Summary:

- The Walt Disney Company is going “all out” to defeat Trian.

- Bob Iger had about as good a track record as a CEO can have long term.

- The coronavirus challenges and subsequent restart were unique challenges that took a while.

- The odds of the “Fox” acquisition working out like the other acquisitions are darn good.

- Management is highly likely to report a better year and demonstrate the advantages of the “Fox” acquisition in the near future.

Drew Angerer

(Note: This article was in the newsletter on January 18, 2023.)

The Walt Disney Company (NYSE:DIS) is wasting no time taking off the gloves. The coming fight is going to be as ugly as any political fight in an election year can be. In fact, Disney made the first presentation I can remember and filed it with the SEC. That presentation is about the coming battle with Trian Partners. I have never been particularly comfortable combining forces with an activist investor because they usually leave the company in worse shape than they found it.

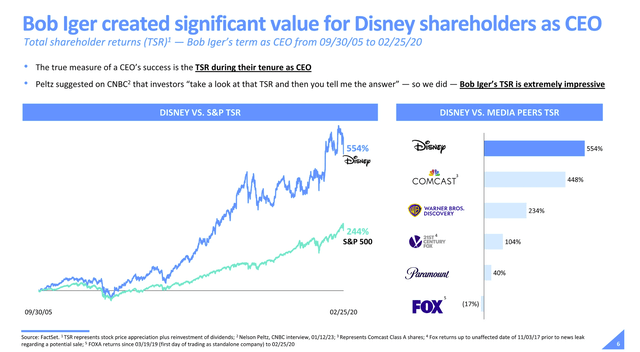

Disney Presentation Of the Stock Performance When Bob Iger Was CEO The First Time (Disney Corporate Presentation January 2023)

One of the likely reasons for bringing Bob Iger back as Disney CEO is that the coronavirus challenges likely created a market impatience with the stock performance. Disney managed to cash flow reasonably well and actually showed a profit before impairment charges.

But oftentimes, the market expects that when something like the coronavirus is over, then it is time for profits to return. No ramp-up time is needed. That put former CEO Bob Chapek in one heck of a bind. Clearly the parks, for example, needed investments to recover from the idle time. Then there was the period where no one was sure parks would stay open or what would allowed capacity be (given distance guidance at the time). Some actually did close again because this bug is not about to fade away like many of us would like it to.

So, Mr. Market has been in a foul mood lately because the parks took more than a year to get to normal (and maybe are still working at it). Meanwhile, the pace of movie releases was nothing close to market expectations, even though the movies that were released by and large did better than any competition (with one notable exception). Now, just about the time Disney is about to have a normal year, a proxy fight appears on the horizon because the return to normal was not fast enough.

This actually mirrors the Exxon Mobil (XOM) proxy fight with Engine One. Like Disney, that fight was over the alleged subpar performance of the company during the coronavirus demand destruction and the period immediately after. Never mind that the price of oil headed below zero. Shareholders were scared to death of the company performance enough to put some hitherto unknown quantities on the board. Fortunately, Exxon management had long been planning for a fiscal year 2022 that may be the best better. All shareholders had to do was be patient.

Acquisitions

The current battle is about several issues. The biggest one is that Disney likely overpaid for the latest acquisition of Fox.

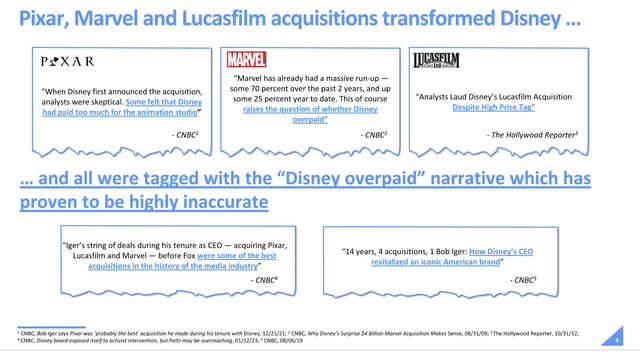

Disney Acquisitions When Bob Iger Was CEO (Disney Corporate Presentation January 2023)

Under Bob Iger as CEO, Disney expanded the storytelling theme into several areas, as shown above, successfully. What no one saw at the time of the acquisition was the Disney ability to exploit the material acquired in more ways than had been the case by the original owners. In every single case, Disney added value to the acquisition so that Disney stock became worth far more as a result.

The market was looking for operational synergies whereas Bob Igor expanded the reach of each acquisition. So, of course, everyone thought that the acquisitions were expensive because no one saw what the future would bring. The “dividends” came from a place Mr. Market clearly did not expect. Now, when everyone looks back, the acquisitions were an absolute “steal.”

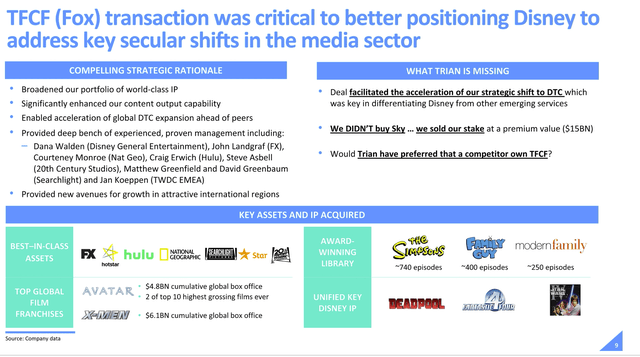

Disney Summary Of Fox Acquisition Assets (Disney Corporate Presentation January 2023)

What Disney likely sees here is a bunch of franchises that have not been exploited as Disney is capable of developing them. The experience is likely to be similar to the other acquisitions in that Disney will find a way to make a lot more money off standard franchises that have a positive space in a lot of memories.

The market, of course, sees another overpayment because the reasoning is the same as it has been for all the other acquisitions. The benefits will come mainly from an expansion of business rather than synergies.

What happened here was the coronavirus challenges shut the process down before the results could become apparent. That meant that things had to “start back up,” and that was going to cost money and time. But Mr. Market typically has patience for neither.

Large companies often take years to get where they are going. Something like fiscal year 2020 had a lot of these large companies scrambling just to survive.

Results

Disney barely completed the “Fox” acquisition when the fiscal year 2020 challenges hit. Not many saw 2020 unfolding the way it did.

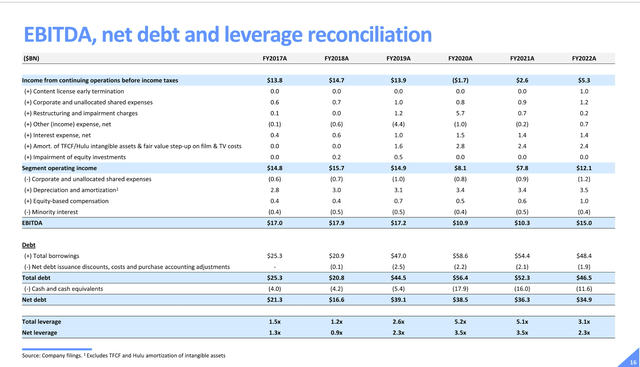

Disney Summary Of EBITDA, Net Debt, And Leverage History (Disney Corporate Presentation January 2023)

Yet despite the challenges, management reported some remarkably resilient numbers in a year where many companies saw cash flow disappear entirely. The company still has its investment grade rating and has managed to chip away at net debt despite all the challenges of the last few years.

This year, finally, should be a reasonably normal year. Movie releases appear to be getting back to normal and the parks could actually be open again without the threat of closure. The Disney ships are also busy. Management, in short, appears to have a reasonable recovery year in store for Disney (finally).

Key Idea

The real key to Disney will be how much impatience the short-term performance crowd will have. That will be the battle subject for the board seat battle in question. If it is like Exxon Mobil, the battle will be fought just before management’s plans comes to fruition. In the case of Exxon Mobil, the activist investors had little to do with the current results reported. But I bet they claim a whole lot of responsibility.

It is likely to be the same with Disney. It literally will take years to recover from the coronavirus demand destruction because that darn bug refuses to go away quietly. Even if that bug had gone away, it still takes time to restart a large company like Disney. The company clearly lost a lot of money (in the form of opportunity costs or what might have been) due to the shutdown. Then it has to spend money to get back to where it was before the revenue comes in for yet another penalty. All the while Mr. Market is having a fit.

Clearly, the institutional crowd was getting tired of waiting for Disney. Let us hope that impatience does not cost the rest of us money. Personally, I back Disney management.

Disclosure: I/we have a beneficial long position in the shares of DIS XOM either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Disclaimer: I am not an investment advisor, and this is not a recommendation to buy or sell a security. Investors are recommended to read all of the company’s filings and press releases as well as do their own research to determine if the company fits their own investment objectives and risk portfolios.

I analyze oil and gas companies, related companies, and Disney in my service, Oil & Gas Value Research, where I look for undervalued names in the oil and gas space. I break down everything you need to know about these companies — the balance sheet, competitive position and development prospects. This article is an example of what I do. But for Oil & Gas Value Research members, they get it first and they get analysis on some companies that is not published on the free site. Interested? Sign up here for a free two-week trial.