Summary:

- Disney’s Q4 2024 results showed a 6.3% revenue increase to $22.57 billion, surpassing forecasts, despite earnings per share falling short of expectations.

- Streaming operations, particularly Disney+, showed growth with Disney+ Core subscribers reaching an all-time high of 122.7 million, offsetting declines in low-value Hotstar users.

- Theme parks and theatrical distribution saw mixed results, with domestic and international parks performing well and theatrical revenue nearly tripling year-over-year.

- Management’s optimistic guidance for 2025 and beyond, including significant earnings and cash flow growth, supports maintaining Disney as a ‘strong buy’.

JHVEPhoto

November 14th ended up being a pretty good day for shareholders of The Walt Disney Company (NYSE:DIS)(NEOE:DIS:CA). Shares of the business rose by 6.2% in late day trading after management announced financial results covering the final quarter of the 2024 fiscal year. Even though the company fell short when it came to earnings per share, it exceeded forecasts when it came to both revenue and adjusted earnings. Management succeeded in reducing net debt further, and they came out with some guidance regarding the next few fiscal years. Add all of this together, and I do believe that this warrants a good deal of optimism.

This is a good thing because I have long been bullish about the company. Since last reaffirming it as a ‘strong buy’ back in August of this year, shares are up a whopping 27.6%. That’s more than double the 12.1% increase experienced by the S&P 500 over the same window of time. Even though we have experienced some nice upside here during this time, I would argue recent revelations from management warrant even more. Because of this, I have no problem keeping the company rated a ‘strong buy’ for now.

A look at headline news

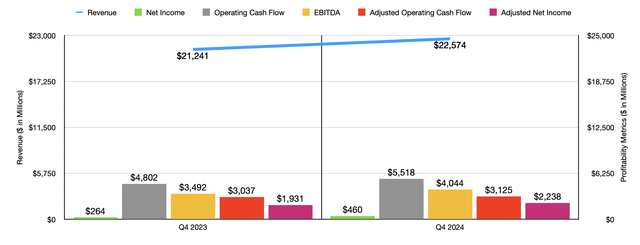

Before we get into the more interesting details, I would like to touch briefly on the headline news regarding Disney and how the company performed during the quarter. During the quarter, the company generated revenue of $22.57 billion. This represents an increase of 6.3% compared to the $21.24 billion the company reported one year earlier. It also happens to be roughly $0.11 billion greater than what analysts were anticipating. Later on in this article, I will touch on some of the key growth areas of the business. But for now, I think that this is adequate.

On the bottom line, the situation is a bit more complicated. Year over year, earnings per share almost doubled from $0.14 to $0.25. This brought net income up from $264 million to $460 million. At first glance, this might seem positive. However, earnings per share did still come in $0.70 lower than what analysts were anticipating. Some of the pain for the company was the result of additional TFCF and Hulu intangible asset amortization and a fair value step up on film and television costs. But the big problem for the quarter ended up being the $1.54 billion in restructuring and impairment charges that the company incurred. On an after-tax basis, this amounts to $1.37 billion as a hit to the company.

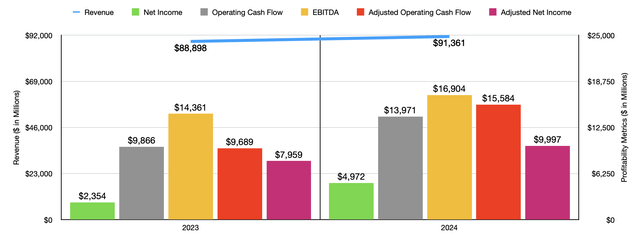

After making the necessary adjustments, Disney ended up with earnings per share of $1.14. That’s comfortably above the $0.82 per share the business reported the same time last year. It also happens to be $0.03 per share greater than what analysts were hoping to see. This translated to an increase in adjusted net profits from $1.93 billion to $2.24 billion. Other profitability metrics for the company also improved year over year. Operating cash flow popped from $4.80 billion to $5.52 billion. If we adjust for changes in working capital, we get a rise from $3.04 billion to $3.13 billion. Meanwhile, EBITDA for the company expanded from $3.49 billion to $4.04 billion. In the chart above, you can also see results for the entirety of the 2024 fiscal year compared to the same time in 2023. Without exception, revenue, profits, and cash flows, all increased nicely during this time.

Taking a look at streaming

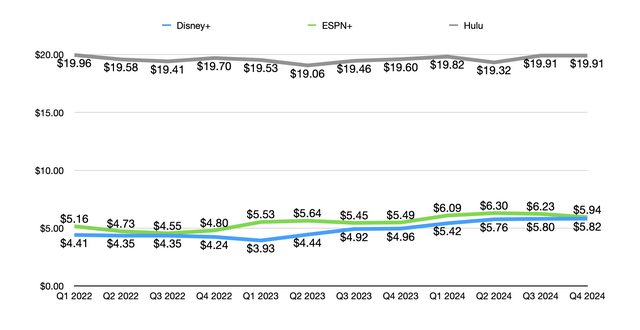

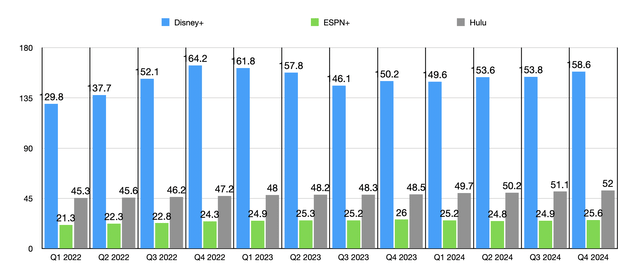

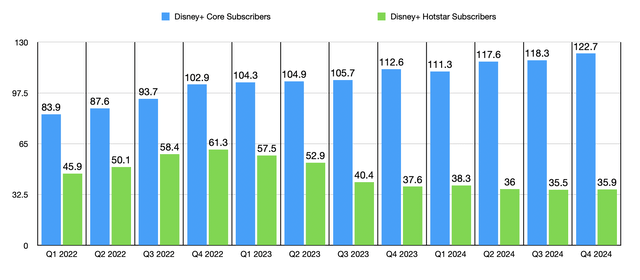

Digging deeper, the very first thing I would like to touch on would be the streaming operations of the company. This has been a key growth area for shareholders for some time. In the recent past, there had been some weakness in overall subscriber numbers when it comes to the firm’s flagship service, Disney+. But that was because of the decline of the low value Hotstar users. I call these low value because they don’t generate much in the way of revenue. The 35.9 million Disney+ Hotstar users generated average monthly revenue for the company of $0.78 apiece. By comparison, for the Disney+ Core members, this number totals $7.30 per month. What’s more, this represents an increase over the $7.22 per month reported just one quarter earlier. In contrast, Disney+ Hotstar users actually saw a decrease from the $1.05 per month reported in the third quarter of this year. This was largely the result of lower advertising revenue.

In terms of overall membership, we did see some nice upticks year over year. Even the Hotstar subscriber base expanded from 35.5 million last year to 35.9 million this year. This year’s figure matches what the company experienced during the third quarter of this year. The hope is that this might finally imply stabilization when it comes to this user base. At its peak, back in the final quarter of 2022, the number of Hotstar users hit 61.3 million. On the other hand, the number of Disney+ Core subscribers continues to grow. In the final quarter of last year, it was 112.6 million. By the third quarter of this year, it had expanded to 118.3 million. And as of the final quarter of 2024, it hit an all-time high of 122.7 million.

Of course, there is more to the streaming side of the business than just Disney+. There is also Hulu and ESPN+. Hulu rose from 51.1 million subscribers in the third quarter of this year to 52 million today. The number of subscribers that it had last year during this time was 48.5 million. ESPN+ reported growth from 24.9 million subscribers in the third quarter of this year to 25.6 million in the final quarter. We still aren’t back up to the all-time high of 26 million that was seen at the end of 2023. But at least this shows that a turnaround is occurring. Pricing has remained flat for Hulu on a quarter over quarter basis. However, because of lower advertising revenue, there was a drop when it came to ESPN from $6.23 per month in the third quarter of this year to $5.94 per month in the final quarter.

Other important aspects of the business

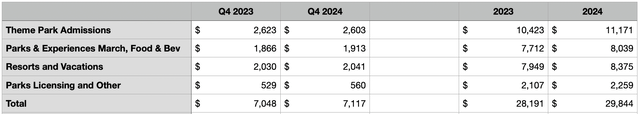

There are, of course, many other parts of the company that we should look at. My favorite would be the aspects that account for its theme parks, resorts, and other experiential assets. In the table below, you can see what these are. During the quarter, theme park admissions revenue came in at $2.60 billion. This was actually down from $2.62 billion the same time one year earlier. This appears attributable to declines in attendance for the company’s international parks.

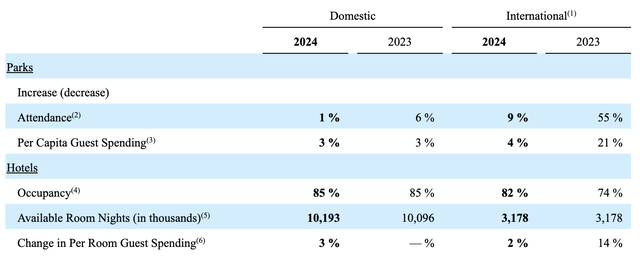

For the entire year, however, parks as a whole did just fine. Revenue of $11.17 billion came in 7.2% above the $10.42 billion reported one year earlier. As the image below illustrates, domestic attendance was up 1% year over year at the company’s parks, while international attendance was up an impressive 9%. Per capita guest spending was up across both categories, while hotel occupancy rates were flat domestically and up nicely on the international scene.

The Parks & Experiences merchandise, food, and beverage category reported an increase in revenue from $1.87 billion to $1.91 billion a year over year. This helped to push overall revenue up from this category for the 2024 fiscal year in its entirety to $8.04 billion. That’s 4.2% above what it was for 2023. We also see increases, admittedly small ones, when it comes to resorts and vacations revenue, as well as parks licensing and other revenue. What matters most, at least to me, is that overall sales improved during this time for all of these categories.

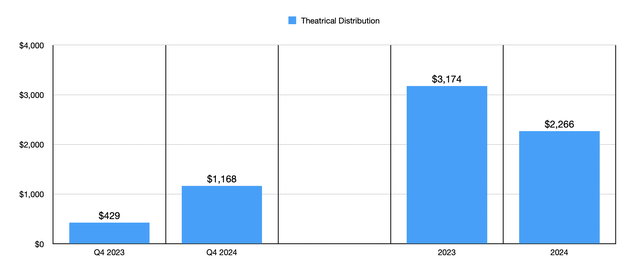

There’s also the topic of theatrical distribution. It has been my long-held belief that while the theatrical distribution side of the company is still quite small, it is the beginning of the funnel that has become the company’s ecosystem. New and exciting content comes out that continues to fuel demand across the rest of the enterprise. During the COVID-19 pandemic, and then after that because of worker strikes in the entertainment industry, this has been an area of weakness.

But now, we are seeing some really impressive results. During the final quarter of the year, this side of the company generated revenue of $1.17 billion. That was almost triple the $429 million reported one year earlier. For the year as a whole, because of the timing of the recovery and the box office space, revenue was still down from $3.17 billion to $2.27 billion. But with the strong showing achieved by Inside Out 2 and Deadpool & Wolverine, the company had one of the best final quarters when it came to theatrical distribution revenue in its history. This surge in sales resulted in the content sales/licensing and other category of the company to achieve operating income of $316 million during the quarter. That stacks up nicely compared to the $149 million operating loss reported the same time last year.

Valuing shares

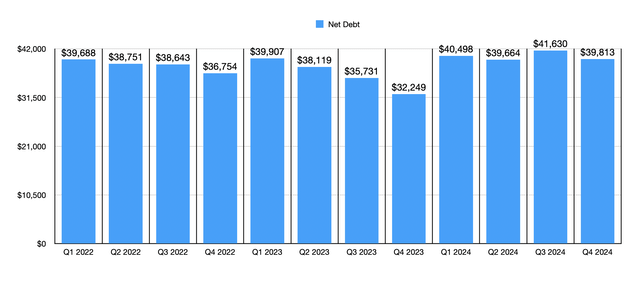

The strong financial performance achieved by the management team at Disney had a nice impact on the company’s overall leverage situation. By the end of the quarter, management had reduced net debt to $39.81 billion. This actually represented a decline of $1.82 billion compared to what the company had at the end of the third quarter of the year. There seems to be a decent chance that net debt will decrease further as time goes on. And this is because management has high expectations when it comes to the next few fiscal years.

For 2025, management is expecting earnings per share to rise at the high single digit rate. For the purpose of analyzing the company, I’m going to assume that this is 7.5%. They are also forecasting operating cash flow of $15 billion and free cash flow of $7 billion. If adjusted operating cash flow rises at the same rate that operating cash flow is forecasted to, that would translate to a reading of $16.73 billion. A similar increase when it comes to EBITDA would be $18.15 billion, while the 7.5% increase in adjusted earnings per share should translate to adjusted net profits of about $10.58 billion. Using the free cash flow the company generates, management plans to allocate around $3 billion towards share buybacks. That would leave up to $4 billion that could be used for further debt reduction if management so desires.

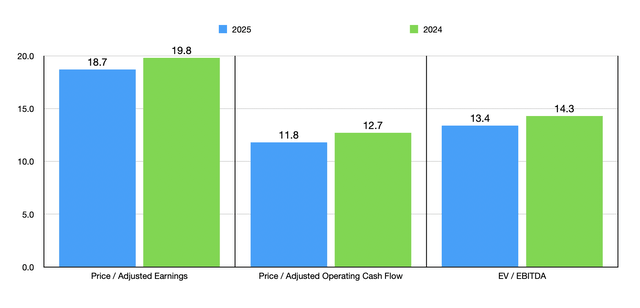

But that’s not all. In 2026, management is forecasting earnings per share growth that rises at a double-digit rate. They’re expecting the same thing when it comes to operating cash flow. And in 2027, they also expect a double-digit increase in earnings per share. Because of the ambiguity when it comes to these forecasts, I dare not project out beyond 2025. But even that reveals that Disney is attractively priced. In the chart above, you can see how the stock is valued using the aforementioned forward estimates for 2025. That chart also shows how the company is valued using 2024 data. While this would typically be in the fair value range for me, I do make exceptions for high-quality companies, especially industry leaders that are showing impressive signs of improvement.

Takeaway

As things stand, I firmly believe that Disney is one of the best companies on the planet. The company has done a great job of turning itself around in the last couple of years, and its share price has benefited recently because of that. Management still has plenty of room for improvement, especially from a cash flow perspective. But with most parts of the business firing on all cylinders, that just seems to be a matter of time. Putting all of this into one picture, I have no problem keeping the firm rated a ‘strong buy’ for now.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of DIS either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Crude Value Insights offers you an investing service and community focused on oil and natural gas. We focus on cash flow and the companies that generate it, leading to value and growth prospects with real potential.

Subscribers get to use a 50+ stock model account, in-depth cash flow analyses of E&P firms, and live chat discussion of the sector.

Sign up today for your two-week free trial and get a new lease on oil & gas!