Summary:

- The Walt Disney Company’s fiscal Q3 earnings showed mixed performance, with revenue growth but declining EPS when excluding one-time items.

- CEO Bob Iger highlighted the progress of Disney’s ongoing business transformation, with cost savings exceeding targets and improved direct-to-consumer losses.

- Disney is facing challenges in popularity compared to Netflix, signaling a need to adapt its creative strategy to the personalization era and blend traditional magic with modern personalization.

kool99/iStock via Getty Images

The Key Takeaway From Q2 Earnings

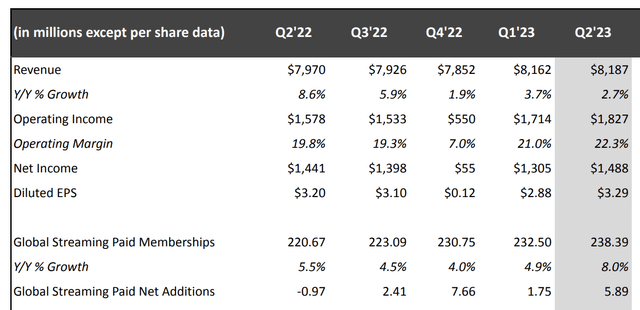

The Walt Disney Company (NYSE:DIS) reported fiscal Q3 results that showed mixed performance. Revenues grew 4% for the quarter and 8% for the 9-month period. However, EPS declined year-over-year for both the quarter and 9-month duration when excluding one-time items.

While more work remains, CEO Bob Iger expressed confidence in Disney’s long-term outlook given the progress made, the new leadership team, and Disney’s core strengths of creativity, popular brands, and cherished franchises.

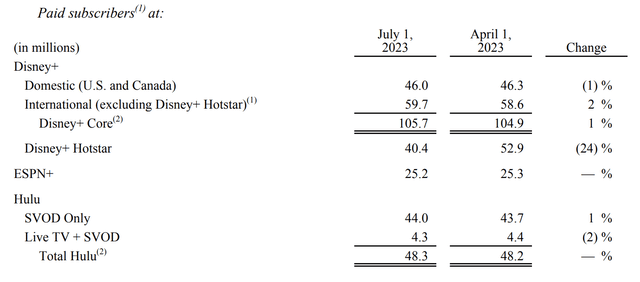

However, we noticed that Disney’s latest revenue growth was primarily driven by price hikes, masking stagnant subscriber gains at Disney+, ESPN, and Hulu.

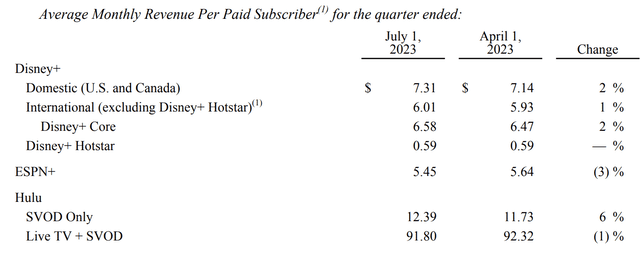

Disney’s subscriber growth (DIS) Disney’s revenue per subscriber (DIS)

In contrast, Netflix (NFLX) grew members by 8% this quarter.

Netflix’s subscriber growth (NFLX)

Disney attributed its flat user growth to Netflix’s password-sharing crackdown and plans to similarly restrict sharing. It also aims to boost growth through upcoming price increases. However, this obscures Disney’s deeper challenges in competing in streaming.

Netflix Leads in Valuation

Despite far lower revenue of $8 billion, Netflix had a market cap 20% higher than Disney’s.

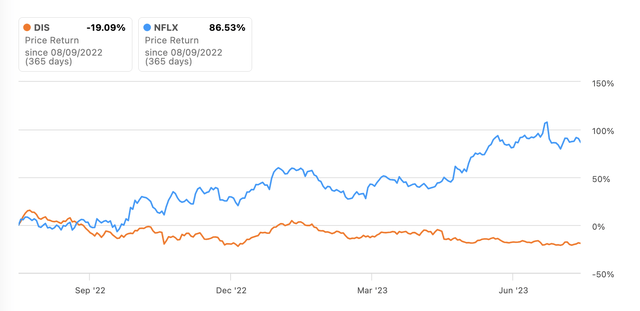

Many see Disney as undervalued. But we view it differently – Disney is becoming Walmart (WMT) to Netflix’s Amazon (AMZN). While Disney remains a powerhouse, the gap with ascendant Netflix seems likely to widen in our opinion.

Pricing and protectionism won’t close this gap. Disney must evolve its 20th-century IP model to compete in personalized, on-demand streaming, as we will illustrate in the following paragraph. Revenue growth through price hikes is unsustainable absent true subscriber gains. Unless Disney can recapture its creative magic and modernize, its dominance will continue eroding in the age of Netflix.

Stock performance (Seeking Alpha)

Disney vs. Netflix Popularity

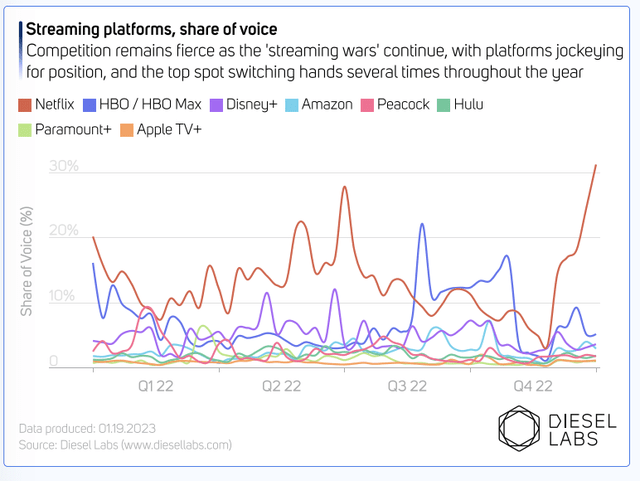

Despite reports of shrinking budgets, streaming platforms keep striving to captivate audiences with fresh, compelling content. Netflix led the charge in 2022, unleashing a torrent of 756 new titles and dominating the share of voice-over rivals Disney+ and Hulu.

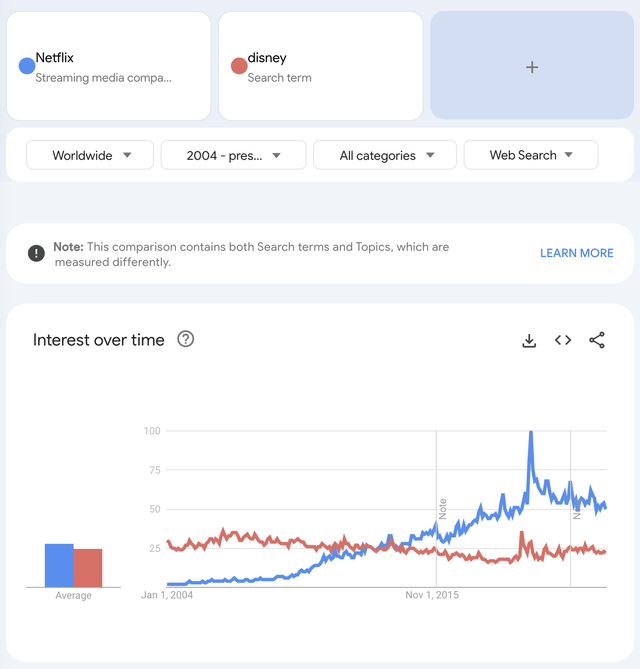

Recent Google Trends data reveals Disney lagging behind Netflix in popularity, signaling challenges for Disney’s IP-driven business model.

Despite acquiring Hulu and launching Disney+, Disney appears to have underestimated Netflix’s personalization advantage.

Disney’s IP Model Vs. Netflix’s Personalization Strategy

Despite acquiring Hulu and launching Disney+, Disney seems to have underestimated Netflix’s personalization superpower.

Disney pioneered monetizing intellectual property, efficiently spinning off hits like Marvel franchises. But Netflix rejects IP reliance, instead using data science to create perfectly personalized content.

Beyond convenient on-demand viewing, Netflix’s algorithms analyze preferences to produce shows audiences crave. Disney remains constrained by its studio-driven model of spotlighting preferred IPs.

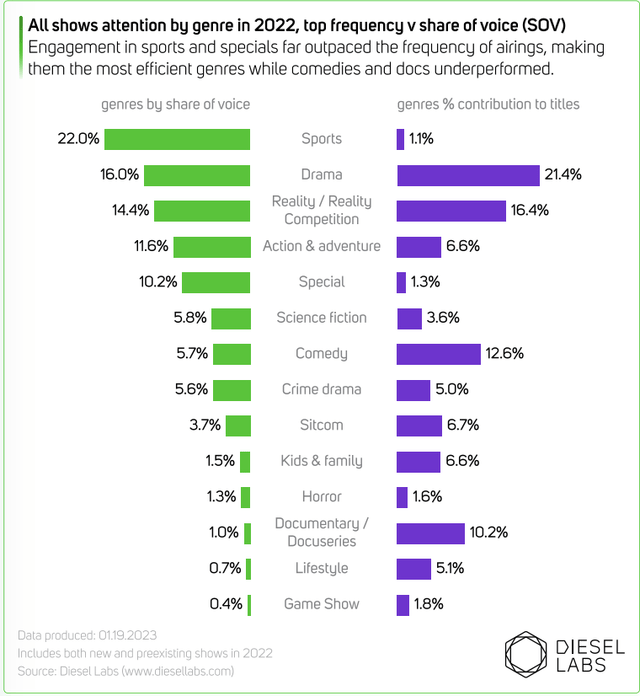

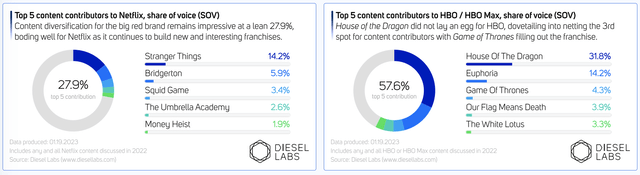

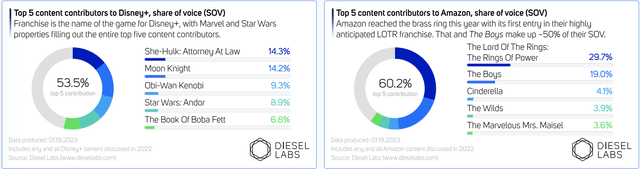

Data from Diesel Labs highlights the strategy gap. Netflix’s top content represents just 28% of the share of voice versus over 50% for Disney, HBO, and Amazon. Disney’s reliance on IP is evident with Marvel’s She-Hulk. But binge watchers now seek engaging themes over brands.

Netflix, HBO (Diesel Labs) Disney+, Amazon (Diesel Labs)

Disney’s IP focus brought past success but limits its addressable market versus Netflix’s broad appeal through personalization. While Disney+ gave Disney a streaming presence, its creative strategy has not evolved.

Disney is now trapped by its IP investments and institutional inertia. But clinging to this 20th-century model while Netflix leaps ahead technologically may cede streaming’s future. To compete, Disney must reinvent itself – not just acquire distribution channels.

Personalization Has A Stronger Moat

IP-driven businesses faced challenges monetizing celebrity-led franchises. Stars could demand greater compensation for sequels after a hit. Disney overcame this by owning cartoon IPs and retaining full control of follow-ons.

But Netflix rejects IP reliance, instead producing one-off hits like Stranger Things by uniquely combining music, themes, and visuals. This increases Netflix’s leverage over talent.

Rather than owning durable IPs, Netflix prioritizes algorithms that personalize at a vast scale. Its data-driven insights into audience desires produce tailored content that keeps subscribers engaged.

Disney’s iconic IP still holds appeal. But its human-led creative process is limited versus Netflix’s machine learning, which can analyze troves of data to make highly customized programming.

According to Statista, Disney boosted content spending by 33% between 2021 and 2022, often allocating double or triple Netflix’s budget. Yet Netflix grew subscribers in mid-high single digits for the past several quarters, while Disney’s user base flattened.

This indicates Netflix’s superior capital efficiency in content. With far less investment, Netflix is attracting more new subscribers due to its data-driven personalization. Its algorithms optimize spending to produce customized shows aligned with audience tastes.

Looking ahead, personalization may eclipse IP primacy. Netflix’s platform model seems positioned to tap wider audiences through technology, while Disney relies more on human artistry. To compete with personalization, Disney needs to evolve its strategy and blend its magic with analytics.

The Enduring Appeal of Sports

ESPN remains Disney’s enduring stronghold, as sports tops the share of voice per Diesel Labs. Sports’ mass appeal stems from fulfilling needs like competition, emotion, and social bonds. Though Netflix is exploring sports, it has made little headway beyond documentaries.

Disney is strategically expanding into sports betting via ESPN to diversify revenues. But this still operates within a traditional IP model, relying on athlete deals and broadcast rights.

Conclusion

Our analysis indicates Disney faces growing challenges in the streaming era. While the company retains strengths from its iconic brands and IP, its business model appears increasingly outdated versus ascendant digital platforms like Netflix.

Disney has yet to fully adapt to on-demand personalization and relies too heavily on legacy franchises. With growth stagnating despite massive content investments, Disney must evolve its creative strategy and leverage data-driven insights.

Sports remain a bright spot for Disney through ESPN, but risks lie ahead as Netflix is chasing. Disney must evolve beyond mimicking Netflix’s technology or pricing adjustment – to compete long-term, Disney needs to reinvent its creative magic and blend data-driven personalization into its human artistry. With the right blend of magic and analytics, Disney can stage a comeback. But the window of opportunity is closing as streaming’s competitive moat widens around technology leaders like Netflix.

We believe Disney’s stock valuation is justified relative to Netflix due to the companies’ differing business models and market opportunities. Netflix has built a wide competitive moat through data-driven personalization, giving it a larger addressable market than Disney’s IP-focused approach. While Disney retains strengths, Netflix’s platform model appears better positioned for streaming’s future. Given this dynamic, we assign a Neutral rating to Disney.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.