Summary:

- Disney stock has rallied due to the promise of changes via the proxy battle. Bob Iger’s re-election into the board raises doubts about the implementation of the changes needed.

- Disney’s focus on aggressive cost-cutting and streaming profitability may indicate a plateau in Disney+ subscribers and limited growth potential.

- I will be watching the results for the company’s upcoming movies and shows to gauge fan excitement for Disney IP.

popovaphoto

Sometimes it takes a while for a thesis to unfold, and it’s something that quite often tests my patience. Luckily, I have a policy to never short a stock, especially one that remains as popular as Disney (NYSE:DIS). Since my last article in November, DIS stock is up close to 20%. However, looking at how recent events have unfolded, I believe that my “bear thesis” remains intact. I am quite surprised that the stock has rallied even more despite the headwinds. In my opinion, this only means that bullish investors from here on out are setting themselves up for more pain.

Disney Remains at Status Quo

The biggest news story from the past few weeks is Bob Iger and his proposed slate of directors being re-elected to the board. They defeated the group of Nelson Peltz’s Trian Group and Blackwells Capital in a highly contested proxy battle. It is in my view that DIS stock rallied because investors were excited about the changes being suggested by Peltz’s group. In fact, one of my main concerns about the company’s “Broken Flywheel” model was also noticed by Trian Group. This concern was that there was a need to either revitalize or refresh the company’s existing intellectual property (“IP”). As quoted in a Variety article.

Trian also recommends that Disney make fewer movie sequels. “Disney’s ‘flywheel’ spins the fastest when the company creates or acquires new intellectual property to monetize,” the white paper says. “Sequels are less risky film ventures to produce, but do not drive long-term benefits in the same way that new IP can.”

The firm continues, “The percentage of Disney films that are sequels, prequels, spin-offs or remakes has dramatically increased — suggesting a creative engine that is sputtering.” Trian is calling for “a comprehensive review of studio operations and culture” by the board, including the state of leadership, process and workflow.

However, with Bob Iger and crew winning, can investors expect any meaningful change? If there wouldn’t be a “comprehensive review of studio operations and culture” why should investors expect any significant changes?

Bob Iger’s More of the Same Future Plans

Bob Iger’s current plan basically boils down to two tenets, 1) aggressive cost-cutting and 2) a dedicated focus on streaming. His key focus is pushing Disney+ into profitability. In a CNBC interview posted in Seeking Alpha, Bob Iger said “We ended up losing a lot of money, more so than we expected initially, part of that was because we were chasing sub-growth, and we were not as focused as we need to be on the bottom line.”

The company has begun to initiate certain initiatives in this regard. Disney has begun to crack down on password sharing starting this June. Netflix (NFLX) was able to do this successfully. However, it did so when it was already the dominant force in streaming. Disney+ subscriber growth has not yet reached its maximum potential, yet growth has already plateaued. This could be a sign of dissatisfaction with the company’s streaming content. I worry about aggressively pushing for a crackdown on password sharing at a time when customer satisfaction is not as high as it should be.

The company as well is pushing into the gaming realm. Disney has bought a $1.5 billion stake in Epic Games, creator of the popular Fortnite videogame series. While past its peak popularity, the battle royale game Fortnite still draws an impressive number of players. The game has over 270 million players worldwide, a dip from its peak of 400 million players but still impressive. The deal will create a new gaming universe within the Fortnite ecosystem. This expands Epic Games’ current licensing deals to bring in Marvel characters and other Disney IPs into Fortnite.

Since Epic Games is a private company, it wasn’t disclosed on what valuation this deal was conducted. In other words, we don’t know what percentage Disney got for Epic Games. While this deal is relatively small compared to the overall size of Disney, the company has been accused of overpaying for transactions in the past, most recently the acquisition of 20th Century Fox.

My main concern is that current management has not outlined the concrete steps that are being done on the creative side to refresh the company’s core IP of Marvel, Star Wars, and Pixar. Netflix can generate higher margins due to its in-house content. I was hoping if Peltz’s group had won, there would be a restructuring on the creative side especially for Star Wars, Marvel, and Pixar. In my view, these brands need to have a creative reshuffle. While IP acquisitions, cost-cutting, re-structuring, and getting more dollars out of every customer are good strategies for increasing shareholder returns, it is my opinion that the creative side of Disney holds at least equal weight.

I will be watching the results for the company’s upcoming movies and shows. In particular these upcoming shows; The Acolyte (Star Wars), Deadpool (Marvel), and Inside Out (Pixar). The success or failures of these shows will give me a gauge of the current strength of the brand’s IP and fans’ level of enthusiasm. As I mentioned in my previous article, I believe that declining fan enthusiasm for Disney’s IP is a challenge the company is facing.

Disney Cost Control Shows Results Yet Streaming Lags

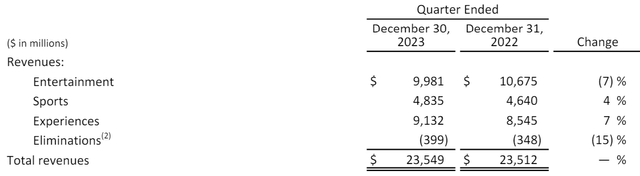

In Q1 2024, Revenues were basically unchanged at $23.5 billion. However, diluted EPS has seen a boost from $0.70 the prior year to $1.04 in Q1 2024, a growth of 48%. The bulk of the improvement on the company’s bottom line has come through its cost reduction efforts. The company has accomplished significant cost savings of $500 million on its SG&A and other operating expenses. Management believes that it is on target to accomplish its $7.5 billion in annualized savings by year-end.

On a per-segment basis, it can be seen that the “Experiences” segment aka the theme parks continues to be the most important. The Experiences segment saw its revenue grow from $8.5 billion in Q1 2024 to $9.1 billion, a growth of 7%. This translated to an 8% increase in Segment operating income ending at $3.1 billion for the quarter.

Q1 2024 results (Q1 2024 results)

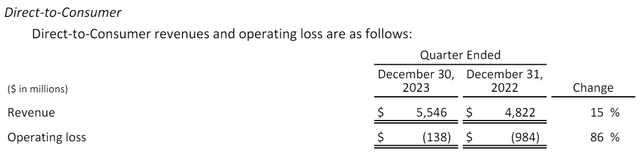

On the income side, it was the “Entertainment” segment that saw the largest increase, more than doubling results from last year. This was all driven by cost reductions as the segment’s revenue actually decreased by 7% from $10.6 billion to $9.98 billion. Entertainment segment income was $874 million this quarter, with the majority of the increase being driven by smaller operating losses in the company’s “Direct to Consumer”, i.e., streaming. Operating losses for this sub-segment fell from nearly $1 billion in the same quarter last year to a loss of $138 million.

Q1 2024 results (Q1 2024 results)

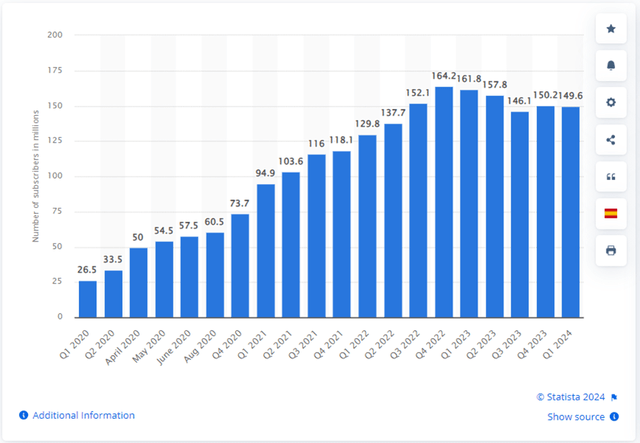

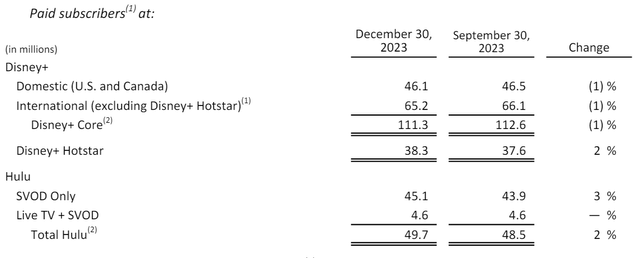

Disney management’s plan of making its streaming service profitable is commendable. However, in my view by focusing on profitability instead of growth, management is signaling that the service may have reached its peak number of viewers. Since peaking in Q4 2022 at 164.2 million subscribers, the number of subscribers has hovered around 150 million for the past 3 quarters. This is especially true in the domestic segment which was flat quarter over quarter at 46 million, indicating stalled growth. The lack of growth is worrying because it puts management in a bind. My concern with these developments is how much more costs can Disney cut before it starts hurting the content on its streaming platform.

Disney+ subscribers (Statista) Q1 2024 results (Q1 2024 results)

Valuation and Key Considerations

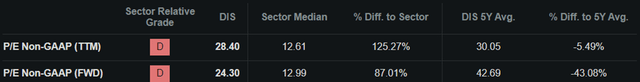

When I wrote about DIS stock last year, it was trading at a premium and was not cheap in my opinion. This conclusion remains the same, as the improved company results are offset by the roughly 20% increase in DIS stock’s price. According to Seeking Alpha’s Quant metrics, the company gets a score of “D” when compared to other stocks in its sector.

Relative Valuation Score (Seeking Alpha)

The company currently has a trailing twelve-month non-GAAP P/E of 28.4x, which is almost double its sector median of 12.8x. This type of valuation is only justified if the company is growing at a healthy clip. It is my view that cost-cutting has its limits. For me, DIS stock is a “sell” given the flat revenues of the company and the plateauing Disney+ subscribers.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.