Summary:

- Disney is the world’s leading entertainment business with a massive portfolio of iconic original IP content.

- The company has a diverse set of revenue streams and a strong economic moat, providing stability and potential for future profitability.

- Disney’s DTC business is making solid strides towards profitability with Q1 2024 expected as a turning point for the firm.

- Shares are potentially undervalued by 43%, making it an attractive investment opportunity.

- Strong buy rating issued.

Bastiaan Slabbers

Investment Thesis

Disney (NYSE:DIS) is the world’s leading entertainment business. Their massive portfolio of iconic original IP content underpins the entire enterprise with the firm having become a master of extracting revenue from their franchises.

The diverse set of revenue streams held by the company both in their media business and through their parks, experiences and products divisions helps bolster their economic moat further and provide stability when it comes to fiscal results.

While the last few years have been difficult for Disney, Bob Iger is turning this steamboat around with significant future profitability potentially on the horizon.

Considering that a potential 43% undervaluation exists in shares, this may be one of the best times in history to build a stake in this industry leading business.

Strong Buy rating issued as I believe Disney is the go-to deep value play of late 2023.

Company Background

Disney FY22 10K

The Walt Disney Company (Disney) is an American entertainment company which has become the world’s leading source of media content for a huge variety of audiences.

In the 100 years since the firm’s founding in 2023, Disney has grown their portfolio of IP’s and content to a truly massive scale with the firm having a huge variety of original movies, TV shows, music and content available for consumers to enjoy.

The firm has acquired many smaller studios and media firms to become a juggernaut in the entertainment industry with their empire stretching from global news outlets to Star Wars with the firm even boasting a raft of world class theme parks, resorts and cruises too.

Disney’s diversification strategy combined with their truly remarkable set of intangible assets has made the company – in one form of another – an essential element of the daily lives of most families and individuals today.

The return of Bob Iger to the helm in late 2022 marks another milestone event in the rather messy leadership succession story currently being told at Disney. I believe that while Bob Iger is the man for the job when it comes to resurrecting Disney as a company, a more holistically qualified successor will still have to be appointed in the next 2-4 years.

Economic Moat – In Depth Analysis

Disney has what can only be described as mega-moat status. Their massive and robust economic moat is built upon a raft of highly valuable intangible assets, a diverse set of differentiated media channels and a lucrative parks & resorts business.

The firm operates six distinct production studios: Disney Animation, Disney Live Action, 20th Century, Marvel, Pixar and Lucasfilm. These studios provide Disney with a diversified set of production assets which allow the firm to produce content on a massive scale.

Furthermore, the huge variety present between these production studios allows Disney to produce content which holistically targets essentially every single segment of media consumers.

Disney Animation, Live Action and Pixar generally produce family-friendly original IP content aimed at families. Iconic franchises such as Mickey Mouse, 2016‘s The Jungle Book and the entire “Cars” franchise are just a couple examples of some of the hugely popular and critically acclaimed movies and franchises that these studios have produced.

These three distinctly different movies all harbor one key trait: they truly cater to the entire family. I believe the ability for Disney to create stories, characters and universes that entertain both children and adults simultaneously makes their content incredibly ‘sticky’ in the consciousnesses of their consumers.

This raft of family entertainment is now complemented by a huge set of franchises and content aimed more specifically at the teen and adult demographics of consumers.

Starwars.com | Homepage

The acquisition of Lucasfilm from George Lucas back in 2012 allowed Disney to exploit the massively popular Star Wars franchise which the firm has now grown to be worth a whopping $70B as a brand alone.

A similar strategy has been pursued by Disney with regards to their acquisition of Marvel back in 2009. Since Disney’s acquisition of the studio, the firm has essentially grown the entire superhero genre from a media form primarily enjoyed by a more niche audience to the category now harboring some of the largest grossing films of all time.

The firm’s 2017 acquisition of a majority of 21st Century Fox’s assets (not including Fox News) has expanded the firm’s studio capabilities even further with Disney now enjoying massive access to a host of legacy content and a highly capable set of staff and assets.

Disney’s ability to breathe life into stagnating or underdeveloped media franchises illustrates the company’s overall aptness at telling great stories.

While the firm has undoubtedly produced some flops and unsuccessful content over the last 100 years, Disney’s overall success as a business has come from their mostly consistent ability to create hugely popular and high-quality content.

Of course, Disney is not simply a film production business with the firm operating a huge number of other media businesses too. The firm owns many traditional cable TV networks such as ESPN and FX which are still hugely valuable revenue streams for the firm.

ESPN in particular is the leading source of live sports in the U.S. with the firm’s rights to the NFL, NBA and NHL making the media outlet irreplaceable within the sports coverage segment.

While ESPN continues to be a primarily cable TV oriented business which is facing significant cord-cutting across the U.S, Disney is rapidly transforming the business by expanding their direct-to-consumer offerings of sports streaming through ESPN+.

Disney also owns huge TV companies such as ABC News, Sky UK and Ireland along with National Geographic. These highly lucrative and popular networks allow Disney to reach an even wider set of audiences across the world and expand the availability of their IP even further.

Disneyplus.com

Disney+ is the firm’s primary answer to declining cable-TV subscriptions and presents what will form the foundations of the media giant’s distribution strategy for at least the next 25 years.

While the DTC industry is highly competitive and has yet to become particularly profitable for any of the major players within the space, I believe that Disney is perfectly positioned to become the clear market leader once again.

When it comes to consumers choosing which DTC subscriptions to buy, be it Netflix, Amazon Prime or Disney+, I believe that the huge variety of content available of Disney+ makes it the most attractive choice for potential customers.

While many competing offerings such as Netflix have great original shows and highly popular franchises too, Disney’s offering of movies, TV shows and content is simply massive.

I believe that success within the DTC segment ultimately hinges on content. When it comes to content and the ability to consistently produce more, high-quality and popular media, Disney is the undeniable king.

Finally, Disney’s ability to extract revenue from their media businesses is truly unrivalled within the industry. Primarily, the firm operates a host of highly successful theme parks and resorts under the Disneyland, Walt Disney World and Disney Resort banners.

Disney Cruise Line Homepage

Disney also operates Disney Cruise Line which is a cruise company offering themed cruises and holidays to consumers across the U.S and Europe.

These physical experiences combined with a massive number of toys, collectibles, memorabilia and licensed products allows Disney to extract even more revenue from their highly popular franchises and media content.

By enabling consumers to enjoy their favorite characters and series through real life theme park rides, holidays and products Disney is able to further increase the stickiness and market penetration of their IP.

I believe this magic formula of creating great quality content combined with the essentially unlimited ability for consumers to continue enjoying the movies and TV shows in the real world allows Disney to occupy an unrivalled presence within the minds of people across the globe.

It is exactly this constant and admirable presence within the minds of consumers that drives Disney to true mega-moat status. Their massive economic moat simply cannot be replicated by competitors in any reasonable timeframe.

Therefore, I believe Disney will continue to enjoy a lasting and tangible competitive advantage for at least the next 30 years.

Financial Situation

From a fiscal performance perspective, Disney has historically been a massively profitable organization and continues to be an absolute cash-flow machine.

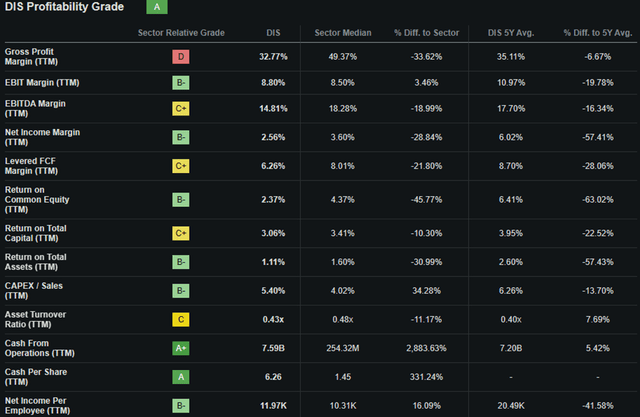

The firm’s 5Y average gross, operating and net margins of 35.91%, 11.06% and 6.36% are still healthy and illustrate that at present, Disney remains a profitable enterprise even when considering the effect COVID-19 had on earnings even moving into 2022.

While these margins do represent around 25% decreases from the firm’s 5Y averages as measured in 2018, I believe that fundamental profitability has not been compromised at the media giant.

Disney’s 5Y average ROA, ROE and ROIC are a little muted at 3.16%, 6.91% and 5.25%. Once again, these ROA, ROE an ROIC’s are significantly down when compared to 5Y averages as measured from 2018 where returns of around 11%, 20% and 16% were present respectively.

While this decrease in operational performance is regrettable, I believe the firm has faced multiple headwinds over the last five years which have all had a tangible role in compromising Disney’s fiscal results.

The COVID-19 pandemic reduced the profitability of Disney’s lucrative Parks, Experiences and Products division for FY20 and FY21 while a bloated staff count has resulted in overall operational inefficiency.

When combined with uncompromising macroeconomic conditions compounding the cord-cutting happening in the U.S and Disney’s ensuing capital intensive shift to DTC distribution through Disney+, it is safe to say the firm has had a difficult business environment to navigate over the last five years.

Disney’s FY23 results have been a mixed bag with regards to profitability, growth and the viability of their DTC business model.

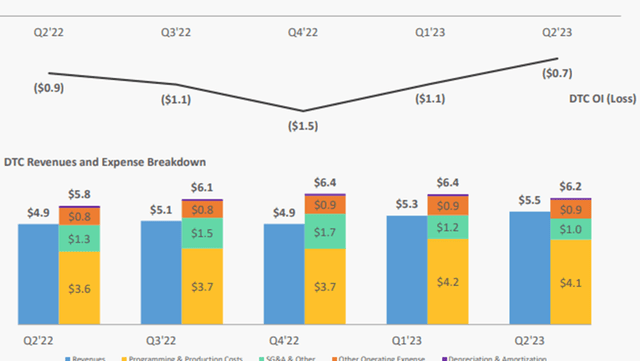

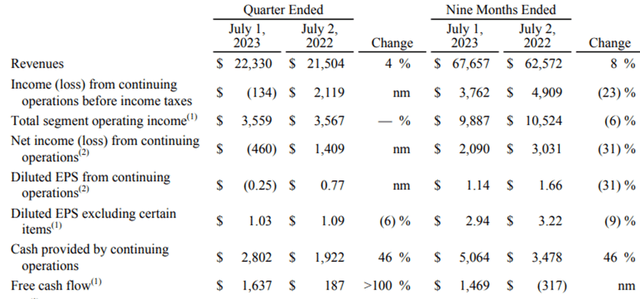

Disney FY23 Q2 Earnings Report

H1 of FY23 saw revenues grow 8% YoY while operating income fell 6%. FCF increased a whopping $1.8B YoY thanks to continuously strengthening revenues from Disney’s Parks, Experiences and Products division which benefitted from growing travel and demand for holidays after the final COVID-19 restrictions especially in Asian countries have been eased.

Disney‘s entertainment and media business segment saw modest revenue growth of around 1% YoY for H1 of FY23 with the firm’s DTC businesses growth of 12% offsetting the around -6% contraction seen in linear network revenues.

The lack of growth in operating income in H1 FY23 was primarily due to the firm’s linear networks operating income falling 27% while the losses produced by DTC decreased only 12%.

These weaknesses in the media business were only partially offset by strong performance in the parks, experiences and products division where Q2 operating income increased 11%.

Disney FY23 Q2 Earnings Report

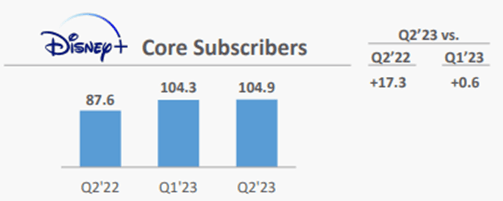

H1 FY23 was also characterized by muted Disney+ growth with Q1 vs Q2 QoQ growth slowing to just 0.6%. However, through significant restructuring efforts within the Disney+ operation, revenue growth and cost efficiencies realization Disney was able to reduce the loss produced by DTC to just $700M.

I believe this consistent march towards DTC profitability illustrates that Disney is winning the DTC race and has the potential to extract significant future profits from the segment.

While H1 of FY23 did see Disney’s revenues grow tangibly with particularly strong fiscal performance being witnessed in their parks, experiences and products segment, increasing COGS due to the inflationary environment combined with continued losses in operating income from the lucrative linear networks media division resulted in an overall decrease in profitability and margins.

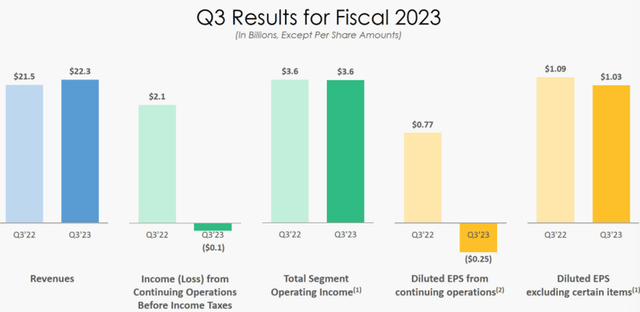

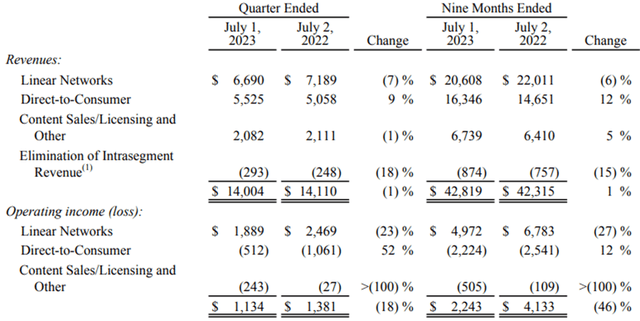

The firm’s most recent Q3 earnings release reported mostly flatline YoY results for Disney.

Modest revenue growth of 4% was primarily achieved by continued outperformance of their parks, experiences and products business which saw revenues grow 13% to $8.33B.

Disney’s media and entertainment business saw revenues decrease 1% YoY to $14.04B due to another 7% drop in linear network revenues. DTC revenues grew 9% in the quarter to $5.53B.

Disney FY23 Q3 Earnings Report

The DTC business continues to steadily march towards profitability with operating losses decreasing 52% YoY to just $512M. I believe that with further scale improvements and a more aggressive clampdown on password sharing, Disney will undoubtedly reach profitability within the business segment.

While many have focused on the fact that Disney+ saw subscriber numbers drop in domestic markets (U.S. and Canada) from 46.3M subscribers to 46.0, the total number of subscribers across markets increased from 104.9M in April 2023 to over 105.6M in July 2023.

This illustrates that Disney continues to excel in marketing their products across the globe and illustrates the potential Disney has with their DTC model. ESPN+ saw flatline subscriber growth but higher operating income thanks to growth in subscription revenues due to retail pricing increases.

hotstar.com | Homepage

Disney’s Indian DTC offering of Disney+ Hotstar saw a 24% drop in subscribers most likely due to a pricing increase for the products premium offerings. Overall revenue per subscriber remained constant.

I believe that this business segment will take some time for Disney to perfect as they figure out the best strategy to extract revenues from more financially pressured individuals.

The quantitative analysis of Disney’s FY23 reveals a mixed set of operating metrics. While some factors suggest that while the company is beginning to return to their historic levels of profitability and operational excellence, the continuing loss of linear networks revenue combined with what seems like slowing Disney+ growth creates some uncertainty regarding their turnaround timeframe.

Qualitatively, Disney has achieved many successes in FY23.

Q2 saw Disney’s Guardians of the Galaxy Vol.3 top the box office in its opening week while The Mandalorian Season 3 has resonated well with fans.

In Q3 Disney significantly improved their DTC operating income and illustrated the rapid rate at which the firm is transforming the business into a profitable and lucrative enterprise. Disney also saw strong viewership growth for the NBA playoffs on ESPN while blockbuster Avatar: The Way of Water become the third highest-grossing film of all time.

I believe that these qualitative successes, combined with a loaded release schedule for upcoming theatrical, legacy and parks products should help Disney have a solid Q4 even amidst the difficult macroeconomic conditions currently plaguing markets.

Seeking Alpha | DIS | Profitability

Seeking Alpha’s Quant calculates an “A” profitability rating for Disney. I believe this to be a mostly accurate overview of the profit generating prowess currently possessed by Disney.

From a balance sheet perspective, Disney is in great shape thanks to solid capital allocation strategies bearing fruit for the company.

While the Fox acquisition generated significant levels of long-term debt for the firm, I believe Disney faces no tangible illiquidity threat thanks to their massive cash flows and diversified set of revenue streams.

The firm currently has $30.2B in total current assets while total current liabilities amount to $28.23B. This solid short-term liquidity leaves the firm with an excellent current ratio of 1.07 and a quick ratio of 0.98.

Total assets for the firm amount to $203.8B with total liabilities just $92.8B. This leaves the firm with an excellent debt/equity ratio of 0.46.

Disney has $44.54B in long-term debentures which is a sizable amount of debt. However, the firms massive FCF should allow the firm to finance these debentures without issue while the firm continues to produce massive amounts of content.

The $60B planned to be spent by Disney over the next decade on expansion of their theme parks and cruise business should allow the firm to materially increase revenues and visitor numbers in these attractions.

I believe that while this investment is substantial, the proposed expansion of popular franchises such as Star Wars, Guardians of the Galaxy, Avatar and Frozen should attract significant numbers of customers to these attractions.

Disney has received an affirmed A2 credit rating from Moody’s for their senior unsecured notes and an affirmed Prime-1 commercial paper rating. The outlook remains stable. A2 is classified by Moody’s as “upper-medium grade and are subject to low credit risk”. Prime-1 ratings are the highest quality of short-term debt ratings.

Considering Disney as a whole I believe that the firm is successfully executing a strategic turnaround that should see the company return to massive profitability in the future. The mixed bag that has been FY23 results illustrates the magnitude of the macroeconomic headwinds that have plagued Disney.

Given Disney’s mega economic moat and historic ability to extract profits from even the most difficult of franchises or businesses, I believe without a doubt that Disney will be able to earn outsized returns on their ROIC in the future.

Valuation

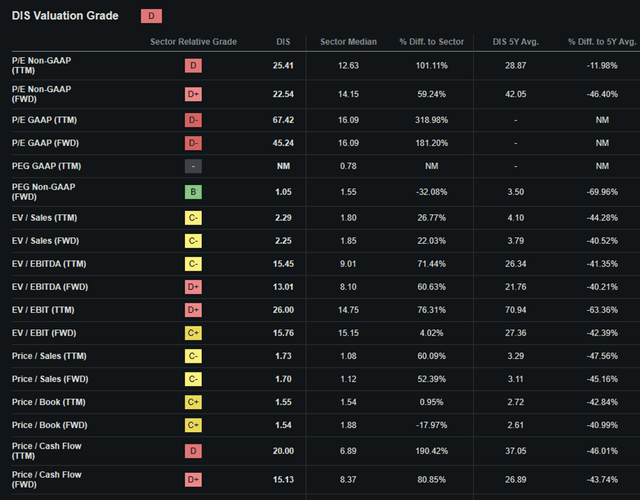

Seeking Alpha | DIS | Valuation

Seeking Alpha’s Quant assigns DIS with a “D” Valuation grade. I believe this is an excessively pessimistic representation of the intrinsic and future value present within Disney shares and illustrates perfectly how fiscal ratings may be misleading when considered alone.

The firm currently trades at a P/E non-GAAP FWD ratio of 22.54x. Disney’s P/CF FWD of just 15.13x is relatively reasonable in my opinion. Their FWD EV/EBITDA of just 13.25x is acceptable especially when considering the firm’s EV/Sales FWD of just 2.29.

Considering only these basic valuation metrics alone I believe deducing any clear valuation for Disney to be essentially impossible.

While the quant grade relies on sector medians for its valuation, I believe Disney is difficult to compare to other enterprises given the truly unique nature of the firm’s revenue streams and business structure.

Seeking Alpha | DIS | Summary Chart

From an absolute perspective, DIS shares are trading at a significant discount relative to previous valuations. The stock has produced negative returns for investors for five years to the tune of 28.51% which is quite poor indeed.

Significant negative market sentiment following Disney’s lack lustered FY21 and FY22 results caused a massive degradation in share prices. At current valuations of around $82 dollars per share, one can buy Disney for the same price as it last traded for in 2014.

While the relative valuation provided by simple metrics and ratios along with the absolute comparison provide conflicting guidance regarding the value present in Disney shares, a more quantitative approach could yield for a clearer understanding.

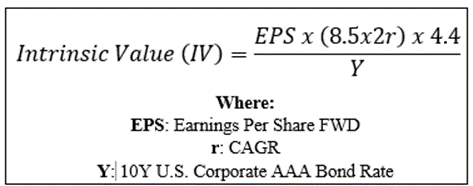

The Value Corner

By utilizing The Value Corner’s specially formulated Intrinsic Valuation Calculation, we can better understand what value exists in the company from a more objective perspective.

Using Disney’s current share price of $82.94, an estimated 2024 EPS of $4.92, a realistic “r” value of 0.13 (13%) and the current Moody’s Seasoned AAA Corporate Bond Yield ratio of 5.13x, I derive a base-case IV of $145.60. This represents a massive 43% undervaluation in the firm.

Even when using a more pessimistic CAGR value for r of 0.10 (10%) to reflect a scenario where Disney sees little improvement to their Parks, Experiences and Products segment along with mediocre media results, shares are still valued at around 120.30 representing a 31% undervaluation.

Considering the valuation metrics, absolute valuation and intrinsic value calculation, I believe Disney is clearly trading in what can only be considered deep value territory.

In the short term (3-12 months), I find it difficult to say exactly what may happen to valuations. While market sentiment seems to slowly but surely be turning positive for the media giant, any negative macroeconomic developments or a recession in U.S. markets could lead to valuations falling even further.

Tax harvesting could also lead to an even greater selloff in shares as many investors seek to maximize the tax efficiency of their portfolios as the year winds to an end.

In the long-term (2-10 years), I see a bright and magical future for Disney. If any firm has a proven ability to extract profits from their business operations, its the Walt Disney Company. While the DTC business will require more refinement and operational improvements to become profitable for the firm, I believe that the progress already made by the firm illustrates that with some time, these improvements will happen.

Risks Facing Disney

Disney faces some tangible risks stemming primarily from the uncertainty surrounding their transition to a DTC model along with the potential of failed media execution.

The colossal transition to DTC has placed Disney’s profitability under significant pressure as the company seeks to transform this difficult and competitive business into a highly lucrative enterprise for the firm.

While Disney has made great progress towards achieving this throughout FY23, any missteps or outsized achievements by its competitors such as Apple TV, Prime or Netflix could place Disney+ under significant pressure.

While Disney’s DTC business doesn’t solely rely on Disney+ with Hulu and ESPN complementing their core offering, Disney must ensure that the distribution of content on these platforms is industry leading to ensure that significant profitability within the business is achieved.

A failed execution of any major movies, shows or attractions could also harm Disney’s future profitability. While the media powerhouse has had many successes over the last years, some notable missteps have illustrated that even Disney is not immune to failed execution.

While consistently poor execution would be unprecedented for Disney and would require what is essentially a complete lack of imagination at the firm, such a scenario would be catastrophic for the firm.

The SAG-AFTRA strikes also add to the risk of failed execution leading to a gap in the content pipeline for Disney. The effects of a lack of new IP being released could ultimately reduce visitor numbers at the parks and even lead to an overall slowdown in the quest for profitability of Disney+.

From an ESG perspective, Disney also faces some risks.

Socially the firm has continued to come under significant pressure regarding labor relations with staff. Allegations of racism, gender discrimination and sexual assault have tarnished the firm’s reputation as an employer over recent year. When combined with what some deem is insufficient pay, Disney faces a real risk of a lack of talent present in their business.

While these issues are more material for the parks, experiences and products division rather than the media business, the ESG concern remains just as relevant.

For governance factors Disney is of course still facing the standoff with Florida Governor Ron DeSantis regarding the Reidy Creek Improvement District (RCID). While this case is on-going, the headache and potential reputational damage this set of lawsuits driven by political motivations has done to the Disney brand could be substantial.

From an environmental perspective, many critics argue that the Disney cruise business is unsustainable and contributes to the destruction of delicate marine ecosystems.

Considering these factors, I believe that while Disney is trying to make tangible moves to decrease the negative ESG impact their business has, the volume of tangible ESG risks currently facing the firm would make it unsuitable for an ESG conscious investor.

Of course, opinions may vary and I implore you to conduct your own ESG suitability research should this be of concern to you.

Summary

Disney is a colossal media giant whose economic moat is unrivalled. The massive breadth and diversity in the firm’s revenue streams allows the company to display economic resilience even amidst macroeconomic turmoil.

The firm’s fundamental business is driven by the massive vault of IP and content the firm creates which over the last 100 years has become engrained in the very identity of millions of customers across the globe.

While the last four years have been more challenging for the firm, I believe that the core profitability and underlying business case present at the firm remains unharmed.

Disney’s rapid progress in making their DTC business profitable is encouraging and suggests that the entertainment juggernaut may indeed be capable of returning to pre-2020 levels of profitability soon.

Complementing their fiscal abilities and huge economic moat is a potentially massive 43% undervaluation in shares. Such an undervaluation would place shares firmly into deep value territory and make the stock a lucrative pick for the value-oriented investor.

Therefore, I assign Disney a Strong Buy rating and believe the firm is the go-to deep value play of H2 2023.

Editor’s Note: This article was submitted as part of Seeking Alpha’s Best Value Idea investment competition, which runs through October 25. With cash prizes, this competition — open to all contributors — is one you don’t want to miss. If you are interested in becoming a contributor and taking part in the competition, click here to find out more and submit your article today!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of DIS either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I do not provide or publish investment advice on Seeking Alpha. My articles are opinion pieces only and are not soliciting any content or security. Opinions expressed in my articles are purely my own. Please conduct your own research and analysis before purchasing a security or making investment decisions.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.