Summary:

- Disney stock is down after the proxy battle. The pullback offers a bargain opportunity to invest.

- Movies are back on track after a lackluster year (for Disney).

- Diversification allows other parts of the company to support struggling areas. This will smooth earnings when movies or streaming hit a profit bump.

- A fair chunk of the linear business is also managed by the same administrators who manage the streaming business. The overall objective is to grow the combined business.

- Most of the parks business is at record levels and the cruise ship business is booming as well.

JHVEPhoto

Disney (NYSE:DIS) stock is down after the proxy battle. That probably makes this a time to consider either adding to a position or initiating one. As the last article noted, the proxy battle win was important to keeping a unified and experienced team at the helm. But also, it was very likely that management had already resolved a lot of issues that caused the battle in the first place. Now the news is pouring in that movies are back on track after a lackluster year by Disney standards. This appears to go along with the idea that the rest of the business is doing unexpectedly well by market standards. That would imply some strong earnings and cash flow comparisons lie ahead, which would be very good for the stock price.

Movies

When movies hit a speed bump, there was an assumption that the whole company had a problem. But as Bob Iger, CEO, noted, other parts of the company continued to do well to help pick up the pieces and gain in importance until movies found their footing again.

As a side note, this is one of the advantages of Disney diversification and ownership of franchises. Other parts of the company can “carry the load” until a struggling area of the company gets going again.

Now, about a year after everyone in the comments section of my articles stated Disney had “had it,” the movie division has a billion-dollar theater ticket revenue producer in the form of the Pixar movie “Inside Out 2.” It may be Pixar’s biggest movie ever because it set an animated fill record for ticket sales, and it still has more sales to go.

This points out that the comments section of my articles accurately reflected the market perception that the “misses” would continue and Disney would not have another blockbuster for years to come.

Instead, what’s happening is what was highly likely to happen. That’s the Disney had a few creative misses, but the minute it happens, management will fix the issue going forward. It’s very possible that some experimental things for potentially future use were part of those perceived “misses” because creativity is one of those skills that needs to keep coming up with a new experience. Audiences get tired of the “same old thing.” But that new experience will invariably include some mediocre results or even a bomb or two along the way.

Now there’s a “Deadpool” movie on the way that’s garnering a lot of interest (and potentially movie ticket sales as well) besides a “Planet of the Apes” movie that did reasonably well also.

The third quarter results and likely the fourth quarter results could well beat expectations, as this company has a fiscal year that ends in September (or sometimes Oct. 1).

Any studio is going to have periodic disappointments. But here, the diversification can keep reasonable earnings and cash flow going until the creative part of the movies business again hits its stride. There was really no need to make any more out of the situation than that.

One thing to keep in mind was that had something been seriously wrong, it would have taken three years to fix that because movies often take about three years to make from “start to finish.” Obviously, things turned around far faster than that, which implies that the creative part of the company was not that far off from where they should have been.

Streaming

Another bear point of contention was the streaming business. It is still a hot area to dispute. But just about any business strategy book like Michael Porters “Competitive Strategies” will tell you that large companies often go for market share first and profits second.

Bob Iger, CEO, recently stated (in the latest conference address referenced at the beginning of the article) that they tried to make too much content and quality went out the window in a number of places (including movies?). The company was not earning an adequate return on that “too much content” and therefore cut back the amount of content while attempting to raise the quality of the reduced content offered.

Keep in mind that the streaming business was relatively new to the company. Therefore, the fast growth was almost by definition not profitable growth. Profitable growth had really yet to be determined.

That means that growth was “attacked” from two angles: Content costs and profitable subscriber growth. The latest conference call mentioned both, as well as sharing of streaming content (where the crackdown on this will begin soon) and subscriber churn.

Left unsaid were the effects of a return to profitability responsibilities to a previous method. That means that profitability for content probably decided the strategic use of the content (such movies or streaming first, television last, and Hulu or Disney+ somewhere in between) while making the content. In essence, the content creator decided the delivery strategy while reviewing all the possibilities. It’s an old idea that now incorporates streaming as part of the equation.

Any company that enters a new business has to learn what’s needed to make it successful. Disney management now has the experience to come up with a future plan that’s likely to prove more profitable than the initial venture that essentially went for market share.

But those future plans may not align with Mr. Market’s thinking. Mr. Market likes things done “yesterday.” But aligning content spends with lower subscriber churn and password sharing could well bring a couple of years without much subscriber growth until the formula is perfected. Disney could well concentrate on the bottom line first. No sense growing a business that does not offer a sufficient return on that business.

Furthermore, the entertainment business is such a huge business that no one really has “cornered the market” or controls enough of the market to be a threat. Instead, this part of the entertainment business largely depends upon a quality experience to encourage any customer or user to return and keep using the product.

There has been talk about companies such as Netflix (NFLX) being so far ahead that it may control the market. But that’s not how it works when it comes to entertainment. Even Disney, which has sports and joint ventures for gambling on sports online (and much more) is not in a position to “corner” anything close to most of the entertainment opportunities available. It’s likely that it’s far better to look at this as a highly fractured market where no one entity has a significant market share and barriers to entry appear to be low enough to allow more competition in the future.

The fact that Disney has survived in the entertainment business for roughly 100 years is noteworthy because the business seems to have an extremely high turnover rate.

Parks And Ships

Bob Iger, CEO, mentioned that parks were largely having record attendance. The ships were likewise keeping pace with this as three new ships are being built. So far, both of these businesses would appear to be long-term growth businesses.

The movies and the parks are really the bulk of the profitability for the company. Both cruise ships and streaming are relatively new ventures. While the market may fret over streaming, the bulk of the profitability is still in some very old lines of the business.

Furthermore, management appears to be proceeding with the idea that the parks and cruise ships business will be around for a long time to come. Therefore, the main idea is to keep the parks’ profitability top-notch while gradually growing the cruise business (at least for the time being).

Television

Interestingly, the established television business is being managed by the same administrators who are also managing streaming. There was some discussion about transitioning ESPN to streaming while not ignoring the older established linear business. It goes without saying that the opportunity to do so elsewhere either does or may exist. This goes back to the original idea of content creation and multiple channels of delivery strategy mentioned earlier. But it’s a relatively new idea here.

The linear business is seen by many as a cash flow business that could be around a very long time. Therefore, the managers in charge of this business have the directive to grow the overall linear and streaming business. It’s not just about the decline of traditional television as much as it is about the overall growth of the business.

I have long believed that what’s now a linear business will in some forms migrate to streaming. Already there are streaming packages offered that mimic cable packages. Maybe not as comprehensive, and certainly more expensive for the options offered. But it’s a start that “streaming packages” will be the “cable” of the future.

Similarly, advertising has now crept into these streaming packages. This makes it look like streaming is simply another way to get content to viewers. Maybe at some point, other options will disappear. But for the time being, Disney is largely combining the management with an overall directive to grow the business.

Bob Iger gave an example at the latest conference how some linear programming now goes to Hulu. It may not always be that way. But for the time being it works. Evidently, the audiences do not overlap (for the most part). Doing this was a profit increasing venture.

Summary

Disney has a major entertainment juggernaut. Even ESPN is widely regarded as a major sports business. It has nothing to do with the rest of the company (in terms of Mickey Mouse, for example). But it can be its own profit center for years to come.

The company hopes to grow revenues by double digits annually in the future for as long as it can. That will likely at some point change to single digits.

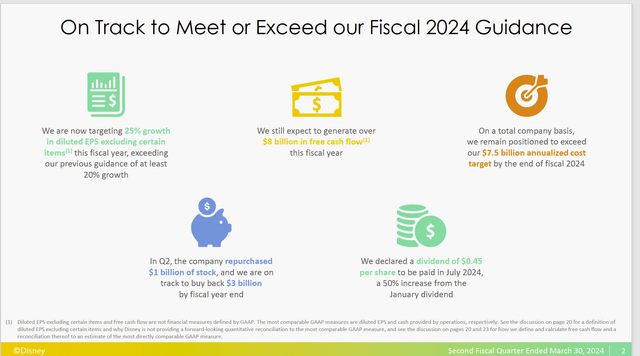

Disney Fiscal Year 2024 Guidance And Progress (Disney Second Quarter 2024, Earnings Conference Call Slides)

Despite the fact that Disney has several contributors to income, the market seems to be pricing the stock solely based upon movie success and streaming growth (with a probably growing emphasis on streaming profitability).

The whole idea that the creative part of the company focused upon hit movies and hit streaming or television shows is a necessarily “hit or miss” process seems lost on the market. Evidently, this company needs to have major hits with every attempt.

The record of the company is to have a lot more hits than misses. There’s no reason to not expect that record to continue in the future. Therefore, the time to invest in a company like this is one is when a perceived “down period” strikes. Right now, there appears to be one ending. Therefore, the stock is likely to recover to old values and then go higher as management intends to grow the business more.

More importantly, there are other parts of the company, like ESPN and the parks (and recreation business) that will make money during times when movies and streaming do not. This should smooth the earnings bumps that the market believes will happen when movies do less than expected and streaming is not up to expectations either.

The stock remains a strong buy now that movies appear to be on their way to a year that Disney is known for. Similarly, streaming is no longer running up huge losses, even though the way to adequate profitability could well be bumpy as management continues to learn more about the business.

This is a business that was a known cash generator in the past. It will likely be known for that in the future.

Risks

The movie business can at any time have a series of movies that perform below market expectations. That may at least temporarily change the outlook for the stock price.

The streaming business still has to show a history of adequate profitability. While that future success is likely, it’s far from assured.

Bob Iger is a key person for whom an adequate replacement has yet to be named. He’s not getting any younger and Disney cannot afford another CEO disaster, as just happened to lead to Bob Iger’s return.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of DIS either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Disclaimer: I am not an investment advisor, and this article is not meant to be a recommendation of the purchase or sale of stock. Investors are advised to review all company documents and press releases to see if the company fits their own investment qualifications.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

I analyze oil and gas companies, related companies, and Disney in my service, Oil & Gas Value Research, where I look for undervalued names in the oil and gas space. I break down everything you need to know about these companies — the balance sheet, competitive position and development prospects. This article is an example of what I do. But for Oil & Gas Value Research members, they get it first and they get analysis on some companies that is not published on the free site. Interested? Sign up here for a free two-week trial.