Summary:

- Disney controls an iconic brand but has struggled in recent years with mounting debts and the effects of the COVID pandemic.

- Disney faces tough choices trying to bring about coherence in their community after having taken initiatives on inclusion that were praised by some but caused backlash among others.

- The combination of uncertainty regarding Disney’s ability to recover to past levels of free cash flow and shareholder returns mean, I’m cautious at the moment.

skodonnell/E+ via Getty Images

The Disney brand & recent corporate events

The Walt Disney Company (NYSE:DIS) controls one of the most valuable corporate brands in the world. In a 2020 publication, Forbes ranked Disney the 7th most valuable brand in the world, with a brand valuation of $61.3 billion.

Later this year, Disney turns 100 years – and for all of those years, Disney has delivered iconic content that has meant something to generations.

Shareholders have generally prospered along the way:

In recent years, however, Disney’s stock price has suffered as the company has navigated through a deal to acquire 21st Century Fox and the aftermath of COVID:

In the wake of several moves by the company that has been described as “woke”, eventually being met with criticism from parts of the Disney community who identify as “anti-woke”, Disney sued Florida governor Ron DeSantis alleging that the governor had waged a campaign to “weaponize government power” over the company.

Whether from a political, moral or legal standpoint either party is right in the matter I will leave for discussion in another forum. But I do think some implications following this debacle have direct effects on shareholders – current and potential – and I will be highlighting some of the events here and my interpretation of them.

In May 2023, Disney launched their new version of “The Little Mermaid“, a top-budget production by Walt Disney Pictures. Sources have estimated that the film will need to make about $560 million at the worldwide box office to make a profit. So far, it’s made just ~$420 million in several weeks of running. Reviews of the film have been generally mixed or poor, with an average approval rating of 68 % among professional reviewers. Also, among certain parts of Disney’s community/customer base, the film encountered some harsh criticism.

On June 13, it was announced that Disney had decided to delay the upcoming “Avatar”, “Star Wars”, and “Marvel” movies, adding to Disney’s troubles to get back on track with their production pipeline.

Why is this important to shareholders? Well, because management is the curator of Disney’s brand – all $61.3 billion worth of it – that I spoke of earlier.

Other companies who also control valuable consumer brands have experienced similar cases of “consumer activism”. Budweiser (BUD) has seen sales decline since a marketing campaign sparked similar reactions in parts of Budweiser’s customer base, and a marketing executive was sent on leave. Mondelez (MDLZ) has continued sales in Russia following the war in Ukraine and was put on Ukraine’s “black list” of companies. While this is a much different matter, it sparked similar reactions from consumers and businesses. Particularly in the Nordic countries, Ukraine’s blacklisting has made some retailers of Mondelez’ products remove their goods from stores. What I think the Disney, Budweiser and Mondelez cases have in common is that they show how difficult contemporary ESG is: I believe all companies should help protect the rights of minorities. At the same time, if the company controls a global brand with a diverse following, a balance must be struck between progressive development and other parts of the community or customer base. At least, if management doesn’t strike a balance, shareholders seem to get hurt.

Disney’s balance sheet trouble

Speaking of balance: Disney has piled up a lot of borrowings on their balance sheet in recent years that – in my opinion – have benefitted debtholders at the expense of equity investors. In this regard, it’s important to remember that the capitalization of a corporation consists of typically two layers of capital:

By the end of 2022, Disney sat on ~$45.3 billion of borrowings. Disney’s debt had taken more than $4 billion to service for the duration of the year. This compares to free cash flow for the year of ~$1 billion of free cash flow, suggesting that Disney’s entire cash flow generation and then some is “eaten up” by debt.

With debt requiring all of Disney’s attention, equity investors are losing out. This is evident when looking at direct cash distributions to investors in recent years.

Disney had been buying back shares consistently for more than a decade and got their share countdown to ~1.49 billion when, in 2018, this practice stopped. This was to preserve cash for the acquisition of 21st Century Fox and the debt assumed from that deal. The dilution of existing shareholders then worsened because of COVID, and the share count is now up to ~1.83 billion shares. This means Disney has been diluting by an average 6.8 percentage points per year in the past 5 years. At this rate, it would take about a decade for the share count to double – or, in the eyes of a shareholder currently owning the stock, a decade before their stock would represent half the ownership it used to. The contractions caused by COVID had also caused Disney to cancel its dividend in 2020. The policy of not paying a dividend has been maintained since, and investors have not received a dividend payment since early 2020.

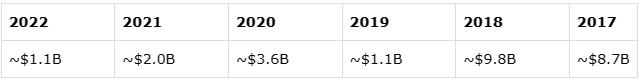

Of course, you could argue that Disney is in temporary trouble. Disney used to generate significantly more free cash flow pre-COVID and before the Fox acquisition. If Disney is able to return to such levels, perhaps investors would once again reap the rewards:

Free cash flow (FCF). Analyst’s presentation, data from Macrotrends.net

Total borrowings have decreased somewhat in the most recent years. This suggests that Disney wants to return to a “healthier” balance sheet and is prioritizing this. But returning to pre-COVID and pre-Fox merger levels will take a long time, as current borrowings are more than twice that of those levels:

Borrowings on balance sheet. Analyst’s presentation, data from SEC filings

In analyzing how and when Disney will recover to pre-COVID levels, I believe you have to factor in the circumstances I described in the first section of this analysis. It’s crucial for Disney to maintain their very large audience; all groups of it, that is. It remains to be seen if Disney can stabilize their community and their brand.

The viewpoint that Disney must stabilize their debt levels, free cash flow generation and community is underscored by the current valuation ratios ascribed to the stock. Disney trades at a current multiple of ~40x earnings and a forward P/E of ~23x. Either valuation ratio requires significant growth to be justified, especially with no cash returns. Besides, even if Disney does recover, the valuation ratios kind of suggest that the market is already expecting that rebound and has priced it in. If you believe in Disney recovering – and at the same time want to invest with a margin of safety – I would estimate a forward earnings multiple of 15x to be reasonable. This is the equivalent of asking a 7% earnings yield, which is low enough that you’re pricing in some growth but high enough that some growth will have likely not been paid for.

Key takeaways & conclusion

I’m rating Disney a Strong Sell because I believe the company has trouble it needs to work through before I’d be interested in buying. As debt investors are prioritized over equity investors, I would not want to enter – or remain in – the equity tranche of Disney’s capitalization at this point.

Aside from the mounting debt, Disney’s free cash flow – which is crucial in bringing Disney back to proper debt levels – has shrunk because of the effects of the COVID pandemic, especially the effects that the pandemic had on Disney’s crucial theme park business. Certainly, Disney’s balance sheet is “designed” for pre-COVID circumstances.

These troubles alone are sufficient to warrant caution. But even if you believe in the concept of mean reversion – the tendency of financials that are currently skewed to eventually normalize – I still think Disney has work ahead to restore cohesion in their community to maintain its brand. Also, Disney’s content pipeline is crucial in restoring prior free cash flow levels. At the moment, Disney’s content pipeline seems under pressure, with movie delays and poor reviews and box office performance from its latest studio production.

With no prioritization of equity shareholders (no dividends, no buybacks), free cash flow in decline and content under pressure, I don’t see investors benefitting anytime soon; they’re stuck in the mousetrap for now.

Do you agree or disagree with this analysis? Let me know in the comments below.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.