Summary:

- Disney’s Q3 revenue of $22.33 billion fell short of analysts’ expectations by $200 million.

- The company reported a loss per share of $0.25, but adjusted profits exceeded analysts’ expectations.

- Despite these weaknesses, the firm delivered where it mattered the most, and its future really does look magical.

smckenzie

August 9th was undeniably an interesting day for shareholders and market watchers of entertainment conglomerate The Walt Disney Company (NYSE:DIS). After the market closed, shares of the company moved up around 2% in response to financial results covering the third quarter of the company’s 2023 fiscal year. Even though the company missed forecasts when it came to revenue and profits per share, it exceeded forecasts with adjusted profits. There was some weakening that was greater than what analysts anticipated. But the company delivered where it needed to most and it revealed that its cost-cutting initiatives are well underway. Although the quarter was not as great as I would have liked, it had just enough magic to keep the company rated a ‘strong buy’ in my book.

Starting with headline news

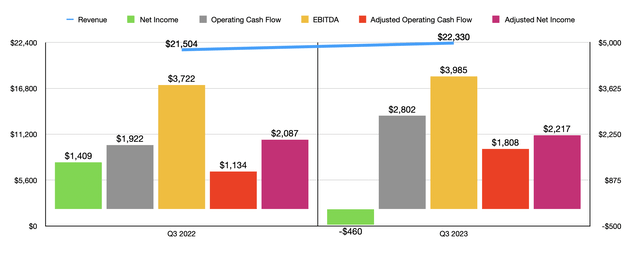

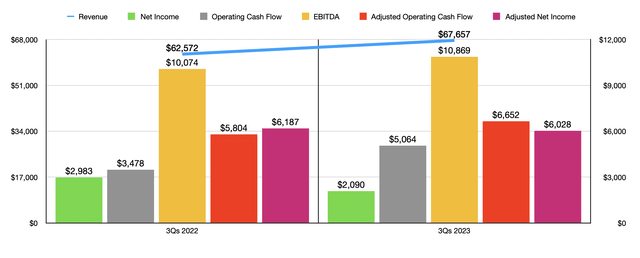

Before we get into the really fun stuff, let us dispense with the headline news. This relates to the basic financial results that everybody gravitates toward when a company initially reports. At the very top, we have revenue. Sales for the business came in at $22.33 billion. That represents an increase of 3.8% over the $21.50 billion the company reported one year earlier. Although it is nice to see a year-over-year increase in sales, it is worth mentioning that revenue fell short of analysts’ expectations by $200 million.

On the bottom line, we saw something similar. The business actually generated a loss per share of $0.25. This compares to a $0.77 per share profit achieved the same time of the 2022 fiscal year. Analysts were actually expecting a profit of only $0.05 per share, with impairment charges and restructuring charges doing the heavy lifting in terms of bringing profitability down. During the quarter, management reported $2.65 billion worth of restructuring and impairment costs. If we adjust for certain items like this, profits would have been $1.03 per share. That is down from the $1.09 per share reported in the third quarter of 2022. However, it is actually $0.06 per share above what analysts thought it would be.

The loss per share that the company reported translated to an overall net loss of $460 million. That’s down from the $1.41 billion reported in the third quarter of 2022. Adjusted profits, meanwhile, came in at $2.22 billion. That’s actually up from the $2.09 billion the company reported the same time last year. There were some other profitability metrics that were incredibly important as well. For instance, operating cash flow shot up from $1.92 billion to $2.80 billion. If we adjust for changes in working capital, it still managed to rise, climbing from $1.13 billion to $1.81 billion. And finally, EBITDA grew from $3.72 billion to $3.99 billion. For context, you can also see, in the chart above, financial results for the first nine months of the 2023 fiscal year compared to the same time last year. Even though net profits and adjusted profits are down year over year, the cash flow data provided by management is definitely looking up, as is revenue.

Diving into the stream

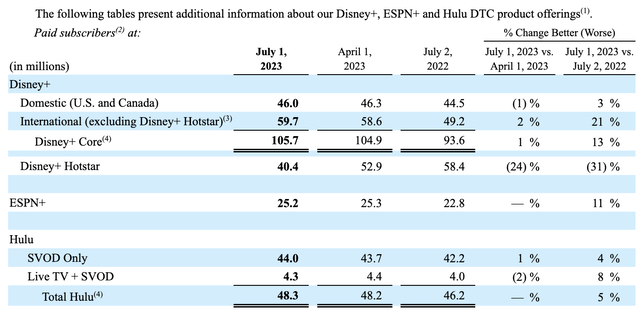

Outside of the headline news items, the part of the company that is worked at the most has got to be its streaming business. In less than four years, Disney became one of the largest streaming companies on the planet. The early days saw rapid growth. However, that picture has changed to some degree. Those who are bearish about the company would point out that the number of subscribers to the company’s hallmark Disney+ subscription dropped again. The total number came out to 146.1 million. That is actually down from the 157.8 million that the company reported only one quarter earlier. It’s even down from the same time last year when the business boasted 152 million subscribers.

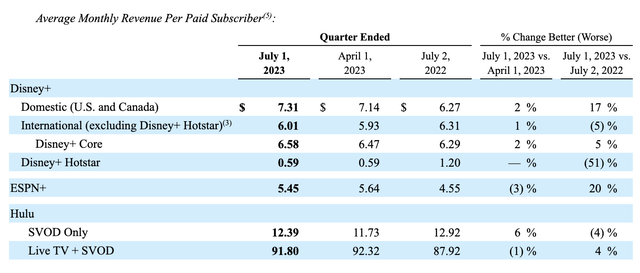

At first glance, this looks awfully scary. It certainly isn’t good to see its subscriber base shrink. But when you dig into the numbers, the company grew where it was most important. What the company calls its core audience actually jumped from 104.9 million subscribers in the second quarter of the year to 105.7 million in the third quarter. The entirety of the decline, then, came from its Disney+ Hotstar offering in India. Subscribers there dropped 24% in the course of a single quarter. However, these are incredibly low-value subscribers, accounting for only $0.59 per month in average revenue. By comparison, core subscriber revenue went from $6.47 per month in the second quarter to $6.58 per month in the third. In the third quarter of last year, it came in at $6.29. To put this all in perspective, the massive decline in its non-core subscriber base cost the company only $88.5 million in revenue per year. That’s for a drop of 12.5 million. By comparison, the 0.8 million increase in subscribers almost offset this by bringing in an extra $63.2 million in revenue per year. It is worth noting that in an attempt to boost financial performance, the company announced not only price increases, but also stated that they were launching the ad-supported tier for Disney+ and Hulu as a bundled subscription for select markets in Europe, as well as in Canada. That will be in November.

There are, of course, other streaming services that the company has. ESPN+ saw a modest decline from 25.3 million subscribers to 25.2 million. Pricing came in a bit weaker, dipping from $5.64 to $5.45. But for the most part, you can say that these numbers were relatively stable. In the investor call that management hosted, they stated that they are exploring the possibility of a strategic partner or partners when it comes to ESPN as a whole. In fact, they even went so far as to acknowledge that they are in discussions with prospective partners. They stated that their goal it’s not necessarily to get capital from this kind of arrangement. Rather, they hope for a partner or partners that can help transition ESPN more toward a direct-to-consumer model.

And finally, we have Hulu. Its subscriber base increased modestly from 48.2 million to 48.3 million. The average revenue per customer went from $19.06 per month to $19.46 per month. This is refreshing to see since it will result in additional revenue for the company. Management did say that they are prepared to acquire the rest of the streaming platform that they do not currently own when that becomes an option early next year. To some investors, this might be discouraging since paying down debt should be viewed as a priority to some extent. But because of the nature of its relationship regarding Hulu, they don’t necessarily have a say in the matter.

Other odds and ends

Speaking of debt, one thing that I found myself impressed about was the fact that management did succeed in reducing debt during the quarter. At the end of the second quarter of this year, Disney had $38.12 billion in net debt on its books. That number dropped to $35.73 billion by the end of the third quarter. That’s a decline of $2.39 billion. Obviously, this was only made possible by the strong cash flows that management achieved. And on that front, we have the cost-cutting initiatives pushed by CEO Bob Iger to thank. In the investor call covering financial results for the quarter, it was stated that the company is on track to exceed the $5.5 billion in cost cuts that were announced now some time ago. That is obviously showing up in the form of cash flows and debt reduction.

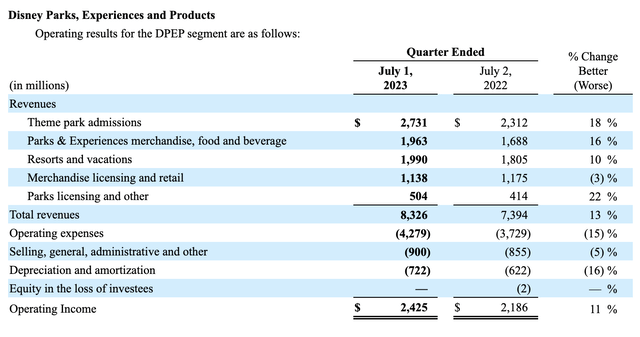

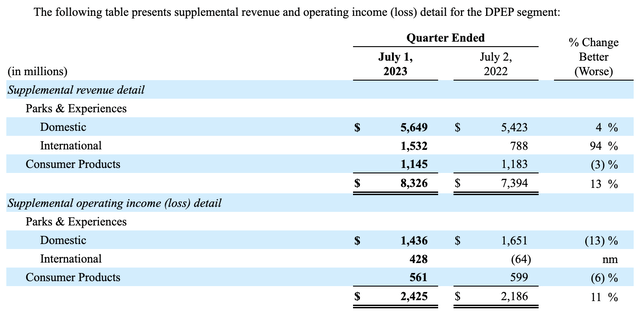

When it comes to specific operating units of the company, there were some other positive results that investors should applaud. The Disney Parks, Experiences and Products segment of the firm, which includes the theme parks that the company operates, the resorts and vacations that it offers access to, certain merchandise licensing and retailing activities, and more, reported revenue of $8.33 billion for the quarter. That’s up 13% from the $7.39 billion reported one year earlier. Operating income also improved, shooting up around 11% from $2.19 billion to $2.43 billion.

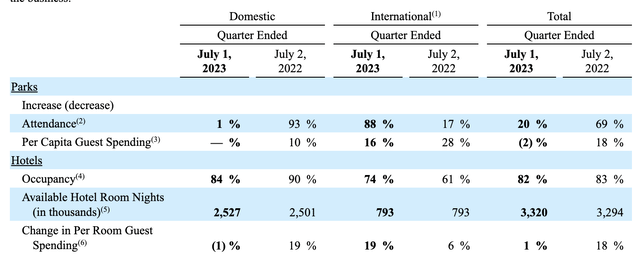

In the domestic market, park attendance increased 1% year over year. Per capita guest spending, meanwhile, remained flat. Perhaps the only negative is that hotel occupancy rates fell from 90% in the third quarter of 2022 to 84% the same time this year. Even though occupancy fell year over year, overall domestic revenue for the Parks & Experiences portion of the company jumped around 4% from $5.42 billion to $5.65 billion. In international markets, results were even more impressive. Attendance spiked 88% year over year, an amazingly high number, but an understandable one when you consider that 2022 saw only the beginning of the reopening of some economies because of the COVID-19 pandemic. Per capita guest spending shot up 16% while occupancy rates expanded from 61% to 74%. This allowed revenue under the international category to jump from $788 million to $1.53 billion. Meanwhile, international operations went from generating an operating loss of $64 million to generating an operating profit of $428 million. The picture would have been better, but the domestic market reported a decline in profits from $1.65 billion to $1.44 billion. But that seems to have been largely the result of higher operating labor that was caused by inflationary pressures and higher volumes at the company’s parks.

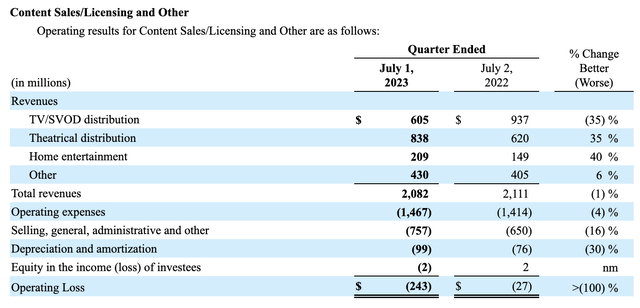

Lastly, I would like to touch on the theatrical distribution side of the company. This has been kind of the last part of the business to show a recovery following the COVID-19 pandemic. As I have written about before, the movie theater business is not yet fully recovered in its entirety. But it is moving in that direction. Overall revenue associated with its theatrical distribution operations came in at $838 million for the quarter. That was up 35% over the $620 million reported one year earlier. We do know that the operating loss for the Content Sales/Licensing and Other segment of the company that this falls under expanded from $27 million to $243 million. But that was largely the result of higher selling, general, administrative, and other costs. That increase, about $107 million in all, was driven by higher marketing costs because of more titles that were released compared to the number that were released one year earlier.

Takeaway

From what I can tell, Disney had a very solid quarter. Sure, revenue fell short of expectations, as did GAAP earnings. But you can clearly see the impact of cost-cutting initiatives in the form of robust cash flows and debt reduction. Disney+ continued to see a decrease in the number of subscribers on both a sequential and year-over-year basis. But the company is growing consistently in its core, high-value markets. It’s only in the low-value market that the business is really suffering. If I had to rate this particular quarter in terms of what the company delivered on compared to what mattered most, I would call it a solid eight out of 10. Things could have been better in some ways, but this has in no way changed my overall thinking about the quality of the company. And it is because of that that I continue to keep it rated a ‘strong buy’ at this time.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of DIS either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Crude Value Insights offers you an investing service and community focused on oil and natural gas. We focus on cash flow and the companies that generate it, leading to value and growth prospects with real potential.

Subscribers get to use a 50+ stock model account, in-depth cash flow analyses of E&P firms, and live chat discussion of the sector.

Sign up today for your two-week free trial and get a new lease on oil & gas!