Summary:

- Disney has a profitable Parks business.

- The company has the second-largest DTC platform.

- The current price is attractive.

Charley Gallay

Price Action

Apple Stocks

Disney’s (NYSE:DIS) stock currently trades at $88, down 55% from its all-time high in March 2021. Some reasons for this massive decline include:

- Reason 1: Strong competition in the streaming space

- Reason 2: Poor macroeconomic outlook & sentiment

- Reason 3: Worsening financials

Investment Thesis

In this article, I have analysed DIS’s business and risks and have ascertained that buying DIS at $85 offers a decent return of 15% CAGR over the next few years.

Business Analysis

As a legacy media conglomerate, DIS has a diversified business model. It produces and distributes shows through many channels. On top of that, DIS has a prominent Hotels and Parks business too. Excluding the Hotels and Parks business, you can say that DIS has the same business model as WBD (WBD) and PARA (PARA), the other two of which are also trying to transition from Linear to Streaming.

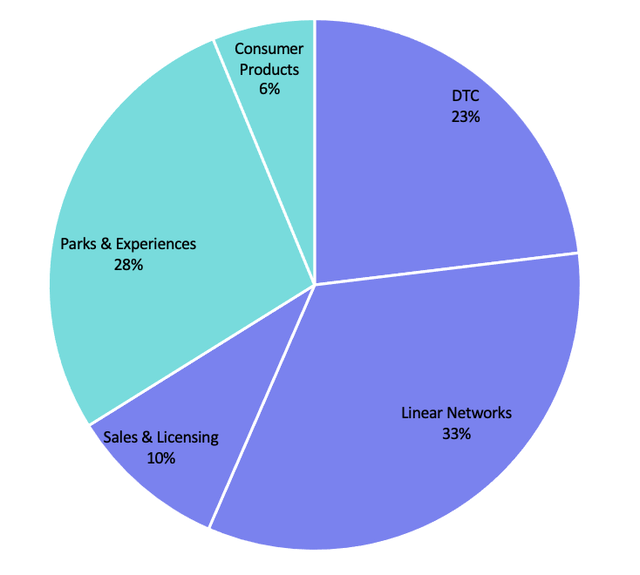

Management has categorized revenues into 2 streams:

- Disney Media and Entertainment Distribution (DMED) in purple

- Parks, Experiences and Products (PEP) in blue

For 2022, its breakdown is as follows:

Author

Note: In 2020 DIS changed its revenue breakdown structure.

DIS’s DMED segment consists of 3 business units. They are DTC, Linear Networks, and Sales & Licensing. On the other hand, the PEP segment consists of 2 business units, Parks & Experiences and Consumer Products. Now, let’s analyse the DMED segment more closely.

1. Linear Network

DIS’s Linear Networks unit includes its traditional domestic and international television channels. This includes ABC, Disney, ESPN, FX, and National Geographic channels. DIS also has a 50% stake in A+E Television Networks which includes a variety of cable channels such as A&E, HISTORY and Lifestyle.

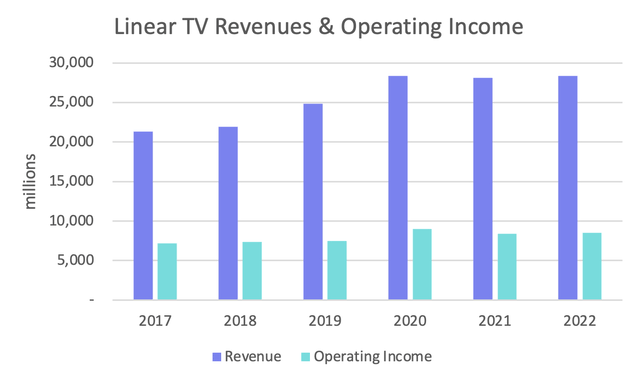

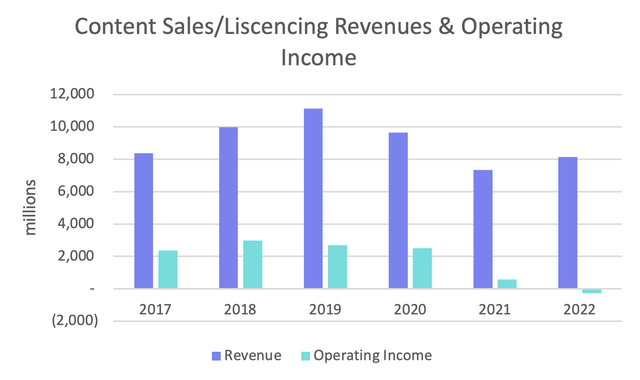

In 2022, Linear Networks made up 33% of DIS’s total revenue, which makes it DIS’s largest revenue engine. Revenues come mainly from fees it charges affiliates for the right to broadcast and advertise on its channels.

Margins

Author

The big increase in Linear TV revenue from 2019 to 2020 was probably due to the effects of the Twentieth Century Fox (TCF) acquisition. That being said, given the trend of Linear TV customers cutting the cord in favour of streaming, it is surprising that revenues have not deteriorated significantly since 2020. However, as the trend of cord-cutting increases, it is important for investors to continue to track the decline of the Linear Network business. The Linear TV segment is profitable and has operating margins of 30%.

Projection

Linear Networks made $28.3B in 2022. If this falls by 4% per year till 2027, it will mean that 2027 revenues will stand at $23B with an operating income of $5.8B.

Author

Now, let’s analyse the next business segment.

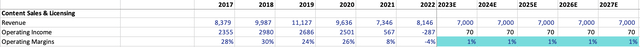

2. Content Sales/Licensing and Others

Revenues from this segment are earned from (largest to smallest segment revenue contributor):

- Sales/licensing of film and television content to third-party television and subscription video-on-demand (TV/SVOD) services

- Theatrical distribution

- Home entertainment distribution (DVD, Blu-ray discs and electronic home video licenses)

- Music distribution

- Staging and licensing of live entertainment events on Broadway and around the world (Stage Plays)

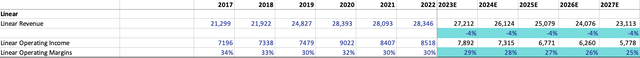

In 2022, Content Sales/Licensing made up 10% of DIS’s total revenue, surprisingly meagre.

Margins

Author

Prior to the pandemic, this unit’s revenues had been growing and margins were consistently around 25%. However, after the pandemic revenues and operating income have cratered and have yet to recover.

According to management the result for 2021 is because:

- TV/SVOD Distribution: Less content available to sell to 3rd parties because of COVID-19 disruptions. Moreover, DIS shifted from licensing our content to third parties to distributing it on our DTC streaming services.

- Theatrical Distribution: Theater closures and capacity restrictions in many territories.

- Home entertainment distribution: 36% lower unit sales and 5% lower average net effective pricing.

According to management the result for 2022 is because:

- TV/SVOD Distribution: Impact from the shift from licensing our content to third parties to distributing it on our DTC streaming services.

- Theatrical Distribution: It mostly recovered, but is still experiencing slight COVID disruptions.

- Home entertainment distribution: Lower unit sales despite the benefit of more new release titles in the current year. Net effective pricing was comparable to the prior year.

Therefore, while it seems that Theatrical Distribution (the 2nd largest revenue contributor to this segment) is likely to make a complete recovery in the next couple of years, the change in TV/SVOD Distribution (the 1st largest revenue contributor) and Home Entertainment Distribution (3rd largest revenue contributor) is more likely to be structural in nature. This makes sense. With Streaming on the rise, fewer people would be willing to rent DVD/s or digital movies. This suggests that the results we saw in 2021 and 2022 are not anomalies, but the new norm. That being said, WBD and PARA still have a profitable Licensing business to help fuel their own DTC transition.

Projection

I believe that Content Sales/Licensing will maintain $7B in revenues and $0.5B in operating profits going forward.

Author

3. DTC

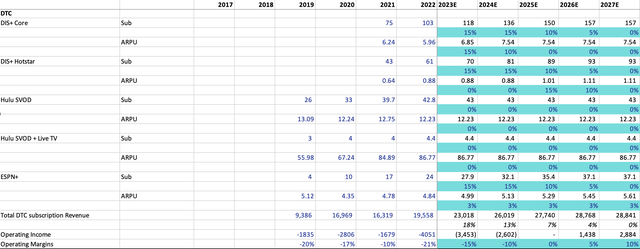

DIS’s Direct-To-Consumer (DTC) segment consists of revenues earned from its various streaming platforms Disney+, Hulu, ESPN+, and Star+. In 2022, this segment earned 23% of total revenues.

This business unit primarily generates revenue from subscription fees on DTC streaming services, affiliate fees and advertising sales. Significant expenses include operating expenses, selling general and administrative costs and depreciation and amortization. Operating expenses include programming and production costs (including programming, production and branded digital content obtained from other Company segments), technology support costs, operating labour, and distribution costs.

Now, let’s explore each of DIS’s streaming platforms.

1. Disney+

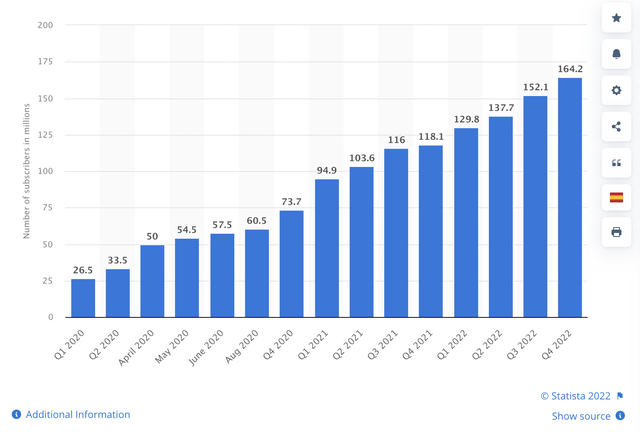

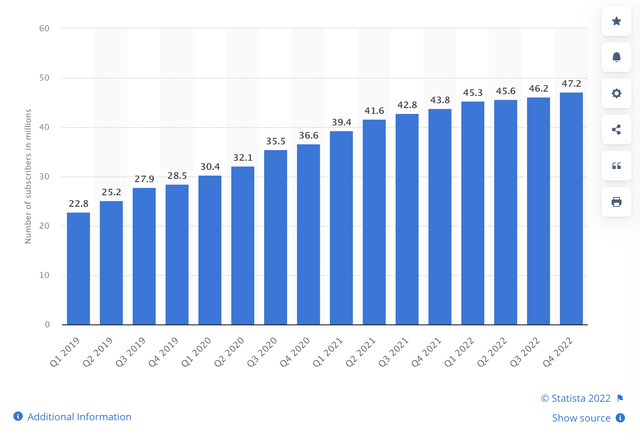

Disney+ is DIS’s flagship streaming platform. From here onwards, I will refer to it as DIS+. Content on DIS+ includes movies and TV shows from Marvel, Star Wars, Disney Classics, Pixar, etc. Starting in December, DIS+ will be available in 2 tiers: Basic Plan, which has ads ($7.99), and the Premium Plan ($10.99), which has no ads. In 2022, DIS+ subscribers grew to over 164 million.

No. of Disney Plus subscribers worldwide (in millions)

Statista

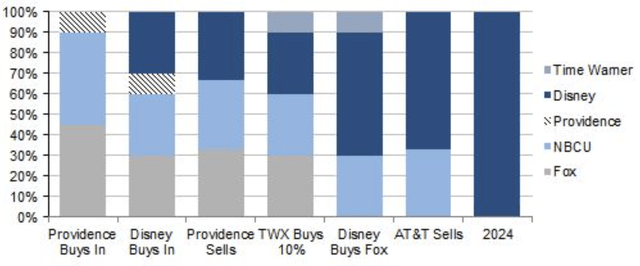

2. Hulu

Hulu is DIS’s oldest streaming platform. In fact, it was launched only 1 year after NFLX. Hulu was initially established as a joint venture between News Corporation, NBC Universal, Providence Equity Partners, and later The Walt Disney Company, serving as an aggregation of content from their respective television networks. Over time, DIS began to own a larger and larger percentage of Hulu. Today, DIS owns 67% and has full operational control of Hulu with CMCSA owning the remaining 33%. Moreover, DIS has a put/call agreement with NBCU, which provides NBCU with the option to require DIS to purchase NBCU’s interest in Hulu and DIS the option to require NBCU to sell its interest in Hulu to DIS. This agreement begins in January 2024. The figure below shows how Hulu’s ownership changed over time.

Hulu’s owners over time

Wikipedia

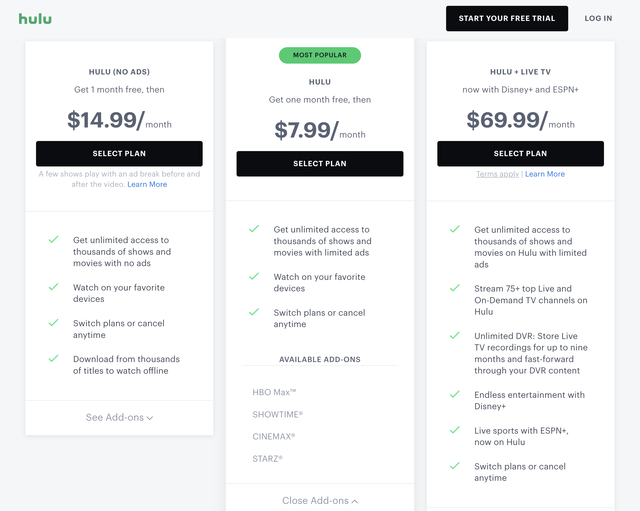

Hulu is available in 3 different tiers as illustrated below.

Hulu

Hulu is not your run-of-the-mill streaming service. Unlike many other streaming services, you can also pay for premium add-ons individually for things like TV Channels. This makes the streaming platform an excellent cable-cutting alternative. Hulu includes original programming and content from Disney, Fox, BBC America, Showtime, TLC, CBS, ABC News, Animal Planet, Complex, Freeform, FX, and others. Despite never expanding beyond US territories, it remains one of the top streaming services with an extensive library of movies, shows, and even Live TV.

Some of you may be wondering what is the point of DIS having two streaming platforms, both Hulu and DIS+. DIS has done this so that DIS+ can house more kid-friendly content in line with its brand, while Hulu houses the company’s more mature content.

One question I had was: Since Hulu is a US-only service, where does DIS house its mature content for its international subscribers? This is where things start getting slightly complicated. The company houses mature content for its international subscribers under the Star hub, which is itself in the international DIS+ app. So basically, it combines the international version of Hulu called Star together with DIS+ shows in one app.

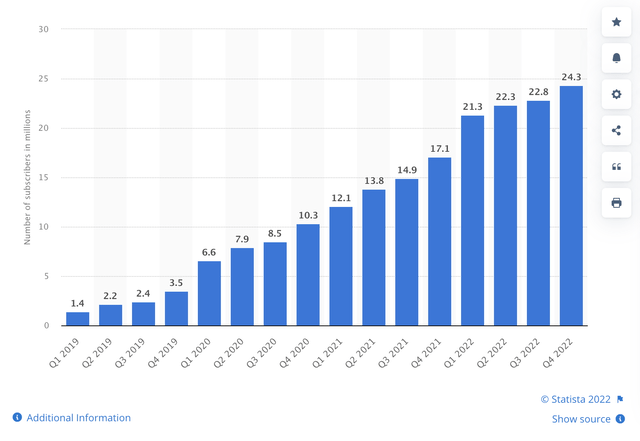

No. of Hulu’s paying subscribers in the United States (in millions)

Statista

Hulu’s no. of subscribers has been growing steadily over time; however, it seems to have started to reach a plateau. This makes sense considering the growth of other competitors on both the streaming and Live TV fronts. Conservatively, I doubt Hulu will add substantial new subscribers going forward.

3. ESPN+

ESPN+ is DIS’s streaming platform for sports programmes. It is the leading sports streaming service. Though ESPN+ has its own lineup of live sports, on-demand shows, and exclusive programs, the service does not include access to the regular ESPN cable channel. Currently, a subscription to ESPN+ costs $9.99 per month. ESPN+ subscribers have been growing steadily and stand at 24.3 million as of 2022.

No. of subscribers to streaming service ESPN Plus (in millions)

Statista

4. Star+

Time for more definitions. It is important to distinguish between STAR+ and STAR. They are not the same thing. STAR+ is a streaming service available only in Latin America. On the other hand, STAR is a content hub within the international Disney+ streaming service that launched on February 23, 2021. The hub is available in a subset of countries where DIS+ is operated. As mentioned before, STAR is the international version of Hulu. This is because management argued that the Hulu brand was not as well-known as the STAR brand outside of the US. Star+ subscribers are not officially disclosed. Star+ makes up only a small chunk of overall DTC, so I will not elaborate on it any further. Now let’s analyse the DTC unit economics.

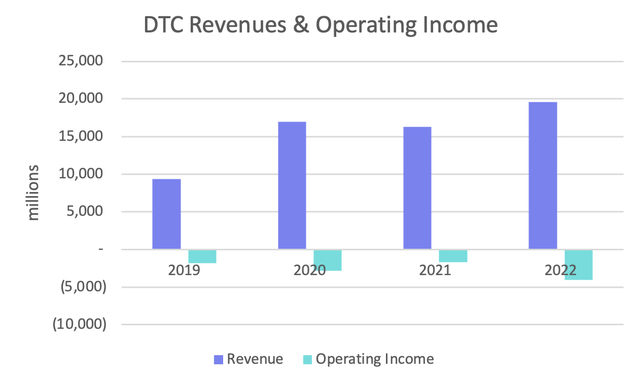

Margins

Author

DTC revenues have been increasing while operating income has been decreasing. In fact, operating income margins decreased from -10% in 2021 to -21% this year. According to management, “the decrease at Direct-to-Consumer was due to higher losses at Disney+ and, to a lesser extent, lower results at Hulu and higher losses at ESPN+.”

To combat the negative operating income, management needs to focus on increasing subscriber count or ARPUs by 21% (assuming no additional operating costs), and that they have done. Management increased the DIS+ subscription prices by ~35% in December. Although I don’t expect a 35% increase to flow straight into operating income, it does means that investors can probably expect the segment to achieve profitability in the near future, given no unusual scale in expenses.

Projection

Based on my projections, DIS+ will have a DTC revenue of $29B in 2027 with an operating income close to $3B.

Author

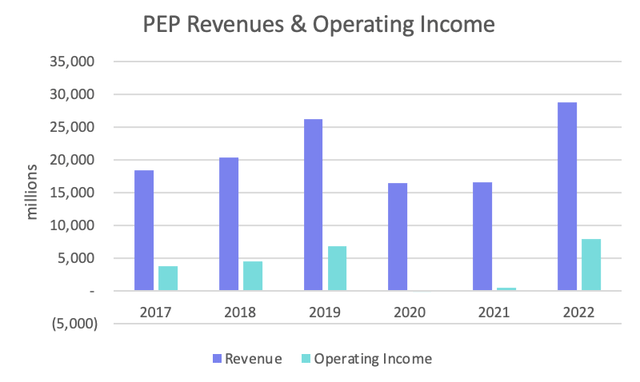

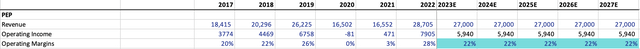

4. Parks, Experiences and Products

The Parks, Experiences and Products segment primarily generates revenue from the sale of admissions to theme parks, the sale of food, beverage, and merchandise at DIS’s theme parks and resorts, charges for room nights at hotels, sales of cruise vacations, sales and rentals of vacation club properties, royalties from licensing intellectual properties and the sale of branded merchandise. Revenues are also generated from sponsorships and co-branding opportunities, real estate rent and sales, and royalties from Tokyo Disney Resort. Significant expenses include operating labour, COGS, infrastructure costs, depreciation, and other operating expenses. Infrastructure costs include information systems expenses, repairs and maintenance, utilities and fuel, property taxes, retail occupancy costs, insurance, and transportation. Other operating expenses include costs for such items as supplies, commissions, and entertainment offerings. Now let’s take a look at DIS’s market share for this business unit.

Margins

Author

Pre-pandemic revenues and operating profits have been growing consistently with profit margins consistently at or above 20%. Even in the pandemic years of 2020 and 2021, operating income was barely negative, signalling the strength of this business segment. In 2022, the Parks business recovered stronger than ever. This was fuelled because of pent-up demand and increasing prices on admission tickets.

Although 2022 results paint an optimistic picture, the PEP business line is mature, so I am not expecting much revenue growth to happen for this segment. Nonetheless, it can aid the company’s transition from Linear to Streaming. This is a pillar that WBD and PARA lack.

Projections

I expect the PEP segment to maintain its current revenues at $27B and operating income at $6B for the next 5Y.

Author

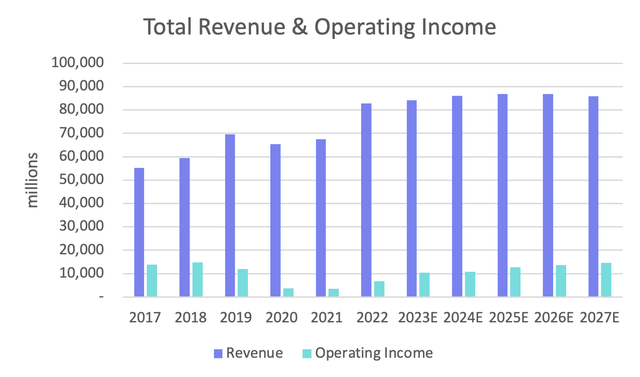

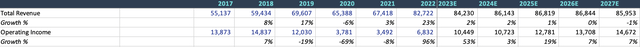

Overall Estimates

Based on the sum of my individual business segment estimates above, I get the following:

Author

I project that 2027 revenue will stand at $86B and operating income at $14.7B.

Author

Now that I have formed my own revenue and operating income estimates, it’s time to compare them with analyst estimates.

From 2023 to 2027, analysts expect revenue to grow at a CAGR of 2.8% and reach $102B. This is 19% higher than my own revenue estimates of $86B in 2027.

Other Financials

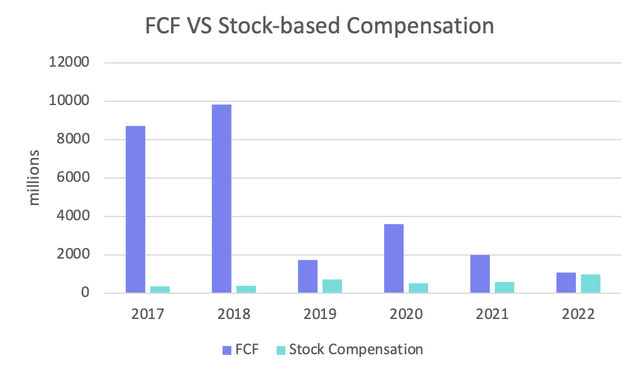

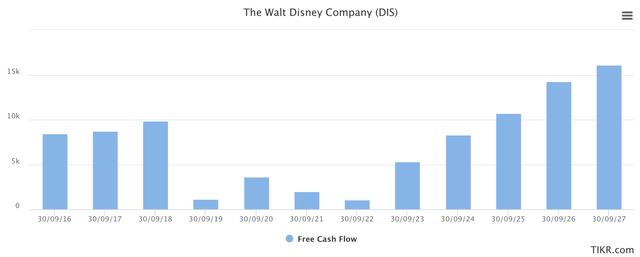

FCF vs SBC

Author

Stock-based compensation (SBC) does not impact FCF numbers, however, it is a real expense so we have to account for it. It seems that DIS’s SBC has been increasing. In fact, if we account for SBC n in 2022, investors would have no FCF attributable to them. Going forward, investors have to monitor whether FCF growth can outpace stock-based compensation growth.

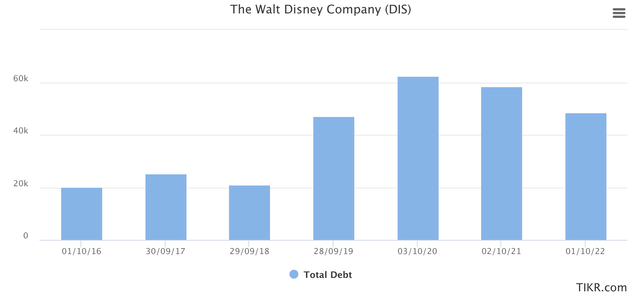

Debt

DIS’s debt exploded in 2019 due to its acquisition of Twentieth Century Fox (TCF). The acquisition of $71B which was finalised in March 2019 was funded approximately 50:50 with cash and shares.

TIKR

How much debt does DIS have today?

DIS has a total debt figure of $48B, which is the highest amongst its peers. In an increasing interest rate environment and an anticipated economic downturn, companies with high debt levels are more at risk of going bankrupt. As such, the market has punished the stock. But let’s dig more into it.

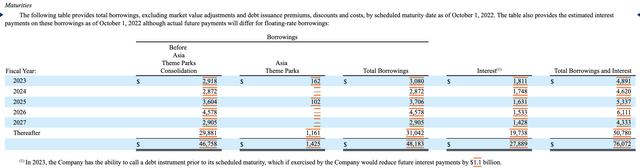

How much of its debt is due to mature soon?

2022 Annual Report

2022 Annual Report

According to its recent filing, 70% of the company’s debt has maturities after 2026. In comparison, 90% of PARA’s debt and 65% of WBD’s debt have maturities after 2026.

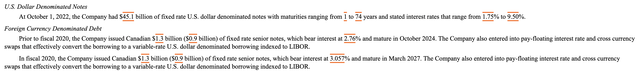

What is the interest rate on debt?

According to management, interest rates range from 1.75% to 9.5%. However, I am unable to draw the average cost of the company’s debt. Moreover, I cannot tell the percentage of fixed interest rate to the variable interest rate.

In comparison, WBD has an average cost of debt of 4.3%, with 87% of it having a fixed rate.

Will FCF be able to cover the near-term debt?

TIKR

Remember that DIS has $48B in debt. If DIS were able to achieve a pre-pandemic FCF of around $7B, it would take the company 7Y to pay down its debt.

In the worse case, if Streaming is proven to be less profitable than linear, DIS could take up to 8Y to pay down its debt.

However, according to analyst expectations of future FCF, DIS will take only 5Y to pay down its debt.

Will DIS reinstate its dividends soon?

Before covid, DIS used to pay investors dividends. If DIS reinstates its dividend, we can expect many new dividend investors to establish positions. However, will DIS be able to reinstate the dividend anytime soon?

During the last fiscal year, the company generated only $1B in free cash flow. I will assume that DIS will reinstate its dividend only when its debt reaches its pre-covid maintenance levels of $15B. This means that before it reinstates its dividend, DIS will have to pay off $33B of debt first. If Streaming is more profitable than Linear, this may take up to 3-4 years. If Streaming is as profitable as Linear, this may take up to 5 years. If Streaming is less profitable than Linear this will take even up to 6 years.

I personally think that DIS will not reinstate its dividends anytime soon.

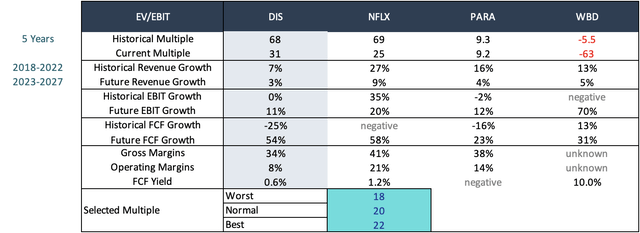

Valuation (EV/EBIT)

I have decided to use EBIT over EBITDA as DIS’s Parks business has significant depreciation and amortization, unlike WBD and PARA. Moreover, this infrastructure is not going to go away anytime soon.

Author

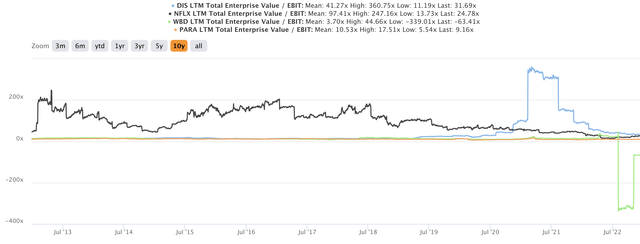

TIKR

DIS is currently trading at an EV/EBIT multiple of 31.7x, compared to its 10-year historical multiple of 41.3x.

Comparing DIS to itself in the past, it can be argued that DIS can trade a multiple of 25x.

Comparing DIS and NFLX (NFLX) up until 2027, it can be argued that DIS can trade a multiple of around 15x relative to NFLX.

Comparing DIS and PARA up until 2027, it can be argued that DIS should trade at a multiple of around 20x relative to PARA.

Comparing DIS and WBD up until 2027, it can be argued that DIS should trade at a multiple of around 20x relative to WBD.

Comparing DIS and media conglomerates of the past.

If all Linear TV operations are ported over to Streaming, Streaming will become the new Linear TV. To determine what is an appropriate Linear TV company multiple we will use the 10-year average of the legacy media conglomerates. The multiples between the companies below differ because they each had different margins and were different in size.

- DIS 10-year average historical multiple was 13.2x.

- DISC 10-year average historical multiple was 12.7x.

- PARA 10-year average historical multiple was 11.2x.

As I find it hard to distinguish the probabilities of each multiple derived above, I shall just take the average of ~20x as my Normal Case multiple for DIS in 2027.

So the three cases are:

- Normal Case Multiple: 20X

- The streaming business is equally as profitable as the linear business

- Bear Case Multiple: 18X

- The streaming business is less profitable than the linear business

- Bull Case Multiple: 22X

- The streaming business is more profitable than the linear business

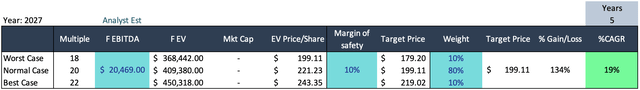

Using analyst EBIT estimates:

Author

Using the current stock price of $85 and analyst estimated 2027 EBIT of $20,469 million with scenario analysis, weighting 80% for the normal case and 10% for the other 2 cases, combined with a final 10% margin of safety, I get a TP of $199.11 for 2027, representing a 134% upside from today’s prices (19% CAGR). Not bad! However, instead of using the more optimistic analyst EBIT estimates, I will now use my more conservative EBIT estimates.

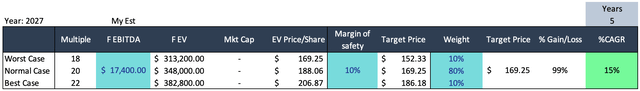

Using my EBIT estimates:

Author

Using the current stock price of $85 and my own more conservative estimated 2027 EBITDA of $17,400 million with scenario analysis, weighting 80% for the normal case and 10% for the other 2 cases, combined with a final 10% margin of safety, I get a TP of $169.25 for 2027, representing a 99% upside from today’s prices (15% CAGR).

DIS’s returns meet my personal active investment hurdle rate of 15%, thus I am considering initiating a position in the company.

Upcoming catalysts

- Disney is implementing ads into DIS+ in December. Given the positive reaction to NFLX ads, DIS could face a similar positive reaction.

Risks

- The recent change in CEO may lead to a different strategic direction for the company.

- Streaming may be a lower-margin business than Linear.

- Since a big part of Disney’s business is driven by discretionary spending, any downturn in the economy will likely prolong the time required to transition to streaming.

- Because of its sheer size, DIS may face a regulation risk

- Vocal employees may cause internal disputes within the company.

Conclusion

In conclusion, Disney faces no shortage of issues at the moment the most pressing of which include management issues and the competitive streaming landscape. However, I believe that the current price is attractive enough to initiate a position in the company.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in DIS over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article.