Summary:

- Disney’s recent Q3 earnings beat expectations, with streaming businesses achieving profitability, despite a slowdown in the Experiences segment due to macroeconomic headwinds.

- I believe Bob Iger’s leadership and the strategic $60 billion investment in parks and cruises will drive long-term growth and profitability.

- Disney’s DTC services, now profitable, are poised for significant growth, leveraging premium IP and strategic initiatives like password-sharing crackdowns and bundling.

- With a promising film slate and historically cheap valuation, I rate Disney as a “Strong Buy” with a price target of $172.

Razvan

Thesis

I began purchasing shares of Disney (NYSE:DIS) last fall, building out a solid stake in the high $70s to low $80s range. I aimed to make the “Mouse house” one of my largest positions (+10% weight) but could only reach about 5% before the stock surged more than 50% in just five months. Earlier this month, Disney reported a strong Q3 earnings beat, exceeding top and bottom-line expectations and raising its full-year guidance. The impressive performance followed a summer of box office hits and included a long-awaited milestone: positive profitability from its combined streaming businesses for the first time.

Despite these excellent results, Mr. Market fixated solely on the slowdown in Disney’s Experiences segment, which had modest growth of 2%. Management’s outlook and commentary did little to alleviate these concerns, forecasting a near-term moderation in demand and exacerbating existing fears about a consumer slowdown.

So why am I running into what seems like a burning building when other investors are heading towards the exits? First, I view the slowdown in the Experiences segment as a result of macroeconomic and cyclical headwinds rather than a fundamental Disney issue. Second, I believe Bob Iger is a man on a mission who is determined more than ever to silence critics about his arguably failed succession. I think Iger is dead set on preserving his legacy as one of the greatest CEOs of our day and setting the company up for its next phase of growth before retirement in 2026. Lastly, Disney’s direct-to-consumer (DTC) services are finally in a position to take the baton from Linear and become the future growth engine of Disney, while the theatrical film slate is undergoing an extraordinary turnaround.

Taken together, I think now is an incredible entry point for long-term investors to acquire a generational company at a historically cheap valuation. Macroeconomic fears have created a “second bite at the apple” opportunity for investors, and I have been aggressively taking advantage. I am rating Disney as a “Strong Buy” and believe the iconic Disney flywheel is just beginning to gain momentum. Here’s why:

Trouble in paradise or cyclical headwinds?

Over the past few years, Disney’s experiences segment has solidified itself as the company’s crown jewel. In FY2023, it contributed nearly 70% of Disney’s total operating income, a substantial increase from 31% a decade ago. The company has leaned into the segment while overcoming the challenges of building out a profitable DTC service and hiccups in the theatrical slate, with some investors describing Disney as a parks business with a free flier on the rest of the portfolio. The experiences segment is more diversified than many might think, with domestic parks, including cruise ships, accounting for 60% of its operating income and international parks and consumer products making up the remaining 40%.

Since 2019, Disney’s experiences segment has performed incredibly well, with revenues and operating income nearly 30% higher as of Q3. A key driver of this outperformance was the post-COVID pent-up travel demand alongside fresh stimulus cash. Consumers can replicate many things at home, but one thing you can’t replicate is the thrill of a theme park filled with roller coasters. This is part of the reason for the surge in travel demand, especially for theme parks.

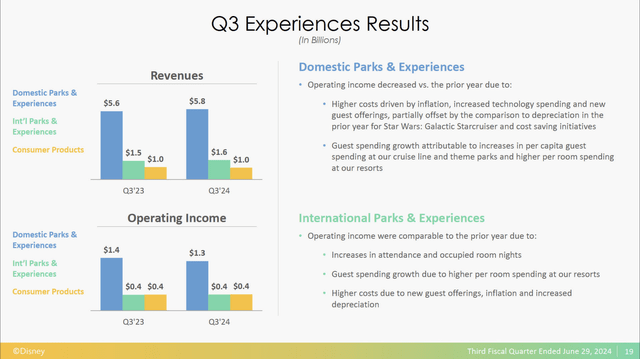

Fast-forward to this past quarter, Experiences revenues grew only 2% while the segment’s operating income decreased 3%. Management forecasted a “demand moderation” for the next few quarters and a single-digit decline in operating income for Q4. Breaking the results down by segment, we can see that cruises, international parks, and consumer products all delivered year-over-year growth, making domestic parks the problem child. The way I see it, the post-earnings sell-off was the market not only digesting the weak results, but also the fact that expectations got overly optimistic. Double-digit revenue growth was never a healthy, sustainable growth rate, and the sell-off simply reflected recency bias.

Now, there are two key reasons why I believe this slowdown in domestic parks is a temporary, cyclical headwind rather than a fundamental, Disney-specific issue. I would first point to the discretionary travel industry and what other companies are seeing. We first saw this when Comcast (CMCSA), Disney’s parks’ main rival, reported earnings in late July. Comcast reported a decline in both revenue and EBITDA for parks, alongside commentary about a post-COVID travel normalization. They also pointed out that given the strength of the dollar, many travelers have opted for cruises and international travel, which explains Disney’s strong results in both segments. Most importantly, CEO Brian Roberts said, “We still view parks as a terrific long-term growth business for us.”

Wait, a few quarters of cyclical headwinds and park demand weakness don’t spell the end of the world for Disney or Comcast? Well, folks, it doesn’t look like that’s the case. In reality, these temporary headwinds set both companies up for easier comps next year. Unfortunately for Mr. Market, he struggles to look that far ahead and grasp the idea of “temporary.” If you are a long-term investor, this lack of patience is something to be taken advantage of.

Enough of my rant; back to the facts. We also saw this soft outlook from prominent travel companies such as Airbnb (ABNB) and Expedia (EXPE). Brian Chesky, Airbnb’s CEO, warned investors, “We are seeing shorter looking lead times globally and some signs of slowing demand from U.S. guests,” and Julie Whalen, CEO of Expedia, highlighted that “We have seen a more challenging macro environment and a slowdown in travel demand.”

Going through these various earnings transcripts makes it abundantly clear and eye-opening: the issues Disney faces regarding domestic parks are cyclical, not structural. Success in parks ebbs and flows with the economy and consumer spending, as it always has. What I care about more is the following: What is Disney actively doing to dampen these cyclical headwinds and return to healthy, profitable growth faster than its peers? The answer to this question comes as a $60 billion check.

Doubling down on the Experiences segment

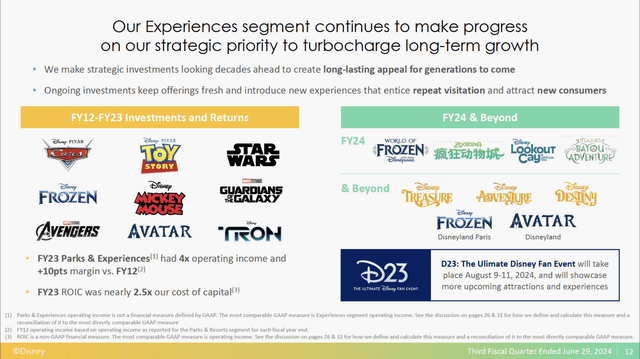

In September 2023, Disney announced plans to expand parks investment and double capital expenditures to $60 billion over the next ten years. Of this budgeted amount, roughly 70%, or $42 billion, will go towards new experiences in domestic and international parks, with the remaining 30%, or $18 billion, serving technology and infrastructure investments and maintenance.

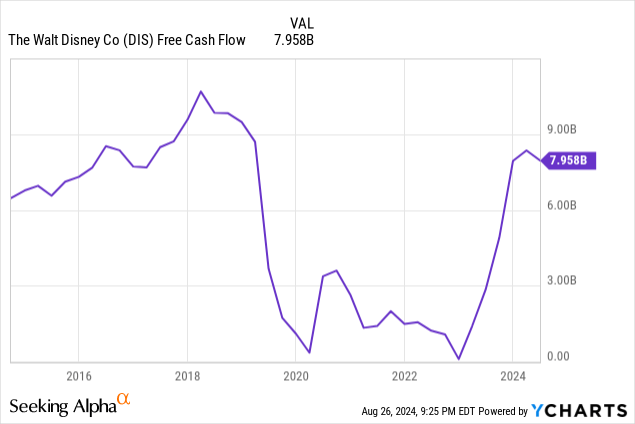

The plan to double down on Experiences makes a lot of sense, especially when considering the present circumstances and the high-return profile of the business. Free cash flow at Disney has been under significant pressure, falling from $9.83 billion in 2018 to a low of $1.05 billion in 2022. The main driver behind this sharp decline in free cash flow was the massive rise in content spend, increasing from $17.6 billion in FY2019 to a peak of $29.9 billion in FY2022. Upon regaining the helm, one of Iger’s strategies has been reducing content spend and cutting costs, guiding $7.5 billion in cost savings by the end of this fiscal year. As a result of this, free cash flow generation is expected to be around $8 billion for FY2024, giving management lots of freedom to reallocate investment focus. Naturally, the question becomes, where do we achieve the highest returns? The long-term return on invested capital of parks, which is said to be robust double-digit, made it the obvious candidate for investment. The decision to increase investments in the parks business looks even timelier when considering rival Comcast’s opening of their new park, Epic Universe, in 2025.

Investors were skeptical of these plans, which had little substance, until hearing the details at the recent D23 Expo. Josh D’Amaro, chairman of Disney Experiences, described Magic Kingdom’s largest land expansion ever, with new attractions such as a villain’s land, doubling the size of the Avengers Campus at Disneyland, and new Avatar attractions. There were plenty more details, which I urge you to read, but the main takeaway is that “this isn’t blue sky,” and these projects are already in motion. Disney has over 1000 acres of land available for development, and these new attractions and innovations will continue to reel in customers from the 700 million total addressable markets.

While these investments on land and at parks are exciting, I believe the investments made at sea, aka the cruises division, will be the ultimate needle mover. Disney has been in the cruise industry for almost 30 years, operating a modest five-ship fleet. The segment has been incredibly profitable for Disney, with a 98% occupancy rate during Q4 and double the revenue per passenger day compared to the industry average. Disney currently has four ships in development and, as part of the $60 billion investment, announced an additional 4 ships coming from 2027 to 2031. With a double-digit return on investment and an industry that, in the words of Carnival (CCL) CEO Josh Weinstein, has an “unprecedented level of demand for 2025 sailings,” this expanded fleet has significant earnings potential. Laurent Yoon, an analyst with Bernstein, projects the additional fleet has the potential to double the segment’s revenue to $5.1 billion by FY2026, while also more than offsetting any lost demand from Comcast’s Epic Universe.

While the next few quarters may remain under pressure at Disney’s Experiences segment, these are the things investors should welcome—a company redeploying investments from cash burning to hugely profitable businesses. Bob Iger and Disney’s management team would not be, in their words, “turbocharging” a $60 billion park investment if they were not bullish on its long-term trajectory. These investments signal a competent management group, not sitting back and waiting for the macro environment to improve, but proactively improving their business.

DTC: Disney’s future growth engine

“Embrace technology to the fullest and treat it as an opportunity instead of a threat.” This principle and a commitment to producing high-quality branded content led the board to select Bob Iger as Disney’s CEO in 2005. After reading Iger’s book The Ride of a Lifetime, it becomes abundantly clear that while the exact form of Disney+ was not foreseeable, his vision of creating an ecosystem of premium Content through years of acquisitions laid the groundwork for innovations like Disney+.

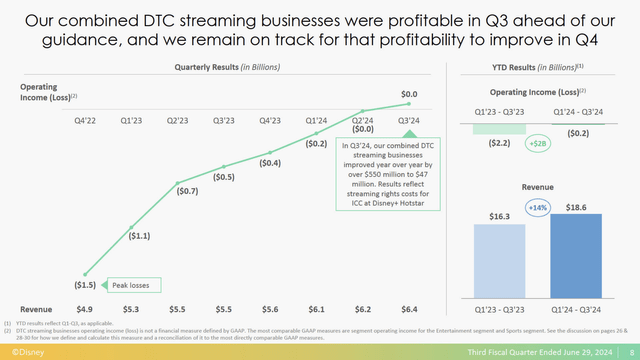

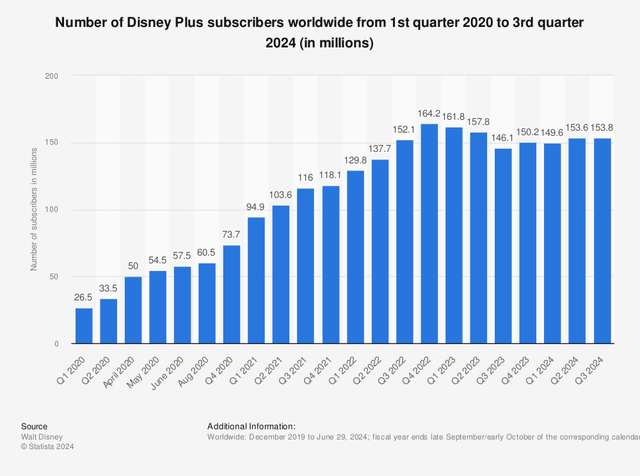

Going all in on Disney+ back in 2018 wasn’t an easy decision; it meant sacrificing hundreds of millions in short-term profits for a long-term vision, and remember, Mr. Market isn’t exactly the patient type… After five years and over $11.4 billion in total operating losses, Disney’s combined streaming businesses hit profitability. During Q3, Disney’s combined DTC steaming businesses generated $6.4 billion in revenues and achieved positive profitability of $47 million, one quarter ahead of schedule. Disney+ core subscribers increased 1% to 118.3 million, Disney+ Hotstar decreased 1% to 35.5 million, Hulu subscribers increased 2% to 51.1 million, and ESPN+ subscribers held steady at 24.9 million. Management expects profitability for both Entertainment DTC and ESPN+ in Q4 and modest growth in Disney+ Core subscribers.

With DTC streaming now hitting profitability, achieving an EBITDA margin of .7%, the focus shifts to its long-term potential. Netflix (NFLX), the industry gold standard, achieved EBITDA margins of 27.23% this past quarter. While I do not expect Disney to reach this level of dominance, a profitability path similar to Netflix’s 2016 to 2020 stretch, where EBITDA margins rose from 4.3% to 18.34%, is highly achievable. Although management hasn’t offered a concrete timeline, they consistently aim for double-digit margins, aiming to “well surpass” them over time.

I believe Disney can achieve a path to 15% to 20% margins even faster than rival Netflix, perhaps by FY2027. This belief is grounded in Disney’s main competitive advantage: premium IP Disney is like a tax for having children, and it is essential for the roughly 40 million households with at least one child across the U.S. and Canada. The incredible IP and trustworthy image that Disney has maintained is what gives the company such strong pricing power, evidenced by the consistent subscriber growth even against the doubling of subscription prices since launch.

Statista, Disney Investor Relations

Now, besides pricing power that no other competitor can match, management has outlined four initiatives that will drive Netflix-like margins over the next few years:

- Password sharing crackdown: Disney began its password-sharing initiative in June and said it would kick in “in earnest” in September. This move follows Netflix’s successful crackdown last year, which resulted in subscriber growth of 39.3 million over the next four quarters, compared to just 11.8 million the previous year. If Disney can monetize around 20 million of its 50 million password borrowers, it would generate an estimated $4 billion in revenue by FY2026.

- Bundling: Disney has the most diverse content library in the industry, spanning original Disney IP, Hulu, and ESPN. By bundling these services, Disney can leverage the large library of premium content to drive user engagement and significantly reduce churn. According to MoffettNathanson, the bundle of Disney+, Hulu, and ESPN+ has just 2% churn, one of the industry’s lowest rates, and consistently below the individual services. Disney continues to lean into the push for bundling by implementing price increases, as seen in the nearly 25% price hikes introduced earlier this month.

- Technology investments: Disney is taking another page out of the Netflix playbook, significantly investing in enhanced technology across its streaming platforms. Key investments include improved recommendation algorithms, personalized marketing, integration of Hulu and ESPN tiles to the Disney+ interface, and the addition of playlists. These enhanced features all share the common goal of boosting user engagement and creating a “stickier” product. This engagement reduces churn and drives greater demand for a best-in-class advertising business, as demonstrated by the 20% growth in Entertainment DTC advertising revenue during Q3.

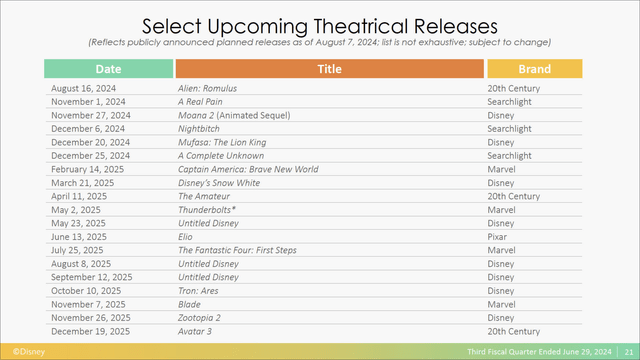

- Strong content slate: The turnaround at Disney’s studio is undoubtedly the most important driver for the DTC business and Disney’s long-term trajectory. Remarkably, this continued strength in Disney’s DTC businesses has emerged during what many view as the darkest days for Disney’s film and content segment in decades. In late 2023, “The Marvels” became the lowest-grossing MCU film ever. Pixar has faced its worst film stretch in years, with “Elemental” marking the worst opening weekend in Pixar’s history ($29.5 million), and there hasn’t been a Star Wars film in over five years. When Bob Iger returned to Disney, his message was to shift from quality to quantity, and his “roll up our sleeves” message at the studios is already showing results. 2024 has been off to a terrific start, with “Inside Out 2” achieving the highest-grossing animated film of all time ($1.65 billion), “Deadpool & Wolverine” reaching the highest grossing R rated film of all time ($1.21 billion), and films like “Kingdom of the Planet of the Apes” and “Alien: Romulus” performing well, grossing $397 million and $225 million respectively.

The upcoming film slate is lining up to be the biggest box office haul in years, with Bob Iger having this to say during the Q3 earnings call:

“We have Moana, Mufasa, Captain America, Snow White, Thunderbolts, Fantastic Four, Zootopia, Avatar, Avengers, Mandalorian, and Toy Story, just to name a few. And when you think about not only the potential of those in box office, but the potential of those to drive global streaming value, I think there’s a reason to be bullish about where we’re headed.”

As Iger mentioned, the impressive film slate has significant potential to boost streaming value, a trend already reflected in the Q3 earnings report. Last quarter, the original “Inside Out” led to over 1.3 million new Disney+ signups and generated more than 100 million views globally, with “Deadpool” driving comparable demand. I expect this momentum to continue, with “Moana 2” set for a Thanksgiving weekend release and the original “Moana” being the most streamed film in 2023.

Valuation

Rather than building an overly complex model, I opted for a quick and easy sum-of-the-parts model for Disney. For such a complex company, this valuation is surprisingly straightforward and does a great job of highlighting how silly the current valuation really is.

In FY2023, Disney’s Experiences segment alone generated $8.95 billion in operating income, accounting for nearly 70% of the company’s total EBITDA. Using the segment’s year-to-date operating income and management Q4 guidance (mid-single-digit decline in Experiences EBITDA), I forecasted an operating income of roughly $9.3 billion for FY2024. Applying a 15x EBITDA multiple would result in a market value of $139.5 billion, or nearly $77 per share. This essentially implies that today’s valuation assigns little to no value for Disney’s DTC businesses, Linear Networks, including ESPN, and Content/Premium IP.

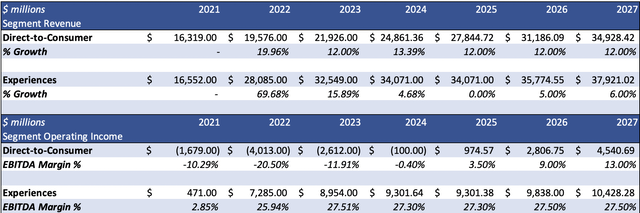

Disney IR, Author’s Calculations

I created a fairly simple three-year model focusing solely on the Experiences and DTC segments. I forecasted a 12% sequential growth rate from FY2025 through FY2027 for the DTC segment. Considering the incredible upcoming film slate and various other initiatives previously discussed, this top-line growth looks increasingly conservative. I forecasted DTC EBITDA margins to reach 13% in FY2027, consistent with management’s guidance of double-digit margins and similar to analyst expectations. Using a 3x Price/Sales multiple on estimated FY2027 revenues of $34.9 billion, less than half of Netflix’s 8x multiple, gives the segment of valuation of $104.8 billion, or $57 per share.

For the Experiences segment, I forecasted flat revenue and EBITDA growth for FY2025. This flattened growth is likely conservative but takes into account management’s expectations of soft demand in the coming quarters. I projected a return to modest growth of 5% and 6% in revenue, respectively, for FY2026 and FY2027. This top-line growth is likely conservative given the increased investment in parks, expanded cruise fleet, and strong consumer product sales driven by successful upcoming films. By maintaining flattish EBITDA margins through FY2027, we land at an estimated operating income of $10.43 billion in FY2027. Applying a 15x EBITDA multiple values this segment at $156.4 billion, or $86 per share.

Adding the values of both the DTC and Experiences segments results in a share price of $143, implying a nearly 60% upside from current prices. While this makes the current valuation already look attractive, it becomes even more compelling when considering the value of Linear Networks and Content.

Even though Linear Networks will likely continue to decline over the next few years, this segment generated nearly $6.5 billion in operating income during FY2023 and shouldn’t be ignored. Assuming profits do, in fact, decline to $4 billion by FY2027, applying a conservative 8x multiple would value the segment at $32 billion, or just under $18 per share.

Despite recent struggles in the content business, the segment has shown promising signs of a turnaround in 2024. With the upcoming film slate over the next few years, it should return to strong, profitable growth. During FY2018, the segment achieved roughly $3 billion in operating income. Assuming content can return to just $2 billion in EBITDA by FY2027 and by applying a 10x multiple, the segment would be valued at $20 billion, or $11 per share.

Combining all these valuations results in a three-year price target of $172, nearly double the current share price. This is a conservative base case scenario, with considerable upside potential from multiple expansion and the likely return to consistent share repurchases.

Risks

While I am highly optimistic about Disney’s long-term bull case, it’s always important to consider potential risks to my thesis:

- Consumer slowdown: Disney is particularly vulnerable to fluctuations in consumer spending and discretionary travel, especially within its Experiences segment. Any prolonged downturn in consumer spending could significantly pressure Disney’s revenues and profitability

- Challenges in DTC businesses: Despite management’s guidance for double-digit margins in the DTC segment, achieving and maintaining this level of profitability is far from guaranteed. Failure to reach healthy profitability would be a major blow to my long-term bull case.

- Continued underperformance in Content: Although the upcoming film slate looks promising, strong box office results are not guaranteed. Continued underperformance in content poses significant pressure on Disney’s long-term trajectory.

Bottom Line

Back in 1957, Walt Disney sketched out the renowned Disney flywheel, with theatrical films at its core. When Disney’s film studios are thriving, the entire company feeds off the success, a pattern that can be observed since its inception. Success from film studios and the beloved IP that is created is what fuels all of Disney’s businesses, from parks to cruises to Disney+ subscribers.

With a turnaround at the film studios now in full effect and showing promising signs in 2024, the flywheel is beginning to spin yet again. Thanks to temporary macroeconomic headwinds at domestic parks and Mr. Market’s impatience, investors have the ability to purchase this generational company at a historically cheap valuation. I rate Disney as a “Strong Buy” with a price target of $172.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of DIS either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.