Summary:

- The Walt Disney Company announced plans to invest up to $60 billion in renewing its Parks, Experience, and Products division.

- The expansion and enhancement of DPEP shows Disney’s aim to creating great guest experiences and removing the investor focus from streaming.

- Disney’s historic returns on park investments suggest a significant return on investment could be on the horizon.

P_Wei

The Happiest Place

There’s one thing that most investors can agree on: when companies announce large spending plans, the market can generally be counted on to react poorly. On September 19th, The Walt Disney Company (NYSE:DIS) made a large announcement as part of an investor summit at Walt Disney World that the company would expend up to $60 billion to invest in renewing its Parks, Experience, and Products division (known internally as DPEP), which, according to the 8K, includes:

expanding and enhancing domestic and international parks and cruise line capacity, prioritizing projects anticipated to generate strong returns, consistent with the Company’s continuing approach to allocate capital in a disciplined and balanced manner.

We have been bullish on the stock for some time, and our first take on this news only solidifies our thinking that Disney–with its cultural bedrock intellectual property and world-class experiences–is moving to a future less reliant on streaming and back towards its core competency of creating great guest experiences.

Some Ancient History

It seems like a lifetime ago (yet it was only January of this year) that activist investor Nelson Peltz of Trian Partners was vying for a seat on Disney’s board of directors after the ouster of Bob Iger replace Bob Chapek, which saw Iger return to the helm of the company.

At the time, Peltz and his firm published a lengthy slide deck in which they alleged that Disney had mismanaged its streaming business, that Disney’s M&A activity had put an anchor around the company’s neck, and that costs at the company had spiraled out of control.

Peltz eventually abandoned his fight for the board after meeting with Iger, saying that “Now Disney plans to do everything we wanted them to do.” At the time, we believed it to be unlikely that this was the whole story, but the recent announcement of the expansion and enhancement of DPEP seems to lend some credence to the idea that Peltz was, in fact, expressing his true opinion.

The Parks Are The Moneymaker

Let’s get the big one out of the way first: Disney bears will often point to the failed Star Wars hotel fiasco as evidence that the company has lost touch with what consumers both want and afford.

To be sure, the hotel was a major miss: it was far too expensive at a whopping $6,000 for a family of four, but (perhaps more importantly) it seemed, well… kind of boring. Guests could only engage in one experience (fighting for the First Order or the Rebellion), and the idea of being totally immersed in a world of Star Wars for days on end was likely to only cater to the most die-hard fans of the franchise, rather than a wide swath of prospective guests.

Not to mention the fact that Star Wars has become a bit of a lightning rod in the never-ending culture wars–a feature which, no matter which side you fall on, you can probably agree isn’t good for business. Further, given the older demographic that the newest shows and movies have targeted (while five-year-olds like Storm Troopers and Darth Vader, the most recent outings in the series have been more teenager and twenty-something oriented).

It is therefore good to hear reports that other franchises, then, are on the short list to appear at various parks and resorts (including Frozen).

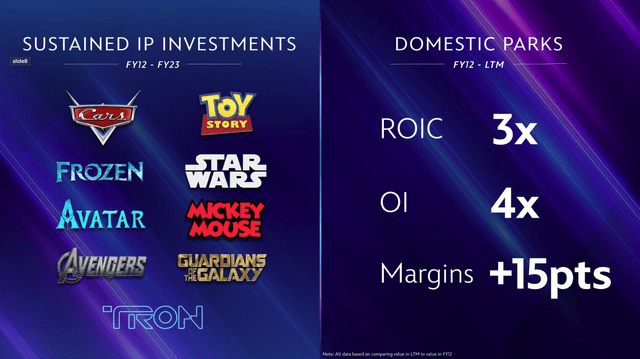

Given the historic returns that Disney has generated on its park investments in the past, there is ample reason to think that further improvements would generate a significant return on investment–up to 3x invested capital in the company’s estimates.

Across its properties both international and domestic, Disney estimates that it has up to 1,000 acres of land accessible for future park development, as well as an untapped market for park visitors of roughly 700 million.

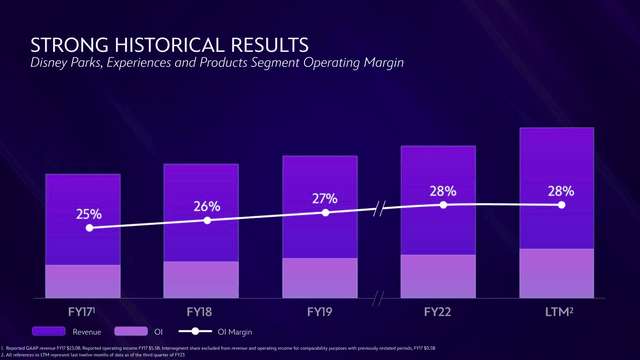

Further, the DPEP segment is–aside from being Disney’s main profit engine–a real cash cow. Operating margins in the segment have climbed by 100 basis points each year (excluding the pandemic FY20-FY21 years), posting a 28% operating margin which resulted in a $9.2 billion operating profit on an LTM basis.

Can They Pull It Off?

All of this is great, bears may say, but can Disney actually execute on this? After all, with DPEP posting $32.3 billion in revenues on an LTM basis, can a doubling of capital spending in the segment result again in a 4x rise in operating income?

While we, even as relative bulls, are optimistic on the stock, we think that 4x may be a little optimistic. Moderating forecasts down, however, does not negate the fact that the resulting boost to operating revenue would be significant (we would perform a more detailed analysis here, but the company did not provide a DPEP investment plan by segment to detail the Parks, Cruises, and Vacation Club allocation).

However, it does seem likely that, given park attendance and current inflation levels, that Disney has bumped prices to the natural limit, and so that lever is no longer available to pull. Boosting the park experience and making a visit more engaging and affordable for families (especially those with young children), now seems to be the main focus.

The Bottom Line

We are encouraged by the fact that Disney has moved from being embroiled in an activist shareholder battle in January of this year to now releasing a plan to re-invigorate its most profitable division. It once again reminds us that turnarounds take time, and that Disney remains in a turnaround effort is that is likely to last quite a bit longer. Therefore, we remain upbeat on Disney stock for the long term and will keep our eyes open for new details on the plan as they emerge.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Disclaimer: The information contained herein is opinion and for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities. Factual errors may exist, and while they will be corrected if identified, the author is under no obligation to do so. Author Is also under no obligation to update changes of view. The opinion of the author may change at any time, and the author is under no obligation to disclose said change. Nothing in this article should be construed as personalized or tailored investment advice. Before buying or selling any stock, you should do your own research and reach your own conclusion or consult a financial advisor. Investing includes risks, including loss of principal, and readers should not utilize anything in our research as a sole decision point for transacting in any security for any reason.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.