Summary:

- Disney shares have experienced a significant decline since March 2021, but recent price action suggests a potential buying opportunity.

- Volume indicators show that institutions and smart money are accumulating shares of Disney, indicating bullish sentiment.

- Momentum indicators, such as the Percentage Price Oscillator, indicate both short-term and long-term bullish momentum in Disney’s stock.

monsitj

In this article, I will outline why I think now is an opportunistic time to buy shares of The Walt Disney Company (NYSE:DIS). I will examine price action, volume, momentum, and relative strength using a weekly price chart. I will also identify a risk management strategy in case the stock goes against my thesis. Let’s look at the weekly price chart.

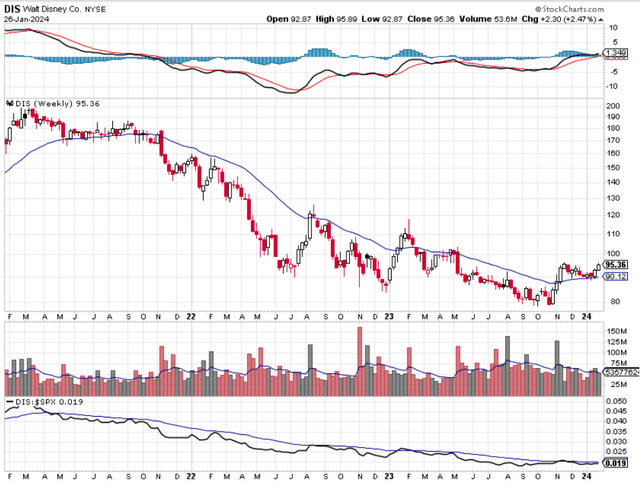

Chart 1 – DIS Weekly Price Chart with 30-Week Moving Average, PPO, Volume, and Relative Strength

www.stockcharts.com

Chart 1 shows the weekly price action of DIS since late 2020. DIS shares hit $202.36 in March 2021 and ever since then DIS shares have declined. Chart 1 also shows the 30-week exponential moving average (EMA) which I like to use as a medium to long-term moving average. After DIS hit its high in March 2021 there was no technical indication that the high was reached. However, there were some indications that you should’ve exited DIS, albeit not when the stock was over $200. For the eight months after DIS hit $202.36, DIS shares stayed above the upward sloping 30-week EMA, which I would regard as bullish. However, in September 2021 DIS shares closed below the 30-week EMA and that was a good sign to close a long position in DIS. Then in November 2021 the real decline began. Price closed below the low that DIS made in January 2021. Also, noteworthy, in November 2021 the 30-week EMA started rolling over. It was no longer trending upwards. It doesn’t make sense to own stocks that are below a downward sloping 30-week EMA. DIS declined to a low of $89.94 in July 2022. Then DIS rallied back to $126.07 in August 2022, but DIS couldn’t hold the 30-week EMA. It’s rare that a stock can stay above a downward sloping 30-week EMA for any length of time. DIS then went on to make a new low, a lower low, at $83.80 in December 2022. DIS rallied again to $117.80 in February 2023 which was a lower high compared to the high made in August 2022. You can see the series of lower lows and lower highs, which is the definition of a downtrend. A positive note on the rally to $117.80 is that DIS managed to stay above the 30-week EMA for five weeks. That indicated that the decline in DIS may be approaching an end. There was one more new low to be made, however. In October 2023 DIS reached its last low at $78.48. All told, DIS declined by 61% from its high in March 2021. It underperformed the SP 500 index during that time as well. Since then, I’ve seen bullish price action in DIS. In November 2023 DIS recaptured the 30-week EMA. More importantly, DIS has stayed above this EMA for the last 12 weeks. Another bullish sign is that the 30-week EMA has flattened out and is now sloping upwards. I like to own stocks that are above an upward sloping 30-week EMA. The last indication of bullish price action is that DIS rallied to $96.20 in November 2023. This too was a lower high, so it was nothing to get excited about. Yet the decline from there was noteworthy. DIS fell to $88.69 a couple of weeks ago. During this decline, DIS stayed above its 30-week EMA. If the price exceeds $96.20 without falling below $88.69 then a trend changed will be confirmed. DIS will then have a higher high and a higher low. The definition of a bullish trend. Right now, I like the price action of DIS. I think it’s bullish.

Volume looks constructive as well. Since August 2023 all the big weekly volume bars, black bars, are on weeks of rising prices. This tells me that institutions or smart money is accumulating shares of DIS. They will only do this if they think that DIS shares are undervalued at current prices. I think volume is bullish.

Momentum is on the side of buyers in DIS. The top pane of Chart 1 shows the Percentage Price Oscillator (PPO). This is a simple momentum indicator to understand. The PPO shows momentum in two ways. The most common way of showing bullish momentum is when the black line is above the red line. That is a short-term indication of bullish momentum. You can see that this condition exists now. The second way of showing bullish momentum is when the black line is above the center line or zero level of the chart. Right now, that condition exists. Note that this condition just occurred. The black PPO line was below the center line or zero level from October 2021 to December 2023. That long-term bearish momentum coincided with the long decline in DIS from about $170 to its last low at $78.48. I prefer to own stocks that are showing bullish momentum. Right now, DIS shows both short-term and long-term bullish momentum using PPO.

Relative strength is shown on the bottom pane of Chart 1. Beating the SP 500 index is hard to do, as I have mentioned before. To outperform the major index, you must own stocks that are outperforming the major index. This indicator is useful in this regard and is easy to understand. It is just a ratio of DIS to the SP 500 index. If the back line is rising, that tells you that DIS is outperforming the SP 500 index. Conversely, if the black line is falling, then DIS is underperforming the major index. You can see that DIS underperformed the SP 500 during DIS’s long decline. Now the relative strength indicator has flattened out and shows a slight upward bias. This is the only indicator in Chart 1 that doesn’t show an outright bullish indication currently.

Whenever I buy a stock, I like to have an exit plan in mind to protect my capital. Proper risk management allows me to preserve my capital and ease my mind. One way to preserve your capital is to say that if DIS closes below its 30-week EMA, you will exit the position and then reevaluate the situation. There is no harm in taking that stance. You can always get back into DIS a week or two later.

Another way to protect your capital is to have a stop loss on your position. A rule of thumb that I use is to not take a loss on a stock that is more than 1% of my account equity. In other words, if my account equity is $100,000, 1% of that is $1,000. I do not want to lose more than $1,000 on my position in DIS. So based on the closing price of $95.36 I would look for a price level that would show that my bullish thesis could be incorrect. The recent low as mentioned above is $88.69. If DIS closed below that level, that may be an indication that my bullish thesis is incorrect. So, let’s say we don’t want to own DIS if it closes below $88.00 to give it some cushion. The difference between buying at $95.36 and selling at $88.00 is $7.36. Take the $1,000 figure which represents 1% of the account equity or my maximum amount of money I am willing to lose and divide that amount by $7.36. That tells me how many shares I can buy of DIS, which would be 135 shares. Buying 135 shares of DIS at $95.36 is an investment of $12,873.60. I then put in a stop loss of $88.00. If my stop loss is hit, I end up selling my shares for a total of $11,880.00. That would be a loss on the trade of $993.60 or 7.71%. That’s not the outcome I want, but it’s not insurmountable either. I can make up that loss of 7.71% much easier than a loss of 15%, 25%, or 61% like the decline DIS had from March 2021 to its low in October 2023. I like to keep my losses manageable, so I always use a stoploss like the one described above.

In summary, DIS looks like a buy to me at current prices. It has bullish price action and is above an upward sloping 30-week EMA. Volume shows that smart money has been accumulating shares of DIS. Momentum is bullish in both the short-term and long-term. Relative strength shows a slight bullish indication, but it could be better. Lastly, if you take a position in DIS, I recommend using either a close below the 30-week EMA or a stop loss on your position to limit your exposure in the event my bullish thesis turns out to be incorrect.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of DIS either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.