Summary:

- Disney continues to be a buy for patient investors willing to hold for the long-term, but the stock will be volatile in the current environment.

- Disney’s evolving strategies, particularly at Marvel, may lead to excitement on the creative end while pressuring the financial side.

- Disney’s valuation is expensive relative to its sector, but the company’s profitability form-factor grade is firmly in the green.

- Disney’s stock faces technical challenges, but the company’s focus on the movie division and talent leverage may lead to future growth.

Matt Winkelmeyer/Getty Images Entertainment

I last talked about The Walt Disney Company (NYSE:DIS) back in May, offering my opinion on the company’s evolving strategies. I will do so again here, in the same context: that of the most recent earnings report, for fiscal Q3 this time. Interestingly, there seems to be even more evolution of strategy, particularly at Marvel, and it may lead to some excitement on the creative end while simultaneously pressuring the financial side (the synergy potential of the ecosystem should benefit, even if with more expense).

But it also might open up opportunities no one ever thought possible.

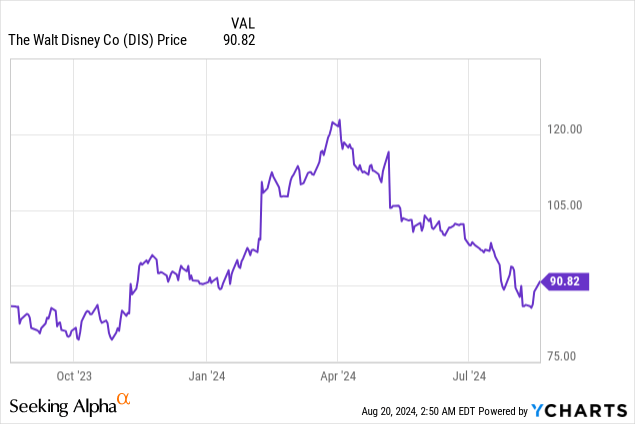

We’ll get to all that (and for this article, that will be the focus, besides the stock, of course). But let me say I still find Disney a long-term buy, even if I think my call for shareholders to be patient has slightly changed to shareholders need to be super-patient…maybe more now than ever before. Not only does the chart for Disney show technical challenges, but there also are considerations for all the volatility we’ve been seeing…yes, stocks, including Disney, might bounce higher by a few percentage points on a Friday, only to sink again (and again, and again) throughout the following week starting on Monday. It’s just the current trading reality; we’ve been here before, we’ll get through it, and we’ll have to deal with it yet again. It’s the market cycle, so predictably unpredictable, as they say.

As with last time, Disney’s valuation is expensive relative to its sector but potentially inexpensive to its internal metric averages over the last several years. The latter might not really matter right now, as more focus is being kept on the former at the moment. The rest of the form-factor grades are firmly in the green…which is a good thing, and which is why patience may be needed here as CEO Bob Iger (will there ever be another CEO?) continues to muster up whatever cost-cutting magic he can.

Disney, even though a blue chip name, is nevertheless subject to risk because of volatility and fundamental challenges to chasing profits in its D+ streaming unit, as well as changes in box-office and linear-cable strategies, but I continue to hold and find the dips favorable for adding to existing positions.

The Quarter

Here are the initial highlights to the third quarter, the numbers (which I may truncate in some cases) that immediately stood out to me (in some cases they may not be the numbers on which most analysts focused, but they are my personal starting points):

- Free cash flow: down for the quarter, $1.2 billion versus $1.6 billion last year, but up significantly on the nine-month period: $4.5 billion to $1.4 billion

- Interest expense (not net) was basically the same at $509 million versus $503 million for the quarter; for the nine-month, it increased slightly to $1.5 billion from $1.4 billion

- Borrowings were $39 billion against $42 billion (no change); current borrowings increased to $8 billion from a 6-handle on a sequential basis

- D+ core subscribers at 118 million versus 117 million sequentially

- Hulu subscribers at 46 million versus 45 million sequentially (the core Hulu)

- Entertainment segment operating income tripled to $1.2 billion year/year

- Cash/equivalents dropped to $6 billion against $14 billion previously

You can probably tell that the theme here is: 1) concern about debt; 2) a desire that the Disney ecosystem between content (Entertainment) and direct-to-consumer continues to thrive.

Debt is holding stable, although there is the dispute between Comcast (CMCSA) and the Mouse over the ultimate Hulu payment (the cable giant wants another $5 billion) so who knows if the company might slip a bit on the borrowing front. I want to see cash increase, and it should over time; the current drop is warranted to keep the balance sheet strong, but the company does want to pay more dividends and buy back more stock, so I hope those activities are done prudently (I myself might’ve held off on them for the time being and focused on debt, but I don’t control the company). $2.5 billion of stock was retired over the last nine months, $0.5 billion was allocated to the dividend yield.

You can find more discussion on the numbers and divisions elsewhere on SA, such as this article, as well as this one. And you should also check out bear takes.

What I like to do is imagine what the company can do now, how it can dig itself out of the quagmire it’s in, not only with the disruption to its linear platforms, but just simply with the stock’s price action. I personally see Disney stock as a great long-term holding for those who can wait and remain patient, but it is true that the recent long-term price action leaves a lot to be desired; yes, the SARS outbreak was a black-swan event, but it did nevertheless demonstrate that there are things out there that can turn a thesis based on the iconic nature of a blue chip into terrible returns for a stock currency. (Of course, maybe CEO Robert Iger should have held off on going all-in on streaming and looked to cut costs even before he left the company, very briefly, that last time.)

Let’s think about Disney and its options.

Disney And Theatrical – A New Marvel Strategy (Perhaps?)

Disney hit it big with the latest adventure featuring Ryan Reynolds, Deadpool & Wolverine. The film has passed $1 billion global box office (domestic has gone beyond $500 million).

This stands in grand contrast to previous Marvel outings. The Marvels, as an example, worried Disney greatly with its $200 million worldwide take back in the fall of 2023. Guardians 3 from summer 2023 did a very respectable $840 million worldwide, while the Ant-Man from 2023 unfortunately came in at under $500 million in all marketplaces. In both cases, respectable and unfortunate, it wasn’t a billion, and nowadays, Disney needs movies to do a billion worldwide to make it worth its corporate while.

Here’s the interesting thing: Bob Iger knows investment in movies needs a new strategy. He’s apparently proposing something interesting: bring back bankable talent.

Robert Downey Jr. has been summoned to the Burbank lot to take on a new role in the Marvel Universe…Doctor Doom. I don’t follow these movies, and I have no idea if he is essentially playing his original character again possessed by this evil villain, as this article seems to speculate. Disney is also bringing back the Russo Brothers for more Avengers projects.

The salient point is, Disney wants to bring back familiar faces, both behind and in-front of camera, and that might be a problem. Mainly because presumably it isn’t cheap to use Downey Jr. and the Russo siblings again. In a time period when Disney is cutting costs, star talent like this breaks the bank and increases risk, necessitating even larger box-office takes. The question, as always, is how much control one wants to yield to stars…after the most recent Hollywood strike, talent of all pay tiers is affecting how streaming units reign in costs and weigh that action against subscriber growth. In other words, less content on D+/Hulu means less need to pay out residuals.

Going forward, Disney will simply need to learn how to have the most effective minimal content footprint on its streamers such that churn is minimized and sign-up activity is maximized. And going back to theatrical, if movies are going to be the equivalent of financial vehicles for the Ryan Reynolds of the world, then maybe the best thing to do is what Iger seems ready to lean into – namely, cut movie output in favor of making bigger bets on bigger tentpoles with big stars. I tend to want larger movie slates at various budget levels, but maybe Disney can optimize this strategy and benefit from it if the hits keep coming. Right now, the company is doing well with Reynolds and Pixar, and it has a lot of tentpoles ready in the coming years – recent announcements include dates for Frozen 3, several Marvel pictures, and Pixar sequels (not to mention the always looming Avatar). The risk is that these expensive projects backfire and simply don’t perform. That’s the blockbuster movie business – you pay up and hope people don’t tire of the formula. Perhaps they won’t if the stars they like are surrounded by special effects that dazzle the senses and storytelling that is at least acceptable (apparently the quality of the story isn’t enough to propel the box-office returns anyway). Until Disney, and any major studio for that matter, can figure out a way to compensate stars without paying out huge fees and profit participation – maybe an automated AI-driven, day-trading hedge fund owned by Disney can someday pay stars’ salaries via extracting value from volatility – it looks like the conundrum of talent leverage is here to stay.

I think Disney will, generally, be successful with this strategy, mostly because, in a sense, it almost could be thought of as a loss leader. That’s a bit of hyperbole, so let me explain what I mean: the movie division essentially acts as an element of synergy that promotes the rest of the company – DTC, parks, ABC, etc. Content begets rides, merchandise, and Saturday night movies on television, in other words. Disney doesn’t run its entertainment division at a loss – as I noted above, income was well over a billion bucks for the quarter – but the theatrical component obviously varies in performance quarter-to-quarter, in a more volatile way than something like parks. This is Hollywood after all, and sometimes you have a hot slate of pictures, and sometimes you don’t. So while that division will be more volatile, think of it as an incubator of future IP assets and differentiated strategies that eventually add value to the Disney ecosystem as a whole. Yes, I would rather above-the-line costs to come down to rational levels, but shareholders will have to accept the reality that Reynolds and Downey Jr. and the Russos are going to get their paydays and profit participation as Disney panics about its movie returns…at least we’ll be along for the ride (I tell myself).

In fact, if Disney is going to go this route, perhaps it should look to going all-in for the time being and see what happens. Get Dwayne Johnson a superhero role in Marvel. Call Chris Pratt to become the next Indiana Jones. Pay Steven Spielberg whatever he wants to executive-produce a new version of The Black Hole. Just make the best deals possible and understand that premiums sometimes have to be paid (at least until that AI-backend system is up and running).

Disney’s stock has been stuck in technical hell, and Iger is going to look to shake things up to get it out of its rut. One of the ways he’ll do that is by reinvigorating the movie division. The pandemic has been a problem, but so-called superhero fatigue has also haunted the studio halls. Here’s what I think we can expect: a return to the familiar. I would have to assume there will be more Iron Man films, as an example. If Downey Jr. can play another role, so too could other famous Marvel stars – Paul Rudd might articulate someone other than Ant-Man, and he could even team up with Reynolds in a Deadpool film. This opens up so many recasting opportunities for fans, allowing them to get what they seemingly truly desire – sure, they always claim a need for great storytelling, and that has to be satisfying on some level, but in the end, it’s the excitement and glamor of familiar star Hollywood talent on the silver screen that makes them exchange a night of watching YouTube videos for a night out at the local multiplex. And I reiterate, the same goes for the directors and writers – bring all that proven talent back that fans trust and talk about on social media. As others have observed, Disney can do anything with Marvel because of the multiverse movie operating system – different actors can play Iron Man, and Doctor Strange could be no different than Doctor Who, and so on.

I foresee further growth in the Entertainment segment, especially as hit films go through the licensing process to third-party competitor platforms. Disney has indicated it wants to increase licensing, and it cited that aspect as being a driver during the quarter. In fact, in an answer to an analyst question, CFO Hugh Johnston commented on the success of the company’s movies and how there seems to be a halo effect. Let me copy the question and the answer, because there is a notable nuance here:

From Bryan Kraft, Deutsche Bank:

[…] the press release mentioned increased sales of TV content and content sales, licensing, and other as a driver of the OI performance this quarter, along with the box office of course. Is there anything to read into this? Is it the beginning of a trend toward increasing content licensing to third parties or is just a timing benefit or one-off?”

Disney CFO Johnston’s reply:

Yeah, the licensing numbers that you see are mostly a reality around the fact that we’ve had so much success at the box office. That’s really what’s driving things more than anything else. No change in our licensing strategy, which has been pretty clear. The things that we consider core IP to the company, we don’t license. There are things that are non-strategic. We’ll continue to license tactically. But it’s not a big strategy for us. The big strategy is producing our own IP and monetizing it.”

My interpretation here is that the excitement of the recent movie hits – not necessarily their current box-office takes, as they are recent phenomenon and will flow into company coffers over time, but the promotion leading up to their releases over the last several months – helped Disney sell its IP to third-party buyers (I’m referring to library IP as well as pre-sales of current theatricals to other platforms) at solid price points. Also, presumably the mention of the box-office success indicates that a project such as Inside Out 2 is driving advertising-ROI at D+ via its runs of the first movie in that series (as well as other Pixar productions that benefit from the aforementioned halo). I do disagree with Johnston that the company should continue to invest in exclusive core IP…that content should be licensed out as well on an opportunistic/strategic basis to bring in more money, increase cash flow, and help out with debt payments.

The Stock

Disney’s stock is no stranger to long periods of base-forming as the company undergoes yet another reinvention in this shifting, disrupting media world.

From a technical perspective, it’s easy to see from the chart – which isn’t a good one – that the company may have to dip below $80 before it can truly make a run-up. The 52-week low is $78…will it make a downward dash for that at some point?

Entirely possible. For some, maybe even preferrable. (There will be a lot of technical resistance points on the way back up, though.) The company continues to rate highly on profitability, save for gross margin, but valuation continues to set a low bar.

I must note yet again in this article, as in past ones, that valuation relative to sector is the issue; Disney’s measure against its own shares’ metrics on a five-year basis tells a different story, one where the stock could be considered more reasonable. As an example, the PEG 5-year had a 3-handle versus the current 1-handle. Unfortunately, the PEG is 1.25 at time of writing, and obviously anything closer to 1.0 or less would be more attractive.

But Disney can, and will, trade at a premium; it has the brand equity and the assets to justify it, at least in many market conditions.

Risks

The risks have not changed…parks could slow down precipitously (there has been, in fact, some stock reaction on that possibility), and the whole direct-to-consumer march to sustained profitability could be halted because of increased churn or price sensitivity to increases, etc.

But the major risk to the thesis I present here on the movie-studio side is that Disney sees a return to weakness in its Marvel/Pixar-branded films. Deadpool and Inside Out 2 may be killing it right now, but future Marvel/Pixar pictures may not. This is why I want to see lower budgets and compensation for talent, but Disney intends on making that premium investment…thus the increased risk.

The stock itself is technically in rough shape. As I alluded to before, it is going to face a lot of resistance from selling pressures as it eventually climbs out of its rut in future quarters…meaning that those who own at higher price points will be selling out to break even. That’s what the chart is saying from Technical Trading 101. We shall see.

Competition is also omnipresent, especially from leader Netflix (NFLX) in the streaming space. Not only does the company present competition for subscribers and advertising inventory, but the stock itself may be considered more attractive at times, attracting investor-capital away from the Mouse…interestingly though, the SA Quant rating on the stock at the time of writing was roughly the same as Disney.

I’m a buyer as the stock trades at these lower levels. I own the stock for the long-term, but do have a shorter-term position as well (which is currently underwater). My bias currently is to add to the longer-term position on dips, and to really double-down if the stock heads below $80 (we’ll see what the Fed does and how the market reacts to that and economic data…that will tell us how soon it gets there, if it ever does). Shorter-term players may want to look elsewhere for better strength.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of CMCSA, DIS, NFLX either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I swing-trade some of these names in a short-term account in addition to owning them as long-term positions.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.