Summary:

- Disney’s financials are under scrutiny as the company’s profitability is in question, with costs growing faster than revenue and net income decreasing despite increased revenue.

- The future profitability of Disney’s segments is uncertain, with linear networks not generating the same revenue and earnings and potentially no longer being core to the company.

- Disney+ profitability could be achieved by the September 2024 target, but that will likely not be enough to offset the decrease in linear networks.

- I believe Net Income will recover from where it is now, but not enough to continue to merit a valuation of $160 billion.

Michael M. Santiago

Once upon a time there was a company worth more than $320 billion with huge prospects over its booming streaming service, expected demand recovery in its parks, film studios known for big blockbusters and, despite some headwinds, solid linear networks that could be considered reliable cash cows. That company doesn’t exist anymore.

Much has been said about Disney (NYSE:DIS) these past few months. Iger is back after less than three years of stepping down, the fight between Disney and the state of Florida, the recent flops in the box office, the slowdown of Disney+ subscribers, etc. You get the picture. However, the goal of this article is to review Disney’s financials and estimate if it will ever recover its past profitability or if what we are seeing now is here to stay.

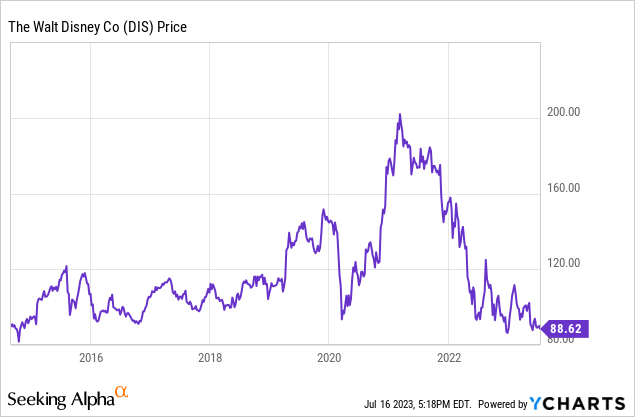

I’ll use the 2014, 2017 and 2022 full year financials in this analysis, mainly because 2014 was the first time Disney was valued at $160 billion (how much it’s worth now), 2017 was the last year without even a rumor about 21st Century Fox and 2022 for the most recent full year picture. Q1’23 and Q2’23 will also be shown as to give perspective of how the segments are evolving. So first, take a look at how Disney’s Market Cap evolved since the end of their 2014 fiscal year (September 2014):

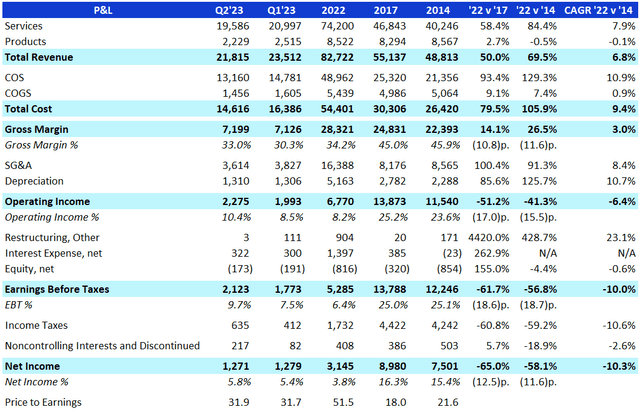

It pretty much went nowhere at a time when the company increased its revenue by 69.5% (6.8% CAGR). The problem is that if Revenue grew 6.8% CAGR, Costs grew 9.4%, SG&A 8.4% and Depreciation 10.7%. Even while increasing revenue by $34 billion between 2014 and 2022, it earned $4.4 billion less last year than 2014.

Disney’s P&L 2023, 2022, 2017 and 2014 (Disney’s IR, Author)

If the Net Income trend seen in Q2’23 and Q1’23 continues for the rest of Disney’s fiscal year, we are looking at a company that will generate $5 billion in Net Income (or ~6%) and, if market cap continues to be around $160 billion, that trades at more than 30 times earnings. This will not stick. If 6% is Disney’s new reality, then the stock is poised to fall and trade closer to a 15 or 20 times earnings (between $75 and $100 billion).

So the main question for any current or future investor in Disney is: will we ever see anything like those +15% of Net Income % from 2014 and 2017 in the short to mid-term? This article will claim that the most likely scenario is one where Disney will not be back to its +15% of Net Income. Something around 10% is my expectation for the short-term Net Income of Disney and that equals $9 billion. With a Net Income of $9 billion, Disney will not be able to sustain its $160 billion market cap as that would be equal to an 18 Price to Earnings ratio in a business with no clear prospects for growth. Disney is a sell.

Disney will likely not be as profitable as it once was

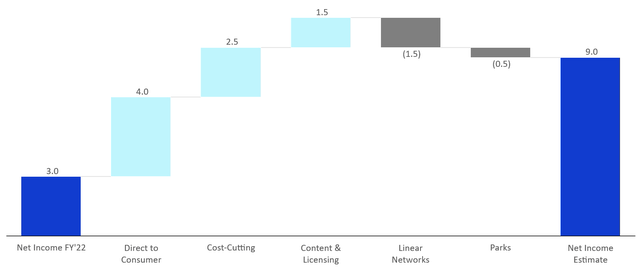

Using FY’22 as starting point, let’s understand how each of Disney’s segments will likely contribute (or not) to its profitability in the future. The main issue in my opinion is that all negatives related to Disney seem to be almost certain, whereas all positives seem to be very uncertain. You’ll get the picture once we deep dive on each of the buckets for the walk below.

Net Income Estimate Walk, in Billion (Author)

$3 billion is the approximate FY’22 Net Income. For the short term, I expect the segments Direct-to-Consumer and Content & Licensing, along with the cost-cutting initiatives, to have a positive impact in Net Income. On the other hand, I expect Parks and Linear Networks to have a negative impact. So if in the short-term Disney’s Net Income is closer to $9 billion and the market continues to value it at 18 Price to Earnings (same as 2017) then we arrive at $162 billion and that doesn’t give us a good margin of safety. Moreover, 18 is actually pretty bullish, so if the market takes a more gloomy view of Disney and values it at 15 Price to Earnings, then a $135 billion is definitely not attractive as it is lower than where it trades today.

Linear Networks

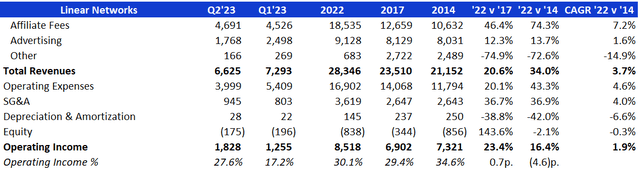

What was once a reliable cash cow is now a puzzle as to its future. Bob Iger just said in an interview to CNBC that the Linear Networks “may not be core” to Disney, leaving the door open to anything. In a similar fashion, Statista projects the number of US households with cable could be as low as 60 million at the end of FY’23, a drop of 40% versus 2014 (the first time Disney hit $160 billion in market cap, remember?). They also believe it could go below 50 million by FY’27. These subscribers will not be back and this means money lost in Affiliate Fees and Advertising for Disney. Plus, the households that are cutting the cord are switching to streaming and don’t forget that currently Disney’s streaming business is bleeding money. So the future doesn’t look so bright when you are facing a decrease in revenues in your best performing segment with +30% Operating Income and all your customers are switching to where you are currently losing 20% Operating Income.

Linear Networks P&L (Disney’s IR, Author)

My rationale for the $1.5 billion of Net Income loss driven by Linear Networks is not an easy one. It’s actually the toughest of the buckets in the walk. We will review the cost-cutting initiatives later on, but note that the initiatives amount to $5.5 billion and I only considered $2.5 billion here. That’s because $3 billion are related to non-sports content spending cuts and Disney didn’t provide any details if those $3 billion are coming from linear Networks or if it’s included in the breakeven plan for the Direct to Consumer segment.

Anyway, my high-level estimate is that part of those costs will be made in Linear Networks and we are likely to see a continued decrease in Revenue coming from this segment. If Disney loses ~12% in Revenue (it decreased YoY by 5% in Q1’23 and 7% in Q2’23) but maintains its 30% Operating Income, then it’s generating only $7.5 billion – or $1 billion less than 2022. That same $1 billion less in Operating Income can also be achieved if Revenue remains flat versus 2022 but Operating Income drops to 26%. One of the two scenarios is certain in my opinion and part of the other is very likely, so the $1.5 billion to me is the bare minimum we’ll see Disney losing from Linear Networks in the future.

Parks

There were no shortages of comments, articles and news these past few weeks as to how empty Disney was during the summer holidays, especially during the 4th of July. Being very straight to the point, Disney likely benefitted in 2021 and 2022 because it was able to capture a lot of pent-up demand for travelling as it was an open space, kid friendly and lifted its Covid mandates fairly early. Now that everyone has gone to Disneyland in the past two years and price hikes weren’t insignificant, I don’t think people are particularly looking for another trip to Disney.

Parks P&L (Disney’s IR, Author)

However, it’s tough to hide that the Parks segment had a great 2022 and numbers for Q1’23 and Q2’23 were definitely very good in terms of both Revenue and Operating Income. My rationale for the $0.5 billion loss in Net Income is because I do not believe Disney will be able to sustain both Revenue at almost $30 billion and Operating Income above 27%. Given these reports of empty parks, Disney will either have to appeal customers with discounts or lose traffic and thus Revenue. To lose $0.5 billion means that Operating Income will be 25% or that Revenue is down by ~8% vs FY’22.

Content & Licensing

I do not have any special insight about the quality of Disney’s next productions or if they will improve their distribution, lower their marketing costs, etc. What I know is that throughout the 2010s Disney was able to earn something between 20% to 30% of Operating Income rather consistently for this segment. Even if the last batch of movies hasn’t been good, it’s impossible to deny how good Disney’s IP is, especially now with the additions of X-Men, Fantastic Four and Deadpool in the Marvel Universe. Pixar could have another hit soon, as well.

So for a unit that consistently achieved around $8 billion of Revenue in the last decade, I do believe it’s likely they will generate 20% of Operating Income in the near future. In comparison to their 2022 performance where Content & Licensing barely broke even, a 20% of Operating Income in $8 billion gives us the $1.5 billion improvement in Net Income considered in the walk.

Cost-Cutting

This one is very much based on Disney’s plans to cut 7,000 jobs and $5.5 billion in costs. This is what the WSJ wrote about how these $5.5 billion are split:

The majority of the cuts—about $3 billion—will come from nonsports content spending, while about $2.5 billion will come from sales, general and administrative costs, the company said.

The $2.5 billion I have considered in the walk as improvement in Net Income coming from this initiative is just the SG&A portion highlighted in the quote above. The $3 billion in content spending that will be slashed are embedded in the Linear Networks and Direct to Consumer analysis.

Direct to Consumer

Finally we arrive at the future of Disney. Remember what I said, if your customers are abandoning the most lucrative business (Linear Networks) and replacing it for the least lucrative business (Direct to Consumer), the future will likely not be as bright as we think. Disney has stated that its streaming business will be profitable after September 2024. That could come from price hikes, higher advertising and/or cost-cutting. The price hikes for the United States were announced at the end of 2022, but that didn’t take the company much further in terms of ARPU globally. Note that Global Disney+ is the total of Domestic, International and Disney+ Hotstar, while Total considers Global Disney+, Hulu and ESPN+.

Disney’s Monthly ARPU by Streaming (Disney’s IR)

So despite a significant price increase in the Domestic market, Disney is still underpricing in International, probably due to its focus in growing the number of customers. There is also a drag on Disney+ Hotstar which, despite having customers paying a fraction of other markets, is watching subscribers abandon it due to the loss of the streaming rights for the Indian Premier League.

Disney’s ARPU is considerably lower than competitors in the Domestic market, as Netflix (NFLX) had $15.86 at the end of 2022, Warner Bros. Discovery (WBD) had $10.83 and Paramount+ (PARA) had closer to $9. A better pricing strategy needs to happen and there is room for it if we simply compare it with other streaming apps. However, the question if Disney will be able to increase it significantly remains, as customers will likely start to choose which streaming app they want to keep when all players are raising prices. I built a sensitivity analysis of how much ARPU would have to increase, taking into consideration how many users Disney could gain or lose, to meet the goal of breakeven by September 2024. If positive, that means it is generating positive Operating Income.

Disney+ Breakeven Sensitivity Analysis (Author)

With 231 million subscribers at the end of Q2’23, it looks like Disney would have to aim for something between $9.54 and $10.34 of ARPU until September 2024 to breakeven. That’s a minimum of 20% increase in ARPU based on the $7.95 at the end of Q2’23, but not all needs to come from price hikes since advertising revenue is still in its early stages and who knows how much it can generate in the long-term. All in all, despite a tough scenario, I’ll give that one to Iger and believe that he will achieve Disney+ breakeven by his target date and add those $4 billion in Net Income that I mentioned in the walk.

Final Thoughts

Finally, with that estimate of $9 billion Net Income confirmed in each of the sections of this article, I do need to rate Disney a Sell based on a future Price to Earnings of 15 (or $135 billion in market cap). A higher P/E was achieved in the past because the avenue for growth was big, but now the scenario isn’t as clear anymore and what we are able to see are several cracks in each of the segments. Again, I see the negatives for Disney much more certain than the positives. Investors who disagree with my analysis could keep a closer eye on the following:

- The downfall of Linear Networks may suddenly stop, although unlikely. Or, even with a downfall, Iger’s exit strategy might be better than the market expects.

- Summer of 2023 could have been just a hiccup for the Parks segment and the crowds will be back for 2024.

- Disney+ will not only breakeven but flourish after 2024 and be a very profitable division for Disney (especially if they get the ESPN+ strategy right).

However, don’t forget that Linear Networks is a big question mark today and my estimates of how much it could lose in Operating Income could be very conservative.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.