Summary:

- Bob Iger and his team demonstrate a solid commitment to profitability improvement via effective cost management.

- Profitability metrics are improving, and I expect free cash flow to follow as well. That said, the company’s recent weak financial position is poised to improve in the near term.

- My valuation analysis suggests DIS stock is massively undervalued.

EnchantedFairy

Investment thesis

My first investment thesis, which I shared a quarter ago, about the Disney (NYSE:DIS) stock was bullish and today I would like to reiterate my “Strong Buy” rating. The company is facing severe headwinds at the moment and the financial position looks weak after the adverse effect of the pandemic-related restrictions. But I see many positive trends in the company’s financial performance under the management of Bob Iger, and the valuation looks very attractive. I expect further profitability expansion and that free cash flow will be allocated properly to improve the financial position.

Recent developments

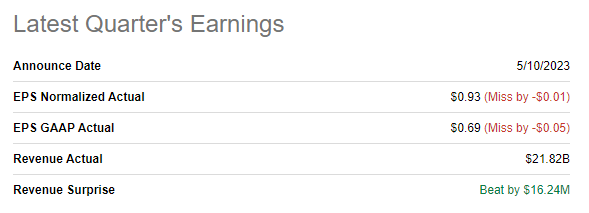

Disney reported its latest quarterly earnings on May 10, slightly missing consensus estimates regarding EPS. On the other hand, revenue was higher than analysts’ expectations. Revenue YoY growth was solid at double digits. The business continued to recover from COVID-related lockdowns. Revenue from the Parks, Experiences, and Products segment increased by 17%. The Media and Entertainment Distribution revenue stream delivered a 3% YoY growth.

Seeking Alpha

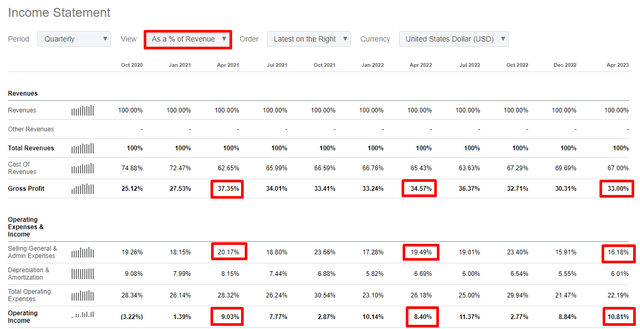

Gross margin deteriorated compared to both FY 2022 and FY 2021. The operating margin demonstrated more than two percentage points expansion YoY and a solid improvement compared to Q2 of FY 2021. This is mainly due to the significantly decreased SG&A to revenue ratio, meaning the management’s cost control initiatives are working well.

During the earnings call, Bob Iger, the CEO, reiterated his strong commitment to the execution of cost-cutting initiatives. It is also important that he confirmed that the company is on track to meet or even exceed the targeted $5.5 billion in structural savings. For me, it is an apparent bullish sign. Disney has a vast scale and cost management is crucial because the company has a large base of sales. Focusing on profitability improvement is the best the management can do at the moment, in my opinion. One of the most essential pieces of information was regarding a 4 million subscriber loss for Disney+ over the quarter. I was not surprised by it, given the December 2022 subscription price increases.

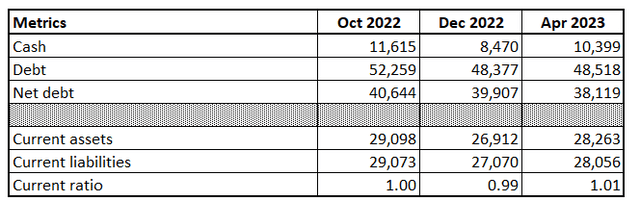

When we look at the company’s balance sheet, we cannot say it is a fortress. The financial position does not look strong primarily due to the substantial level of debt. As of the latest reporting date, the company was in a massive net debt position. But I would like to add context here. The situation with net debt has improved since Bob Iger returned to the CEO position without sacrificing the solid liquidity position.

I am very optimistic about the company’s near-term prospects. The most important is that the company demonstrates revenue growth because Bob Iger and his team are committed to optimizing costs. With these two variables in place, profitability, and the FCF will inevitably improve. The company plans to resume paying out a small dividend in September 2023, meaning that a significant part of the FCF will be allocated to the balance sheet improvement.

Valuation update

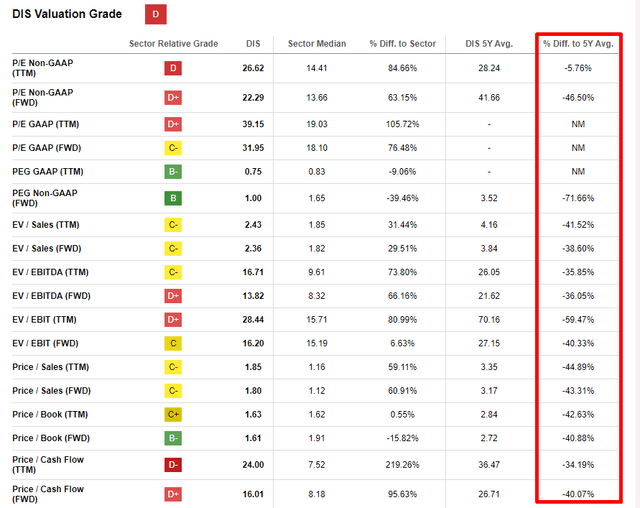

The stock price was almost flat year-to-date, which is significantly weaker than the broader market performance. Seeking Alpha Quant assigns the stock a low “D” valuation grade due to being substantially higher than the sector median multiples. On the other hand, the company has a unique brand, and I think that the premium to the stock price is fair. What is more important is that current multiples are by far lower than 5-year averages across the board. Therefore, based on the valuation ratios analysis, I think the stock is substantially undervalued.

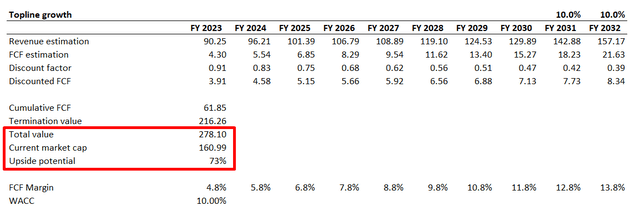

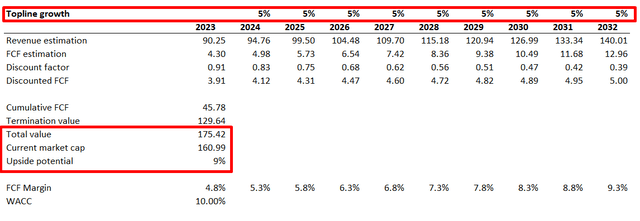

To cross-check the multiples analysis, I simulate several discounted cash flow [DCF] scenarios. For the base case scenario, I use revenue consensus estimates available up to FY 2030 and expect a 10% revenue growth for the years beyond. I use a modest 4.8% FCF margin assumption, aligning with the current TTM level. I expect the FCF margin to expand by one percentage point yearly, which looks fair given the prior decade’s performance. I use a 10% WACC, close to the level suggested by valueinvesting.io.

The DCF formula after all the above assumptions are incorporated suggests the stock has a 73% upside potential, which is massive. Disney bears might disagree with a long-term revenue growth rate of 10%, so let me simulate a more pessimistic second scenario with a mere 5% revenue CAGR over the next decade. Under the second scenario, the FCF margin is also expected to expand much slower, at 50 basis points yearly. The WACC remains unchanged.

In the above spreadsheet, you can see that even under very conservative assumptions, the stock still has a 9% upside potential. In my opinion, the valuation is very attractive at the current stock price level, and the margin of safety is vast.

Risks update

The major risk I see now is a harsh macroeconomic environment. In particular, companies in the entertainment and leisure industry, like Disney, face the risk of softening consumer spending on discretionary items. Disney’s offerings are not essential for daily living and can be postponed or cut back if households face financial difficulties. In challenging economic times, people are more focused on essential needs. With that said Disney faces significant near-term headwinds. The eurozone, one of the world’s wealthiest markets, is already in a recession. The U.S. is not in a recession yet, but the environment is challenging with high inflation and the highest Federal Funds rates since the Great Recession.

The second risk is fierce competition in the entertainment industry. Nowadays, even TikTok and Instagram are massive competitors for Disney because they are trying to get people’s attention and eyes. Consumer preferences are changing and if Disney fails to be up to date, the company will lose people’s attention and people’s eyes. Fewer eyes mean far less monetization for the company. And the competition is becoming more challenging every day since the audience is bombarded by new types of entertainment almost every day.

Bottom line

Overall, I reiterate a “Strong Buy” rating for the Disney stock. The company faces substantial near-term headwinds, and the balance sheet looks weak. On the other hand, I have seen many positive trends in the company’s financial performance since the iconic manager, Bob Iger, returned to the CEO’s chair. Moreover, the valuation looks very attractive and the upside potential far outweighs the risks and uncertainties.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in DIS over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.