Summary:

- Disney’s stock has stagnated, increasing only 6.02% over the last decade compared to the S&P 500’s 186.94% gain, disappointing long-term investors.

- The company is challenged to match growing consumer expectations with compelling new content, overcoming difficulties in certain segments.

- There are optimistic developments, though, that give consumers and investors hope for Disney’s ability to get back on track.

- With the profitability of the DTC business nearing, expanding franchises, and sports gaining momentum, the demand for stock after earnings might be high.

Lazaros Papandreou/iStock Editorial via Getty Images

Disney’s Stagnantion

Walt Disney (NYSE:DIS) – the company and the brand that shaped hundreds of millions of lives has been facing challenges for quite a while. A failed succession of the beloved CEO Bob Iger, controversial decisions of his successor, a dividend suspension, and finally profitability struggles resulted in a fall out of favor among customers and eventually, investors. Although the financial metrics and the business’s overall health have been decent, the stock price has gone nowhere over the last 10 years. Investors who put their money into the company and have held it to this day must be disappointed with the minuscule returns. While the S&P 500 (SPY) index has gained 186.94% over the last decade, The Walt Disney Company’s stock price increased by a mere 6.02% in the same period.

Disney’s films and products have entertained families all over the World throughout the decades. In recent years, millions of households welcomed the new form of experience through the company’s streaming platform. Disney+ was booming, becoming a serious competitor to the Netflix (NFLX) library. Yet, Disney’s new revenue stream stagnated, encountering a decline in subscribers in recent quarters. There are optimistic developments though that give consumers and investors hope over Disney’s ability to get back on track and continue to be the golden standard of entertainment for families and children. Investors, on the other hand, want to know if the business will remain the entertainment powerhouse, find new ways to generate revenues, and grow for the years to come, generating ample returns for its shareholders. More clarity on this matter should come very soon. In less than two weeks, Disney will release earnings for FY 2024. Investors are reviewing their estimates ahead of the event. While expectations aren’t high, some key aspects will matter and may influence the stock price in the midterm.

Disney’s Issues

First, the eyes are turned to the Direct-to-Consumer (DTC) segment, where Disney remains in a transition phase as it shifts to streaming. As with many DTC platforms, the initial stages have come with operational losses, and Disney has held back some content from streaming to slow the erosion of its traditional Linear Networks. Although challenges for both business parts were supposed to be only temporary, difficulties have persisted.

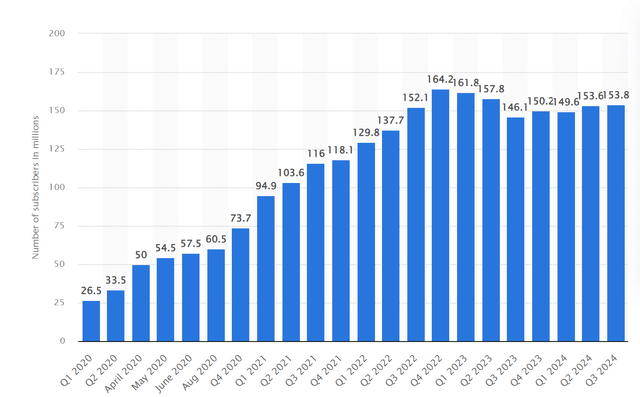

Regarding Disney+, the company first lowered its goal of reaching 230-260 million subscribers by 2025. The guidance was ambitious and set during the boom of new viewers storming the platform in months of the pandemic. Shortly after lowering the estimate by 15 million, it became clear that this target was also overly optimistic. Just between Q3 and Q4 2023 approximately 1.3 million subscribers left the platform in the wake of the price increase. Although this decline represents only about a 1.2% reduction in the overall subscriber base, it underscored a critical issue for Disney’s growth model, which depends on attracting new subscribers every quarter. This drop also highlights consumer resistance to rising subscription costs, as fewer customers are willing to pay the increased rates.

Disney+ Subscribers excl. Disney+ Hotstar (Statista)

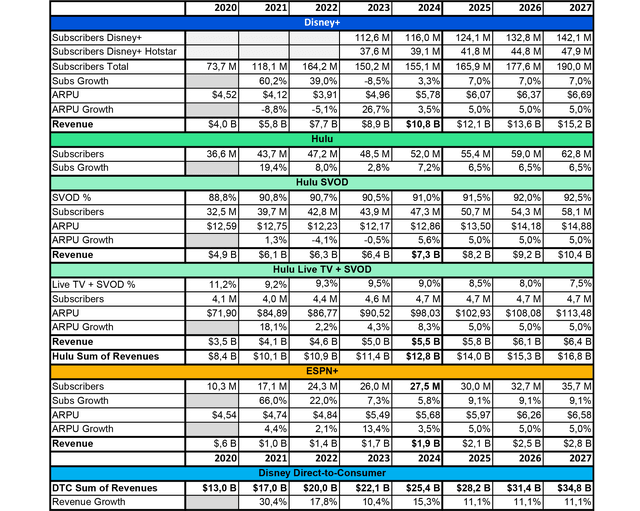

With 153.8 million Disney+ subscribers worldwide, the viewer base is a staggering 61.2 million short of the lower range from the adjusted guidance. The company set the bar low in the previous quarter and forecasted a modest Disney+ growth in Q4 2024. With that in mind, investors may expect the following numbers where revenue for the combined DTC streaming businesses, which include the Direct-to-Consumer division within the Entertainment segment and ESPN+ under the Sports segment, are expected to be as follows:

DTC Revenues and Growth Estimates (Author (Data: Disney))

The increase in the Disney+ subscriber base may remain muted, especially in the short term, after the company introduced another price hike in 2024.

- Disney+ (with ads): $10 per month (increased from $8)

- Disney+ (ad-free): $16 per month (increased from $14)

- ESPN+: $12 per month (increased from $11)

The average monthly revenue per paid subscriber for Hulu service experienced a dent in recent years. However, the trend is reversing based on the last several quarters, driven by higher advertising revenue.

ESPN+, like Hulu, will hit the subscriber target originally set on Disney Investor Day 2020. The service is expected to end FY 2024 with 27.5 million viewers, generating $1.9 billion in revenue annually.

In conclusion, regarding the DTC business, the services will likely have generated $25.4 billion in total sales for the year. Assuming moderate growth, this number is expected to increase to $34.8 by 2027, which corresponds to an 11.1% growth CAGR.

In late 2023, Disney+ lost subscribers following a price hike, though it might regain numbers through further integration with Hulu, which has consistently grown to 51.1 million subscribers in Q3 2024. With newly raised prices, the question remains whether Disney can match growing consumer expectations with compelling new content. ESPN, on the other hand, continues to be a powerhouse in sports programming and distribution, though its influence has waned as pay-TV declines and cord-cutting accelerates. A shift to offering ESPN’s linear programming via streaming seems likely soon, especially as ESPN still attracts major sports leagues and talent.

Disney’s Entertainment segment, including various cable channels, also faces headwinds from declining linear viewership. On the bright side, Disney’s film and TV studios, franchises, and content catalog strongly position Disney+ and Hulu for being in the green, potentially reaching sustainable profitability by 2025. However, churn poses a notable threat to DTC services, especially as subscribers increasingly adopt “service rotation” habits, cycling through streaming services to maximize content variety and cost savings. This trend directly impacts Disney’s ability to retain a stable subscriber base, leading to unpredictable revenue fluctuations and increased pressure to constantly acquire new users. If Disney can’t handle churn effectively, the company risks eroding its DTC profitability, making sustainable growth more challenging.

Disney’s Opportunities

Disney’s coverage in the news was rather negative over the last few years. The company got into trouble several times, getting unfavorable press and having a bad sentiment built around the brand.

The sentiment shift started with a succession of Bob Iger in 2020 amid the pandemic. Quarterly results under the new CEO, Bob Chapek became repeatedly disappointing. His role as a leader was deteriorating, and relationships with Disney’s top management started taking a hit. He was eventually released. During his term as CEO, he brought a lot of bad press onto Disney by getting the company involved in disputes like the battle with the state of Florida over the Parental Rights in Education bill, or a legal battle with Scarlett Johansson over the release of the Back Widow movie. The company had to redefine its focus again.

Bob Chapek’s successor, who happened to be his predecessor – Bob Iger, stepped in nearly two years ago and over time managed to improve the atmosphere, although the situation isn’t perfect. Many claim that Disney lacks direction and clarity about the future or what priorities to stick to which Bob Iger himself admitted during the FY 2023 Disney earnings call.

So I feel good about the direction we’re headed, but I’m mindful of the fact that our performance from a quality perspective wasn’t really up to the standards that we set for ourselves.

Yet, Disney’s vast collection of iconic intellectual property (IP) presents a strong opportunity for sustained revenue growth across multiple platforms and decades. With franchises like Toy Story, Avengers, Star Wars, and Avatar, Disney continues to monetize these beloved IPs through new films, streaming content, themed park attractions, and retail sales. For example, Toy Story has not only succeeded at the box office with over $3.3 billion in revenue but also remains the most-viewed animated franchise on Disney+ and brings in over $1 billion in annual retail sales. The Avengers and Star Wars franchises show similar potential, with upcoming film releases, themed lands, and record-breaking merchandise sales. These properties define Disney’s brand, driving loyal fan engagement across its parks, cruise lines, streaming platforms, and retail sectors. As a result, Disney’s ecosystem offers robust opportunities for growth.

What creates another sizable opportunity for the company is sports, particularly through ESPN’s development into a leading digital sports platform. ESPN continues to see strong viewer engagement, with Q3 primetime ratings reaching a 10-year high among adults 18-49, and a record-breaking audience for events like the NBA Finals. Disney’s upcoming ESPN tile on Disney+ in December 2024 and a full direct-to-consumer ESPN platform in 2025 will expand ESPN’s digital presence. Disney also secured long-term premier sports rights, including an 11-year extension with the NBA and exclusive global rights to the College Football Playoff, confirming its position as a major player in sports media. Through these strategies, ESPN may drive substantial digital and broadcast revenue for Disney.

Disney’s Fundamentals And Financial Health

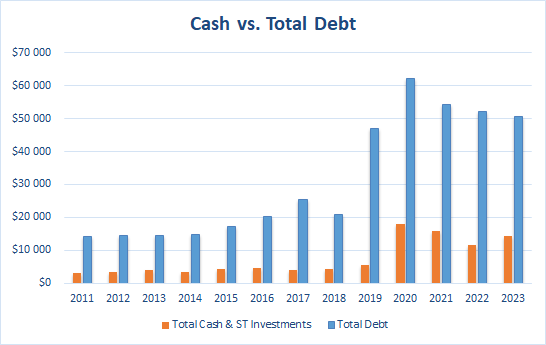

With ongoing issues and emerging opportunities underway, Disney’s financial fundamentals reveal both resilience and weak spots. The company carries a significant amount of debt, which ballooned upon the acquisition made in 2019 only to get further inflated during the pandemic crisis.

Walt Disney Cash vs. Total Debt (Author (Data: Seeking Alpha))

Disney’s acquisition of 21st Century Fox seriously affected its debt, adding roughly $19 billion in new liabilities from the transaction itself, which, combined with related financial obligations, brought Disney’s total debt to over $50 billion shortly after the acquisition. While the acquisition was a strategic move to strengthen Disney’s content portfolio, the elevated debt level placed pressure on the company’s balance sheet. Although the obligations have been reduced, they still comprise almost half of Disney’s equity, expressed by the Total Debt / Total Equity = 44.8%.

The company can comfortably cover interest payments, suggesting that these obligations do not overly strain Disney. A look at EBIT / Interest Expense may give a quick overview of the company’s burden due to its debt expense. In the case of Disney, the ratio is 6.04. When a company’s interest coverage ratio nears 1.5 or lower, its ability to meet interest expenses may be questionable. Other liquidity measures, however, show that Disney may face challenges managing short-term liabilities, with limited cushion in cash and short-term investments to cover immediate needs with the Current Ratio and Quick Ratio at 1.05 and 0.85 respectively. This puts pressure on Disney, forcing the business to keep steady cash flows to support operations and debt.

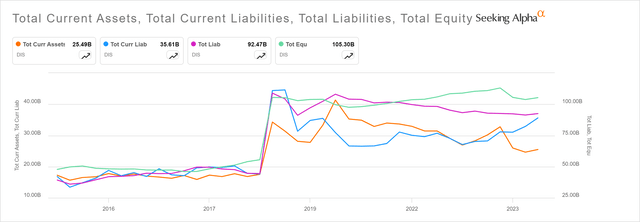

Disney’s Assets, Liabilities And Equity (Seeking Alpha)

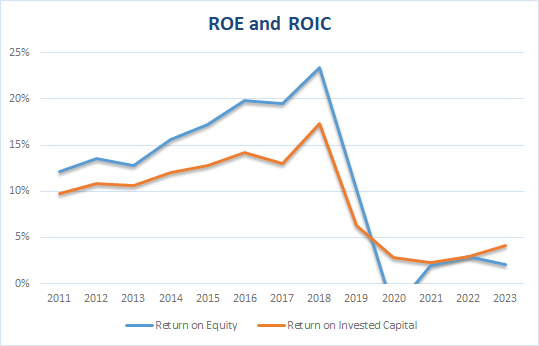

Disney’s profitability metrics indicate moderate returns for investors, with its Return On Equity and Return On Invested Capital suggesting a relatively cautious growth outlook. Both measures slightly recovered after the nose-dive from 2019, although they are at seriously depressed levels compared with years before the 21st Century Fox acquisition. This likely indicates a mediocre performance rather than high returns.

Disney – Return on Equity, Return on Invested Capital (Author (Data: Seeking Alpha))

Revenue pressures persist in the key segment Direct-to-Consumer, which remains costly to operate and expand. It heavily affected profitability margins. On a positive note, Disney’s steady, free cash flow provides financial flexibility. Moreover, the company owns outstanding assets and has a competitive advantage, unlike any other business. To visualize it, one can imagine replicating Disney’s success, which would be nearly impossible regardless of the available funds. Yet, the fundamentals of Disney’s business continue to be challenged and can be fixed by focusing on three main aspects: managing debt, enhancing profitability, and improving short-term liquidity. Getting it done won’t be an easy task, and it’ll need time.

Disney’s Valuation

A key to a successful long-term investing strategy is the ability to value a business based on conservative assumptions of its future earnings and cash flows. Once it’s properly done, an investor has only to wait for the moment when the price of the stock gets below its estimated value and act accordingly.

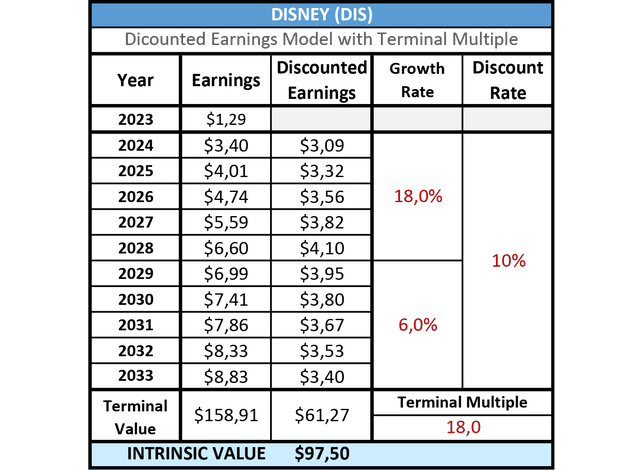

Based on analyst numbers, Disney is expected to grow its non-GAAP earnings by 14.21% CAGR in the next 3-5 years. The company should be able to record an even higher increase in GAAP profit. In the discounted earnings model, DEM 18.0% was assumed. In the following 5 years, the growth will probably slow down. Since five years is a fairly long period to make precise predictions, a 6.0% CAGR expansion in earnings per share (EPS) is estimated. The discount rate in the model is set to 10.0% and the terminal P/E ratio at the end of the 10 years is 18 to match the median of the historical price-to-earnings multiple of the S&P 500.

Disney Discounted Earnings Model Valuation (Author)

The intrinsic value of Disney based on the assumptions is $97.50 indicating the stock is fairly valued. There is also nothing suggesting that the growth will be higher than in the model. In recent years, the DTC segment has given hope to boost revenues and profits. Yet, only sales have grown. Earnings didn’t follow, and investors’ expectations for a rapid change faded together with analyst estimates. Even the return of Bob Iger didn’t seriously lift the unfavorable sentiment. More is needed to spark excitement among the consumers and market participants. However, with the profitability of the DTC business nearing, expanding franchises, and sports gaining momentum, the demand for stock in the midterm might be high, especially if these developments are supported by strong Q4 numbers.

Disney’s Future

In conclusion, Disney stands at a crossroads. Despite its long-lasting appeal, beloved characters, and a brand that resonates with millions worldwide, Disney faces challenges. A decline in segments such as Linear Networks, a flat stock price over the past decade, and fundamental pressures from high debt and low liquidity are troubling. Disney’s valuation is fair, concerning expected growth. Investments in the streaming platform brought some positive developments, but profitability has struggled under the weight of ongoing content costs. Additionally, an unclear strategy has flared mixed reactions. Yet, Disney’s unique cultural legacy and its powerful competitive advantage give it resilience and the potential to evolve and entertain future generations of children with unique movies and shows. For investors and consumers, the question remains whether Disney can successfully navigate these pressures while preserving the magic that defines it.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of DIS either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.