Summary:

- Disney stock jumped after its latest results with beats in 3 major areas.

- The positive sentiment was enhanced with Moana 2 breaking big records.

- We analyze the current setup and valuation and update our thesis.

İlker Çekiç/iStock Editorial via Getty Images

Hat Tip to Eddy Grant for inspiration on the title.

In the recent past, we have stayed in the neutral zone on Disney (NYSE:DIS). In fact, our last bearish piece was in 2021, when the stock was trading at $160.09. In 2024, we have found the weight of the evidence to come down firmly in the center. On one hand, we expect positive 10-year returns. This is very different than what we expected at $193 per share (no positive returns out over a decade). On the other hand, we expected these returns to be mediocre and likely lagging that of investment grade bonds. We go over the recent results, the analyst upgrades, and the big success of Moana 2 to see if we can take a clear stand today.

Q4-2024

Disney has a September fiscal year-end and the quarter just reported for Q4-2024. The revenues came in at $22.6 billion, a bit ahead of $22.50 billion. Adjusted earnings per share beat by 3 cents a share ($1.14 vs. $1.11). The biggest beat was on Disney+ core subscribers that came in about 3 million ahead of estimates. Disney threw down the gauntlet for the bears by raising 2025 and 2026 growth guidance above Wall Street numbers. The stock rallied from $102.50 before the results, all the way to $119.00 over the next few days, before pulling back.

Moana 2 – The Much-Needed Victory

Some of the positive sentiment on Disney stock can be attributed to recent developments around Moana 2. Disney has a history one-hit wonders in the animation fields. What we mean by that is that many sequels tend to go to video/DVD. For the ones that have gone on to make a sequel for a big-screen release, the success has been iffy. Atlantis 2 was one that got the big-screen treatment and the results were fairly mediocre.

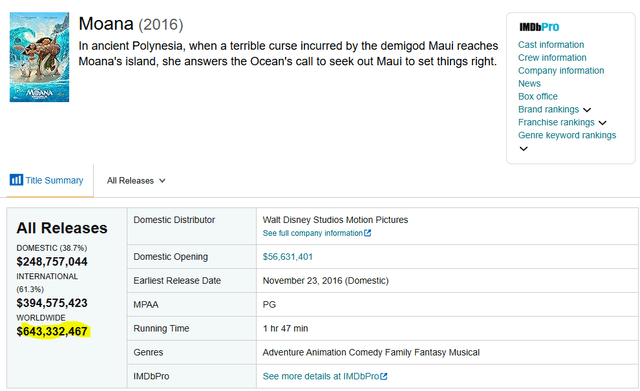

Moana was set to get the treatment bad ventures get. Direct to streaming on Disney+. This was the case till end of last year/early this year, Disney announced that Moana 2 would be hitting theaters that November. The scale of success of the first movie gave enough reasons for Disney to back this and not use it as a crutch to try and support Disney+ subscriber growth.

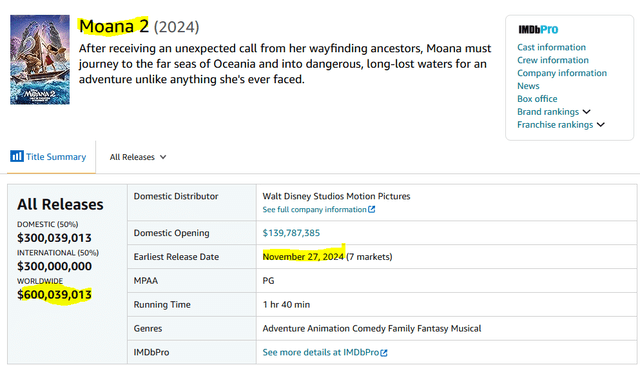

Well, as good as the first one was, Moana 2 appears to be taking it higher. We are less than 2 weeks from the release, and the sequel is already within striking distance of the first one’s entire collection.

This success is critical for Disney, as it shows it can achieve a balance between the old media and the new media. The bear argument always has been that Disney+ is a revenue machine and not a profit machine. Pouring everything Disney can make into that only results in a cash flow poor company. This question was even more important after the Avengers Franchise plummeted post Avengers: Endgame release. The Marvels was a gigantic box office bomb and lost Disney over $200 million. Moana 2 showed that the Disney magic can be repeated outside of the Avengers Franchise, if the company focuses more on content and less on messaging.

Our Outlook

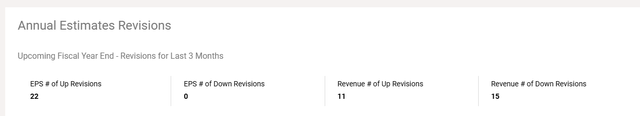

Wall Street was in celebrity mode right after the results. All 22 analysts had to raise their earnings estimates. On the other hand, the revenue estimate changes were mixed.

Generally, to get a sustainable run, you need both revenues and earnings to come ahead of where the analyst community is sitting. We saw that during the “reopening” play post COVID-19, where the beats were magnificent, and the numbers had to be constantly moved higher. Even the earnings change here is basically flat over the last 6 months. We lost some ground after Q3-2024 results and gained it all back now.

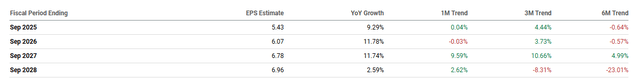

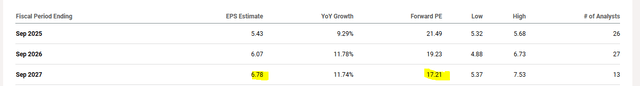

On a valuation basis, the stock is now trading at 17X 2027 earnings.

For a media stock like Disney with a 5% long-run growth rate, we would pay no more than 16X earnings, especially with 6% available on investment grade bonds. While the projections are that Disney will grow faster than that, our projection is post the 2027 timeframe. It is hard to even argue that the stock is cheap today at 21.5X earnings.

Verdict

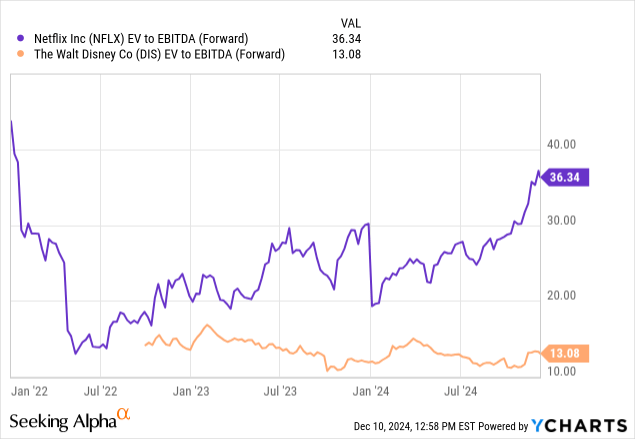

You can convince yourself to buy Disney if you look at some of the multiples other stocks are sporting.

By using this logic, you can convince yourself to buy anything. You can even tell yourself that Netflix Inc. (NFLX) is cheap because Palantir Technologies (PLTR) is trading at 69 times revenues. That will likely cause tears in the long run. Many investors found this out in the 2022 bear market, but those lessons appear to be forgotten. We would look at Disney as a highly cyclical stock with vulnerabilities in theme parks as well as risks of intense competition from multiple streaming services. You really don’t want to pay an arm and a leg for this. 17X earnings from 3 years away, built on the assumption that there will be no recession between now and then, is already quite expensive. We continue to rate this a hold and would look for a buy point under $80.00.

Please note that this is not financial advice. It may seem like it, sound like it, but surprisingly, it is not. Investors are expected to do their own due diligence and consult a professional who knows their objectives and constraints. Our articles are not written for “buy and hold” investors.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Are you looking for Real Yields which reduce portfolio volatility?

Conservative Income Portfolio targets the best value stocks with the highest margins of safety. The volatility of these investments is further lowered using the best priced options. Our Enhanced Equity Income Solutions Portfolio is designed to reduce volatility while generating 7-9% yields.