Summary:

- The Walt Disney Company’s strong share price performance in recent months creates a problem for expected returns through the rest of the year.

- The company’s dominance in the Box Office market is a distant memory, and all eyes are now on the streaming business, which needs to deliver.

- Potential upside for Disney’s margins in 2024 is still limited, even if Disney+ finally breaks even.

- In the meantime, the share price is running well ahead of current business fundamentals and this is a problem for investors.

FelixCatana

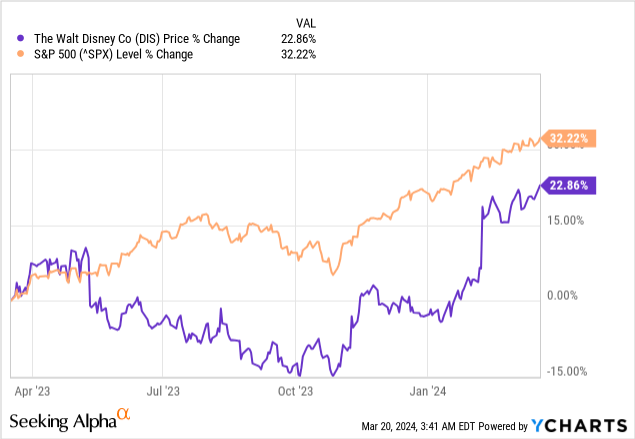

The Walt Disney Company (NYSE:DIS) stock has seen a wave of optimism in recent months as the Media giant is slowly recovering from its peak losses in its Direct-to-Consumer (“DTC”) division and parks are near peak performance.

Optimism also came from the ongoing cost cutting program and the potential bundling deal of the new sports joint venture – all of which culminated in one of the best quarterly results for the company in a very long time.

Seeking Alpha

But as the short-term euphoria subsides and the impact of sell-side analysts’ rating upgrades fades, the hard part in front of Disney’s management remains – deliver on its strategy and return to the level of profitability, prior to going all-in on the DTC strategy.

At the same time, DIS is still lagging behind the broader equity market over the past year, even though share price now pricing-in further profitability improvements (more on that below).

For the time being the recovery narrative remains strong and with that short-term share price performance is likely to remain positive as the long-awaited profitability breakeven of Disney+ is now within sight.

Beyond that, however, there’s more progress to be made before Disney becomes a solid “buy.”

Box Office Malaise

One of my main concerns regarding Disney back in 2019 when I first rated the stock as a sell, was the company’s dominant positioning in the Box Office Worldwide that was under threat as the company was relying too much on certain IP.

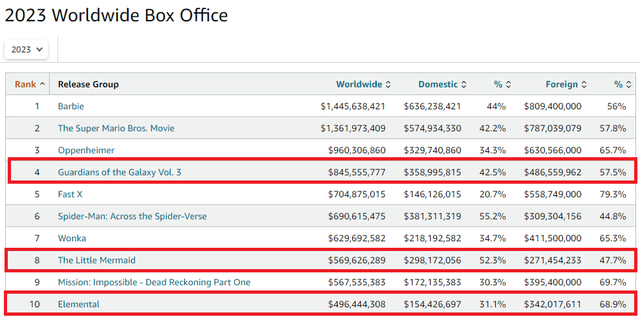

After totally dominating the top 10 places within the Box Office ranking in 2019, last calendar year was a very different for Walt Disney’s studios, with the company’s success of previous years being a distant memory. On one hand, competition for blockbuster movies has increased significantly, but on the other it seems that audience fatigue is also playing a role when it comes to producing sequels or superhero movies.

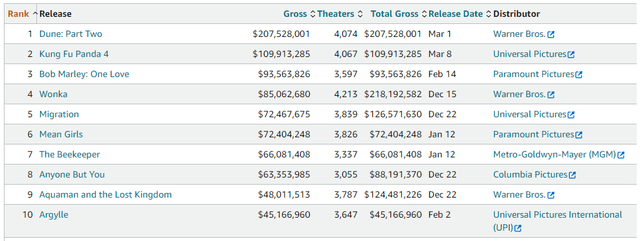

It seems that 2024 might be even worse for Disney, as the studio does not have a single title within the top 10 rankings so far.

The studio’s lineup for the rest of year is also not spectacular, and once again it’s all about recycling the same intellectual property over and over again.

Just consider the lineup of titles we will release through the end of 2026. This year, we have Kingdom of the Planet of the Apes, Inside Out 2, Deadpool 3, Alien: Romulus and Mufasa: The Lion King.

Source: Disney fiscal Q1 2024 earnings call.

Given Disney’s strategy to go all in on direct-to-consumer, while also relying heavily on its theme parks to squeeze additional dollars from it IP, the company does not necessarily need to be among the leaders in Box Office market share. This, however, puts enormous pressure on the DTC segment to perform.

The Main Margin Driver

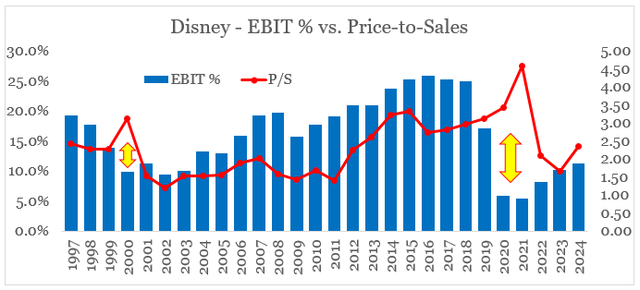

I have been using the graph below for a number of years now as a starting point on where is Disney’s stock is currently trading relative to fundamentals and what this implies for future margins. After the troublesome gap between the stock’s sales multiple and the operating margin has finally closed at the end of fiscal year 2023, the recent price action is once again a cause of concern.

prepared by the author, using data from SEC Filing

It seems that Disney’s share price increase since late last year and the multiple expansion that followed are predicated on future margin improvements.

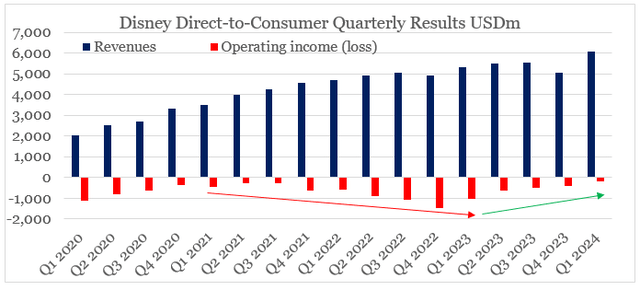

The highly anticipated profitability breakeven of Disney+ is the key factor that should contribute to Disney’s operating profitability improvements in FY 2024. So far, however, this has not happened and with all the competition in the space it remains doubtful whether or not DIS would be able to extract significant margins out of the DTC segment.

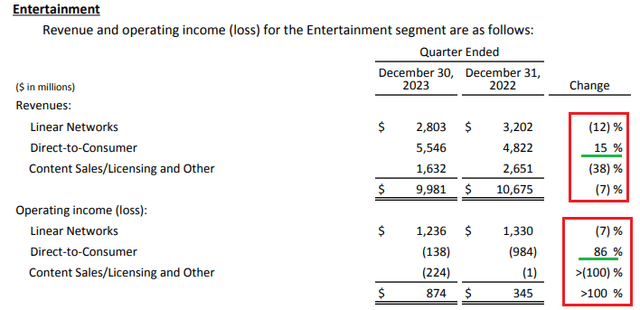

prepared by the author, using data from Disney Earnings Releases

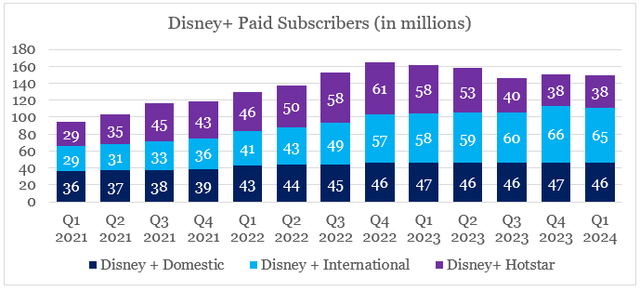

In terms of paid subscribers, Disney+ Domestic segment has been relatively flat for 6 quarters in a row and the company relied largely on the International segment to fuel the topline growth.

prepared by the author, using data from Disney Earnings Releases

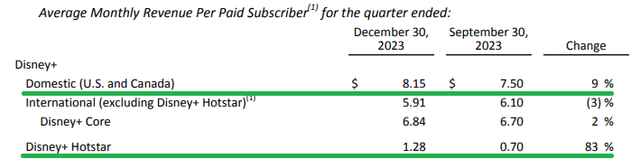

But as we see from the graph above, during the last reported quarter, subscribers of Disney+ outside of the U.S. and Canada actually declined. This is a major signal that market for the service is likely reaching its saturation point and with that price increases both in the U.S. and overseas would be a key driver for achieving profitability.

In Domestic we already saw a 9% increase of the average monthly revenue per paid subscriber during the last reported quarter as Disney implemented price increases of its premium (no ads) service.

Given the slowing growth in subscribers, it comes as no surprise that Disney’s management will continue to utilize price increases to achieve profitability and the rest of FY 2024 will be a pivotal in that regard.

We expect Disney+ core ARPU to increase in the second quarter due to the continued benefit of price increases, which should only be partially offset by the impact of adding Charter’s Spectrum TV Select subs to the Disney+ ad tier.

Source: Disney Q1 2024 Earnings Transcript.

Nonetheless, achieving high and sustainable profitability in the DTC segment appears limited for the time being and would likely rely on more cost cutting measures. Looking beyond the very near term, stiff competition from Netflix (NFLX), Amazon (AMZN), Apple (AAPL) and Warner Bros. Discovery (WBD) would also limit Disney’s ability to achieve meaningfully increase prices of its service.

Peak Performance In Other Segments

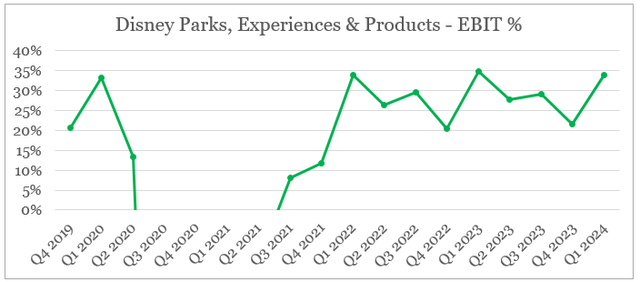

In the other business segments of Disney, we are currently observing a record high business performance when it comes to margins. Most notably, EBIT margin in the Experiences segment is now hovering at multi-year highs as strong consumer spending allowed DIS to fully capitalize on its strong franchises following the pandemic lockdowns.

prepared by the author, using data from SEC Filings

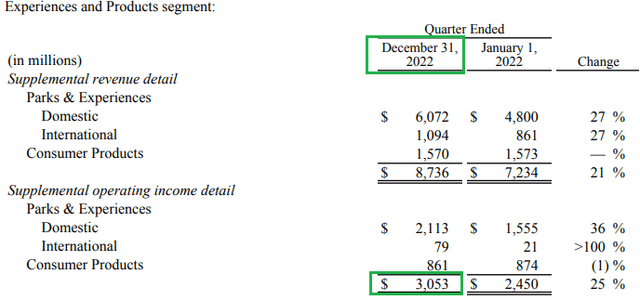

Operating income increased by an impressive 8% during the last quarter from a year ago (see below), but that involved some reshuffling of the company’s reporting segments.

For anyone who has been following DIS for the past 5 years or so, a change in reporting segments has become a business as usual that happens almost every other year. This was also the case in the aforementioned segment, which had a total operating income of $3,053m during the Q1 2023 period when it was initially reported (see below). However, due to some recent changes, this number has become $2,862m in the latest reported quarter.

Regardless of the changes made in reporting segments, the Experiences and Products segment is now running at record high margins which leaves little room for improvement, unless it increases in size relative to Disney’s other businesses.

So far this appears to be the case as revenue is expected to continue to grow in FY 2024 and Disney’s management has pledged to increase investments in the segment to an average rate of $6bn per annum

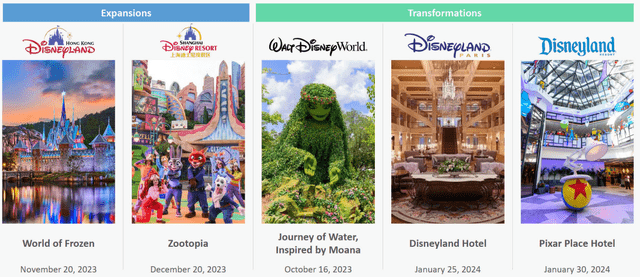

We’ve had a tremendous response from guests visiting our newly opened World of Frozen at Hong Kong Disneyland as well as our first-ever Zootopia Land at Shanghai Disney Resort. And as I’ve said before, we also have so many untapped stories just waiting to be brought to life in our parks across the globe as we continue to invest in this extraordinary business. (…)

We plan to invest approximately $60 billion into the business over the next 10 years, of which approximately 70% is earmarked for incremental capacity expanding investments around the globe, which we expect to generate attractive returns.

Source: Disney Q1 2024 Earnings Transcript.

As with the DTC segment, the next quarter will be very important in evaluating the result of the recent expansions of the “World of Frozen” and “Zootopia” parks.

In the meantime, Linear Networks – a very profitable area for Disney, is expected to continue to decline in significance for the company which would put more pressure on the DTC segment to finally become profitable and achieve high and sustainable margins.

Lastly, in Sports both top line growth and margins remain low and although there is some optimism around the recently announced joint venture, future results remain highly uncertain.

Conclusion

Short-term optimism has returned for Disney’s stock price as its streaming business is expected to make its first ever quarterly profit later this year. With margins at Disney’s Parks already at record highs, performance of the Direct-to-Consumer segment will be the centerpiece for Disney’s total margins through the rest of 2024. At the same time, The Walt Disney Company stock is already pricing in a notable improvement in profitability which makes DIS unattractive from a risk-reward perspective for the rest of the year.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of WBD either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Please do your own due diligence and consult with your financial advisor, if you have one, before making any investment decisions. The author is not acting in an investment adviser capacity. The author's opinions expressed herein address only select aspects of potential investment in securities of the companies mentioned and cannot be a substitute for comprehensive investment analysis. The author recommends that potential and existing investors conduct thorough investment research of their own, including detailed review of the companies' SEC filings. Any opinions or estimates constitute the author's best judgment as of the date of publication, and are subject to change without notice.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

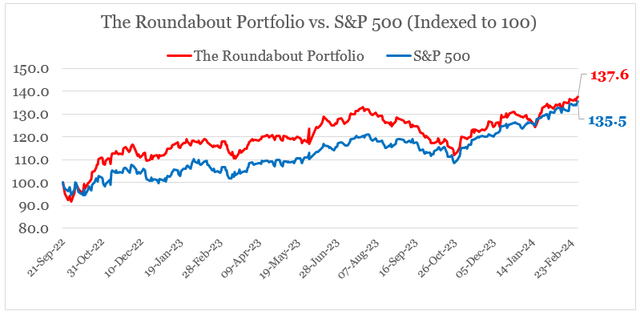

Looking for better positioned high quality businesses?

You can gain access to my highest conviction ideas across different sectors by subscribing to The Roundabout Investor, where I uncover conservatively priced businesses with superior competitive positioning and high dividend yields.

Performance of all high conviction ideas is measured by The Roundabout Portfolio, which has consistently outperformed the market since its initiation.

As part of the service I also offer in-depth market analysis, through the lens of factor investing and a watchlist of higher risk-reward investment opportunities. To learn more and gain access to the service, follow the link provided.