Summary:

- DIS stock has risen approximately 50% over the past six months but dropped 3.1% after a series of proxy votes.

- Activist firms, including Trian Partners and Blackwells Capital, challenged Disney’s management but were ultimately defeated.

- Walt Disney’s management has made changes and improvements, leading to growth in revenue, cash flows, and reduction in debt.

- This likely won shareholders over and Disney is well on its way to continue delivering on its promises.

Joe Raedle

Over the past six months, things have gone quite well for shareholders of The Walt Disney Company (NYSE:DIS). Due to a number of reasons, the stock has risen approximately 50% over this window of time. However, on April 3rd of this year, something happened that pushed the stock down about 3.1% for the day. This was the result of a series of proxy votes that, in theory, will have a big impact on the company moving forward. Motion notably, the company succeeded in fending off two major challenges from activist firms.

Leading up to the event, there was considerable uncertainty as to whether management would be faced with a shake-up and what that might mean for the company moving forward. For some time now, the activist firms, not to mention many other investors, have been unhappy with developments at the world’s most famous entertainment company. Even though the stock is up materially over the last six months, shares have underperformed the broader market if you go back several years. To be perfectly honest with you, I view the defeat of the activist investors as something that, at worst, is neutral and that, at best, is positive. Had this been 18 months ago, my thoughts probably would have aligned with the activist investors. But given how things have gone from a fundamental perspective and the path that Disney appears to be on now, I think their push for change has seen its time come and go.

Disney’s management weathered the storm

During the investor day, the most significant challenge that Disney seemed to face involved activist investor Nelson Peltz and his investment firm known as Trian Partners. Back in January of 2023, for instance, he and his firm attempted to get himself appointed to the company’s board of directors. At that time, he recognized that Disney was one of the ‘most advantaged consumer entertainment companies in the world, with unrivalled global scale, irreplaceable brands, and opportunities to monetize its intellectual property better than its peers by leveraging the Disney “flywheel”’. This flywheel referred to the collection of assets that the company has come into ownership of over the years that feed on one another to create value. Examples include, but are not limited to, its theme parks, consumer products, networks, and more.

Trian Partners

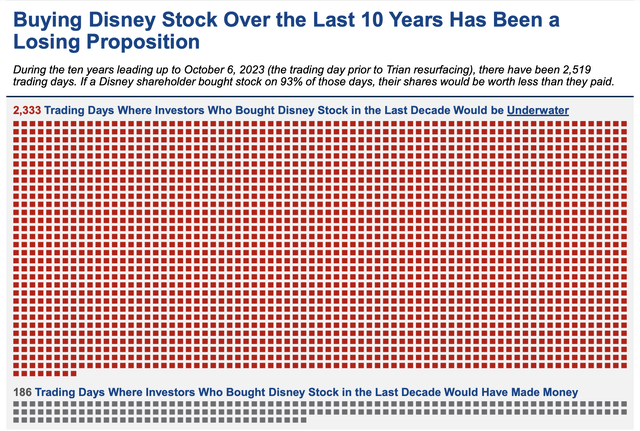

To be perfectly honest, this is exactly how I view the company and it’s a reason why it is one of only a handful or so of companies that I own stock in at any point in time. On the other hand, he also pointed out the abysmal shareholder returns that the company had achieved. For instance, over the past 10 years leading up to that date, the S&P 500 had generated a return that was 116% higher than what Disney had achieved. He blamed the company’s troubles on failed succession planning, compensation practices, and a variety of other factors. And on all of this, I would say he was largely correct.

The effort back in early 2023 was short lived. I say this because, after Bob Iger stepped back into the business in November of 2022, he quickly set about making changes with how the company operated and with its goals moving forward. By early February of last year, Trian Partners ended the proxy campaign, even applauding the company for its maneuvers. Unfortunately, this piece was also short lived. By November of last year, Peltz was once again pushing for board representation. However, Iger informed Trian that it would be rejecting this proposal. This new push came as shares of the entertainment giant plummeted, losing around $70 billion in value for shareholders. This was followed up in the middle of December of 2023 with Trian Partners nominating two candidates to Disney’s board.

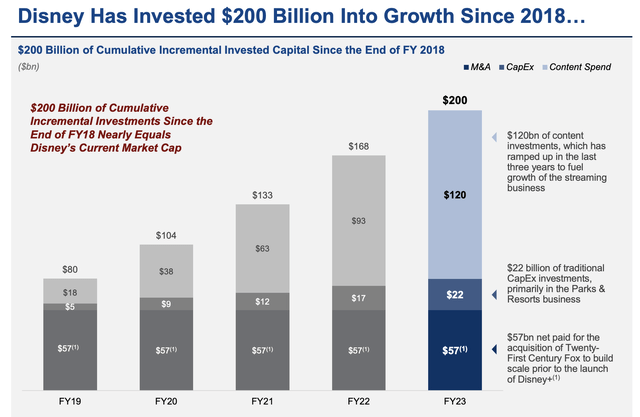

Unlike the first skirmish, this proved to be an all-out war in the making. In February, Trian sent out a letter to shareholders of Disney to complain about the company and its lack of success leading up to that point. And in early March, the firm went so far as to issue a white paper explaining the problems and proposed solutions. This white paper was a 133 slide presentation. Clearly, Trian Partners insisted on doing a thorough job. Just as was the case with earlier in this article, where I discussed the flywheel the company has, Trian Partners was spot on in some of its criticism regarding the entertainment behemoth. The investment firm was correct in pointing out that, from 2019 through the end of 2023, Disney had allocated around $200 billion in capital to the enterprise, and yet the stock did not reflect this. $120 billion of this was in the form of content investments that the company spent three years significantly ramping up. And a lot of that was under prior leadership with the goal of supercharging the firm’s three streaming platforms. $57 billion of it, on top of this, was spent on the acquisition of Twenty-First Century Fox.

Trian Partners

Based on my long history of analyzing the company, I would agree that the purchase of Twenty-First Century Fox was a mistake. It’s also true that shares had materially underperformed the broader market. But it’s important to note that this was not the only challenge to the company. There was also a challenge issued by Blackwells Capital, which encouraged shareholders to support three nominees that it had for the board of directors. Just like Trian Partners, Blackwells Capital issued a rather sizable presentation on the troubles facing the entertainment giant.

Blackwells Capital

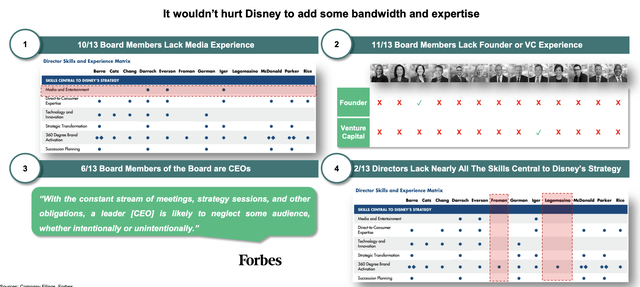

That presentation was 101 slides long. A lot of it focused on just how much shares had declined since the start of 2021. They also pointed out that many of the board members, 11 of the 13 in all, lacked either founder or venture capital experience. Blackwells Capital also took issue with the $60 billion spending plan that CEO Bob Iger implemented and plan to spend over the span of 10 years. Blackwells Capital even went so far as to file a lawsuit against Disney over the allegation that Disney’s decision to share certain information with activist firm ValueAct for the purpose of getting ValueAct to consult with it on ‘strategic matters’ was nothing more than Disney paying ValueAct to take its side in the proxy fight.

Author – Yahoo! Finance Data

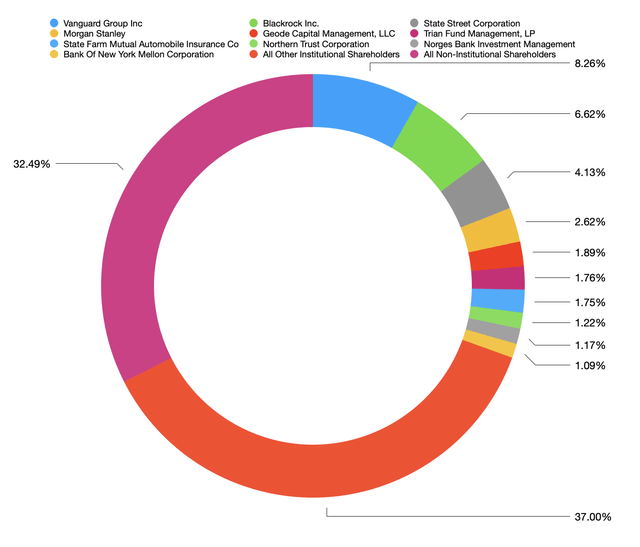

Unfortunately for those parties, Disney prevailed, successfully getting its full slate of 12 directors elected by what management called ‘substantial margins’ over the nominees selected by the activist firms. We don’t know all of the details yet. And that’s because the information has not been made publicly available. But we do know that around 75% of retail investors voted in line with the management team at Disney suggested. Non-institutional investors as a whole only account for around 32.5% of all Disney shares outstanding. But we also know that Vanguard Group, Blackrock, and State Street Corporation all voted in favor of management’s wishes as well.

Disney

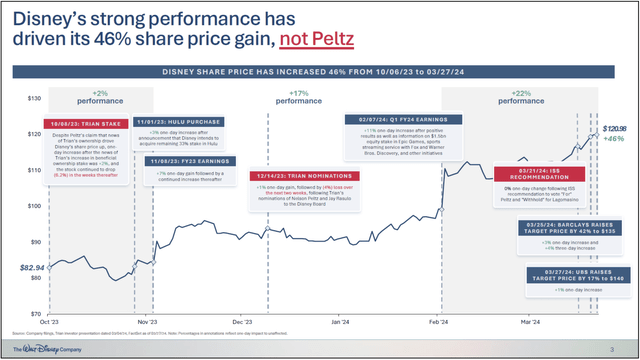

To be perfectly honest with you, I believe that there are two primary reasons why Disney succeeded on this front. The first involved the company pointing out, rather accurately, that some of the claims made by Peltz lacked evidence or were just plain false. While it is true that shares of the company have underperformed the broader market, Trian Partners had claimed that the company’s recovery and share price was driven largely or perhaps even entirely by Trian Partners stepping up to the plate and demanding changes. But as the image above illustrates, there doesn’t seem to be any concrete evidence to support this claim.

Author – SEC EDGAR Data

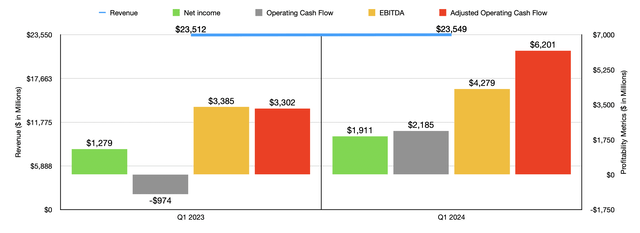

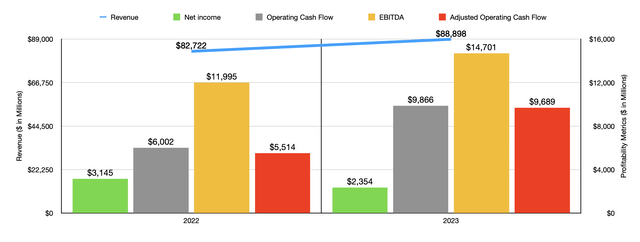

The second reason why I feel as though management prevailed relates to the overall fundamental health of the company and how that has changed since Bob Iger came back in November of 2022. In the chart above, you can see financial results covering the most recent quarter, which would be the first quarter of the 2024 fiscal year. Those results are stacked up against how the company performed in the first quarter one year earlier. And in the chart below, you can see financial results covering 2023 relative to 2022. The business has returned to growth from a revenue perspective. Although net profits managed to rise only recently, cash flows have been roaring higher.

Author – SEC EDGAR Data

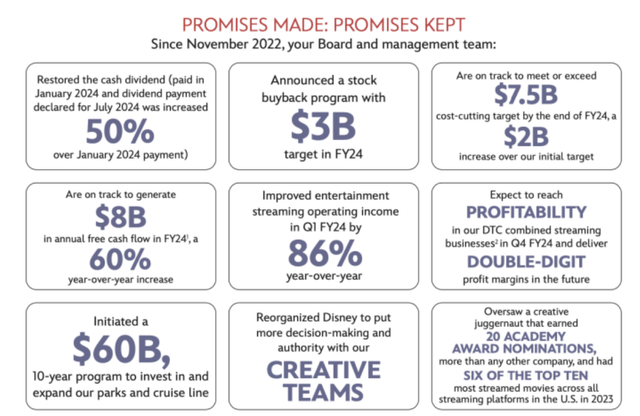

Originally, the goal was to reduce expenses by around $5.5 billion on an annualized basis. Late last year, management increased this to $7.5 billion. And in February of this year, they said that they are on track to meet or exceed that $7.5 billion target by the end of 2024. Management not only restored the cash dividend from nothing to something small, they also increased it by 50% for the dividend payment declared for July of this year. They are also on track to buy back around $3 billion worth of shares this year thanks to the expectation of generating around $8 billion in free cash flow. By the end of this year, it’s also expected that the streaming operations will finally reach profitability.

Disney

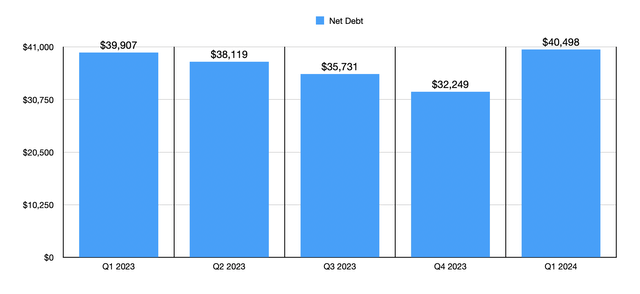

Management has also been successful in reducing debt over this time. In the quarter in which CEO Iger came back on, the company had $39.91 billion of net debt on its books. By the final quarter of the 2023 fiscal year, this had declined to $32.25 billion. It’s important to note that, in the first quarter of this year, debt rose back up, hitting $40.50 billion. However, that was only because the company had to allocate $8.61 billion toward buying up the rest of the stake in Hulu that it did not previously own. If we were to remove this from the equation, net debt would have fallen even further to $31.89 billion. This means that the company is consistently reducing leverage, which not only reduces risk, but also reduces annualized expenses. Ignoring the impact of purchasing up the Hulu stake that the company was required to do, the $8.02 billion of net debt reduction the company saw, if it carried with it a 5% annual interest rate, would result in pretax interest savings of around $401 million annually. Clearly, the company is moving in the right direction.

Author – SEC EDGAR Data

Takeaway

As things stand, it has been an interesting journey for Disney so far. It does appear as though some investors were banking on the proxy fight working out against the business. But with major institutional investors, as well as a majority of retail investors, agreeing with the company, that path now seems over. In all likelihood, this is because of the continued strong performance of the company since new leadership came into play. And so long as that continues, and as long as I continue to see improvements across the board, I will maintain the ‘strong buy’ rating I have assigned the stock. You know likelihood, I would continue to do so until shares hit around $150. At that point, I likely will sell some or all of my units.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of DIS either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Crude Value Insights is an exclusive community of investors who have a taste for oil and natural gas firms. Our main interest is on cash flow and the value and growth prospects that generate the strongest potential for investors. You get access to a 50+ stock model account, in-depth cash flow analyses of E&P firms, and a Live Chat where members can share their knowledge and experiences with one another. Sign up now and your first two weeks are free!