Summary:

- In my view, Disney had found the winning formula but the desire to get into new competitive businesses is changing the game.

- Not creating successful new original content is a problem because it limits new introductions to parks and new merchandising opportunities.

- In my opinion, there is a real risk that Disney may be way ahead of what the current sentiment is on the theme of inclusion and diversity.

Keystone/Hulton Archive via Getty Images

If I had invested in Disney (NYSE:DIS) in 2015, to date I would have achieved a capital gain of 0%, certainly an unsatisfactory return during one of the most important bull markets in history. Still, the Disney brand remains one of the most internationally recognized and appreciated, so why is the company going through this slump?

The reason, in my opinion, is the radical changes that have taken place in recent years and are completely transforming this company. Not only has the business model changed, but also the attitude toward the creation of new productions.

Whether these changes are good or bad only the future will tell, but at the moment I remain quite puzzled, which is why my rating is a hold and not a buy.

1st change: Business model

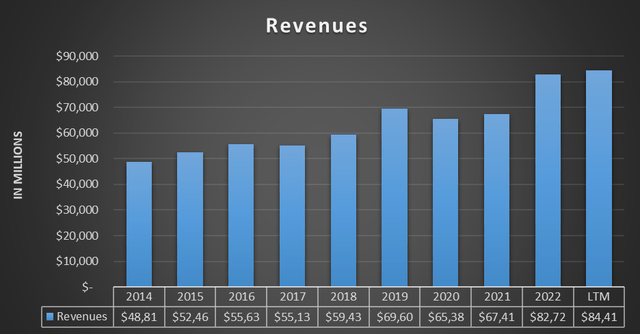

If we focused only on revenue growth, undoubtedly management has done an excellent job over the past few years. However, there is a problem: revenues have grown but margins have shrunk.

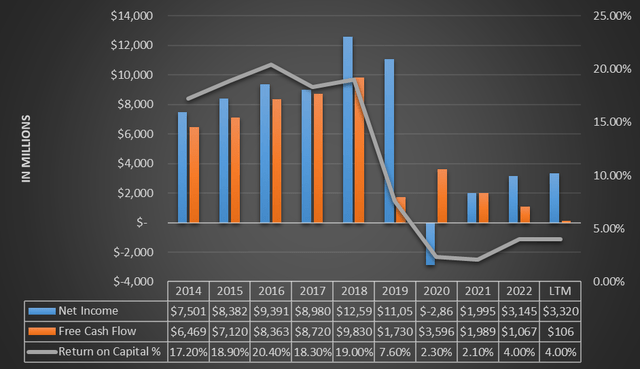

Looking at Net Income and Free Cash Flow from 2014 to the present, a major decline from 2019 is visible, especially after the outbreak of the pandemic. While this slump in profitability was widely expected given the forced closure of the parks, it should be noted that in FY2022 the pandemic did not have such a major impact to justify a result so far off the highs of 2018. The only parks that suffered were Hong Kong Disneyland Resort and Shanghai Disney Resort open for 37/52 weeks. In short, there are clearly difficulties, and even the Return on Capital near all-time lows seems to testify to that.

However, the problems are not only limited to profitability but also to the balance sheet.

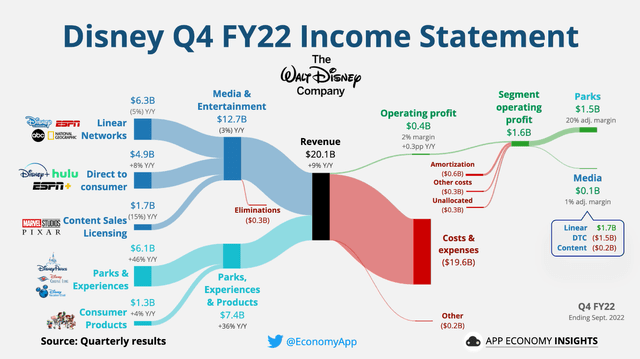

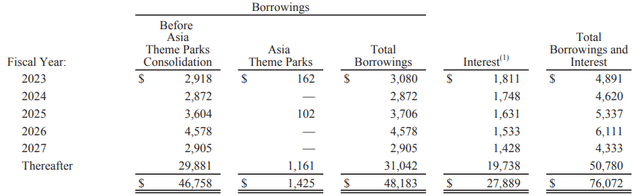

When cash flows worsen, the debt becomes less sustainable, which is why LTM FFO can no longer cover interest and total debt as in the past. After all, huge cash inflows have to be generated to support a $48 billion debt.

FISCAL YEAR 2022 ANNUAL FINANCIAL REPORT

A large amount of debt will mature in the next few years that, including interest, far exceeds the Free Cash Flow produced in the years after 2018. The issue here is not so much whether the debt will be repaid, thinking of a default would be absurd, but at what interest rate the new debt will be refinanced. The interest Disney pays is already very high; in fact, it covers about 23% of FY2022 operating income.

With banks demanding increasingly exacting credit standards these days, the risk of refinancing is tangible for all those highly indebted companies including Disney.

But why is Disney so indebted and especially why have revenues increased but profits not? The reason lies in the countless acquisitions over the past 10 years that have led Disney to change its business model.

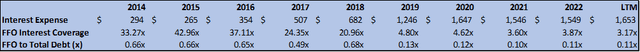

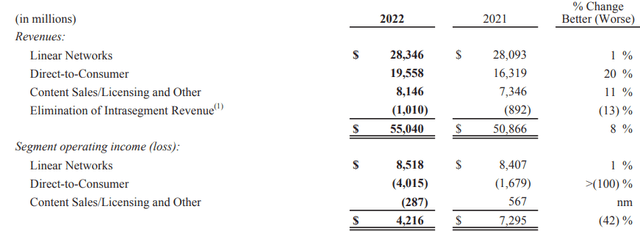

In this excellent illustration, we can see that Disney’s revenue structure has changed a lot from the past, in the sense that the segment we all know it for, which is Parks, Experiences & Products, now accounts for only 37% of total revenues. The remaining 63% is the Media & Entertainment segment, by far the largest segment after the acquisition of 21st Century Fox for $71.30 billion in 2019. However, it is not the latter but the former segment that generates most of the profits.

FISCAL YEAR 2022 ANNUAL FINANCIAL REPORT

According to FY2022 data, the Media & Entertainment segment achieved an operating margin of 7.65%, too low in my opinion for a company of this caliber. The reason for such a low margin is due to the saturation and competitiveness of this market, not so much to Disney’s mismanagement. In addition, it should be pointed out that the operating loss of the Direct-to-Consumer division is mainly caused by the much-discussed Disney+.

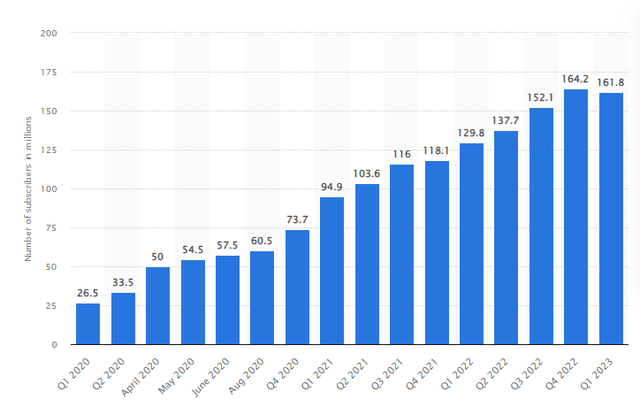

Despite reaching 164.2 million subscribers in FY2022, the platform recorded a loss of about $834 million just considering programming and production costs. In addition, the subscriber figure for Q1 FY2023 may represent some sort of maximum threshold now reached.

For the first time, subscribers declined from the previous quarter, a signal that the platform’s latest price increase did not please Mickey Mouse fans. This does not mean that subscribers will not grow from now on, but my guess is that it will be more difficult to grow at the same rate as in the past. This could be a problem since the company expects Disney+ to become profitable by the end of FY2024. As Bob Iger stated, it is necessary for subscribers to continue to grow for the platform to be profitable, but the perfect trade-off between price increases and subscribers still needs to be found.

It’s also obvious to us is we can’t get the profitability and turn this into a growth business without growing subs. So, while we’re taking off-the-table sub guidance, we’re still going to look to grow subs. We just want to grow quality subs that are loyal and where we actually have an ability to continue to price effectively to those subs.

In addition, in order to make Disney+ profitable, the price increase will also be matched by reductions in production and promotion expenses.

We want the quality on the screen, but we have to look at what they cost us. So, we’re going to continue to go after subs, but we’re going to be more judicious about how we do that. we’re going to look carefully at pricing. We’re going to reduce costs, both in content and of course, infrastructure.

Whether all this will be enough to achieve the profitability goal we cannot know, but in my opinion I am quite puzzled. The price elasticity of demand may not be as expected, and the recent reduction in subscribers may be an early wake-up call. In addition, reducing production costs could on the one hand save several million, but on the other hand offer productions not in line with the standards Disney has accustomed us to. Finally, the coming recession certainly does not help.

Overall, the Media & Entertainment segment is by far the largest in terms of revenues, yet in FY2022 it generated only 35% of total operating income despite being responsible for 63% of total revenues. Consequently, the Parks, Experiences & Products segment is responsible for only 37% of total revenues but generates 65% of total operating income.

In sum, management’s decision to diversify its business through the acquisition of 21st Century Fox has led to an increase in revenues but a compression of margins. Disney still remains heavily dependent on its segment that made it great; thus, years after that choice I wonder how much it was worth it to invest so much in a market where you had no competitive advantage, where profit margins are minimal due to cut-throat competition, and so unrelated to the company’s core business. On top of that, significantly increasing debt.

What do news, documentaries, sporting events have to do with Disney? In the collective imagination, this company excels in the production of children’s and family films, as well as its stunning theme parks. Disney’s competitive advantage lies in this, not in broadcasting sporting events.

Personally, I do not fully understand the motivations behind this management expansion plan, which is why I see it as an example of diworsification. Therefore, I do not find it so absurd that for the past 8 years the capital gain has been 0%; after all, today’s Disney is a completely different company from the past. If I were a shareholder, I would have preferred that the billions invested to diversify the business had been used to create new successful productions to be integrated into the theme parks, or make targeted acquisitions as it was with Pixar and Marvel in the past. Those acquisitions were a bargain because they had the potential to integrate into the Disney ecosystem without disrupting it.

In my view Disney had found the winning formula but the desire to get into new competitive businesses is changing the game. Today they are trying to change the foundation of an empire built over decades, but is it really worth it?

2nd change: The main problems of new productions

One of the reasons Disney has become one of the world’s leading companies lies in its ability to create original content that is appreciated worldwide and by multiple generations. No matter if we are talking about a movie from the 1940s or the 1950s, the classics are still appreciated by both young and old.

The ability to make its content anachronistic and still merchandised is perhaps the most striking aspect of this company’s competitive advantage. However, even in this favorable situation a problem can arise: one should not wallow in past successes. Disney always needs to create new original content, yet at the moment it does not seem to be the priority.

Zootopia (2016), Frozen (2013), and Frozen II (2019) have been the only major successes in the last 10 years if we evaluate the ratio of box office revenues earned to the cost of production. Moana (2016) and Ralph Breaks the Internet (2018) were successful but in my opinion not so successful as to be remembered over the decades. Encanto (2021) was a box office flop, the same for Raya and the Last Dragon (2021) also due to the double release both in movie theaters and on Disney+ for $30. As for Strange World (2022), it was one of the biggest flops ever and caused losses of about $200 million. There is no single reason why this film performed so poorly, but in my opinion there are two main factors that affected it:

- Families may be more averse to going to the movie theater than in the past since they will simply wait for its release on the Disney+ platform. This is an important factor, especially considering that Disney+, despite this, remains unprofitable.

- The second important factor concerns the content of the film, which was deemed unsuitable for as many as 20 international markets including Middle East, China, Malaysia, Indonesia, Pakistan, Turkey, Vietnam, East Africa, West Africa, Maldives, Nepal, Bangladesh, and Russia. The reason for this exclusion can be attributed to the plot of this film based on love between two people of the same sex, something that is unfortunately frowned upon in many countries around the world.

These two aspects also partly negatively affected the box office gross of Lightyear (2022), having totaled a loss of about $106 million. Again, the film had problems from the beginning since some countries belonging to the international market banned its release due to the inclusion of LGBTQ+ characters.

The latter could actually be a problem for Disney’s coffers in the future as well since it seems more focused than ever on the theme of inclusion and diversity. The mindset in the East is unlikely to change any time soon, and this would mean less exposure of the company to some international markets. In this case, one would also have to consider the indirect consequences on the eastern Disney parks, especially in China.

In all this, I am assuming that the theme of inclusion is not at all a problem for Western families, which unfortunately is not true. In short, it will not be easy for Disney to find the right compromise and not exclude anyone.

Are live-action really the best choice?

But then, if new original content is not the priority, what is the company focusing on? From the latest releases it would seem that live-action is the new fashion.

Before 2010 there were only 4 live-actions, between 2010 and 2018 there were 8, as well as between 2019 and 2022. In addition, dates have already been released for 2 live-actions in 2023 and 2024.

In short, it seems that Disney is increasingly focused on reworking content that has already been successful in the past rather than creating new content. It is a kind of “low-risk investment” as the company plays it safe by repurposing something that has already been enjoyed. The risk of failure in this way is reduced.

This was the case with Maleficent (2014), Cinderella (2015), Beauty and the Beast (2017), Aladdin (2019), and The Lion King (2019). All of these films have performed remarkably well. However, things do not always go well, and the latest live-action films are proof of that:

- Mulan (2020) was a failure, registering a loss of about $141 million. The hope was to gain strong acceptance especially in China, but that did not happen. The release during the pandemic certainly had an impact. Beyond the difficulties related to release, this live-action was not liked and the 5.7/10 rating on IMDb is proof of that.

- Pinocchio (2022) had an available budget of $150 million, excluding advertising expenses. Despite the large financial outlay, the result was bad and there was no shortage of criticism. Its rating on IMDb is 5/10.

- Lady and the Tramp (2019) cost $60 million excluding advertising expenses and the result is a barely adequate rating of 6.2/10. Nothing exceptional in short.

In any case, I believe that monetary losses are only a minor problem here; in fact, it is the lack of innovation that concerns me most. Disney is the epitome of creativity and imagination, which is why I expect much more than just a live-action based on a plot that everyone knows and has already enjoyed. This is not how the company became what it is today, and people may get tired of seeing yet another live-action.

Not creating successful new original content is a problem because it limits new introductions to parks and new merchandising opportunities. The business model of this company depends on new creations, and if they are not there the gear gets stuck.

Finally, I think the company still needs to find an ideal solution to the monetization of new content. Releasing new movies on Disney+ may increase subscribers but at the same time lead people not to buy tickets to the movie theater. Considering that the platform is not even generating profit at the moment, I don’t know how far it can continue with this policy. There is a lot to work on and until the picture is clearer I prefer to avoid Disney for the time being.

Final considerations

The content that made Disney famous, however much it is still appreciated, is quickly becoming more obsolete than ever in this historical period where everything first comes under the lens of political correctness. While there are those who appreciate this progressive attitude, there are also decades-old fans clinging to the Disney of the past and nostalgic for the days when politics was not a subject of discussion in a movie. In my opinion, there is a real risk that Disney may be way ahead of what the current sentiment is on the theme of inclusion and diversity. The failures of Strange World and Lightyear may be the first wake-up call.

Let’s be clear, as an internationally renowned company, Disney obviously has no political preferences; its only goal is profit. After all, that is what shareholders care about.

The problem is that not everyone feels the same way, such as Florida Governor Ron DeSantis who wants to end Walt Disney World’s special tax privileges after more than 50 years since the agreement was made.

Right now the company is going through a major transition phase, where they want to change the winning formula of the past as it is considered obsolete. The question is, was this really necessary?

The market does not seem to have appreciated this given the stalled price per share; however, we know that sometimes the market is wrong and short-sighted. EPS is not what it used to be, but at the same time Disney now runs a platform with 141 million users. The potential of Disney+ is high, and once the proper monetization plan is understood and expenses are reduced there could be the long-awaited recovery.

Personally, for the time being I am just observing the situation as a spectator, at $100 per share I do not think I have a high enough margin of safety on the risks discussed in this article.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

This is just my opinion, not financial advice.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.