Summary:

- Disney is set to extend its media rights package with the WNBA through ESPN, hoping to boost enthusiasm for women’s basketball led by rising star Caitlin Clark.

- Management has reiterated expectations for the streaming businesses to reach profitability by the end of the year.

- Despite the high debt load and past underperformance, I see the potential for 40% upside in the stock.

GoodLifeStudio/E+ via Getty Images

Disney (NYSE:DIS), through its majority-ownership of ESPN, appears set to reach a monumental extension of its media rights package with the WNBA. Investors may be hoping that a rise in enthusiasm for Women’s basketball, likely led by the rising star Caitlin Clark, can help spur growth in the company’s ESPN business and further spark a stock which is essentially flat over the past decade. Management has shown an increased commitment on driving profitability, which is a welcome development given the recent history of arguably aggressive growth. While I am cautious on the lofty debt load, I expect improving profitability in the company’s streaming businesses to help drive both a significant boost to consolidated profitability as well as an eventual re-rating in the stock price. I rate the stock a buy.

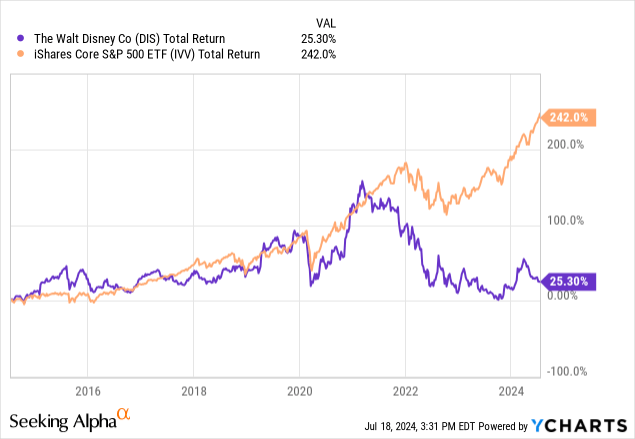

DIS Stock Price

I last covered DIS in June of 2019 where I rated the stock a strong buy and explained my reasoning for why I thought the company would “crush” Netflix. This ranks as one of my worst calls as the stock has underperformed the broader market (and Netflix for that matter) by around 120%. The stock has greatly underperformed the broader market over the past decade.

Making matters worse, earnings per share on a GAAP and non-GAAP basis are down since then. But the company has successfully recovered from the pandemic and I see continued gains to profits as the streaming businesses begin to show operating leverage.

DIS Stock Key Metrics

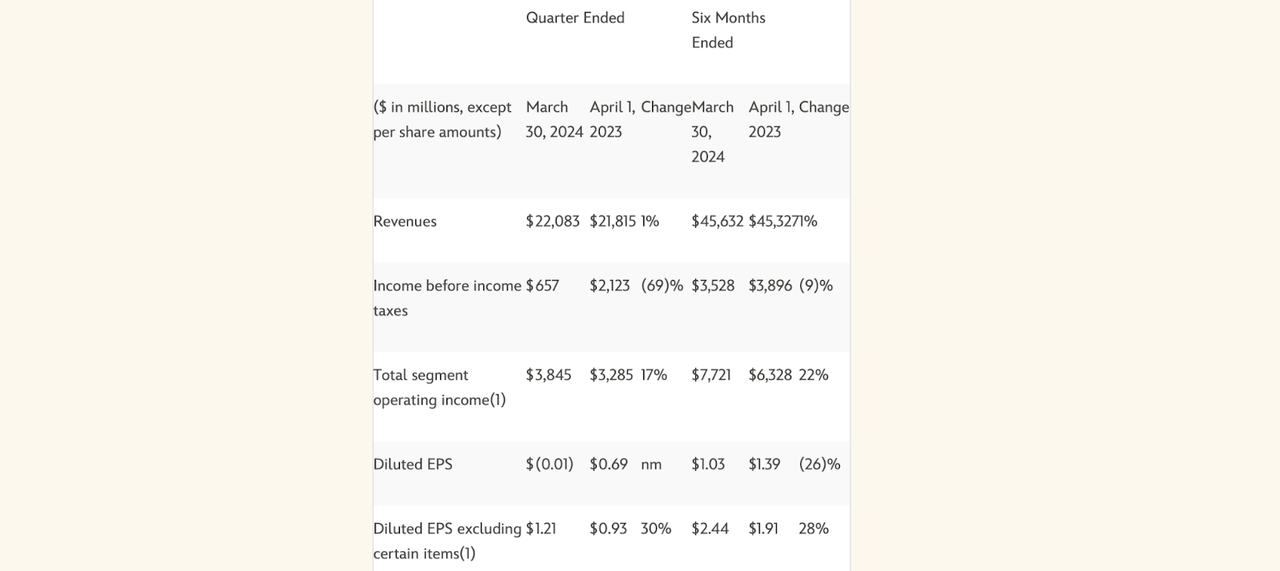

In its latest quarter, DIS saw revenues increase by a paltry 1% YoY as the company no longer benefitted from easier comparables. Segment operating income grew 17% YoY and non-GAAP earnings grew 30% YoY to $1.21 per share, reflecting management’s push for more efficient operations.

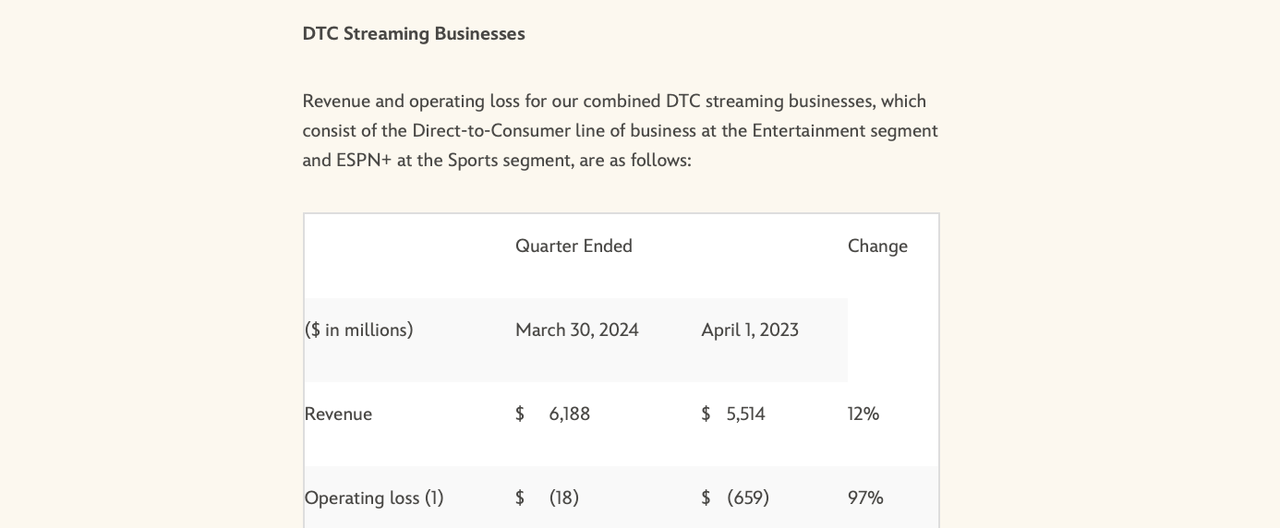

FY24 Q2 Press Release

I note that the main non-GAAP adjustment to earnings appears to be impairment charges, which is a reasonable add-back. The company’s cash cow continues to be the parks and experiences segment, which saw 10% YoY revenue growth and generated 59% of overall segment operating income.

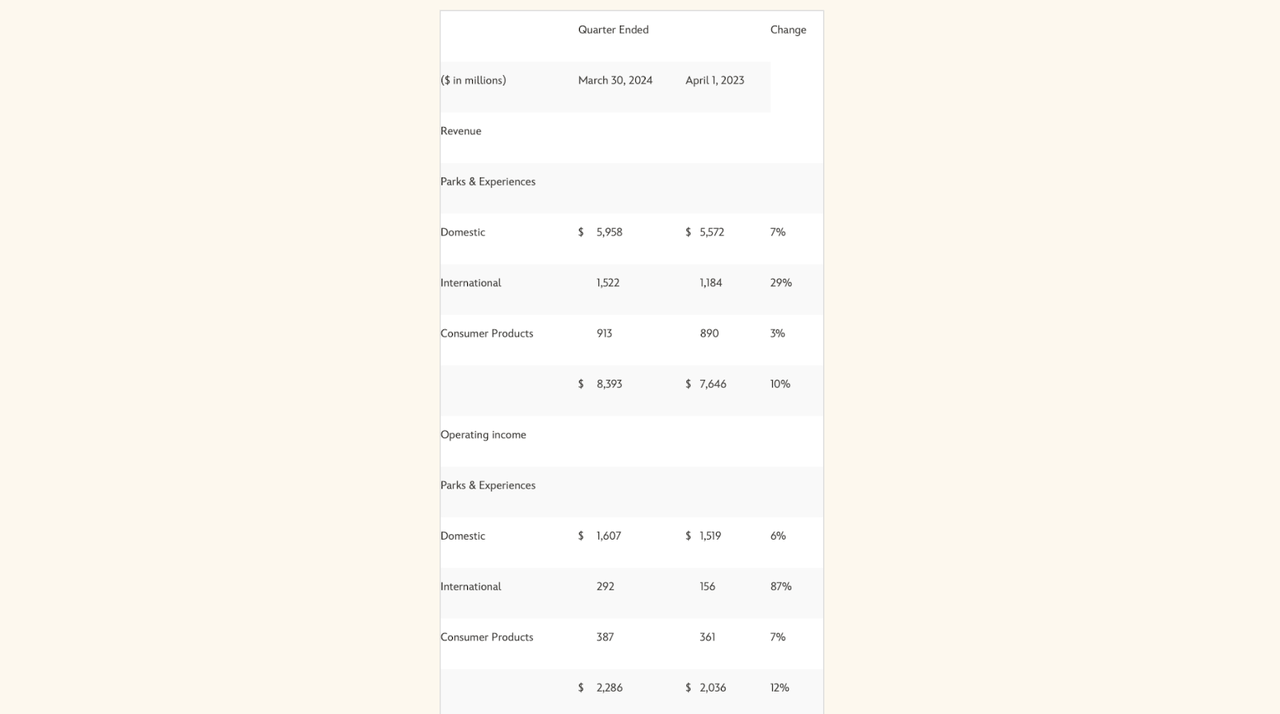

FY24 Q2 Press Release

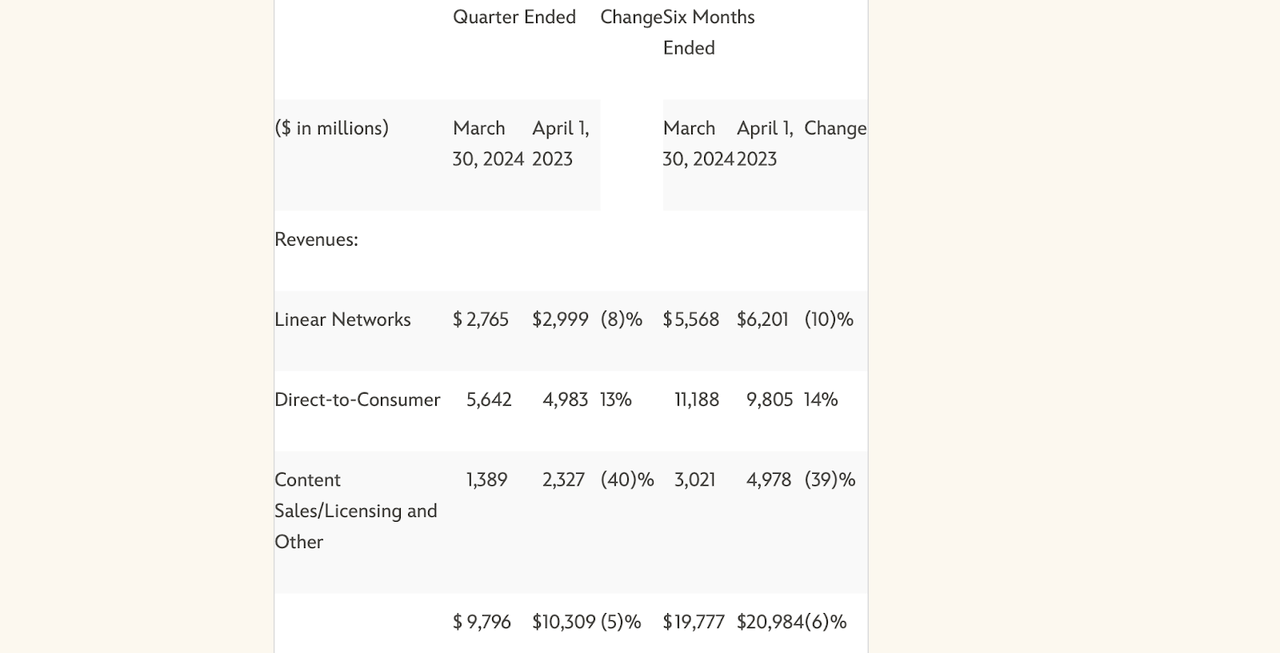

As for the entertainment segment, revenues declined 5% YoY in spite of 13% YoY growth in the direct-to-consumer streaming revenues. Linear networks still generate substantially all of the entertainment segment’s operating income.

FY24 Q2 Press Release

DIS did see its DTC streaming business operating losses improve dramatically from $659 million to just $18 million. On the conference call, management reiterated expectations for profitable streaming operations by the end of the fiscal year.

FY24 Q2 Press Release

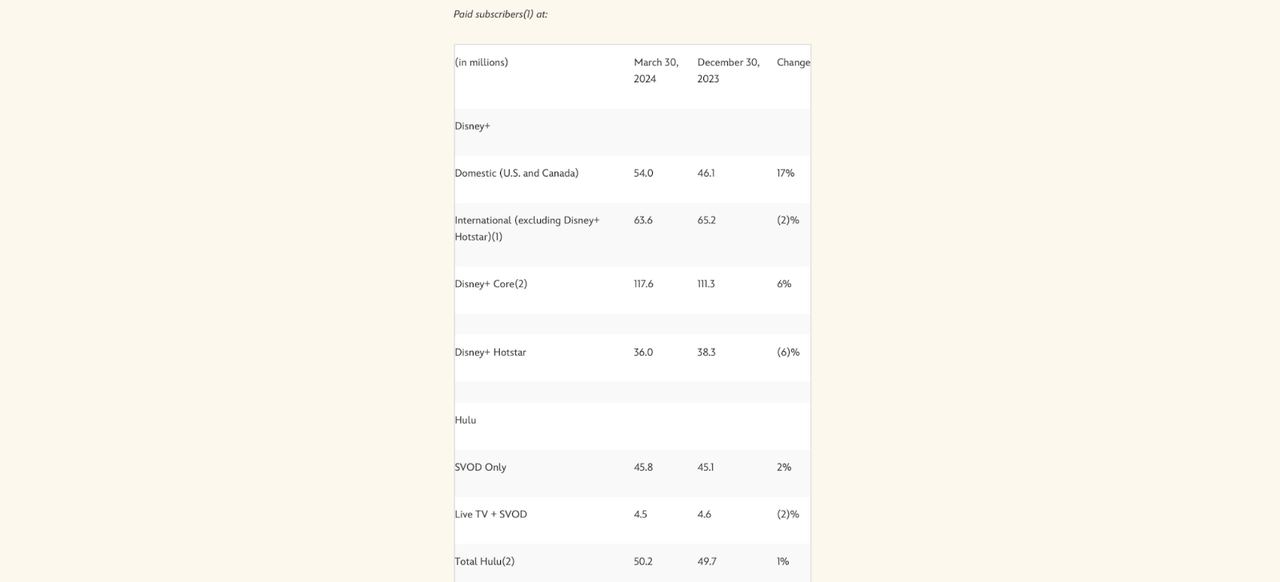

DIS saw core Disney+ subscribers grow 6% sequentially and 12% YoY to 117.6 million. In contrast, Hulu subscribers grew by only 4.1% YoY to 50.2 million. DIS has sought to purchase the 33% stake owned by Comcast (CMCSA), but the two companies are still in discussions regarding valuation.

FY24 Q2 Press Release

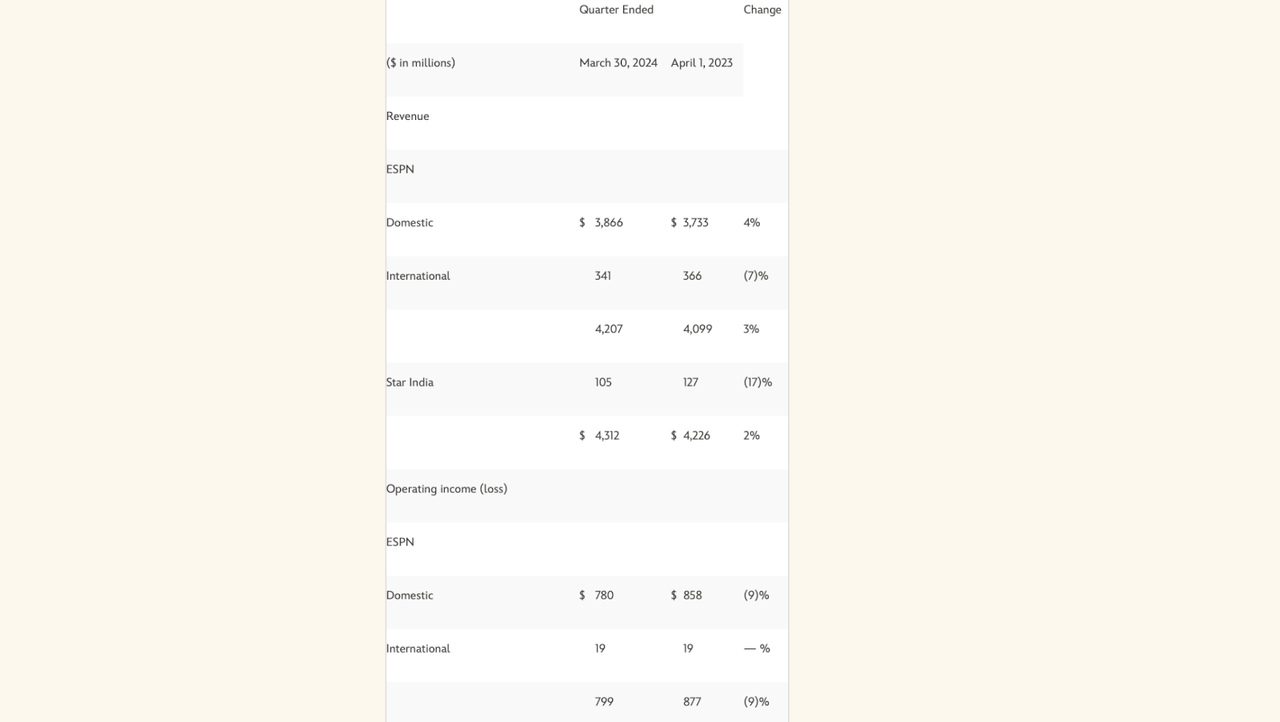

Just this week, reports noted that DIS and others have reached a $200 million per year deal over the next 11 years with the WNBA. That is a large jump from the prior amount of around $50 million annually. The WNBA has seen renewed interest, likely due to the rise of Caitlin Clark, who has seen her NCAA heroics transfer over to the WNBA. If there are any groans about women’s sports, I should note that in theory there’s great potential here given that statistics show that approximately 63% of female viewers have no interest in the NBA (versus just 34% for male viewers) – and I note that Clark is a nightly highlight reel. A boost would be welcome for the ESPN division, which has seen top-line growth slow to a crawl with segment operating income continuing to slide.

FY24 Q2 Press Release

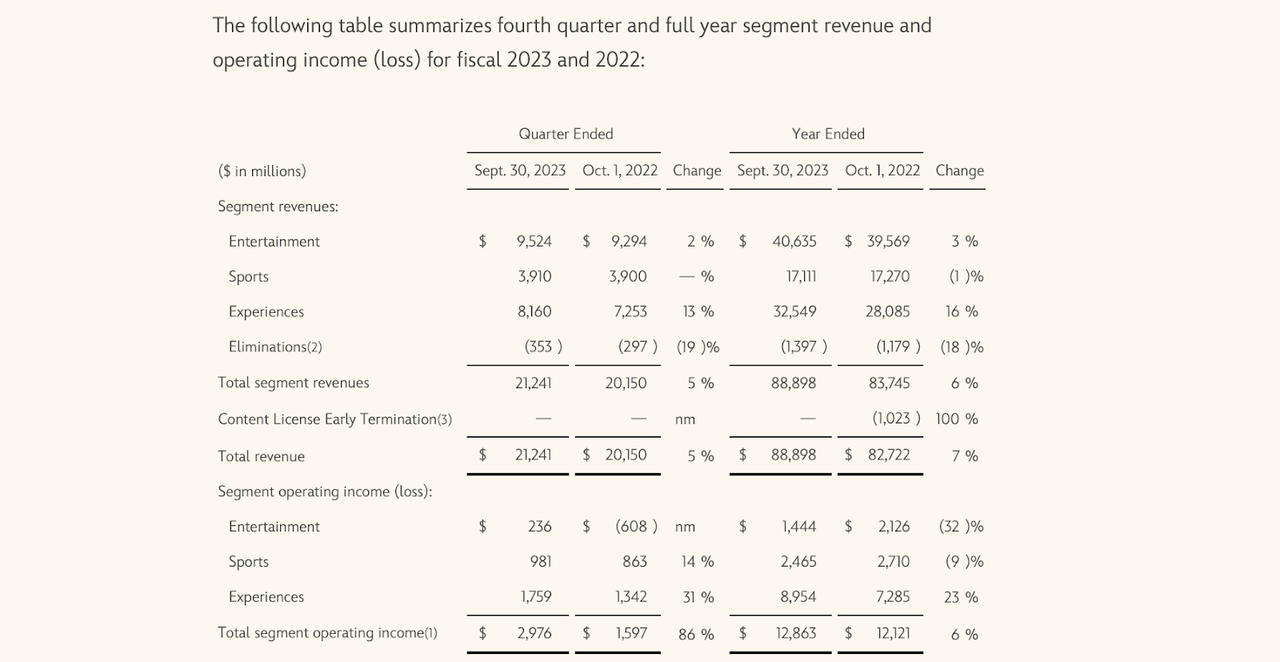

In the prior fiscal year, the ESPN sports segment saw revenues decline 1% YoY and segment operating income decline 9% YoY. ESPN has long been considered a sort of troubled child for the company – perhaps Clark and the WNBA can come to the rescue?

FY23 Q4 Press Release

DIS ended the quarter with $6.6 billion of cash versus $46.3 billion of debt, representing a highly leveraged balance sheet at around 3x 2023 segment operating income. For now, this leverage ratio looks manageable given the consistent nature of the experiences segment.

Management has increased their full-year guidance for adjusted EPS growth to 25% (non-GAAP EPS stood at $3.76 last year). Management continues to expect over $8 billion of free cash flow this year, which should help fund their ongoing share repurchase program. Management does not expect to see core subscriber growth at Disney+ in the upcoming quarter but expects growth to return in the fourth quarter. DIS was a big beneficiary during the pandemic when it saw Disney+ subscriber growth spike, but it appears that the comparables will be more difficult moving forward.

Is DIS Stock A Buy, Sell, Or Hold?

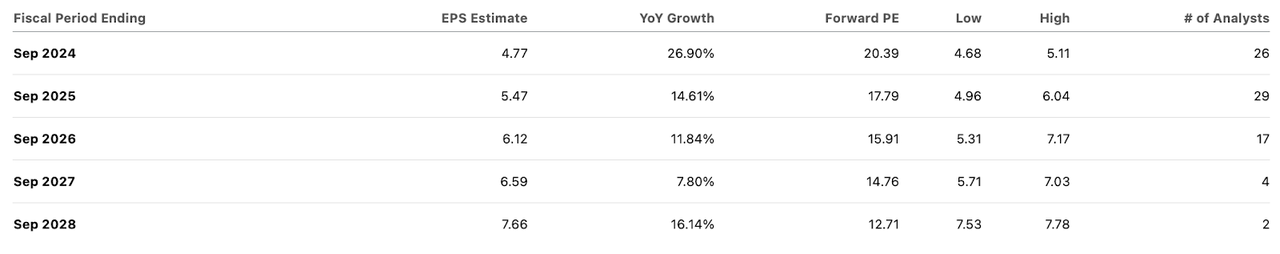

At recent prices, DIS found itself trading at around 20x this year’s earnings estimates (consensus estimates see DIS exceeding management guidance to the tune of 26.7% YoY growth).

Seeking Alpha

That earnings multiple looks attractive considering that most of the earnings comes from the experiences business, with the streaming businesses having minimal to negative impact (for now). I can see an argument for the experiences business being worth at least 20x earnings given the apparent long term pricing power, offset by the capital intensity of the business. To be conservative, we can assume a 10x earnings multiple for the sports business. What might Disney+ and Hulu be worth? Netflix (NFLX) recently traded around a $280 billion valuation, implying a 7.2x sales multiple. While Disney+ and Hulu are not nearly as profitable as NFLX, I see the former as having greater long term pricing power due to the lower starting point. As a result, I see 7.2x sales as being at least a conservative multiple for these businesses. Against $22.4 billion in annualized direct-to-consumer revenues, that implies a valuation of $161 billion. We can apply a 30% discount for a margin of safety. Adding these three parts together, we arrive at a valuation of around $142 per share, implying over 40% potential upside.

DIS Stock Risks

Long time shareholders may unfortunately know that DIS has seemingly been ensnared in “transitions” for many years now, as management has had a voracious appetite for M&A. I do believe that management is highly committed to driving profits as it is showing in the numbers, but there remains the possibility that management embarks on new M&A which pressures both the bottom-line and the balance sheet. It is possible that the company eventually sees growth slow or even turn negative at its experiences business. Anecdotally, I view the parks and cruises as being of very high quality, but I doubt anyone can argue with the sentiment that both prices and traffic are already high. The company’s large debt load increases the risk profile especially given the higher interest rate environment. The company has seen mixed reviews on some of its latest releases, including The Acolyte, which appear to be in part due to the increasingly polarized nature of the political landscape. If this trend were to continue, then Disney+ might not be able to realize its full profit potential.

Conclusion: Disney Stock Is Undervalued

There appears to be an undervaluation case to DIS stock, with much of that value coming from the streaming businesses. The company might see some spark from increasing interest in women’s sports, but the stock looks attractively valued even without it. The balance sheet is a potential cause for concern, but barring another pandemic, the experiences business should generate enough cash to manage it. I rate the stock a buy.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of DIS either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I am long all positions in the Best of Breed Growth Stocks Portfolio.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Sign Up For My Premium Service “Best of Breed Growth Stocks”

After a historic valuation reset, the growth investing landscape has changed. Get my best research at your fingertips today.

Get access to Best of Breed Growth Stocks:

- My portfolio of the highest quality growth stocks.

- My best deep-dive investment reports.

- My investing strategy for the current market.

- and much more

Subscribe to Best of Breed Growth Stocks Today!