Summary:

- Disney’s stock has experienced a sharp recovery, outperforming the S&P 500 with a gain of over 22% from its October low, as the market turned too pessimistic in October.

- The company’s fourth fiscal quarter results showed strong performances in Parks and Direct-to-Consumer businesses, mitigating declines in Linear TV.

- Disney’s market leadership and cost-saving measures make it well-positioned for the transition of its TV assets. However, the return to its pre-pandemic glory is still a distance away.

- I explain why dip buyers who bought Disney’s October lows should remain vested, as they benefited from its remarkable recovery.

- With my contrarian thesis playing out, it’s apt to move back to the sidelines as we wait for another more attractive buying opportunity.

EnchantedFairy

I urged The Walt Disney Company (NYSE:DIS) investors not to give up in my previous update in October. I argued why it was my “top contrarian play” then. Therefore, the sharp recovery in DIS over the past six weeks didn’t surprise me, as DIS reached significant pessimism. Accordingly, DIS outperformed the S&P 500 Index (SP500) significantly, notching a price-performance gain of more than 22% from its October low through its late November high.

As a result, I believe it’s timely for me to provide another update, given the sharp recovery on whether it’s still appropriate for investors to add exposure at the current levels.

Observant investors should recall that Disney reported its fourth fiscal quarter or FQ4 earnings release in early November, beating Wall Street’s estimates easily on its bottom line. However, it missed its topline forecast slightly. Accordingly, Disney posted an adjusted EPS of $0.82, more than 15% above analysts’ estimates of $0.71. The company also posted assuring performances in Parks and DTC, helping to mitigate the secular decline in its Linear TV business.

Notably, Disney added about five million subscribers to its streaming services QoQ, driving a 12% increase in revenue growth for DTC. It was helpful as Disney registered a 9% decline in its TV business. Moreover, the remarkable performance in Parks and Experiences was notable, delivering a 30% YoY improvement in operating income, underpinned by broad-based growth “across all international sites, Disney Cruise Line, Disney Vacation Club and Disneyland Resort.”

Given Disney’s incredible scale as a wide-moat operator, I believe the market’s pessimism was overstated in October. Management demonstrated its ability to garner higher operating efficiencies, as Disney remains on track to achieve $7.5B in cost savings by the end of FY24. It’s a significant improvement on its original $5.5B target. In addition, Disney will rationalize its content spending further in FY24, reducing its estimates to $25B, down from FY23’s $27B and FY22’s $30B. As a result, I believe Disney’s market leadership and scale advantages have allowed the company to pull its cost levers in a big way to manage the secular transition of its TV assets.

In addition, Disney CEO Bob Iger highlighted recently that the company isn’t looking to offload its TV assets. As a result, it likely assured the market that Disney’s world-class TV assets are well-underpinned by ABC, ESPN, and Disney Channel. While its ESPN+ streaming service is expected to gain prominence over time, Disney’s legacy assets remain highly monetizable. The recent fervor over its sports betting partnership with PENN Entertainment, Inc. (PENN) isn’t expected to be highly accretive to earnings in the near term. However, it helps to consolidate ESPN’s ability to continue dominating the sports content market, improving the value delivery to its customers with the betting entry.

DIS remains priced as a growth stock, with a valuation grade of “D” and a growth grade of “A+.” As a result, management needs to meet its estimated free cash flow or FCF guidance of $8B in FY24, marking a significant growth inflection from FY23’s $5B estimates. However, caution must be heeded, as Disney’s FCF margin isn’t expected to recover to its pre-pandemic highs in the near term. As a result, I believe DIS could remain in an extended consolidation range unless the market is ready to re-rate it much higher.

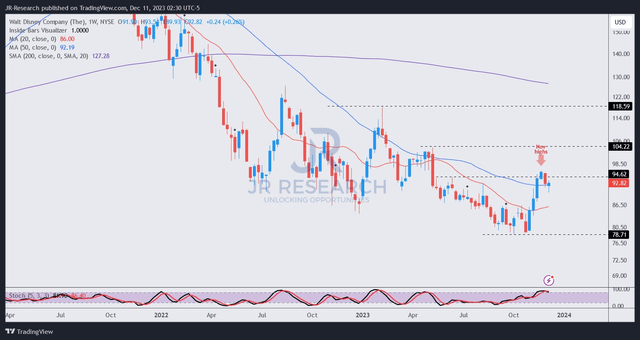

DIS price chart (weekly) (TradingView)

DIS’s price action has shown signs of caution over the last two weeks since it topped out at the $96.50 level. However, I didn’t glean red flags, suggesting dip buyers should remain invested and ride through the recent volatility.

While there could be near-term volatility leading to a potential pullback, I gleaned it should represent another buy-the-dip opportunity and not a more “malicious” falling knife scenario that could beset buyers.

With my recent contrarian thesis on DIS having played out as it surged, I’ve decided to move back to the sidelines as I assess DIS’s subsequent buy levels.

Rating: Downgraded to Hold.

Important note: Investors are reminded to do their due diligence and not rely on the information provided as financial advice. Please always apply independent thinking and note that the rating is not intended to time a specific entry/exit at the point of writing unless otherwise specified.

We Want To Hear From You

Have constructive commentary to improve our thesis? Spotted a critical gap in our view? Saw something important that we didn’t? Agree or disagree? Comment below with the aim of helping everyone in the community to learn better!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of DIS either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

A Unique Price Action-based Growth Investing Service

- We believe price action is a leading indicator.

- We called the TSLA top in late 2021.

- We then picked TSLA’s bottom in December 2022.

- We updated members that the NASDAQ had long-term bearish price action signals in November 2021.

- We told members that the S&P 500 likely bottomed in October 2022.

- Members navigated the turning points of the market confidently in our service.

- Members tuned out the noise in the financial media and focused on what really matters: Price Action.

Sign up now for a Risk-Free 14-Day free trial!