Summary:

- Disney’s direct-to-consumer streaming is turning the corner as the U.S. market matures and churn rates decline.

- Significant global growth potential still exists as linear TV viewing is declining and smart TVs become more widespread.

- Disney’s bundles offer subscribers a leading array of content, positioning them as a strong competitor to Netflix.

simpson33

Direct-to-consumer streaming is Disney’s (NYSE:DIS) most significant growth initiative in decades and is likely to continue driving the company’s profit growth for many years to come. This industry is still in its infancy, however, and most of the players are not profitable.

Linear TV viewing is expected to keep declining as smart TVs become more widespread, even in less affluent countries, creating a decade-long growth opportunity for streamers. US media companies, with their leading budgets and high-quality content, are poised to gain market share globally. As distribution arrangements and content offerings develop, Disney will gain direct access to millions of households worldwide.

Streaming platforms not only extend the reach but also provide content owners with direct access to viewers, enabling them to capture a much larger share of the industry value compared to content licensing.

Disney already generates over $20 billion in revenue from streaming but continues to invest aggressively and operate at a loss. Despite this, the growth potential is considerable, and we welcome this investment. Streaming is likely to become Disney’s largest profit centre, significantly boosting the company’s earnings.

We are excited about these growth prospects, especially given the modest earnings multiples at which Disney is currently trading.

The streaming industry has been challenging but bright spots are emerging

Over the past years, streaming has been largely disappointing for most market players, with the notable exception of Netflix (NFLX). However, analysts often forget that it took Netflix fifteen years to scale and achieve double-digit profit margins. Other major content producers are likely to join the ranks of profitable streamers, but it will take time.

In anticipation of enormous growth potential, streaming platforms have over-invested in hopes of attracting subscribers and building the necessary scale. However, they overlooked a significant issue: user retention has been low. As a result, much of the money spent on marketing, promotion, and original content may have been wasted.

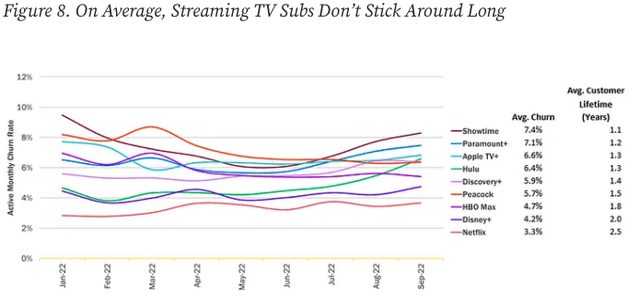

Many market participants now find themselves in a dilemma: continue spending to maintain their subscriber and revenue base, hoping to eventually turn a profit, or stop throwing good money after bad. So far, no one has chosen to give up, despite annual churn often exceeding 40%. Netflix is seen as a default service, while other platforms cycle short-term re-subscribers whenever new and attractive content is uploaded.

However, there are some bright spots on the horizon. Domestic subscriber growth numbers have plateaued, indicating that market maturity is nearing. Market shares are starting to settle, reducing the incentives to spend heavily to drive subscriber volumes.

Streaming platforms are therefore beginning to moderate content and marketing budgets and are increasingly focusing on margin improvement while maintaining subscriber bases. All market participants have also started raising prices.

Streamers are now starting to adopt a tried-and-tested media industry strategy: bundling. Initial data suggests that bundling helps to reduce churn rates considerably. For instance, the triple Disney+, Hulu, and ESPN+ bundle has achieved the lowest churn rates in the industry, even lower than Netflix. Disney+ re-subscribers who choose this triple bundle are 59% less likely to churn again within the next 12 months. This is a very significant development!

This reduction in churn rate is expected to boost Disney’s top and bottom lines. As re-subscribers stick around longer, overall subscriber numbers are expected to rise, as leading bundles will gradually gain market share from high-churn streamers. Higher customer loyalty will also enable lower marketing, promotional, and original content spending. The profit margins of the leading streamers will gradually rise!

The bundled offering will help raise profit margins

Disney’s expanded content portfolio, offered through bundled packages, is resonating well with consumers and will help the company gain market share by upselling its services in the domestic market.

The bundles offer considerable price savings as compared to purchasing the subscriptions separately, therefore should put pressure on Average Revenue Per User. However, Disney has been raising prices and reducing promotional activity on individual services as it has been introducing bundles. As a consequence, ARPU has actually climbed up as bundles were being introduced. Going forward, as the share of bundled subscribers increases, ARPU can be capped without additional price increases.

Disney is now taking bundling a step further by integrating Hulu and ESPN+ content directly into the Disney+ platform for subscribers who opt for the triple bundle. This move not only increases the amount of content available on Disney+, justifying a higher price and lowering churn. Content integration in one flagship platform also unlocks considerable operating efficiency gains.

Achieving profit margins similar to Netflix will take time, though Disney seems to be moving in that direction. As long as Disney+, Hulu, and ESPN+ operate separately, significant marketing and promotional expenses will be necessary due to the lack of scale benefits. However, over time, most of Disney’s streaming customer base will likely consist of bundle subscribers. This shift would allow Disney to gradually phase out the standalone services of Hulu and ESPN+, ultimately leading to improved operational efficiency and profit margins.

Disney bundles offer subscribers as much value as Netflix

The streaming business is highly competitive, and yet, one market player stands out with its profitability. It’s no surprise that this player, Netflix, has the highest streaming content budget in the industry.

Streaming is fundamentally a commodity business driven by scale. The platforms that can offer the most content for an average subscription fee are poised to be the winners. The content game has two key components: the overall content budget and the quantity of content. While a substantial content budget is crucial, the quantity of content is a strategic choice, as there is often a trade-off between quantity and quality.

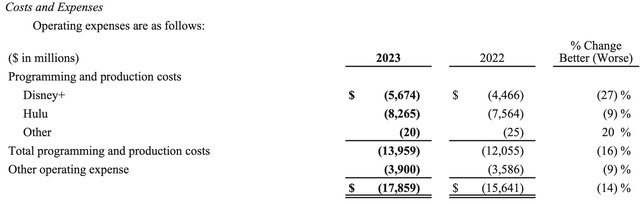

Netflix subscribers receive ~$14-17 billion worth of content per year, significantly more than from any other platform. This massive content budget is a key reason for Netflix’s market dominance. In comparison, Hulu subscribers receive around $8 billion worth of content annually.

However, when combining the offerings of Disney+ and Hulu, subscribers gain access to approximately $14 billion worth of content, positioning Disney as a close second to Netflix. The value proposition becomes even more compelling when ESPN+ is included in the bundle, enhancing the overall content offering and providing significant value for money to subscribers.

Disney’s strength is content quality, and it should not compete on quantity

While a large content budget is essential, the sheer quantity of the content is also important. A streaming service must not only have a leading budget but also effectively convert that into popular and abundant content. Streaming platforms are playing to their strengths when it comes to choosing content strategies.

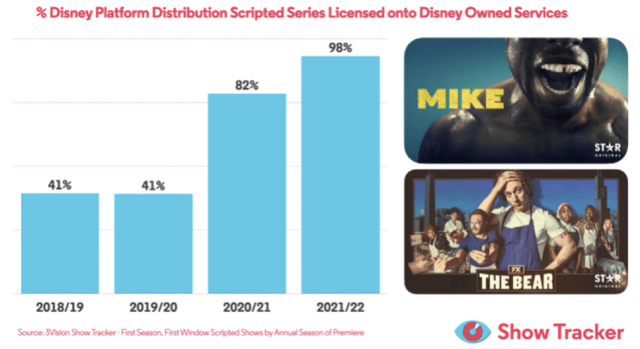

Disney owns valuable franchises and an impressive back catalogue of high-budget, high-quality film and cable TV titles. This allows Disney to produce popular high-budget originals based on its franchises and secure exclusive rights from its linear networks. Notably, series aired on Disney’s linear networks recently accounted for 17 of the top 20 most-viewed shows on its streaming platforms. This demonstrates Disney’s ability to capitalise on its traditional high-budget production strength in the direct-to-consumer streaming market.

To drive subscriber growth on its streaming platforms, Disney has been sacrificing licensing revenues from third parties. By focusing on building its subscriber base, Disney aims to leverage its content strengths and secure a competitive edge in the streaming market. Disney cannot and should not compete with the likes of YouTube (GOOG) primarily on content quantity.

Netflix, in contrast, focuses heavily on content volume and targets smaller market niches using user preference analytics and an international third-party cost-plus content production approach. While Netflix may not hold the rights to many popular titles, it can produce significantly more content hours per dollar of subscription fee than most other platforms, with the exception of YouTube. This strategic advantage is increasingly important as major studios withhold popular content for their own platforms.

Having said that, Netflix has built its subscriber base using high-budget titles. Popular titles attract subscribers, while the diverse content offering ensures they stay. As for Disney, quality is the driving force but quantity is also needed to compete successfully. We believe that Disney still needs to improve its approach to addressing market sub-segments, similar to Netflix’s strategy.

Disney needs to improve its international production capabilities

Disney will also need to develop some low-cost budget production capabilities to cater to smaller subscriber sub-segments. They do not have to get as good as Netflix, though, as their rich content back catalogue compensates for the lack of original content volume.

Disney, as well as other legacy content producers, are still in the early stages of developing their international content supply chains. Disney has only launched their International Content Group back in 2022. Disney is now investing significantly in the “creation of original local and regional content for its streaming services, with more than 340 titles already in various stages of development and production”.

The international market presents subscriber growth opportunities but also can be a cost-efficient source of globally relevant content. Korean content especially tends to resonate well with viewers across South East Asia and also globally. Disney has recently announced a fresh content slate with originals from France, Spain and Poland among many others.

Global Content Spending (Televisual)

While Disney is still lagging behind Netflix in international production capabilities, they are rapidly catching up. This is particularly true as international subscriber numbers grow and local production costs can be covered by local revenues.

International content will be needed to succeed globally

Disney has the scale to compete with Netflix domestically due to its large content budget and diverse offerings. However, Disney is not as strong in international markets, as Hulu is only available in North America.

Many of Hulu’s licensing agreements include geographic restrictions that limit content distribution to the U.S. market. Internationally, Disney+ can only offer originals and content from their linear networks that have not been licensed out. As a result, Disney+ probably offers approximately $8-$10 billion worth of content in international markets, considerably less than Netflix. Disney does lack volume and diversity of content when it comes to international markets and local production can address this issue.

Despite this, Disney+ features popular titles from Disney, Pixar, Marvel, and FX, which help it to drive subscriber growth. But to achieve lower churn in international markets also, Disney needs more content. International growth is the main long-term driver for the streaming industry, and success in these markets will determine Disney’s future growth prospects.

Currently, Netflix has 190 million international subscribers, while Disney Core has only 64 million. To become more competitive with Netflix, Disney needs to expand its content offerings for international subscribers.

Improving profitability domestically will enable Disney to invest more aggressively internationally. There is a long leeway for growth but it also requires a lot of investment.

Valuation and financials

During FY2023, Disney generated $11.7 billion in adjusted operating income, which included $2.5 billion in losses from the streaming division. This figure also reflects depressed “Content Sales and Licensing” profits due to a shift from external licensing to in-house streaming platforms.

Disney’s direct-to-consumer streaming growth ambitions are currently putting significant strain on its profits. However, streaming is expected to break even next year, while the Experiences division continues to grow. Disney is trading at about 16X next year’s adjusted earnings.

The current valuation multiple is modest, considering the already significant direct-to-consumer streaming scale and long-term growth prospects.

|

FY2022 |

FY2023 |

FE 2024 |

|

|

Revenues |

82,722 |

88,898 |

|

|

Direct to Consumer |

17,975 |

19,886 |

22,400 |

|

EBITDA, adj |

14,145 |

15,342 |

14,868 |

|

Depreciation |

-3,183 |

-3,626 |

|

|

Operating income, pre- amortisation, adjusted |

10,962 |

11,716 |

14,868 |

|

Entertainment |

2,126 |

1,444 |

3,700 |

|

Linear Networks |

5,198 |

4,119 |

3,700 |

|

Direct to Consumer |

(3,424) |

(2,496) |

0 |

|

Content Sales/Licencing |

352 |

-179 |

0 |

|

Sports |

2,710 |

2,465 |

2,465 |

|

Experiences |

7,285 |

8,954 |

9,850 |

|

Corporate |

(1,159) |

(1,147) |

(1,147) |

|

TFCF and Hulu acquisition amortization |

(2,353) |

(1,998) |

|

|

Restructuring and impairment charges |

(237) |

(3,836) |

|

|

Interest expense, net |

(1,397) |

(1,209) |

(1,209) |

|

PBT |

6,975 |

4,673 |

13,659 |

|

PBT, adj |

9,565 |

10,507 |

13,659 |

|

Earnings, adj |

7,556 |

8,301 |

10,791 |

|

EPS |

4.6 |

5.9 |

|

|

PE |

22.0 |

16.0 |

|

|

Cash and cash equivalents |

11,615 |

14,182 |

|

|

Current portion of borrowings |

3,070 |

4,330 |

|

|

Borrowings |

45,299 |

42,101 |

|

|

Net Debt |

36,754 |

32,249 |

|

|

Net Debt/EBITDA |

2.6 |

2.1 |

Source: Financial statements, Author estimates

ESPN streaming service should reinvigorate sports earnings growth

Live premium sports content has largely been immune to the declining viewership seen in other linear TV segments, and as a result, the costs have been rising. Content cost inflation has been an issue, particularly given the declining linear TV subscriber numbers.

ESPN, Disney’s flagship sports property, plans to launch a DTC streaming service in the fall of 2025. Currently, ESPN has 71 million domestic subscribers, down from a peak of 100 million in 2011. This decline is largely due to cord-cutting, even though sports remain popular content, as evidenced by rising prices.

The new flagship streaming service will help Disney target cord-cutters and amortize content costs over a larger subscriber base and revenue pool. We expect the sports business to remain resilient despite rising sports rights costs and the trend of cord-cutting.

Disney is trading at a low valuation despite strong growth prospects

Considering that Disney’s significant streaming operations are still not producing any profits and that Linear Networks’ contribution is limited, the 16X PE multiple is quite attractive.

While it is challenging to place a precise value on the streaming business today, we believe there is considerable growth potential both domestically and internationally. It might take some time for Disney to attract most American consumers into bundles, the development of international distribution and content production will also take time. However, there is significant room for growth.

Just as smartphones enabled online music streaming, the gradual rollout of smart TVs and changing consumer habits will increase the adoption of digital video streaming over time.

Disney is one of the largest spenders on scripted content and has already developed a leading-scale streaming business. Disney will likely be one of the largest beneficiaries of the streaming market growth. The company’s addressable market is probably about 500 million households.

Key Risks

Despite building leading content bundles in domestic markets that rival Netflix’s low churn, Disney still needs to develop their content offering in International markets. It remains to be seen if Disney can cost-effectively produce appealing local content and reduce churn rates internationally as well.

The competitive environment domestically has become more favourable, on the other hand, as streaming platforms increasingly look internationally for subscriber growth, competition can heat up there. Just as streamers over-invested in the content domestically, they could potentially do the same in Asia and South America.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.