Summary:

- Disney is an unrivaled entertainment juggernaut with a huge portfolio of products, brands, and services.

- The last five years have been largely unimpressive from a fiscal standpoint, which has left the company trading at much lower prices than before.

- Bob Iger’s return to the helm has sparked hopes of a return to profitability for the company.

- Excessive losses in the DTC streaming segment combined with weakening Linear Network revenue create uncertainty in Disney’s revenue streams.

- Excessive exposure to risk warrants Disney a Hold rating.

MrNovel/iStock Editorial via Getty Images

Investment Thesis

The Walt Disney Company (NYSE:DIS) is one of the world’s largest entertainment business. They boast a truly unrivalled portfolio of characters, products and services ranging from classic animated films to global news shows all the way to theme parks.

While the last five years have been less than impressive for the company, the return of Bob Iger as Disney’s CEO has once more sparked hopes that the profitability magic may be rekindled at the entertainment juggernaut.

Nonetheless, a detailed company analysis combined with a financial valuation must be conducted to understand whether or not Disney offers any tangible value to investors.

Company Background

Disney is an American MNC entertainment and media conglomerate headquartered in in Burbank, California. The company is one of the largest content creating firms in the world.

Disney was founded back in 1923 with a primary focus on animated movies and cartoons. 100 years later and the company still products such original content – along with hundreds of other movies, TV series and products.

The company’s constant diversification into alternative forms of entertainment, content and media has propelled growth resulting in the media powerhouse we now have today. Today, Disney has elements of its business that span from global news to Star Wars all the way to some of the world’s largest theme parks and resorts.

Nonetheless, the last five years have been difficult for the company with unimpressive fiscal achievements resulting in the company’s shareholders exhibiting dead-money characteristics for the past half-decade.

While previous CEO Bob Chapek managed to expand Disney into the direct-to-consumer (DTC) content streaming business along with a significant expansion of many franchises content pools, little was done to address the company’s profitability and operational efficiency.

Now that ex-CEO Bob Iger (who had a very successful run as Disney CEO from 2005-2020) has returned to the helm, the question remains as to whether or not he can turn this steamboat around.

Economic Moat – In Depth Analysis

Disney is one of the largest entertainment media companies in the world. Their unrivalled portfolio of products and services, immense studio capabilities combined with significant industry expertise provides the company with a very wide economic moat.

The sheer breadth of Disney’s content portfolio alone earns the company a significant moat in the digital entertainment and media business.

Walt Disney Studios is Disney’s primary motion picture and animation segment responsible for the creation of Pixar, Lucasfilm and Walt Disney Animation Studios productions. The department also controls a distribution segment responsible for marketing and selling viewership rights to their content.

The Lucasfilm division is primarily responsible for the immensely popular Star Wars franchise. Since Disney’s acquisition of the company from George Lucas back in 2012, the company has grown the Star Wars empire alone to be worth a whopping $70B.

To complement these two juggernauts of content creation Disney also owns Marvel Entertainment & Studios as well as Fox Entertainment Group. Marvel was wholly acquired by Disney in 2009. Since then, Disney has been laser focused at expanding the Marvel Comic Universe to better flesh-out the incredibly diverse and detailed fictional world.

Fox Entertainment Group not only produces movies and TV content, but also includes the Fox Sports Media Group and National Geographic + Partners businesses. These subsidiaries allow Disney to target different segments of the digital content consumption environment and increase the diversity present in their cash flows. Such sub-divisions also help to vastly increase brand penetration as well as funneling new customers into Disney’s other product offerings.

This content creation business already illustrates the massive scale on which Disney operates as a pure, digital entertainment and motion picture company. Their unrivalled portfolio of Disney original movies, including the massive “add-ons” of Star Wars, Marvel and Fox means the company produces a huge portion of today’s, yesterday’s and no doubt tomorrow’s top films and series.

Additionally, the company has the entire Disney Parks, Experiences and Consumer Products division which is responsible for the Disney theme parks like Disneyland, Walt Disney World and the Disneyland Resorts. This huge travel and experience division is responsible for taking the digital and movie content and creating physical entertainment parks for customers to enjoy first hand.

This mix between physical and digital content is undoubtedly one of Disney’s strongest marketing elements as it vastly helps strengthen the psychological connection viewers of a movie may have to the fictional characters and worlds. Furthermore, the ability for content consumers to spend more money within the Disney world by not only watching a movie, but physically going to a theme park creates significant revenue generation potential.

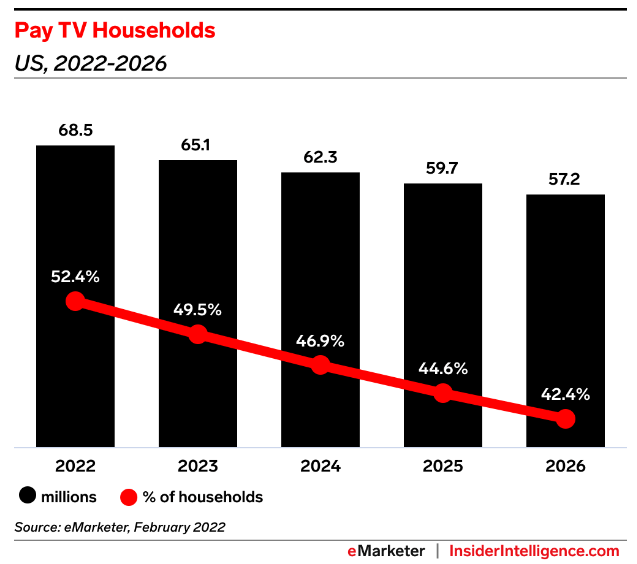

On top of this, Disney has a significant set of news and global media outlets such as ABC News, Sky UK, and Ireland along with ESPN under its ownership. This allows Disney to benefit significantly from the huge revenues present in the pay-television market which is still being used by around 50% of American households today.

Intelligence Insider | eMarketer

While this market segment is on the decline with viewership rates dropping by around 5% per year, the segment still products significant revenues for the company. Furthermore, the ESPN network is a huge player in the U.S. sports broadcasting business and is responsible for a vast portion of these cable TV revenues.

ESPN itself is a source of significant moat for the company thanks to the presence and established image the company holds in the sports entertainment business. Disney is wholly aware that the beginning of the end is coming for cable TV which is why the company is also expanding ESPN into the online streaming DTC market with ESPN+.

Overall, Disney’s digital content and theme park business is truly outstanding and allows the company to extract huge revenues from a number of different markets and business segments. This diversity also provides the company with huge scale in content creation which makes it difficult for rival companies to compete with their products.

Furthermore, through the significant breadth of Disney’s different business endeavors, the company has built a truly remarkable intellectual resource pool which provides the firm with a huge and valuable set of intangible assets.

The household name that has become Disney, their content and their theme parks also provides the company with significant economic moat. Watching new Disney animated movies, Marvel action films or going to Disneyland once a year is common place for many people across the globe.

Such influence also allows Disney to create huge third-party licensing agreements for other companies to expand upon their core businesses with merchandising, toys and many more products for consumers to enjoy. This only acts to enhance the power of Disney’s brands and illustrates the huge network effect the company enjoys.

Disney has a truly massive economic moat thanks to a set of intangible and tangible resources which would be almost impossible for competitors to recreate.

Financial Situation

Disney has been a relatively profitable firm for the greater part of their existence. Their consistent EBIDTA margins of 14.10% combined with a 5Y average ROIC of 6.76%, while not outstanding, are still quite healthy from a profitability perspective. However, the tides could be beginning to change for the company with 2022 being an incredibly impressive year.

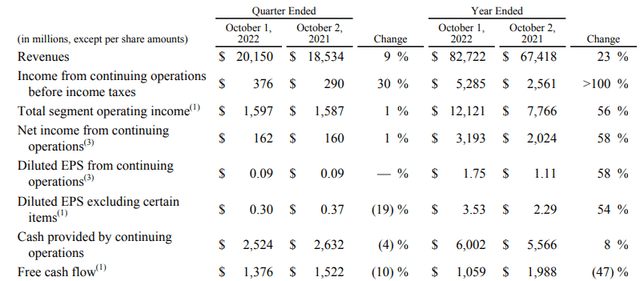

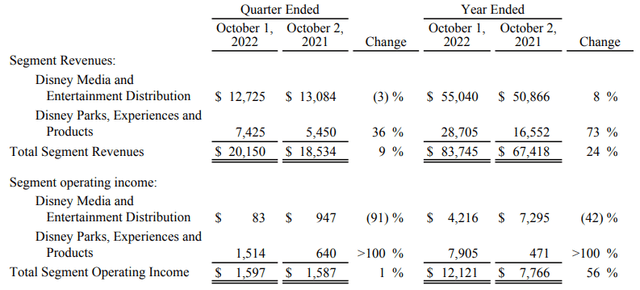

In FY22, Disney generated $82.7B in net revenue. This represents a 23% increase compared to the same period in FY21. Furthermore, the company managed a 104% increase in income from operations before tax in FY22. Net income from operations increased 58% to a whopping $3.2B.

2022 was clearly a successful year for Disney, with particularly strong revenues being generated by their Parks and Experiences and Products segment.

Thanks to COVID-19 restrictions finally being eased across the globe along with a significant pent-up demand for travel, Disney’s Parks earned a record setting $28.7B of revenue in FY22 representing a 73% increase compared to FY21. Operating income for the same division increased over 1000%.

Furthermore, their core media and distribution business showed strong revenue growth thanks to their Disney+ subscription service gaining an additional 14.6 million subscribers. The company also credited “some of their best storytelling yet” for bringing in plenty of new consumers into the Disney ecosystem in 2022.

The unfortunate decrease of 42% in Disney’s Media and Entertainment segments operating income was due to lower operating results at Direct-to-Consumer and Content Sales/Licensing, which was only partially offset by growth at Linear Networks.

The decrease at Direct-to-Consumer was due to higher losses at Disney+ and, to a lesser extent, lower results at Hulu and higher losses at ESPN+. These losses on the DTC streaming business are unsurprising due to the incredibly competitive and costly nature of the market environment.

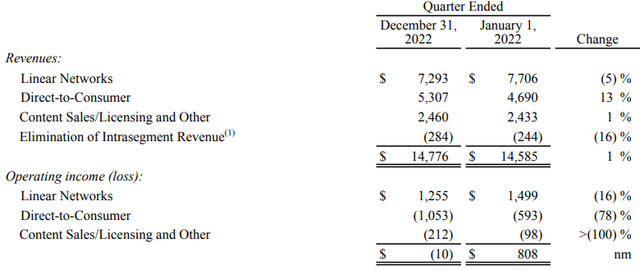

While some of these losses were offset by strong U.S. Domestic Linear Network (cable TV) results, weaker international linear network earnings led to overall revenues and operating income increasing just 1% for this segment.

Luckily, the massive earnings brought in by the parks and experiences division helped offset these losses, but it does raise a question as the world transitions to a more DTC streaming oriented entertainment business.

Disney Earnings Report Q1 FY23

This concern is echoed in Disney’s Q1 FY23 earnings report which saw the company’s streaming service lose customers for the first time. Disney+ lost 2.4 million subscribers in the last three months of 2022. However, the company was quick to point out this was entirely due to a decline in Disney’s “Disney+ Hotstar”, a version of the service offered in India and Southeast Asia.

During an earnings calls, Iger announced Disney is eliminating approximately 7000 jobs (around 3.2% of its global workforce) in an effort to reduce operating costs by $5.5B. Since Iger’s return to the helm of Disney, he has announced a strategic objective to streamline their operations to increase the profitability of their operations.

Iger also announced that Disney will be paying a dividend to shareholders by the end of the calendar year 2023. This is welcome news after the company axed this valuable source of shareholder returns during the pandemic in 2020.

Total revenues in Q1 rose by 8% compared to FY22 with net income still comparatively having decrease 7%. This was primarily driven by once more weakening operating incomes in their DTC service with losses increasing by 78% in Q1 compared to the previous year.

Clearly, while other elements of the company’s business (particularly their Parks, Experiences and Products division) continue to show significant growth and profitability, their DTC streaming business is a significant strain on the company.

While revenues and subscriber counts continue to grow (except in the aforemetioned Indian and Southeast Asian markets), it seems Disney is failing to turn a profit from these operations. Furthermore, the route to profitability is difficult given the competition from alternative platforms like Netflix or Amazon Prime.

Iger highlighted this issue in the earnings call stating that under the leadership of ex-ceo Chapek, the company placed excessive emphasis on growing the platform instead of focusing on its profitability.

To rectify this, Iger stated Disney will begin looking into strategies to reduce their promotion of the platform as well as find ways to increase its operational efficiency. While this is welcomed news for shareholders, it will be interesting to see what changes the company will make moving into the future. Even more importantly, we will have to wait to analyze weather or not these changes are working.

From a long-term perspective, the company has operated the last five years with a net margin of just 8.05%. This is a little slim for my liking and a far-cry from their 2000-2016 run of margins in the high teens and low twenties.

While gross margins have fluctuated between 20-40%, they have shown steady growth. Therefore, it is clear that the fundamental issue lies in their operating margin which has steadily decreased from highs of 25% in 2016 to just 7.78% in FY22. Disney must begin to control their COGS more effectively in an ever increasing competitive environment.

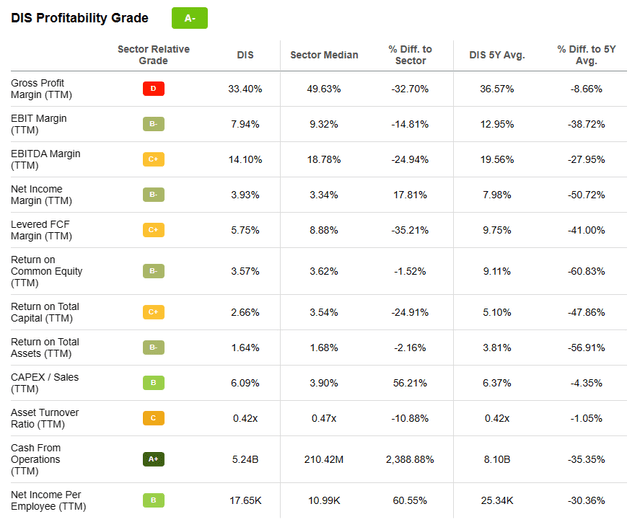

Seeking Alpha | DIS | Profitability

Seeking Alpha’s Quant assigns Disney with an “A-” Profitability rating which I am largely inclined to agree with. Their reasonable profitability metrics provide the company with a good footing to begin building a stronger and more exciting financial future.

Of course, it must be said that this increase in profitability will largely revolve around the company finding ways to decrease the huge operational costs associated with their DTC streaming services. Without improvements in the segments efficiency, it will be almost impossible for the company to generate great investor returns.

Disney’s balance sheets look to be in relatively healthy shape. Their total current assets for FY22 are $29.1B while total current liabilities for the same period amount to an almost identical $29.07B. This leaves the firm with a reasonable debt/equity ratio of 0.50.

Their quick ratio (current assets minus inventory divided by current liabilities) is just 0.83.

These fiscal stability metrics illustrate that Disney operates using relatively healthy balance sheets. S&P affirms Disney rates a BBB+ Foreign Currency LT Credit rating. Moody’s affirmed Disney’s A2 long term senior unsecured credit rating and the firm’s Prime-1 short term rating. The outlook is stable.

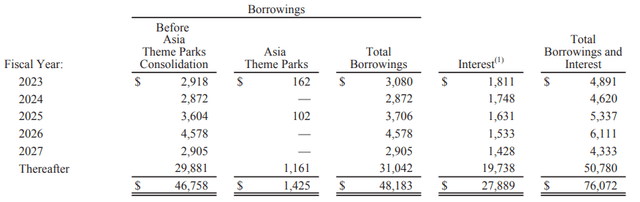

Disney’s total long-term debt amounts to $46.76B. These borrowings have been financed very strategically leaving a large majority to be maturing after 2027. Furthermore, the use of fixed rates for most of their notes means Disney is less directly affected by rising interest rates than many other firms.

Overall, it is safe to say that from a long-term perspective, Disney has a solid platform upon which they can build their business. Their strategic plans to decrease operational costs while increasing the profitability of their streaming platform are fundamentally sound, but it may be difficult to execute.

While short-term headwinds as a result of a regrettable macroeconomic condition are less than ideal, their long-term position as the entertainment juggernaut is unrivalled.

Valuation

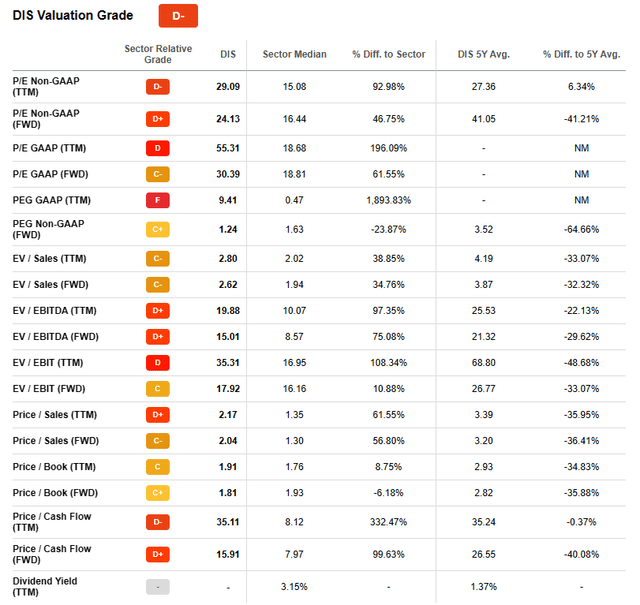

Seeking Alpha | DIS | Valuation

Seeking Alpha’s Quant has assigned Disney with a D- Valuation rating. I am not entirely inclined to agree with this rating, as I believe there is perhaps a greater deep-value proposition present.

The firm is currently trading at a FWD P/E GAAP ratio of 30.39 and a FWD P/CF ratio of 15.91. Their FWD Price/Book ratio is just at 1.81 and the company’s EV/Sales FWD is only 2.62. While these valuation metrics suggest the company is somewhere between fairly and undervalued, I don’t believe the full story is being told.

Seeking Alpha | DIS | 1YCharts

From an absolute perspective, Disney’s shares have fallen a 24.6% over the last year resulting in shares underperforming the rest of the U.S. stock market. From being valued around $200/share in mid-2021, the company’s stock now trades for just $100.

This drop in valuations was due to investors reacting to weakening profitability in FY21/22 which led to the decline in the company’s share prices. This makes it difficult to objectively judge the validity of this reactionary sell-off as the truth is, Disney has not had a great last five years.

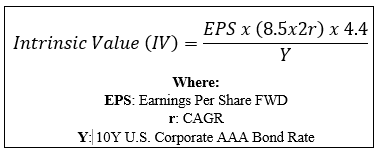

By accomplishing a simple financial valuation based on the calculation below and using the forecast average EPS for 2023/2024 of $5.00, an ultra-conservative r value of 0.06 (6%) and the current Moody’s Seasoned AAA Corporate Bond Yield, we can derive an IV for Disney of $98.9.

When using this ultra-conservative CAGR value for r, Disney appears to be fairly valued. Furthermore, when using a marginally more optimistic CAGR value of 0.08 (8%), we see an undervaluation of around 15% with an implied intrinsic value of approximately $120.

The Value Corner

Therefore, I believe Disney could begin to present a compelling value proposition for investors looking at timeframe of around 2-4 years.

In the short term (3-10 months) it is difficult to say exactly what the stock will do. I believe the stock may begin to exhibit some bearish tendencies moving towards the midpoint of FY23, simply due to the prevailing theme of a recession later in the year.

A drop in valuations in the short-term could absolutely be a possibility, especially as a significant turn-around in streaming profitability is unlikely to be achieved in such a short timeframe.

In the long term (2-5 years) I do expect their position as a leader in the industry to become stronger thanks to increased profitability. The potential for Disney to return significant value to shareholders is real, although currently a little uncertain.

In evaluating Disney’s current suitability to value-oriented investors, I believe a potential argument to build a position in the company could present itself once concrete evidence exists that Disney is turning-around the profitability of their DTC business.

At present, entering into a position could be risky due to the lack of margin of safety present both in the company’s share price and its core revenue streams.

Risks Facing Disney

The primary risk facing Disney is the inability for the company to begin creating real returns from their DTC segment while Linear Network profits continue to fall.

Unless the company can adapt their DTC business to be less costly while delivering the same value to consumers, they will be unable to create profits from this segment. While Iger has identified where the company went wrong, it would have been pleasant to hear some concrete objectives or strategies the company will implement to rectify these issues.

While Iger did state that Disney+ will achieve profitability in 2024, the lack of evidence to support this provides little stability to this statement.

Another threat to Disney arises from the risk of failed execution of films, theme parks or products. The significant investments required to produce and market a motion picture require these projects to be incredibly popular to ensure tangible returns are made. While Disney has incredible levels of expertise in this field, there is always the potential for a misstep.

While Disney’s theme parks are more popular than ever, the threat of more global restrictions limiting travel could also impact their profitability. The company currently relies on this business segment to create profits, thus highlighting the utmost importance of these revenue streams staying open.

From an ESG perspective, Disney continues to face a significant threat from a labor perspective. The company faces allegations of worker mistreatment, poor employment practices and insufficient wages.

In February of 2023, Disney World Workers Union rejected a contract offer which would have seen their wages rise by just $1 an hour. Furthermore, recent accusations of discrimination within their workforce have tarnished the happy, family-oriented image Disney attempts to convey to consumers.

This labor threat is a very real issue for Disney and will require significant, long-term solutions. How such resolutions fit in with an operational streamlining strategy will be interesting to observe.

Overall, it is fair to say that Disney faces many “ifs’ and buts’” in their current operations.

Summary

Disney is an entertainment juggernaut with an incredibly diverse set of revenue streams. Their continued efforts to further diversify their operations while consolidating financially ineffective elements of their business should allow the company to hopefully become more profitable in the future.

In my opinion, current share prices could represent an undervaluation for the company’s stock, but this evaluation is quite uncertain. There are currently too many uncertainties facing the company for a true value-oriented investment proposition to be made.

In the long-term, Disney could prove to be a fantastic investment, especially if Bob Iger is able to return the company’s fiscal results to those last seen in the mid-2010s. However, for the time being I will be investing my leftover cash elsewhere.

I therefore believe Disney warrants a Hold rating. I believe building a position in the company at present may expose investors to excessive levels of risk.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: I do not provide or publish investment advice on Seeking Alpha. My articles are opinion pieces only and are not soliciting any content or security. Opinions expressed in my articles are purely my own.

Please conduct your own research and analysis before purchasing a security or making investment decisions.