Summary:

- Hold The Walt Disney Company stock from here on at your possible peril as CEO Robert Iger and the company continue to Band-Aid its own warts. Valuation can creep much farther south unless they wake up.

- Using political warfare as a rationalization for the cancellation of the Florida campus is a red herring: it was a terrible idea from day one.

- Moving ESPN to total streaming rather than selling it kicks the can down the road and does not monetize assets.

yujie chen

“It is hard to imagine a more stupid or more dangerous way of making decisions than by putting those decisions in the hands of people who pay no price for being wrong…”

Thomas Sowell

The sage quote above from Dr. Sowell here strikes at the very heart of what is wrong with, and what has been wrong about, the once-great The Walt Disney Company (NYSE:DIS) for far too many years. As we have noted in prior Seeking Alpha analysis, we believe the golden resume denizens of the Disney board, bobblehead dolls all, have sat fat dumb and happy for far too long.

They deserve the admonition shouted out in 1653 at the British Parliament by Oliver Cromwell. The “Protector,” as the revolutionary leader was called, had become frustrated by a lack of reform actions he had demanded to bring relief to the population at large.

“You have sat there too long for any good you have been doing lately, in the name of God go!”

The series of events that have triggered much of the bearish sentiment that has attached itself to many investors, otherwise big fans of the company, began with the retirement of Robert Iger in 2021 his appointment of Bob Chapek as a replacement, and then his one eighty-degree turn, in firing Chapek and putting himself back at the helm. Kudos flooded in with happy talk board statements-the same board that had hailed Chapek’s appointment two years before.

The board, responsible and well-meaning, no doubt stood up and saluted the Disney anthem – just wish upon a star and pray something nice will happen. So back comes Iger wielding a sword or a penknife – you decide.

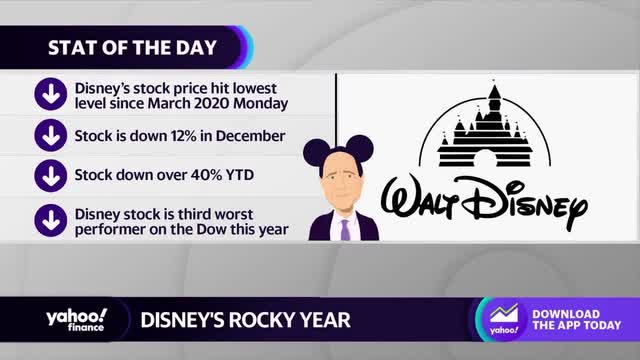

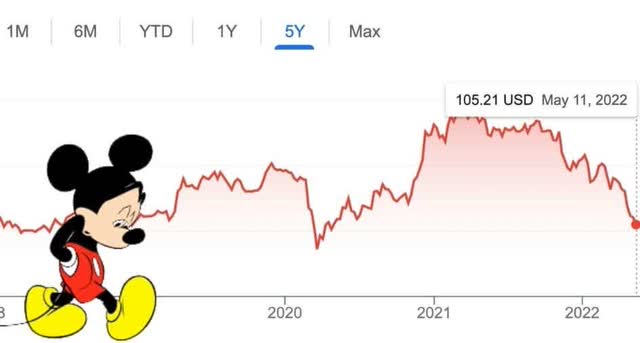

Above: Is it just a bad year, or the cumulation of bad decisions over time?

Iger’s plan to take action fast to staunch the bleedings the company had endured under both his own reign as well as his fleeting successor was prescriptively correct. Cutting 7,000 bodies, promising to find over $5b in savings, was at least a start. All hands on deck to return to strong profitability.

Every Disney vertical would be placed beneath a Sword of Damocles, having to prove its profitability or potential for it, or else face the drop of the blade at its neck. A good start, considering the mammoth losses mostly in streaming that had bled the company badly for at least three years. Part of the blame, of course, was covid. Nobody’s fault, but the aftermath has a different story of responsibility to face for shareholders.

The hidden ailment went beyond the pandemic. It was this: Disney had come to see itself as a global distributor of popular entertainment in all verticals. It was a go-to place for kids without question, but also a place where adults could find engaging, compelling entertainment in movies, TV shows, theme parks, cruises, etc. etc. etc.

And in the process, it also viewed itself as a proponent of virtue signaling. Why? Because implied therein was the conviction, from the board down, that part of its mission was to educate the poor, dumb millions of customers of their products, morally inferior to themselves of course, who missed the point about becoming woke. So, the degree to which wokeism overtook Disney is for others to sift. That it alienated some potential customers for really no good reason was pure foolishness, a misconstruction of what a public company’s true mission is: to make money for shareholders, to be good, enlightened employers and stay clear of any implication of virtue signaling out of respect for all customers. Period. Job one: is to entertain, not preach. There are endless outstretched hands in the charitable foundation sector for you to place checks in all good conscience. That’s where woke belongs.

Above: Yes, the pandemic was brutal, but it also hid structural failings in the long pursued business model.

A steel cage brawl with a governor

It would appear that the well-meaning Mr. Iger has an appetite for the field of combat. He reportedly was interested in buying an NFL team. When that thrust of his competitive spirit was blunted, he apparently turned to the Florida governor to exchange verbal acrobatics within a steel cage match.

The plan was to move 2,000 employees from California – what? The land of confiscatory taxation? The mother lode of wokeism, the place where the idea of moving gave employees more heartburn than hope? We’ll give the benefit of the doubt to the company in that the relocation to Florida had positive implications for the bottom line, though the employees were screaming like stuck Porky Pigs.

While the announced cancellation of the big move estimated to cost ~$845m was positioned as a case of smart corporate asset saving butting head against “business conditions,” the company has soaked up the accolades from its media compadres in assigning blame for the cancellation at the door of Governor Ron DeSantis. We have also read adoring media pieces about how Iger vs. the governor is a steel cage match that the feisty politician can’t win. At least, that is the media script setting up Iger as Hulk Hogan and DeSantis as The Iron Sheik that Disney stock fans have played out. The outcome of that match is best left to another kind of forum. What we see here is a prime example of a senior management and board that apparently once saw the move as economically sound, but suddenly, in what looks like a childish petulance, withdraws it.

The transition is real, but is it still not being met with structural change?

All the logic of building it to begin with is trashed because the company is going through a transitional downside, we are also told. Because the company has no better answer than to find ways to cut costs they can blame on other headwinds and people. The end game decision is understandable, considering the company is facing perilous challenges ahead. But dig a bit deeper and ask why the apparent risks in the project had not dawned on management from day one. That is where we think investors have a legitimate rationale to question management and the board. So, imagine the celebrations in California among employees who no longer face moving across country.

Now we have yet another Band Aided debacle from this management in the announced closure of the Star Wars hotel. They’re flushing maybe $1b down the toilet because nobody on the board or management bothered to ask at the get-go: Wait, $2,000 a head a night to watch a bunch of costumed robots bring in room service? Or tend bar? Or bring you your Cap’n Crunch for breakfast? What’s wrong with this picture?

The ESPN decision defies logic–at least for the moment

Wait, we’re not finished. On top of this comes the genius move to make ESPN a total streamer, just to assure its place among the rubble on the entire streaming vertical sector. So, we abandon the $9.65 a head we are getting from the MSOs and offer ESPN as a standalone streaming service. In other words, all the free money Disney gets from tens of millions of cable folks who couldn’t care less about ESPN but who are forced to pay anyway, is no big loss?

Now we can offer ESPN to sports fans only beginning with ~ 20m subscribers or less and fight our way into consumer wallets in hand-to-hand combat with every other streamer that is losing its shirt in the process-including Disney+. What this begins to show us is clearly a board and a management at sea, fumbling and stumbling around, looking for a miracle cure. That cure is staring them in the face, but it’s a future they don’t want to see, therefore, it does not exist.

This is not the kind of decision tree many shareholders would wish to see Disney management and the board climb. And when too much weight hangs from too thin a tree branch, it’s all-fall-down time.

As we have noted, there are still parts of Disney we believe are deeply rooted in a solid consumer need for diversion-principally for children. The main part is, of course, the theme parks.

Apart from that, there are businesses that simply do not have to fight their way through to arrive at a workable margin.

As I have noted, ESPN should be a candidate for sale. Stripped of all its excess baggage and cost overruns, it could be sold to a viable operator, valued at as much as $22b. Turning haha panelists and lots of crappy game content over to a buyer who can concentrate on ESPN games that mean something in the NFL, MLB, NBA and NHL plus selected college sports would justify its cost. And the $22b proceeds could make a huge dent in the Disney mountain of debt. And Mr. Market would love it, we believe, and be a sure way to move the shares strongly north.

Valuations

We have already hypothesized about a trimmed-down Disney composed of theme parks, Disney Plus, and the Disney movie studio, all focused on consumer value, free of an irrational compulsion to play a virtue agenda and the unleashing of the great DNA of Disney artists. Free them to create IP instead of paying out billions to others for IP that is either amid its prime or at the beginning of the end of it, like Star Wars.

At that, Disney, well-managed to contain costs, still innovative, keeping the parks within reasonable affordability and moving ahead without the virtue-signaling baggage that turns off a segment of the consumer market, and you have a stock that could soar. But at the current cut-and-paste approach, change without real change, you have a continuing struggle to regain a trading range that speaks to Mr. Market in its own language:

Disney could prove it was a company with its head on its shoulders, working the great stuff it already has, creating new stuff, and in the process generating an earnings profile that includes secure dividends and a lasting place in the global fight for eyeballs.

Right now, to us, it’s hard to make the case that the Disney stock is worth $99 a share.

According to Alpha Spread, the discounted cash flow (“DCF”) value of DIS is $54.04, making it overvalued at 47%. The worst-case value is calculated at $36.46. But its best-case scenario, of which there are still many adherents who do see light at the end of the tunnel, comes in at $113.71. Intrinsic value is estimated at $64.49.

The five-year high attained was on March 8, 2021, at the nation’s earliest blip on the positive side of the covid disaster, at $201.91. Between this high and more recent highs – before it became clear the company was in turmoil – we saw the shares holding for a time at ~$150 to $130.

These are all estimates. To be honest, one can formularize the prospects here for the stock and come up with price targets, or PTs, that are far more bullish. At writing, DIS stock is trading at $92. Analysts are looking for a 1- year consensus target ~$122 a share. We presume that takes into account that the promised $5b in cost savings will be reached sooner than later. This is a realistic prospect to a degree.

What we do not know, however, is the beating The Walt Disney Company streaming service will take in the interim, if anything near the $1.4b or more already gone. Nor do we know if the encouraging upside on Parks will continue if a real deep recession comes. That segment will endure, as we have noted before, but the burden of turning around the forward earnings profile will be heavier for that division of the company.

My own sense here is that the stock has an equal possible downside as the positive analyst PT. In other words, I can see DIS shares moving south between 25% and 30% if the next sequential two quarters prove disappointing, just as the pom pom twirlers can look at an upside to ~$122.

Even more critical for holders and would-be buyers on the dip to consider in my view is what confidence do we have up till now that the moves taken by Iger and the company going forward will make for sharp earnings increases.

My own level of confidence in Disney at the moment is low only because I do not see either the board or senior management making the kind of moves, I think will clearly point the way to strong price recovery. Disney apparently does not recognize this. They could well be right. But to me, at least till now, it’s the same old same old at work, a mentality that doesn’t want to deal with reality. By the way, just for the record: I’m not alone in this view.

A former colleague from back in the day who moved on to Disney when the Eisner and Katzenberg era began in 1984 talked to me. He’d stayed long enough to soak in much of what was great about the company as well as lots that wasn’t. He retired some years back. But he’s tuned in at a kind of middle level of management, perhaps a tad higher. His input reflects what he says echoes the input of several inside people he knows. Some of what I’ve written here is informed by his impressions as well.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

For in-depth and deep dive research on the casino and gmaing sector, subscribe to The House Edge. New: Free excerpts from our book in progress “The Smartest ever Guide to Gaming Stocks” – free to existing members and new subscribers.