Summary:

- Once-great The Walt Disney Company has systematically reduced its prospects by its continuing belief in an infinitely expandable pie that is gone.

- We can’t judge Disney stock by past or current metrics alone before we take a hard look at a moribund management culture.

- Since the Eisner era, The Walt Disney Company has had its share of triumphs and failures–can it row through the turbulent waters of today?

yujie chen

“What’s past is prologue….” William Shakespeare, Act 1 The Tempest.

The ongoing debate between true believers and skeptics about the recovery and chances for a dramatic The Walt Disney Company (NYSE:DIS) upside continues to provide far too much heat and far too little light for the majority of its investors. On the one hand, we have a bull case built off the powerful fundamentals of the Disney business—its scale, its creative juices, the sheer breadth of its global business. On the other, we have the wary who believe the basic business model on which this once great company was built has been damaged beyond repair. Nobody expects Disney to go out of business at any time now. Nor does the bull scenario seem to meet the acid test of the new world of how entertainment will be delivered to global audiences.

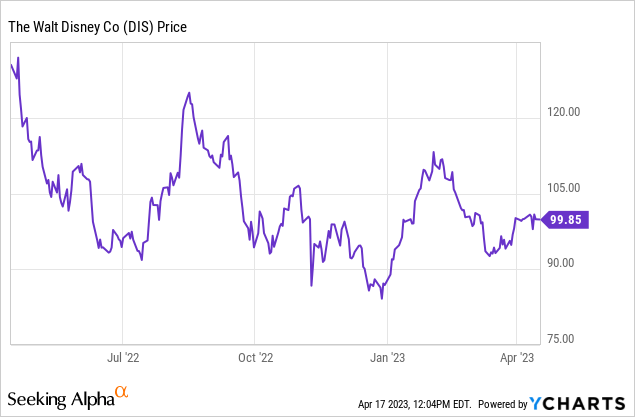

The stock today is at best a HOLD if you own; if not, a pass.

Like most analysts, I sat down and looked at a data set of the company’s performance going to way back in the day. I began with 1984, the start of the Eisner/Katzenberg era, down to this day, let’s call it early post-covid 2023. What appeared to me to be the only conclusion was this: a decision now to be in the stock based on this long track record can’t entirely be made on poring over the numbers, the metrics and forward projections.

I often (perhaps too often) quote the famous line about show business uttered by the great screenwriter William Goldman. When asked how entertainment executives make decisions based on their knowledge, he said, “Nobody knows anything.”

Goldman was, of course, among the few truth seekers of the entertainment business who was singularly skeptical of anyone who was reputed to have the “golden gut.” That is the industry’s description of executives celebrated and lauded for their presumed ability to find the peals among the thousands of oysters presented to them. And Goldman’s quote belies that descriptive, implying that all entertainment is a crap shoot.

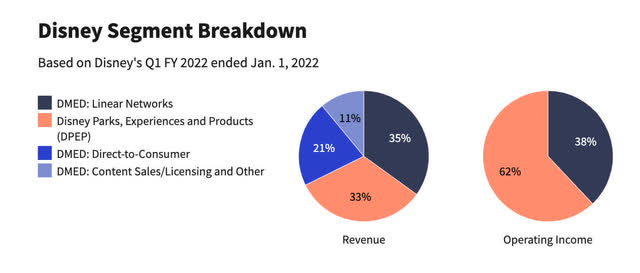

Above: The breakdown shows that above all segments, the Parks are still the most durable of contributors to EBITDA over time.

To get a firmer grasp on where Disney shares appear to be headed, one must, I concluded, dig deeper, not only through its historic metrics, but more critically, its operating history in the hands of the people who ran it. Is the Disney that was, the Disney that is? Yes, was my conclusion—right or wrong, you take your pick. And more critically, is the Disney that is, a product of what was, the Disney that will be?

My conclusion—right or wrong, is no. And for that reason I conclude—again right or wrong—that as yet, in the light of this history, I see no prospect for exponential recovery of Disney stock. Looking down the road at a probable recession looming, to me, for the foreseeable six months, my thought is that at ~$100 the stock is overvalued. The key: company history speaks to me. It has this message: the ghosts of Disney past, haunt its present and probably, its future. It will need a far more gut-wrenching swerve than is thus far evident, to bring it back to a fat-dividend-paying, high-ROI performance justifying the current price target consensus among analysts of $125.62.

Let’s dig: 1984-2023 What and who happened?

google

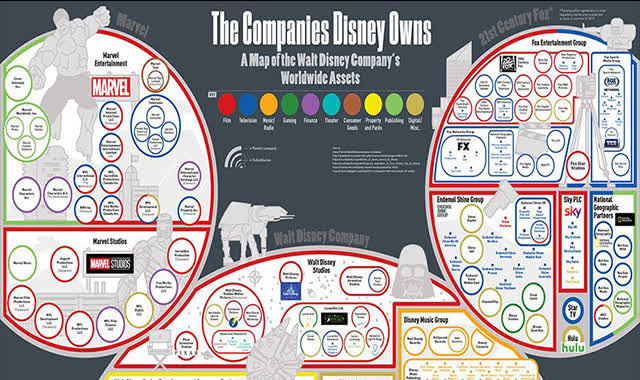

Above: There is no more graphic way to show Disney’s insatiable appetite for endless expansion of its IP well beyond the present capacity to absorb it than this visualization of the Disney businesses and units.

By any measure, the milestone events in the company began with the death of Walt Disney in 1966. Rummaging through the relics of the post-Walt era finds proof that in the 18 years after his demise, the company floundered. Its live action and animated movie product grew stale, trite and rarely profitable, with exceptions every now and then for a real hit. So, family heir Roy E. Disney (son of co-founder Roy Disney Sr.), his lawyer, Stanley Gold and mostly the voting power of its biggest shareholders the Bass brothers, brought pressure on the good old boy directors at the time, to approve a change in top management—then led by Walt’s son-in-law, Ron Miller. The owner of what was conceived as a hit pedigree from Paramount and ABC programming, Michael Eisner, was recruited and brought along with his side car associate of many years as well as close friend, Jeffrey Katzenberg.

Without question, the pair resuscitated Disney from its death spiral with a simple formula that was the Eisner mantra: “Don’t worry about hitting homers. Hit singles and doubles and you will score runs.” Don’t overspend, exit all the dinosaurs on the board and in senior management. Shake the place up, face facts, and act expediently. It worked–for a while–but the Lion Kings are always few and far between as much as they can skyrocket earnings in a given year. More important, the management culture stagnated with time.

To be sure, tons of tell all Disney books, articles and biographies including Eisner’s own, have uncovered the good, the bad and the ugly of Disney’s Eisner era and subsequent history these last 40 years.

For something of a fly on the wall recollection, I turned to an old friend who was a Disney employee during part of the Eisner era. He worked at various jobs at Disney for seven years. He is best described as a member of the upper middle management. He is a man who subsequently built a great career in the industry after he left Disney on his own accord.

He’s a man best described as having the smarts of a skilled CIA field agent “Much of what Michael did was great. But there was constant scuttlebutt about executive comings, goings; angers and knifings were the style at high levels, we believed” my friend recalls. One man’s opinion, but much corroborated by lots of Disney gossip accumulated over the years.

Here’s his take.

Once Eisner was able to systematically exit the old board and replace them with his acolytes, he ran the company through the lens of his own skills and failings. Disney was forever disorganized with reporting lines blurred, with backbiting among its top people raised to a high art. In succession, Eisner exited Katzenberg (who later sued for his bonuses), and an endless line of c-suite executives presumably brought into ease his burdens after his near heart attack in 1994 and soon after the tragic death of Frank Welles, who was really the glue that held the parts together.

Our observer (paraphrased from several phone conversations): This may sound a bit nutty, but for all his great qualities, Eisner never found a number two after the death of Frank Welles he really believed in. In fact, I had the crazy sense that he unconsciously hired top people for their potential to fail, not succeed. In that way, he assured himself of no competitor to hold the reins. It began with Jeffrey, then the disaster of Mike Ovitz (big gun from privately held CAA), Jamie Tarses, Schneider, Bloomberg, Murphy, and many others. There was a lot of Hamlet in Eisner, maybe even a bit of Macbeth thrown in.

He was an impulsive man. He could meet someone on a street corner, engage in a nice conversation, and decide on the spot to hire the person, impose him on the existing department and trigger hate and chaos. Over time, what you saw was one betrayal after another, old friendships destroyed. The success of the company during his reign definitely sprang from his willingness to bet on some of the creative geniuses around him in animation. But the gut truth of Disney is this: theme parks were always the reliable work horse that produced the most important profit center—sometimes all the earnings. Movies, with the exception of several animated home runs like The Lion King, were a roulette wheel where most of the bets made were losers. Disney did have live-action low-budget hits, but the studio over time generally underperformed regardless of the revolving door of management “geniuses” who pushed through them.

Eisner’s agreement to acquire ABC-TV was a wise one at the time. It was runner up to his original appetite for CBS, in which Lawrence Tisch held firm on a bloated price— and which he ultimately got from Sumner Redstone.

Eisner retired in 2005 when the CEO job fell to Bob Iger, then COO. He was the only number two, after the death of Frank Wells, to survive. Iger served to 2021. Unlike Eisner, he wasn’t a generator of initiatives, ideas, and infusion of fresh thinking, but a dealmaker, who expanded the company through acquisitions of IP. His hand-picked replacement, Bob Chapek, lasted only a year before he was summarily ousted. It was clearly an echo of the Eisner era. Iger, apparently wallowing in second thoughts as Chapek tried to pivot, was re-drafted to save the company. This triggered applause among shareholders and the industry.

Chapek blundered on the Florida “woke issue” tussle with its Governor. That’s a discussion for another forum. But one who understands the history of the Disney culture, cannot but conjecture whether Iger was merely repeating the old Eisner ego-tripping of building up, then destroying his number twos.

There are structural flaws in Disney leadership over time that is partially the genetic make-up of the entertainment business. But here we find the same old, same old. Iger creates an heir apparent, puts him into action as a successor, then observes – if not participates – in his shaky start only to re-emerge as a savior. This is standard Disney culture. Iger began almost immediately to move executives around the chessboard as did Eisner, making sure those changes insulated his own command free of challenge.

The board in the Eisner era was transformed from one old boys club to another new boys (and girl) club. They proved toothless. Today’s DEI Disney board is just as terrible in that instead of a new girls/ boys agenda, it is a woke array of golden resume holders picked first for their contribution to the illusion of diversity and then for some elusive ability to keep a CEO focused on reality. We shall see. Thus far, I’m unimpressed.

What has dogged Disney from the Eisner era until this day are a few underlying, unavailing truths investors need to take into account when deciding whether to buy, sell or hold.

It’s far too facile to simply judge Disney on the so-called “magic” of its IP and the potential for more to come. There is no Disney magic in a market where magic has become discounted, as it were, by glut—as I have noted in prior articles. What there is the global positioning of the company and its scale that sets the road to recovery of its excellent IP. However, those analysts who believe in the “forever power” of that IP need to take a second look. If you try a discounted cash flow version of valuing Disney IP—not the stock—over the next five years can you definitely say it is worth what it was five years ago? Or more realistically, can you discount its value assuming that audiences are so changed in composition that their worth will be diminished by the marketplace and technology

AI is so scary – I am told that one can sit at a computer with an AI app and order this “Produce me a script that shows funny animals in a zoo Disney style, escaping into the night and staging a Broadway show with ten potential hits.” I am told this could be done in roughly 15 seconds or less.

Disney shares are down 23.43% for the year. In October of 2020, in the teeth of the worst of covid, the stock was hanging in a $181.8. The most recent PT among analysts is $125.82. While I don’t see this as unrealistic given a head start by the recovery in theme parks, I also see far too many bearish signs that, try as he may, there are few tough tools Iger may have at his command, beyond cost cutting and content slashing that could bring DIS stock around. Both those tools were often reached for by Eisner. His mantra always was that of a cost cutter, an excess hater (though billions were wasted in his tenure), and a chess board mover of executives. His repeated attempts to consolidate businesses mostly failed.

What Disney needs most is a hard look at its scale, across all its businesses. Since the Eisner era, the ongoing culture was that there were always more worlds to conquer. That the demand for the great Disney IP was insatiable. They believed in a pie that had no limits to its circumference. The endless repurposing of IP through every conceivable kind of distribution channel is a flawed idea going forward. Disney will continue to release periodic winners. But as in the past, none of them will bring unto itself a solution to the dramatic recovery of its stock until it restructures its management culture to a more rational view of what lies ahead.

At writing, Disney’s ROE is 3.4%, clearly reflecting the covid damage among other causes. Confidence in the company remains strong among many big investors. As of this writing, the short interest is $1.81b and ratio at O.99%. So, it would suggest that the true believers remain convinced that led by Iger, some way, some time, Disney will recapture the magic and show the blowout earnings it once achieved when led by a blockbuster movie or a price rise at the parks.

It may happen, but our view, its wishing upon a star.

We see a downside drift ahead for The Walt Disney Company stock until Mr. Market gets a tighter grasp on the sector’s future then anything afoot by management today. If you own DIS stock, hold, a 20% move up or down could easily happen. If you don’t, pass.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

For in-depth and deep dive research on the casino and gaming sector, subscribe to The House Edge. New: Free excerpts from our book in progress "The Smartest ever Guide to Gaming Stocks" – free to existing members and new subscribers.