Summary:

- Disney’s stock has fallen significantly in value and public sentiment towards the company has declined but seems to be improving.

- The company’s financial overview shows growth in assets and recent job cuts and cost-cutting measures are expected to improve profitability.

- Disney has faced criticism from both liberals and conservatives, impacting its reputation and brand image, but these concerns are fading.

MN Chan

Remember when The Walt Disney Company (NYSE:DIS) could do no wrong. Maybe I am being nostalgic but I have so many positive memories of Disney. Even a decade ago everything that Disney did or bought just seemed to make sense and add value.

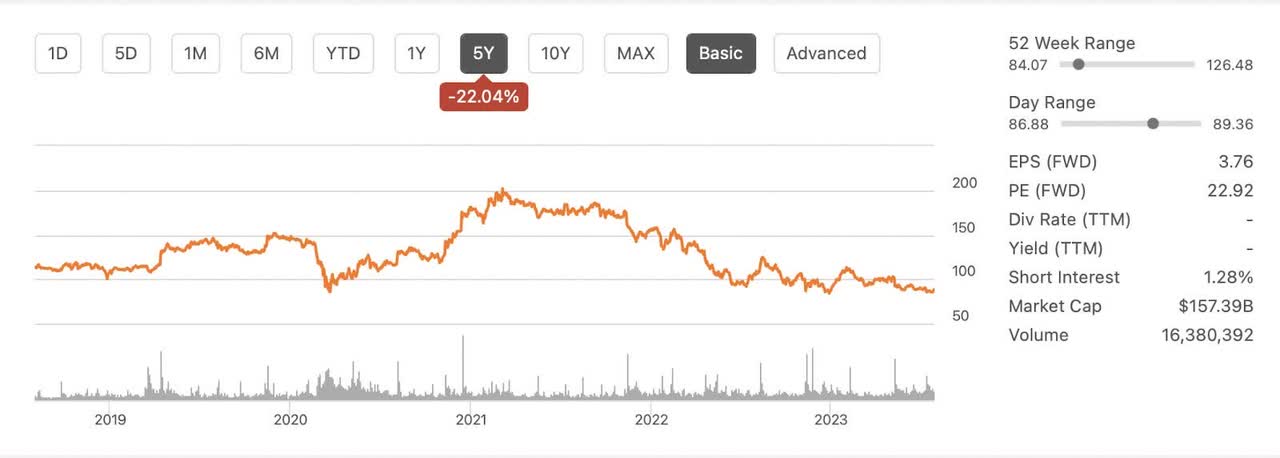

This virtuous cycle saw Disney’s shares shoot to the moon and peak in 2021 at over $200. Since then, things have changed and Disney has been in a free fall both in regards to share price and how people view the company. This combined with high costs caused shares to fall all the way to its current value of around $88. We believe that sentiment has reached an inflection point and the good times will come again.

Judging Disney’s value is a difficult task. From its theme parks to its media and sports entertainment empire, Disney has its hands in a lot of pies. Disney owns over 200 companies including but not limited to this impressive list.

It would be impossible in the confines of a short article to break down everything about Disney. Each individual company within Disney could be its own article. However, we feel comfortable looking at the overall sentiment of the company and an overview of the financials to determine an approximate intrinsic value for this giant company.

Financial Overview

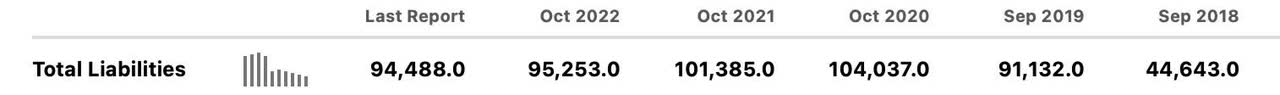

Since 2018, Disney has grown assets from $98 billion to $204 billion. During this period Liabilities have increased from $44 billion to $94 billion. The growth in the spread between assets and liabilities has increased from $54 billion to $110 billion.

This impressive growth has happened while Disney was experiencing a lot of criticism and the share price has reflected this drop in sentiment as well as the impact of the pandemic.

The Five Year Chart

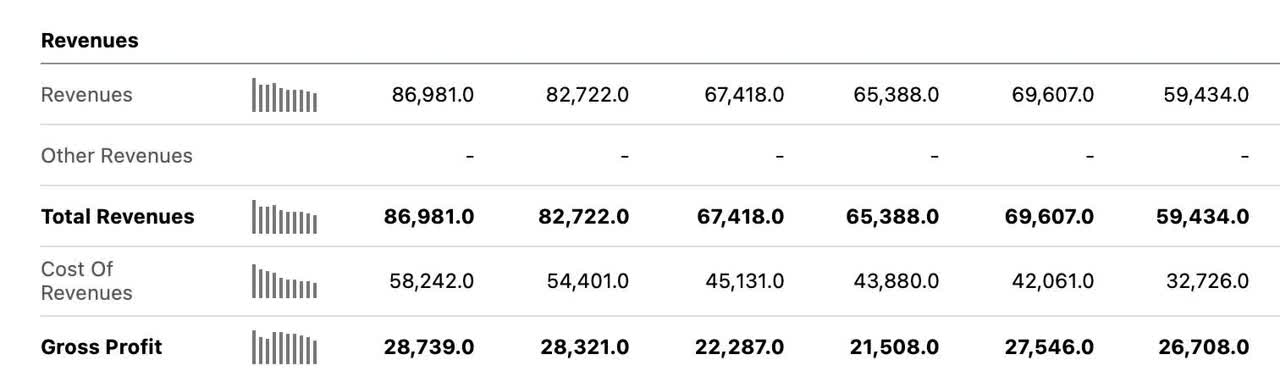

But Disney’s growth is not just for growing sake, Disney has been committed to growing revenues and profits as well.

Revenues have also grown considerably but so have costs. We believe that the recent cost cutting steps taken by the current CEO will significantly improve profitability. The job cuts we discuss below show that Disney is not only aware of its problems but that Disney has also taken the necessary steps to correct them. We believe the fair value of Disney to be between $150 and $215. This represents a significant discount at its current price.

We believe the main reason that Disney has fallen is because of sentiment. Sometimes Disney’s commitment to growth has led to controversy and sometimes the controversies have come out of left field. These controversies have seemingly snowballed over the last five years causing Disney to appear to be under attack. The combination of controversy and excessive costs have been a headwind for the last five years and have been a drag on its shares value. Below we will look at how the sentiment of Disney shares has been impacted by these controversies.

The Disney Heiress’ Complaints

Since 2018, Disney Heiress, Abigail Disney, has criticized Disney for various reasons related to the company’s business practices and corporate governance. One of the main concerns raised by the heiress is the issue of income inequality and executive compensation within the company. During a 2019 interview she criticized Disney’s executive compensation, “If your CEO salary is at the 700, 600, 500 times your median worker’s pay, there is nobody on Earth … Jesus Christ himself isn’t worth 500 times his median worker’s pay.” She has repeatedly expressed how Disney’s top executives receive exorbitant pay packages while many lower-level employees struggle to make a living wage. This criticism aligns with the broader societal debate on income inequality and the fairness of executive compensation in large corporations. It also put Disney in the crosshairs of liberal politicians and made it a central focus of the U.S. culture wars.

She didn’t stop her criticisms there though she also raised concerns about Disney’s environmental and social impact. She has pointed out that the company’s theme parks generate substantial waste, and its reliance on single-use plastics is detrimental to the environment. Furthermore, there have been concerns about the treatment of workers in Disney’s supply chain, particularly in countries with weaker labor protections. All of these issues tarnished the magic at the magic kingdom especially amongst liberals.

From a financial perspective, these criticisms have impacted Disney’s reputation and brand image, which has affected consumer perception and loyalty. These reputational risks have not dissipated and have negatively impacted investor sentiment and shareholder value because part of the Disney magic is predicated on Disney being a magical place. Nothing is more important to Disney than brand image.

These issues have led to continued public backlash and potential regulatory scrutiny, which has further impacted the company’s operations and share performance. But Disney’s reputation isn’t just being hit by the left.

Culture Wars Continue to Drag on Star Wars Owner

Disney seemingly has not only infuriated liberals, but it has also managed to anger extreme conservatives. In a yearlong dispute between Florida Governor Ron DeSantis and Disney, tensions have escalated over the company’s stance on the Parental Rights in Education Act, dubbed the “Don’t Say Gay” bill, which prohibits classroom discussions about sexual orientation and gender identity in certain elementary school grades.

Disney publicly criticized the legislation, prompting conservatives to label the company as “Woke Disney.” This criticism, coupled with previous contentious changes in Disney’s theme parks and streaming services, has fueled the fight between the two parties.

Additionally, Disney’s special tax status, which granted it extensive control over its operations, became a point of contention when the Florida Legislature initially moved to abolish it, but later decided to allow Disney to retain the special tax district while giving Governor DeSantis authority over the board. Despite the challenges, Disney expressed its willingness to work within the new framework and continues to be a significant employer in the state.

Corporations hate being embroiled in cultural issues because it rarely helps them but often has deleterious effects. These impacts can be bad when any political group becomes active against the company.

Disney has somehow managed to not only offend one group but to somehow be embattled by both extremes of the political spectrum. No matter what you personally believe it is possible you have a gripe against Disney.

Viral Negativity

Even people who have little political involvement have complained about Disney’s high prices and lack of awareness. One of my personal favorites was the viral 2022 story where Disney had to apologize for an apparent stopping of a marriage proposal when an employee grabbed an engagement ring from a man on bended knee at its Paris theme park. You just can’t make this stuff up. You can read more about this not so magical experience in a New York Times article here. These combined mishaps have tarnished the magical image of Disney. The house Mickey Mouse built has suffered a tarnishing of its once pristine image. An image predicated on making children and families happy. A place where super bowl MVP’s used to gladly go to celebrate their awesome achievements.

The company has tried to ignore the criticism and stay focused on the bottom line but focusing on the bottom line has caused more criticism.

JOB CUTS

Disney CEO, Robert A. Iger announced the company’s plans to eliminate 7,000 jobs in March of 2023, accounting for 4 percent of Disney’s global workforce, in an effort to reduce costs by $5.5 billion.

Such significant cuts will certainly have implications for the company’s future performance and overall financial health. As investors, it’s essential to closely monitor how these cost-cutting measures and restructuring efforts unfold and how they may impact Disney’s bottom line and long-term growth prospects. In many ways, we see these job cuts as the turning point for Disney.

In addition to Disney’s global cuts. ESPN has also made some significant cuts.

This is incredibly important because excessive costs at the sports leader have been a drag on Disney’s performance and we believe cuts will be a catalyst for share growth.

Recently, ESPN cut over 20 high profile analysts. CBS news stated, “ESPN chose the high-profile cuts to avoid laying off a larger number of behind-the scenes employees, according to the source.” You can read more about these cuts here.

These layoffs, although unpopular, lay the foundation for future profitability and significantly reduced the costs at the sports leader. Even if this impacts the quality of reporting, we believe people tune into sports for the sports not the reporters. Given the glut of available talent and people trying to enter the field it appears to be a smart move.

The Turning Point

A company of Disney’s size cannot exist without some criticism, but the current negative sentiment that had been consistently growing from 2018-2022 we believe is at an inflection point. We believe the former negativity is already priced in and has reached its peak. We also believe Disney has learned from these problems and will seek to avoid them in the future.

We also believe that Disney has begun to digest some of its earlier purchases and will figure out how to better profit from them in the future. Cost cutting steps will be reflected in the late 2023 and 2024.

Upcoming Earnings

The upcoming earnings present another opportunity for Disney to create a positive catalyst. Consensus estimates place Disney’s quarterly earnings at 1.01. I expect that recent cost cutting measures should positively impact earnings. I also believe increases in tourism and travel this year coming off of the pandemic should cause large growth in Disney’s theme parks. These factors cause me to estimate that Disney should surprise to the upside and could possibly report at the high end of expectations somewhere around $1.15 in earnings.

While I expect a surprise to the upside in earnings this quarter, it is possible that cost cutting efforts will not show up till the third quarter or next year. Regardless of this quarter’s earnings, I expect that Disney will report good news and guide future earnings upward. The most important thing is that Disney shows progress which I believe they will do. This should be a significant turning point for Disney, and I believe Bob Iger knows he has to show improvements. He has been active promoting spending cuts and efficiency and this is another opportunity to show Disney is on the right track.

I expect that Disney will seek to reward investors and deliver on their expectations. The only possible scenario where I see earnings surprise to the downside is if they suffer additional costs this quarter from terminating high end personnel contracts. These one-time costs would pave the way for future increases in profitability and I don’t see this being a high probability.

Risks

Investing in Disney comes with several risks that investors should be aware of. Disney’s businesses, particularly its theme parks and media networks, are sensitive to economic downturns, affecting consumer discretionary spending and attendance at theme parks. While we believe that the end of the pandemic should be beneficial for Disney, we have no idea what further problems in the economy could arise. The streaming industry’s fierce competition from established players and new entrants poses a challenge in gaining and retaining subscribers for Disney’s streaming services.

Although we believe Disney’s franchises are some of the best, we acknowledge that poor content will infuriate the fans of these franchises. The success of Disney’s media and entertainment businesses heavily relies on the popularity of its content, making it susceptible to fluctuations in performance. The operation of theme parks is also subject to various factors, such as weather conditions and health crises, which can significantly impact park attendance and revenue. Furthermore, changes in regulations, intellectual property protection challenges, and currency fluctuations in international operations can all pose risks to Disney’s operations and profitability. The company’s debt levels, technological disruptions, and governance issues are other factors that investors should consider when making investment decisions in Disney. We recommend conducting thorough research in order to understand and manage these risks effectively.

Conclusion

For value investors, Disney presents an attractive investment opportunity for several reasons. The stock is currently trading at a discounted price compared to its intrinsic value, offering potential for capital appreciation.

Disney’s diversified revenue streams, including theme parks, media networks, studios, and streaming services, provide stability and resilience to economic fluctuations. Its strong brand recognition and loyal fan base translate into a competitive advantage and pricing power. Moreover, Disney’s streaming service, Disney+, has demonstrated significant growth potential, and the reopening of theme parks after pandemic restrictions could drive further growth.

Cutting costs in 2023 will benefit the company in the long term and allow them to invest in profitable opportunities in the future.

Whether you love Star Wars, Marvel, Pixar, National Geographic, Disney Theme Parks, or ESPN. Disney literally has something for everyone and it has grown immensely over the past decade. The past few years have seen difficulties but don’t let it confuse you. Disney is an incredible company with the potential to become the premier entertainment and streaming company in the world. We believe that Disney has advantages of scale that will allow it to continue to grow. We also note that Disney has not traded at these levels since 2018, and we believe that Disney’s current price presents a compelling opportunity for those looking to start a position.

We believe the majority of the negative news surrounding Disney is old news and that the current controversies will fade overtime. We note that Disney owns a few of the world’s favorite franchises and should be able to create content that fans desire and the distribution channels to get content to fans.

With valuable intellectual property and financial stability, Disney’s position as a content powerhouse adds to its appeal. While these factors make Disney an enticing investment prospect, it’s crucial for deep value investors to acknowledge potential risks, such as economic downturns, competition in the streaming industry, and uncertainties related to theme park operations, and to conduct thorough research and analysis before making any investment decisions.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of DIS either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.