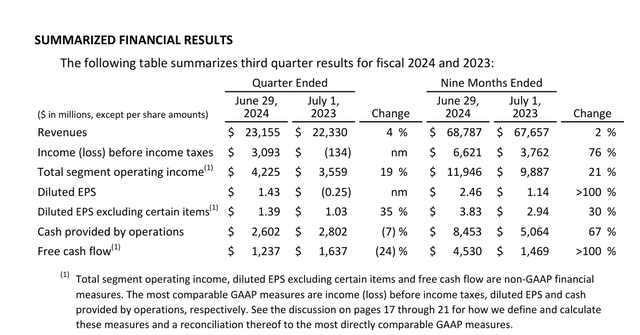

Overall, the company had good results, primarily because of the profit improvement in the DTC area.

Disney Summary Of Financial Results Third Quarter 2024 (Disney Third Quarter 2024, Earnings Press Release)

Earnings per share were impacted by an impairment charge in the previous fiscal year. But the segment operating income would be the ongoing progress that company operations make. That comparison is getting to what Disney used to do for a long time.

Cash provided by operations is still far ahead of what it was for the previous fiscal year, even though the third quarter saw a slight reversal in cash provided by operations when compared with the fiscal year before.

There were questions during the conference call. But management answered those cash questions by noting that the guidance for the fiscal year has not changed (and really, there is only one more quarter to go). While that negative comparison was not anticipated by the market, it evidently is not a significant event or guidance would have changed.

The same explanation goes for free cash flow, which shrank somewhat in the third quarter but is still far ahead of the year before in the Year-To-Date comparison.

The Future

This is really the first fiscal year that had a normal schedule of movie releases. The theme parks were likewise not faced with a potential shutdown for the first time in a few years as well. This business took longer to recover than many expected. But now that it has recovered, the future could be predicting “more of the same good old days.” That would mean a decent earnings growth pace that used to exist.

Large companies generally do not do anything fast because the logistics of such a task are often daunting. Mr. Market, however, typically sets a deadline no matter the reason for an issue, and it expects that deadline to be met no matter if the challenge continues. Therefore, it was not unexpected that the market lost its patience with this stock.

However, the stock remains a strong buy with the idea that the company is back to doing what it does best (entertaining people). This company has far more resources to do what it does better than most.

Bob Iger, CEO, has set some ambitious revenue and earnings growth goals that he has discussed on road shows and conference calls. Now we will see how closely he gets to his goals. Even if he misses a little, the results should still be pleasing to shareholders.

Risks

Any entertainment company has to generate new blockbusters. The Disney franchises create an advantage over many competitors. But there is still no assurance that Disney can repeat its record of blockbuster hits in the future. A long dry spell could well result in a different future assessment.

The loss of the services of Bob Iger, CEO, could materially change the company’s prospects, as it did the last time he retired. Solving the issue of his succession has yet to find an excellent answer.

The entertainment business can be much more affected by shutdowns than some other businesses. While there appears to be no repeat of the past, the future is not all that certain.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of DIS either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Disclaimer: I am not an investment advisor, and this article is not meant to be a recommendation of the purchase or sale of stock. Investors are advised to review all company documents and press releases to see if the company fits their own investment qualifications. I may initiate a position at any time in WPC without further notice.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

I analyze oil and gas companies, related companies, and Disney in my service, Oil & Gas Value Research, where I look for undervalued names in the oil and gas space. I break down everything you need to know about these companies — the balance sheet, competitive position and development prospects. This article is an example of what I do. But for Oil & Gas Value Research members, they get it first and they get analysis on some companies that is not published on the free site. Interested? Sign up here for a free two-week trial.