Summary:

- Disney’s stock has plummeted, but recent solid quarter results show potential for streaming and cost-cutting.

- Disney’s theme parks performed well and there is potential for strong performance in the future.

- Disney’s cash flow is improving and streaming continues to grow, with international subscribers increasing.

- Disney’s stock could move higher as the turnaround continues.

Marc Piasecki

The Walt Disney Company (NYSE:DIS) has gone through a challenging phase, with shares cratering to their lowest level since the coronavirus meltdown. The stock dropped by 62% from its high above $200 and is now trading in the $80-$90 range. However, Disney recently reported a solid quarter, illustrating robust streaming potential and significant cost-cutting. Moreover, Disney’s ESPN assets appear underrated, and it can continue improving streaming monetization as we move on. Additionally, Disney’s theme parks performed well, and we could continue seeing strong performance in the space. Disney has solid earnings growth potential and may continue outpacing consensus estimates, leading to a considerably higher stock price as we advance.

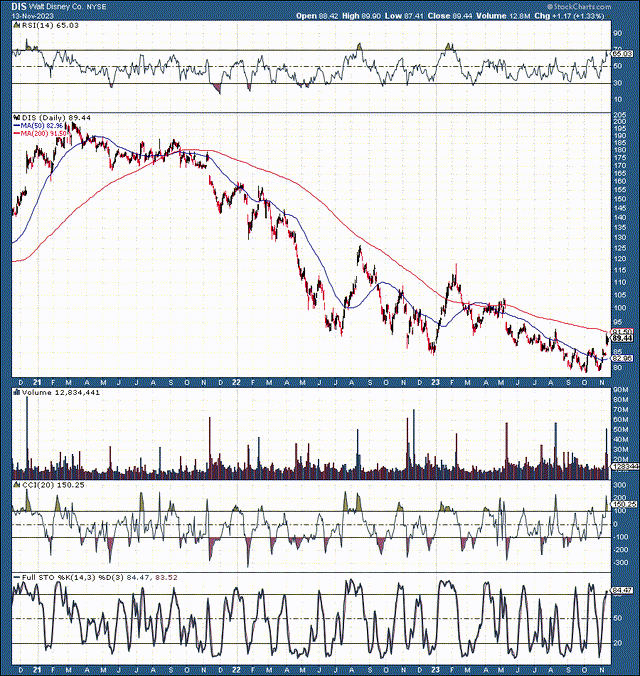

Disney’s Stock Obliterated

Disney’s stock has been obliterated since its 2021 high. Disney crashed 62% from peak to trough, illustrating a spectacular market cap meltdown of over $200 billion. However, Disney’s stock may stabilize, forming a base around $80. We see improved momentum as Disney attempts to move above the 200-day MA, and we could see the 50-day MA trend higher soon. The RSI, CCI, full stochastic, and other technical indicators also suggest the worst may be behind Disney, and clearer skies lie ahead for the company’s share price.

Disney’s Solid Quarter – The First Of Many

Disney reported non-GAAP EPS of $0.82, beating the consensus estimates by 11 cents last quarter. Revenue fell short of the consensus estimate by $170M but was up by 5.7% YoY. Despite the slight revenue miss, adjusted earnings surged by 173% YoY. Disney is on track to hit $7.5B in annualized cost savings, roughly $2B better than expected.

Excellent news came from Disney’s streaming segment, as Disney+ subscribers increased to more than 150 million, beating the estimate of slightly more than 147 million. Disney expects its combined streaming segment to become profitable in Q4 2024. Disney’s experience and theme park division revenues jumped by 13% YoY to $8.16 billion. Net income surged by 63% from the same quarter one year ago.

Disney is doing an excellent job at cost-cutting. Its fiscal 2023 spending on produced and licensed content declined by nearly $3B to roughly $27B last year. Moreover, Disney plans to cut spending by another $2B in fiscal year 2024.

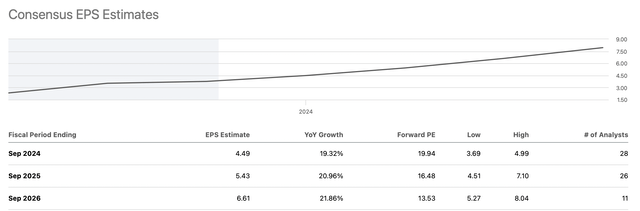

Cash Generation to Improve

Cash flow (static.SeekingAlpha.com)

Disney went through a challenging phase in recent years, but its cash flow increased significantly last year. Moreover, Disney expects to return to its pre-pandemic levels in 2024, suggesting a free cash flow of $8-$10B. This dynamic implies that Disney should become increasingly profitable soon, potentially leading to a reinstatement of its dividend.

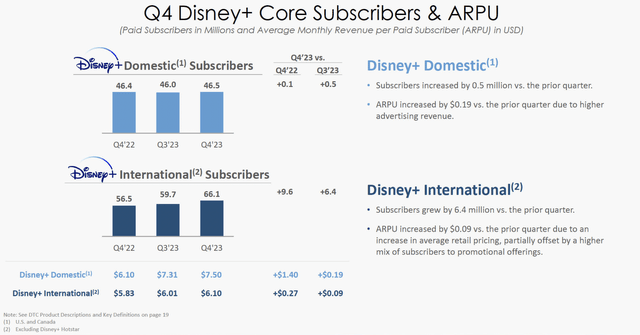

Streaming Continues Improving

Streaming stats (static.SeekingAlpha.com)

Despite a domestic growth stall, Disney+ international subscribers increased by more than 10% QoQ and 17% YoY. We see significant growth in a slow economic environment, implying global penetration remains relatively low for Disney, and there should be plenty of growth ahead. Moreover, we could see improvements in domestic growth as the economy returns to more solid growth in future quarters. Also, we see improvements in ARPU growth, suggesting monetization should continue expanding in the coming quarters.

ESPN – An Underrated Component

ESPN is a leading global sports brand, and Disney is looking to turn it into a preeminent digital sports platform. ESPN viewership was up in the last four quarters, maintaining steady success throughout the year. Also, ESPN Bet launches next week through Disney’s partnership with Penn Entertainment. In future years, ESPN should work well as a standalone streaming offering for Disney.

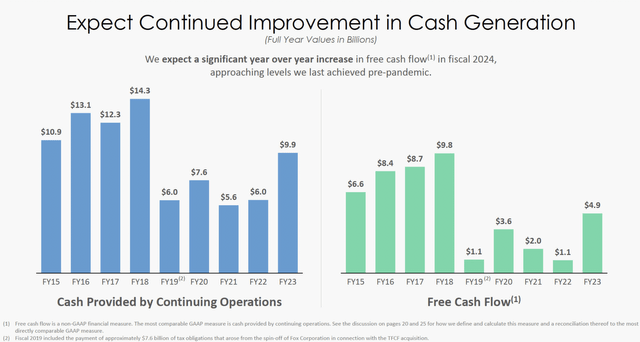

Disney’s Solid EPS Growth Potential

This year (fiscal 2024), Disney could earn around $4.50 (per consensus estimates). Yet, higher-end EPS estimates suggest Disney could earn up to $5. While next year’s consensus EPS estimate is around $5.50, Disney could earn around $6-$7. Therefore, if we go by the consensus estimate, Disney is trading around 16.5 times forward EPS. If we utilize higher-end estimates, Disney is trading around 13-15 times forward EPS. Also, Disney has the potential to grow EPS by 20% or more for several years, implying its EPS could increase considerably as we move forward. Therefore, Disney’s stock has a high probability of appreciating substantially in future years.

Where Disney’s stock could be in the future:

| Year | 2024 | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 |

| Revenue Bs | $94 | $102 | $112 | $122 | $132 | $141 | $150 |

| Revenue growth | 5% | 9% | 10% | 9% | 8% | 7% | 6% |

| EPS | $4.70 | $6.25 | $7.50 | $8.85 | $10.21 | $11.74 | $13.38 |

| EPS growth | 25% | 33% | 20% | 18% | 16% | 15% | 14% |

| Forward P/E | 17 | 18 | 19 | 20 | 19 | 18 | 17 |

| Stock price | $106 | $135 | $168 | $204 | $223 | $241 | $260 |

Source: The Financial Prophet

I used relatively modest revenue and earnings growth projections. Moreover, I used a muted forward P/E ratio of 20 or lower. Disney could provide more robust sales and earnings growth in future years. Furthermore, we could see a higher than-anticipated P/E ratio under favorable economic conditions. Additionally, Disney’s stock should benefit from increased demand once it reinstates its dividend.

Risks to Disney

Despite my bullish projections, Disney faces risks. Disney’s movie studio has put out several flops recently, and Disney’s content could use a significant tune-up. Therefore, Disney could continue getting mixed reviews and lackluster results at the box office if its current movie strategy persists. Also, macroeconomic factors could continue weighing on Disney’s streaming and theme park businesses. This dynamic could constrict sales and profitability growth, keeping Disney’s stock price lower for longer. Investors should examine these and other risks before investing in Disney.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Are You Getting The Returns You Want?

- Invest alongside the Financial Prophet’s All-Weather Portfolio (2022 17% return), and achieve optimal results in any market.

- The Daily Prophet Report provides crucial information before the opening bell rings each morning.

- Implement my Covered Call Dividend Plan and earn 50% on some of your investments.

All-Weather Portfolio vs. The S&P 500

Don’t Wait! Unlock Your Financial Prophet!

Take advantage of the 2-week free trial and receive this limited-time 20% discount with your subscription. Sign up now and start beating the market for less than $1 a day!