Summary:

- Warren Buffet once said “be fearful when others are greedy and to be greedy only when others are fearful.”

- Despite recent turmoil, investors should hold Disney stock due to its world-renowned brand names and products.

- DIS’s combination of theme parks, streaming services, and linear TV networks boosts audience reach and brand love.

P_Wei

Investment Thesis

The Walt Disney Company (NYSE:DIS) has been facing a lot of turmoil in 2023. The stock hit a new 9-year low this past week amid the uncertainty surrounding the stock. Streaming is struggling to add and retain subscribers while growing profitability. Its linear TV brands, which everyone knows are slowly dying off, just reached an agreement with Charter Communications (CHTR) to keep its networks in Charter’s TV package in return for giving streaming access to CHTR customers. ESPN has no idea what it is doing or where its future lies. The company’s political stance has drawn more attention and backlash than ever.

Despite all of this, I would still tell investors to hold DIS for one simple reason: the company’s world-renowned brand names and reputation. Disney owns Marvel, Star Wars, Pixar, 20th Century Studios, ESPN, Hulu, FX, National Geographic, ABC, and so much more. It uses these brand names to offer TV shows and movies, theme park and cruise experiences, and merchandise.

Disney’s Empire Product Umbrella (Google Images)

Disney not only has a strong hold over young viewers (18 and under) with its kid-friendly content but also a huge audience of adults thanks to its brand history. Disney owns 8 out of the 10 biggest box office movies, including films from the Marvel Cinematic Universe, Star Wars, and the Avatar franchise. Their unmatched brand reputation gives them a moat and hold over their audience like no other brand. The brand loyalty they have built gives them an edge that no other media or communications company can replicate.

Disney also owns 7 out of the 10 most visited theme parks in the world, with Orlando’s Disney World sitting at number one with 17.1 million visitors in 2022. Their combination of parks and streaming services go hand-in-hand, boosting audience reach and growing brand love. On top of that, they sell merchandise to further strengthen their brand equity.

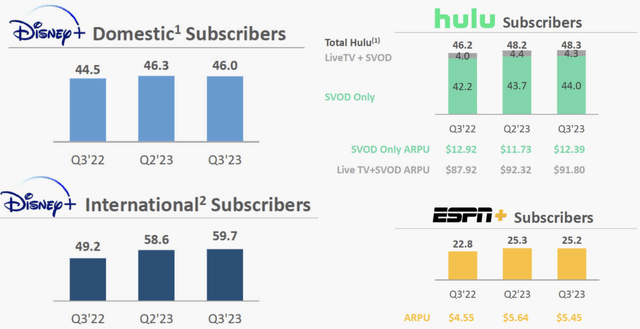

Although the company is struggling to find direction and get profitability back to its 2018 highs, I believe the stock is still a hold because of its branding power. As of the Q3 earnings report, ESPN+ has 25.2 million subscribers, Hulu has a total of 48.3 million, and Disney+ has a total of 105.7 million. All of its parks combined see an average of 62 million visitors per year. These numbers demonstrate the global popularity of Disney products.

Disney Streaming Subscribers (DIS Investor Relations)

My point is that Disney is not going anywhere. Its brand recognition and hold over people all over the world make it a brand and company that I would want to own. Management and political views have been holding it back, but both of these things can be corrected over time. In my opinion, Disney is a great price to buy in the long term given its longevity and brand awareness. This is a stock that you will kick yourself if you don’t buy now. The risk-to-reward ratio is too good to pass up at its current price in the low 80s. If you are watching DIS, don’t wait too much longer or you may miss the initial move-up.

Growth Strategies

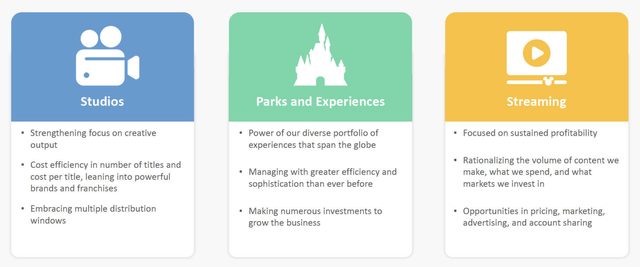

Disney highlights its drivers of growth and value creation through three segments: Studios, Parks, and Streaming.

Studios – Focus on creative output and utilizing its powerful brands and franchises to retain customers and generate steady cash flow

Parks – Building and strengthening its diverse portfolio while staying cost-efficient when expanding operations and offerings.

Streaming – Rationing quality content over volume with a focus on sustained and improved profitability.

Disney Growth drivers (DIS Investor Relations)

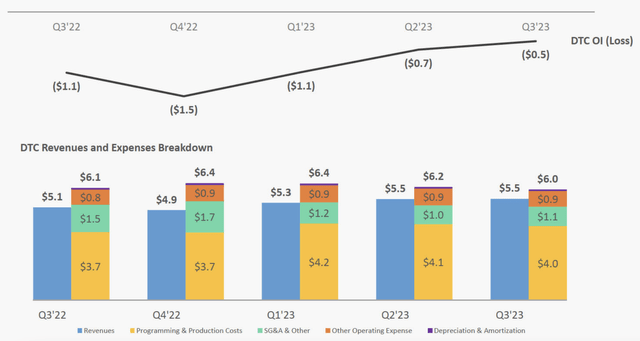

The main driver of growth for Disney, in my opinion, will be the improved profitability of its direct-to-consumer (DTC) business. This part of the business has been operating at a loss for some time now as it has been building out its streaming platforms and rolling out new content. However, it has been improving as management has been working on cost-cutting and efficiency measures, controlling output, and content creation. Management has stated that it plans to reinstate the company’s dividend by the end of the year, which is a sign that profitability is getting back on track after a few rough years.

Disney Quarterly Operating Loss (DIS Investor Relations)

Disney has implemented an ad-supported tier for Disney+ and Hulu to help drive profitability and sales by leveraging its wide range of subscribers. This will improve its DTC business and help get profitability back to positive. Its linear networks and parks have held strong over the years, which has helped mitigate the amount of losses Disney has had. With the company reducing its content volume and focusing on quality and average revenue per user (ARPU), I believe now is the time to invest in Disney before it is rewarded by the market for its profitability turnaround. Just look at Netflix (NFLX) and its ability to generate profits from streaming and the market’s love for its new ad-supported tier. Disney is a few quarters away from a significant move higher.

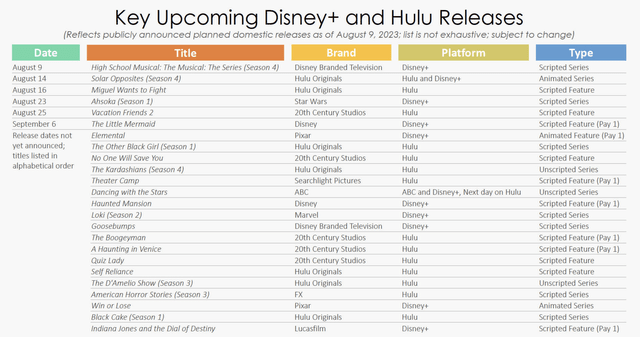

Upcoming Streaming Releases (DIS Investor relations)

They have a lot of new content coming out in the next 12 months, and their focus on efficiency leads me to believe that it is time to consider investing before the narrative changes. As Warren Buffett once said, “Be fearful when others are greedy, and be greedy only when others are fearful.”

Improving Fundamentals

Disney has been doing everything it can to adapt and navigate through new trends and markets. The COVID-19 pandemic forced the closure of its parks, which led the company to focus on streaming and Disney+. The parks have since reopened, but the economy is in a tougher spot, which has shifted the focus from growth to profitability. All of this has happened in a few short years, and it has been challenging for Disney to adjust each part of its business due to its size and diversity.

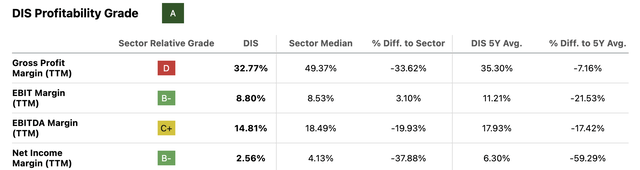

Starting with margin pressure, Disney has seen a contraction across all parts of its balance sheet. Gross profit, operating, and net income margins are all down between 3% and 4% from their five-year averages. Net income margins have seen the biggest decline, currently sitting at 2.56%, down from a high of 21.2% in 2018. The company has a lot of room for margin expansion and to return to normal levels. Netflix has a net income margin of 13%. If Disney could get its streaming services’ net income margin to at least half of that, paired with its higher-margin businesses, I see a lot of room for growth and expansion.

Disney Profitability Overview (Seeking Alpha)

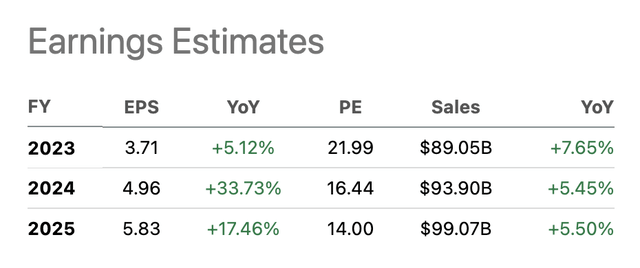

The company’s lower margins and profitability have led to multiple contractions, which makes sense since the company is generating less cash flow. Disney is trading at 22.2x forward earnings for 2023 and 16.6x forward earnings for 2024. The COVID-19 pandemic skewed the company’s P/E ratio, as its earnings were drastically affected by the closure of its parks. However, if we look at the company’s P/E ratio from 2013 to 2019, its forward P/E average was 18x, which is much lower than the skewed five-year average on Seeking Alpha of 41.95x earnings.

Analysts are expecting EPS growth of just over 5% this year and 33% the year after. I believe there is room for price appreciation and multiple expansions. I believe Disney should be trading between 20x and 24x forward earnings based on growth expectations and historical valuations. The company’s brand reputation allows it to trade at a premium to its peers, and analyst estimates of steady growth rates indicate to me that it should be trading at a low 20s P/E.

DIS Analyst Estimates (Seeking Alpha)

When looking at the company’s enterprise value to sales (EV/S) ratio, it shows that DIS may be trading at an even bigger discount. Disney is trading at a 10-year low EV/S ratio of 2.2x. Its 5- and 10-year averages are both around 3.4x. Sales have steadily increased for the company over time, but the value of the company is lower than usual when compared to its revenues. This is another indicator that it is a good time to buy into Disney as it is undervalued based on EV/S.

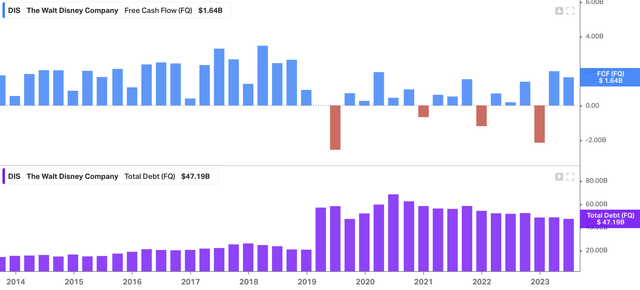

With increasing profitability and margins, cash flow will get back on track. In 2018, Disney had $9.8 billion in free cash flow (FCF), which was an FCF yield of just over 6.5%. This is not bad for a media/communications company, as we typically look for an 8% FCF yield. However, 6.5% is still very strong. Today, Disney has $2.8 billion in FCF, which is up from its 2021 lows, but is only an FCF yield of 1.88%. There is plenty of time and room for Disney to build back up its cash pile, which will just take time.

They will slowly generate more cash over time. I would like to see them have $3-5 billion in free cash flow at the end of their fiscal year (FY). However, I am worried that they are rushing to bring back the dividend. Their cash pile is depleted, and they had to take on additional debt during the COVID-19 pandemic to help fund operations and prevent mass losses during the shutdown. In September 2019, they had reduced their total debt to $47.14 billion. However, they took on an additional $20 billion in debt during the pandemic, ending with $68 billion in debt in the summer of 2020. They have slowly paid off some of this debt and have it back to pre-pandemic levels ($47.19 billion), but it is still elevated from their historic levels.

At the end of the day, Disney will push to get margins back on track. They will figure out how to make streaming profitable, and an ad tier is a good first step. In my opinion, they will become the cash cow they once were. Management has done a good job of being flexible with the balance sheet over the past few years as problems have arisen. As things clear up, I believe DIS will be in good shape for margin expansion based on increasing earnings and profitability.

Price Targets

To start, Koyfin reports that the average analyst price target is $109, with a high of $145 and a low of $65. Morningstar rates fair value at $145 per share, with a high of $224 and a low of $87. Market-Q states that the average analyst price target is $108.83, with a high of $135 and a low of $65. When we condense these street averages, we see that estimates put a fair value around $109 per share over the next twelve months (NTM), with a high of $145.

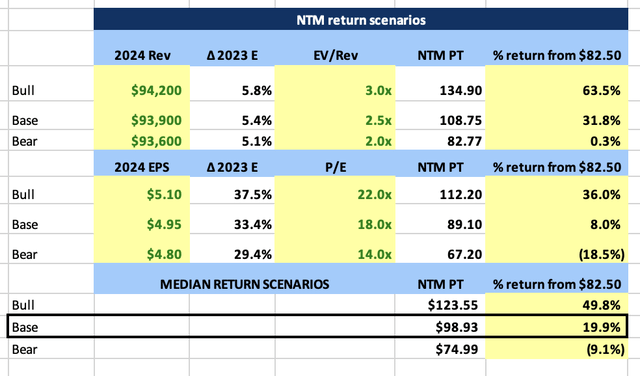

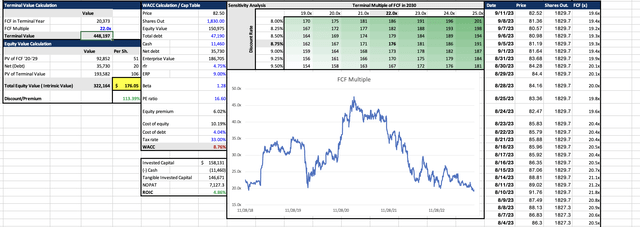

After conducting my own price targets, both short term (next twelve months) and long term (five years +), I see a current fair value of around $99 per share, which is about a 20% upside from current prices of $82.50. For my next twelve months (NTM) price target, I use a price target scenario table to the create bull, base, and bear scenarios for the stock based on current analyst estimates and historic valuations. DIS currently trades at a compelling 5.5x risk-to-reward (R:R), where we typically look for greater than 3x R:R. Anything below $87 would give you an entry price with a greater than 3x R:R, and the lower you buy in, the better the R:R.

Below are my current price target scenarios and analysis:

Disney NTM Price Target Scenarios (Author Calculations Based on Analyst Estimates From Data on Koyfin)

As you can see, I have a price target high, or bull case price target, of $123 per share, which is almost 50% upside from current prices. However, based on 2024 estimates, I only see a roughly 9% downside from current prices, which gives us a risk-to-reward ratio of just over 5x.

Using a discounted cash flow (DCF) analysis, we can generate a longer-term price target (3-5 years) based on the company’s expected cash flow, which is expected to increase from current levels. My long-term fair value price target is $176 per share, which would indicate over 100% upside from current price targets. However, $176 per share would still be 14% short of the stock’s all-time high of $201 per share, which DIS saw in early 2021.

Disney DCF Analysis (Author Calculations Based on Data from DIS Investor Relations)

DIS has a long road ahead of it, but with its current cost-cutting measures and plans to drastically improve profitability, I believe Disney will regain its status as a cash cow. Although a 113% upside and a fair value of $176 seems steep now, over 3-5 years, this could translate to steady outperformance over its peers and the overall market. DIS has been hit hard, falling by more than half. Once management turns things around and can clearly forecast the company’s direction, I believe Disney has a long runway for improvement and growth ahead of it. I cannot reiterate enough how much of a steal DIS shares are at current prices.

Risk

Each business segment that Disney operates has its own risks to note and look out for in the coming years.

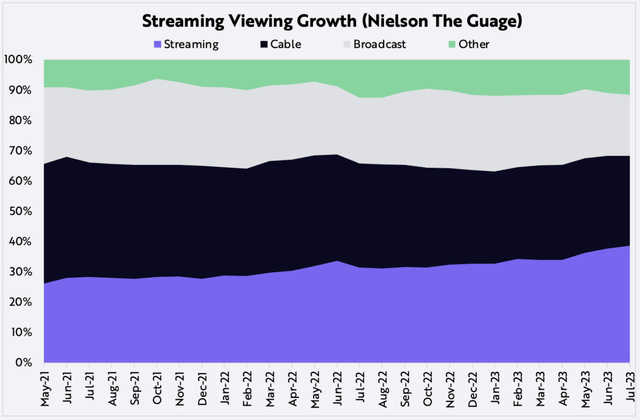

Studios/linear networks

The changing media landscape is a concern here. Cable TV is fading as customers simply bundle the subscriptions (Netflix, Hulu, Disney+, Paramount+, HBO Max, etc.), they feel they need for a cheaper or similar price. In 2022, streaming surpassed cable viewing for the first time. I believe the gap between streaming and cable will only widen in the future. You have the option of ad-free TV, the ability to choose what show or movie you want to watch, and the ability to start and pause the show whenever you want. The graph below from ARKK research shows how the gap has closed and now favors streaming.

Streaming Viewing Growth (ARKK Invest)

Streaming

There are two main risks associated with streaming:

- The high cost of content creation is rising quickly.

- The crowded and competitive field will eventually lead to lower margins.

Disney+, Hulu, and ESPN are all facing growing competition from established and new players, such as Warner Bros. Discovery (WBD), Paramount (PARA), Alphabet (GOOGL), Amazon (AMZN), Netflix, and others. In a competitive streaming market, it is natural for margins to decline over time as companies compete for subscribers with lower prices and better deals. Disney still has a way to go to improve its profitability and margins, so this is not something to worry about right now. However, over the next 5-10 years, we could see margins rise and then fall again due to industry-wide pricing pressure.

Parks

The most obvious risk to Disney’s parks is another pandemic that could shut them down. The company lost millions when COVID-19 closed its parks around the world. Another such event could further damage the company and could force it to take on more debt to keep operations afloat. A smaller risk is the increasing competition in the theme park industry, with Universal parks growing in popularity and Nintendo entering the market with its own theme park, Super Nintendo World.

There are also rumors that Netflix may try to do something similar to Disney, using its shows and movies to create theme park attractions and diversify its revenue streams. This is just a concept or idea, but if Netflix were to do this, it could steal market share from Disney and potentially divert millions of annual visitors away from Disney parks. Not everyone will have the time or money to visit both types of parks in a year, so it could be a trade-off between the two from year to year. This is just a potential catalyst and risk to watch.

Overall, Disney faces some challenges in the streaming and parks businesses. However, the company is well-positioned to overcome these challenges and continue to grow in the years to come.

Conclusion

Disney is a great buy-and-hold investment at current valuations for long-term investors. The company’s product portfolio and brand reputation are unmatched. From Star Wars and Marvel to Pixar and 20th Century Studios, to Hulu and ESPN, Disney offers something for everyone.

There is no doubt that Disney management has been struggling, but this has been reflected in the stock price. Once the future outlook becomes clearer and the company improves streaming profitability, the stock is poised to rise.

The stock is trading at its cheapest valuation in years. My base case price target shows a roughly 20% upside with a safe risk-to-reward ratio, given that the stock is trading in the low $80s. Disney’s brand equity is too strong to give up on. The company is not going anywhere. From 4-year-old kids to 50-year-old men, people have grown up loving Disney’s movies, TV shows, theme parks, and merchandise.

I know that Disney does not fit everyone’s investing values or views. However, when investing, we need to put our emotions aside and listen to the numbers, charts, and management. I believe that investors will regret not picking up shares of DIS here. Don’t let that be you.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in DIS over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Jake Blumenthal is a Registered Investment Advisor and Portfolio Analyst with Meridian Wealth Management, a SEC Registered Investment Advisor. The views and opinions expressed in the following content are solely those of Jake Blumenthal and do not necessarily reflect the views and opinions of his employer, Meridian Wealth Management. The content provided is for informational purposes only and should not be considered as financial advice or a recommendation to engage in any investment or financial strategy. Readers are encouraged to conduct their own research and consult with a qualified financial professional before making any investment decisions. Meridian Wealth Management does not endorse or take responsibility for any content shared by Jake Blumenthal outside of his official duties at the company.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.