Summary:

- The Walt Disney Company’s unexpected positive quarterly results, particularly in Direct-To-Consumer, or DTC, caused the stock to soar.

- The improvement in DTC is the largest in the company’s history, leading to overall improvement in the entertainment division.

- Disney and Warner Bros. Discovery prioritize market share over profits first, and then later aim for cash flow and profits.

- Disney management presented a future vision that captured the market’s attention.

- First quarter’s free cash flow took a big jump due to the DTC improvement and the strikes. Some of that improvement should reverse in later quarters.

VALERIE MACON/AFP via Getty Images

The Walt Disney Company (NYSE:DIS) reported an unexpectedly good fiscal first quarter that surprised the market enough that the stock soared. Much of that surprise was concentrated in Direct-To-Consumer (DTC), as the company is facing a lot of issues. But nothing helps stock performance more than a positive (unexpected) comparison combined with what management is doing to provide more upside potential in the future. A currently positive earnings comparison often gives the rest of the story more credibility than it would have without the current comparison. With Bob Iger back at the helm, investors can expect the positive news to keep showing up as earnings one quarter at a time. He has been considered an expert at “keeping things going in the right direction.”

DTC

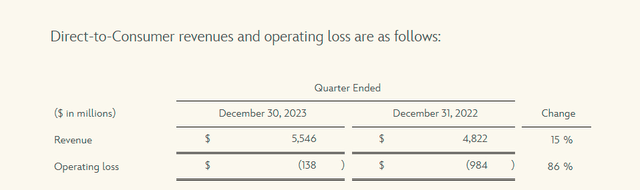

Much of what happened would not have been possible without the DTC. Here is what management provided in the quarterly press release.

Disney DTC First Quarter 2024 Results Comparison (Disney Earnings Press Release First Quarter 2023)

It needs to be noted that Disney is a big company and there are lots of earnings “swings.” However, the DTC improvement shown above is easily the largest. This enabled the whole entertainment division to show quite an improvement, even though revenues are slightly down.

This should not be a surprise, as Warner Bros. Discovery (WBD) management quickly stemmed the losses at the streaming service as well.

As an aside, there was some churn of subscribers. But the focus should always be on profits (with cash flow) and not just growth for growth’s sake as it appears to be elsewhere.

It is not unusual for large companies like both Disney and Warner Bros. Discovery to go for market share first and profits second. That, as management strategy theory books like Michael Porter’s “Competitive Strategies” point out, is actually standard practice.

Disney gave guidance about turning this around before. Management has now stated they are on track to make this profitable. One of the things that both Disney and Warner Bros. Discovery will often emphasize is cash flow. For both of them, a cash flow objective comes from a multitude of company businesses, as both are integrated. This is a big advantage over any company that is simply a streamer.

In fact, now that the losses have been effectively driven to a very low level, there may be other divisions making money off the streaming service material to offset those losses presently.

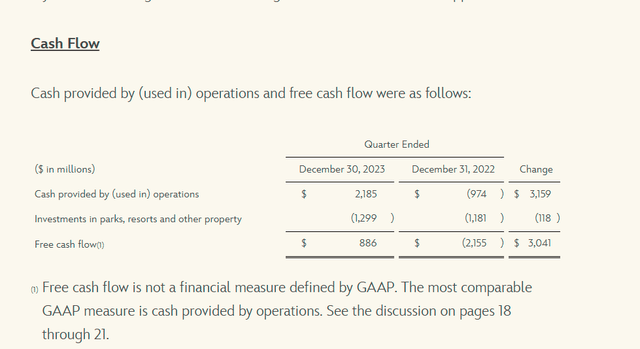

Cash Flow

Between the streaming improvement and the effect of the strikes, the free cash flow took a big jump over what would have normally been expected.

Disney Free Cash Flow Comparison First Quarter 2024 (Disney First Quarter 2024, Earnings Press Release)

Management also mentioned some timing issues and, of course, there will be a “make-up” or “catch-up” period to make up for the strikes. So, some of this comparison will reverse. The other consideration is that the company may now finally be “up to speed” and fully recovered from the shutdown.

On the other hand, management is guiding that the improvement in the Direct-To-Consumer is only going to get better. That pretty much assures positive comparisons for the rest of the fiscal year. Note that those comparisons are likely to be big all year, given the improvement shown in this quarter.

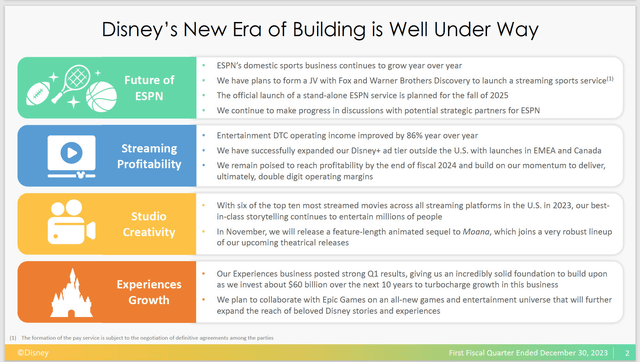

Focus Change

For the last year, the market was largely focused on the Disney problems. A review of the articles on the website reveals a segment of opinion that pretty much stated these problems were not going away anytime soon.

Disney Future Projects Underway (Disney First Quarter 2024, Earnings Conference Call Slides)

But, as the above slide demonstrates, the challenges do not have to go away anytime soon as long as management has a “winning” future vision. If management has no solution, which is the situation that existed under the previous CEO, then the market concentrates on the problems while assuming the problems are permanent. This largely resulted in a lower stock price.

Now, admittedly, Disney has taken a fairly long period of time to recover from the pandemic. Both the theme parks and the movie release schedule were affected by the pandemic. There was also a public misstep or two as well.

But as the fiscal first quarter conference call largely proves, a vision that can be accepted by the market often cures a lot of current ills in the eyes of the market.

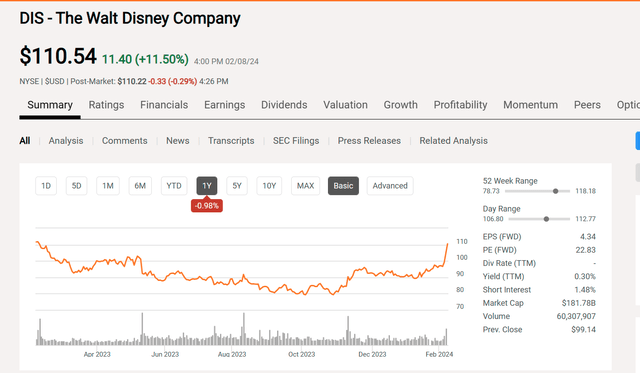

Stock Price Action

The stock price likewise responded to a largely positive view of the future compared to the past conference calls that were largely focused upon pandemic recovery and all the issues that appeared along with it.

Disney Common Stock Price History And Key Valuation Measures (Seeking Alpha Website February 8, 2024)

The net result is that the market would (of course) value a positive vision with a “story” behind it that promises a lot of profits in the future. Mr. Market generally assumes that what happens today will happen into the future.

The market does have some minimum requirements, such as a positive earnings comparison and expectations of future growth. But as management discussed in the conference call, there is a fair amount of growth now planned well into the future. The stock price reaction should be expected. Clearly, the market had the proof it needed to get rid of the negative view of the company.

Now, any turnaround is likely to be accompanied by heavy volume and increased volatility as the beginning turnaround proceeds. On the other hand, the pathway to restoring confidence in the company and some previous stock price valuations is now open.

For Shareholders

The lack of losses at DTC as well as the international parks improvements has meant that the company is now returning to its (giant) cash flow roots.

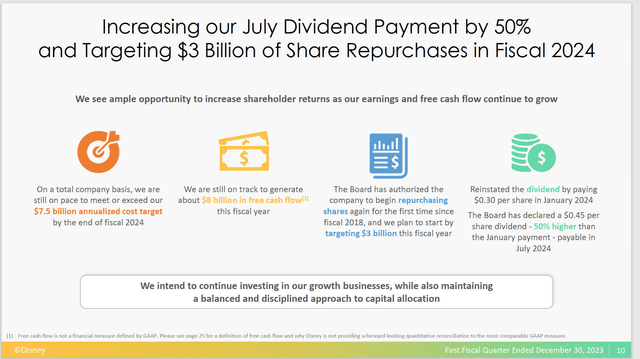

Disney Shareholder Returns And Key Free Cash Flow Goals (Disney First Quarter 2024, Earnings Conference Call Slides)

Management will be increasing the dividend as shown above. Probably the biggest surprise was the free cash flow goal. In the past, Disney was usually a big free cash flow generator. It looks as though that is going to be the case again sooner rather than later.

Much of the free cash flow improvement is due to the lack of parks expenses that did not have corresponding revenue as the recovery from the pandemic proceeded.

It is also likely a similar story with films, because the movie schedule is now close to normal, so the expenses for future movies can be matched against current releases for cash flow purposes. Anything was better than (essentially) a zero during the pandemic (followed by fewer than normal releases after that). Likewise the strike may help cash flow “up front.” But that cash expense comes back later.

Parks

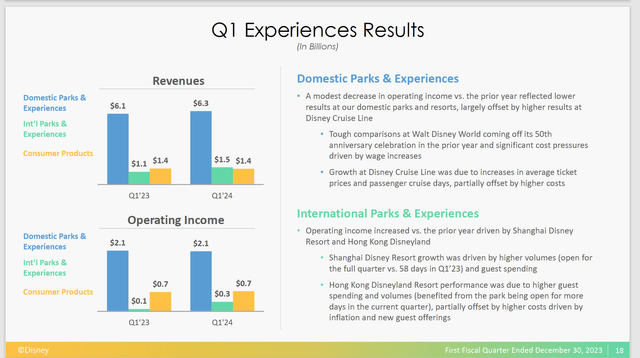

Notice also that for all the worry last year about the price increases, management managed to “hold the line” on parks. This removes yet another market worry.

Disney Parks Results Summary (Disney First Quarter 2024, Earnings Conference Call Slides)

Parks are probably a mature part of the company. Therefore, the emphasis here would be to produce cash that can be used to grow other businesses. As shown above, the overall division essentially reported flat results, with nothing close to the expected financial “disaster” Wall Street was expecting last year.

This is yet another reason that the first quarter report was so good in the eyes of the market.

Summary

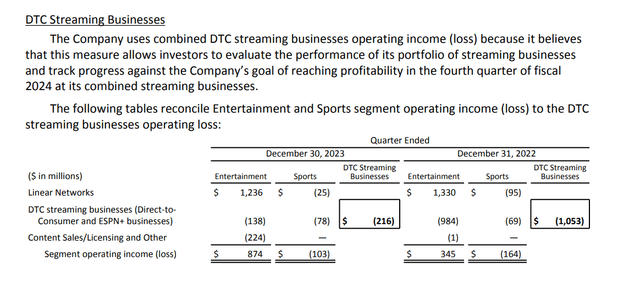

Management may well be putting the ESPN business in the same classification as the DTC streaming business. That places a lot of future growth in one place, with the streaming as the common element.

Disney Combined Streaming, Linear Networks, and Other Results (Disney First Quarter 2024, Earnings Press Release)

As shown above, management intends to build this profitability area quite a bit in the future, and as evidenced through the various press releases and the discussion in the conference call.

Disney remains a strong buy as the turnaround continues under Bob Iger. The succession issue has temporarily faded as the current vision of a bright future takes hold. Any stock price valuation is at least partially dependent upon a future vision combined with proof that vision is underway.

In this case, a positive earnings comparison combined with likely more positive earnings comparisons is likely to take good care of the stock price this fiscal year. The future vision has yet to play out. But at least there now is a future vision to replace nothing but market worries. That alone probably means that The Walt Disney Company stock price is in for a good year, and probably more than a few future good years.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of DIS WBD either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Disclaimer: I am not an investment advisor, and this article is not meant to be a recommendation of the purchase or sale of stock. Investors are advised to review all company documents and press releases to see if the company fits their own investment qualifications.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Long Player believes oil and gas is a boom-bust, cyclical industry. It takes patience, and it certainly helps to have experience. He has been focusing on this industry for years. He is a retired CPA, and holds an MBA and MA. He leads the investing group Oil & Gas Value Research. He looks for under-followed oil companies and out-of-favor midstream companies that offer compelling opportunities. The group includes an active chat room in which Oil & Gas investors discuss recent information and share ideas. Learn more.