Summary:

- Memories provide a different frame of reference in valuing DIS.

- DIS enthusiasts should not take overheated enthusiasm for the stock because of the great opening numbers for Inside Out 2.

- Too many DIS verticals are still holding back a strong upside ahead.

Jorgefontestad/iStock Editorial via Getty Images

Premise: Inside Out 2, Disney‘s (NYSE:DIS) sequel to a very successful Pixar release, went beyond expectations, logging a superb $295m in early global grosses out of the box. This is clearly great news for DIS and its loyal investors, who have endured a long stretch of the WBD trading ranges stuck in bearsville. Overall, industry-wide theater grosses so far this year have hovered at the edge of disaster, showing an average fall of 24% from its familiar roosts over time.

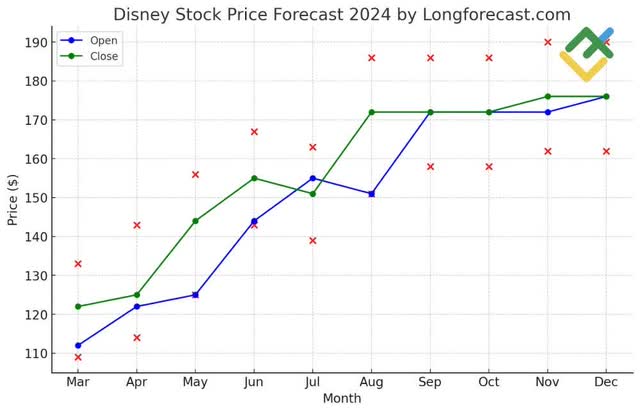

So IO2 was welcomed as perhaps a harbinger of better things to come this summer in that sector. It, with streaming subscription rises, seem to be the only results in earnings calls Mr. Market gets gaga over and moves the shares ahead. Pre-earnings, DIS shares had traded as low as $88. Post-earnings, largely based on the Q2’24 performance, are at $101 with some price targets in the $120 range. Is recovery to anywhere near its high at $200 beginning? We think it may be a bridge too far. Holders feel good, but questions persist.

So what is Mr. Market to think now? Well, the upsides of streaming subs are surely plus indicators. What contributed to the $1.21 Q2’24 earnings which provided an overall 8% jump, and 30% YoY rise? So if sequels will rule the grosses again this summer, DIS has them on its release schedule – that’s another bright light ahead. DTC revenue was up 13% with operating income at $47m vs a loss of ($587m) YoY.

Of all the results for Q2, this was the most hoped for by investors. Yet at the same time, we note that total corporate revenues for all of Disney were only up 1.2% YoY – to $22.8b. Digging a bit deeper, we find that total DIS upsides were due to price increases in streaming, experiences and other service lines.

That may show elasticity or not, but it is by no means a harbinger of a massive upside of the stock. In fact, we believe that the DIS story ahead needs to clear far more logic barriers to move it back to anywhere it traded pre-covid disaster. DIS has made a few good turns, but its road ahead is still filled with more potholes that investors may be seeing beyond the performance in Q2. Let’s take another road to test ride a recovery.

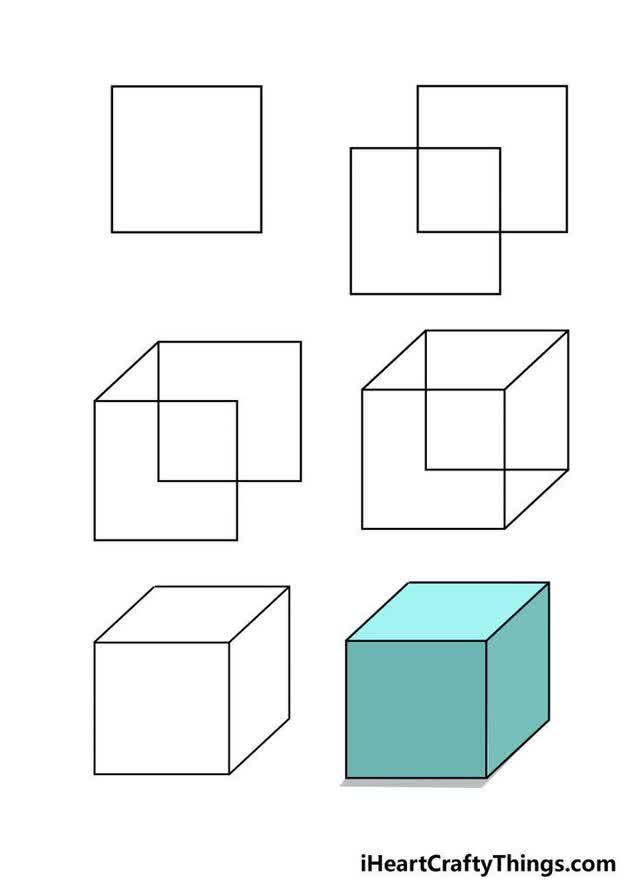

Above: This chart cannot pass the test of our “Logic cube” as presented by our professor in our grad school many decades ago. Flawed but enlightened.

The sealed cube logic test

Above: Too often people forget that a cube has six sides to seal.

At the Columbia grad school, I studied economic history. In a course roughly labeled Stock Prices vs. Economic Events, our professor shared a theory in progress. I believe he said early results proved surprisingly accurate. But presenting it as an unfinished work subject to wider testing, he warned it was best used among other more proven theories. He did say the sealed cube logic test had done well with large cap blue-chip stocks under challenge.

The central thesis he was working on was that you studied a stock in a deep dive, looking to construct it as perfect a cube (6 SIDES) as “bodyguards against bearish challenges” to the core logic. He noted as analogous the famous Winston Churchill quote describing the WW2 “bodyguards of lies” British Intelligence had constructed to shield its most prized secret, the solving of the German Enigma Code by locking a logical case inside. What he was in the process of constructing was a thesis on the stock that sealed off bearish challenges at the same time it proved its bullish case. The key: When its premises sealed off six sides, it was as near a perfect take on a stock as one could make. And, of course, the reverse when the cube said SELL.

So springing from Q2’24 DIS results as validating a sustainable bull case for the stock, you begin by closing each possible challenge to the sealed cube with a viable bullish conclusion based on fact:

Bottom panel: Is the stock’s liquidity questionable, short term, intermediate term or long term? The answer is no. Provide balance sheet as evidence.

Top panel: We have made the case by citing the overall incremental revenue gains for major verticals of the stock by noting Experiences gains, streaming increase subscriptions and a good start for theatrical releases grosses based on can’t miss sequels. The challengers are present in that those DIS verticals that have shown revenue gains report they come mainly from price increases. Bears disagree, noting that Disney Experiences’ results depend on attendance of families, specifically those with children in the golden DIS demographic age of 5-15 are not to be taken for granted longer term.

In fact, fellow SA contributor and former colleague Harold Vogel (CFA) has recently cited macroeconomic factors in SA he expects to play into the longer-term growth prospects of DIS Experiences. He noted that Disney Experiences’ results depend on total attendance of families, specifically those with children in the golden DIS demo age 4-12, with the mid-teen years next. Vogel’s research indicates that there could be a drop in the birth rates of that cadre ahead. He also noted that macro data suggests a strong linkage between DIS Experiences’ attendance and consumer incomes arc in the forward years. Vogel suggests this could presage a short term bearish take on the stock. This dents the cube’s assertions that DIS is a buy now stock.

1 Side panel: Overall governance issues: Central to the challenge mounted (and lost) by Nelson Peltz was his objection to the resolution of succession planning issues. He included the neglect in naming an Iger successor. Vogel has likewise pointed to that issue. But logic digs deeper in noting the composition of the BOD as well. There have been some changes, but the BOD remains fundamentally the same. It does not hold promise that core issues still confronting DIS that will continue keeping it from innovative structural movies that are long-standing obstacles to organic growth. Peltz also argued for these changes. This is a fundamental flaw.

2nd side panel: ESPN, the sports network, showed a 4% increase in revenue, but domestic was down (9%) while international was flat and Star India down (24%). The ESPN vertical has been an enigma under the DIS banner far too long. DIS has added a streaming vertical, a gambling partnership with Penn Entertainment (PENN) which commits the casino operator to $1.5b in marketing investment over ten years. Thus far, ESPNbet is fundamentally going nowhere in this already leader dominated (FLUT, DKNG) online sports betting market. IN Q2’24 revenue was up 4% from $3.733b to $3.866b. A lingering logic block from bears: Why hasn’t DIS sold or spun off ESPN?

Forbes latest estimate for the value of ESPN is $24b. Its subscriber base is down from last year by 500,000 continuing a bleeding of over 20m as it absorbed the pounding LINEAR TV has taken over 10 years and still continuing despite these fixes. Its Q2’24 Earnings release attribute the poor performance to higher college football production costs and lower overall system revenue.

Logic question: The ESPN brand is not what it once was considering the massive increase in sports programming. Yet, its reach in the 56m range can still be formidable for other owners The bull case for this side is built off the conviction that ESPN, once established as a top sports streamer, will more than pay off the corporate decision to keep it.

3rd side panel: Linear TV – There is a bull case that linear TV is headed for the dust in of history. Part of that conclusion is linked to the probability that few, if any, credible buyers would want it yet. It may be unsaleable, but could be spun off. This year’s presidential election will have big revenue gains, but after that, it is difficult to see why it remains in the corporate home. Both ABC and its cable units will remain strained. The bull case: Eventually, as streaming takes on more of the characteristics of linear (ad support and small subscription fees), linear will become more competitive.

4th panel: Financial moves: Presumed $60b invested on massive upgrade and modernization of Experiences, Parks, and Cruises while, at the same time, reducing operating expenses by $7.5b. Disney Experiences bear 70% of the burden of generating corporate EBITDA. So on the surface, a $60b investment makes sense over a decade. On basic group structure, the $7.5b savings promised is also a powerful indicator that DIS has long been a company widely overstuffed with bureaucracy, and lots of thumb twiddlers. So this reform was long needed and remains a logic plus.

So now the bull challenge to the logic cube: We see more than 2 logical bear challenges to keep the DIS bull logic cube predictive. This means, according to the professor’s early results, that the stock does not pass the iron logic test as there are too many challengeable assumptions breaking the seal.

Yet, we reviewed 20 DIS analysts tracking the stock pre and post Q2’24. We found 17 dominated by BUY and STRONG BUY guidance. But that may be at odds with our Logic Bodyguard’s conclusions which guides sell, or perhaps hold. Only when all six of the logic sides were agreed on a bull, bear or hold case was it selected for a move.

Our professor believed that when his theory both finds new support for the bull cases of analysts or penetrates the walls with bear challenges that do hold up its action time. He’d done trial studies with the logic idea and found that of five companies he’d thus far studied, two bull conclusions held up, and two bear ones likewise held up. In all cases, the conclusions disagreed with analysts calls within 90 days.

Note: I have reconstructed our professor’s in progress note from class notes now yellowed with age from more than50 years ago. I believe that while perhaps imperfect, they echo a different pathway to decision on a stock. I have stipulated that our professor said he was far from publishing the early results. I have searched the files and found no work in progress texts, both in the university and personal writings. I used them to awaken ideas about different thought processes in valuing the future of given stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

The House Edge is widely recognized as the only marketplace service on the casino/gaming/online sports betting sectors, researched, written and available to SA readers by Howard Jay Klein, a 30 year c-suite veteran of the gaming industry. His inside out information and on the ground know how benefits from this unique perspective and his network of friends, former associates and colleagues in the industry contribute to a viewpoint has consistently produced superior returns. The House Edge consistently outperforms many standard analyst guidance with top returns.

According to TipRanks, Klein rates among the top 100 gaming analysts out of a global total of 10,000.