Summary:

- Disney’s Q4 and full-year results showed a healthy growth rate, driven primarily by the theme parks segment.

- The Entertainment segment’s operating income saw a huge drop of 32% in FY 2023.

- The failure of “The Marvels” movie raises concerns about declining enthusiasm for the wider Marvel Cinematic Universe and the company’s next generation of heroes.

stecks05/iStock Editorial via Getty Images

I’ve written about Disney (NYSE:DIS) recently where I laid out my bearish view. Contrary to what I expected, the company had a banger of a quarter in Q4 2023 and the stock surged as a result. Did I get my prognosis of the company totally wrong? Or is this the calm before the inevitable storm? In this article, I would like to review the company’s Q4 and full-year results and update my thesis.

Quarter and Full Year Review

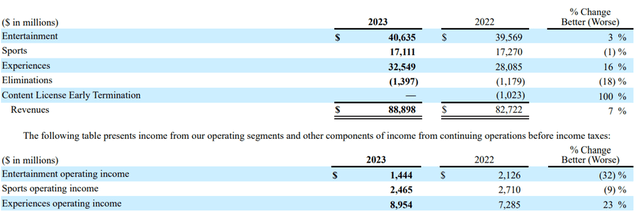

In Q4 2023, Disney grew its total revenues by 5% compared to the same time last year from $20.15 billion to $21.24 billion. The company had year-end revenues of $88.9 billion compared to $82.7 billion last year a growth of 7%.

This is a relatively healthy growth rate, especially for a company this size. Breaking this down though on a per-segment basis, it can be seen the majority of growth has been driven by the “Experiences” segment aka the theme parks. Disney’s theme parks have always proven to be its cash cow and 2023 proves no different.

The company’s “Entertainment” segment only slightly grew by 3% from $39.6 billion to $40.6 billion. Disney’s “Sports” segment which contains its ESPN assets among others had a slight decrease of 1% and was practically flat at roughly $17 billion. The company’s Parks business though which is almost as large as the entire entertainment division grew by a whopping 16% from $28 billion to $32.5 billion.

When examining Operating Income the picture looks even clearer on how much Disney depends on its Parks. The Entertainment segment’s operating income saw a huge drop of 32 % in FY 2023 from $2.1 billion to $1.4 billion. The sports segment saw a smaller yet similar decline of 9%.

All this while the Experiences / Parks segment grew its operating income by 23%. So, while the Parks segment represents roughly 36% of revenue, it represents a massive 69% of operating income. This segment has propelled Disney to deliver decent earnings that the market could accept. Adjusted Diluted EPS for FY 2023 increased to $3.76 compared to $3.53 the previous year, an increase of 6.5%.

Bear Thesis Remains

While the financial results of Disney were pretty good, it has not invalidated my original “bear thesis”. In fact, certain developments have only strengthened it. I believe that the Parks business would be the last to suffer as Disney’s overall brand image weakens. It is my view that the company’s Entertainment segment is going to see continued deterioration.

Marvel and Star Wars have been two of the largest intellectual properties owned by Disney. The latter has been suffering a decline in recent years as it’s been relegated to Disney + shows with no movies coming out in the near future. There is evidence that the Marvel brand could be in trouble as well.

Disney just released “The Marvels” which has gone down as the worst-performing Marvel Cinematic Universe (“MCU”) movie of all time. The Marvels had the worst opening in MCU history at $47 million domestically. This is much lower than the initial projections of between $75 million and $80 million. In fact, there have only been two MCU films that have had a similar debut 2015′s “Ant-Man” and 2008′s “Incredible Hulk” both of which opened $57 million and $55 million respectively.

The movie also had the worst second-week drop in the MCU, dropping a massive 79% from its already poor opening. Before the Marvels, the largest second-week drop belonged to this year’s “Ant-Man and the Wasp: Quantumania”. For comparison the first “Captain Marvel” made roughly 3x its sequel at $153 million in 2019 indicating the decline in enthusiasm since then. Given that the film had to gross at least $400 million to break even, “The Marvels” has been an unmitigated disaster for Disney and the MCU.

The main question now for investors is the movie’s failure a “one-off” or part of a larger trend. In my view, the movie’s failure is problematic for a few reasons. First, it shows a decline in enthusiasm for the wider MCU – something coined as “superhero fatigue”. The second issue is that it shows that the company’s next generation of heroes is not resonating with audiences. A recent TIME article titled “How Marvel Lost Its Way” opines.

Marvel Studios is losing viewers. Audiences used to line up to snag the best seats to the latest Avengers movie. Now they’re queuing for Barbenheimer instead. Not long ago, Marvel movies usually snagged the top three or four spots on the list of highest-grossing films every year. This year at the global box office, Barbie, The Super Mario Bros. Movie, and Oppenheimer all outgrossed both Guardians of the Galaxy Vol. 3 and Ant-Man and the Wasp: Quantumania.

Disney+ Remains an Anchor

In my view, the best way to rehabilitate both Star Wars and Marvel is to take a bit of a hiatus. In fact, the Star Wars prequels were universally panned upon release yet have gotten much nostalgia in recent years showing that franchises can be resurrected.

The issue though why Disney is unable to do something like this is Disney+. Getting into the streaming game requires generating massive amounts of content. The bulk of the original content released by Disney in the past few years has centered around Star Wars and Marvel.

Disney is stuck between a rock and a hard place. As their management is well aware that they have been putting out far too much below-average content. CEO Bob Iger himself has stated that “Marvel diluted focus and attention from fans by offering so many TV shows on Disney+.” The question then becomes how to generate content on Disney+ if the company starts pulling back on Marvel and Star Wars. How would streaming be affected amidst a slowdown of content?

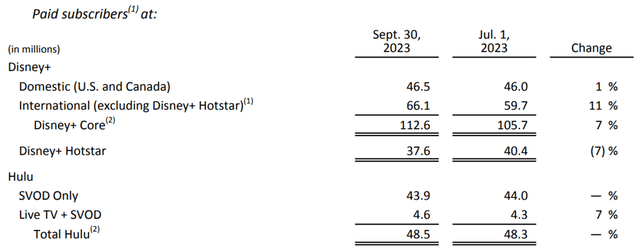

In fiscal 2023, the company reported that Disney+ had an increase of 7 million subscribers. However, digging deeper into these numbers, we can see that Domestic subscribers have stalled at approximately 46 million. Almost all new subscribers have come from international markets many of which had launched Disney+ only this year. Once the initial hype fades, we will need to see results in the next few quarters if it can sustain this momentum. Time will tell if Disney will be able to achieve its goal of streaming profitability in Q4 of next year.

Disney+ subscribers (Earnings press release)

Valuation and Key Considerations

Disney is currently trading at a premium and is not a cheap stock. According to Seeking Alpha’s Quant metrics the company gets a score of “D”. The company currently has a trailing twelve-month non-GAAP P/E of 25x which is almost double its sector median of 13x. Even on a forward basis, the company is trading at a P/E of 21.4x.

Disney valuation (Seeking Alpha)

Such a valuation is warranted, if you believe in the company’s growth story which is centered around its transformation from “traditional entertainment” to a streaming powerhouse. However, as discussed above there are pitfalls to that story as enthusiasm for its brands wanes.

It is my view that the company has mismanaged its most valuable IP by putting out too much below-average content. Disney management is aware of this though and has made steps to course correct. There are also activist investors such as Nelson Peltz and ValueAct who see the company’s valuable assets and believe that they can turn things around.

A management overhaul or drastic strategic pivot is a key risk to my bearish thesis and could ignite bullish momentum on DIS stock. I believe though that the damage has been done and that it is an uphill battle to regain fan enthusiasm. Due to these factors, I reiterate my Sell Rating on DIS stock.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.