Disney: Long-Term Progress Overshadowed By Q3 Guidance

Summary:

- The Walt Disney Company is expecting a down quarter for its Direct-to-Consumer business.

- However, the year-to-date DTC operating results trend shows significant improvement, with a $600 million improvement in one quarter and $1.5 billion in six months.

- The market is overreacting to the third quarter issues, but Disney management has likely resolved them so they will not transition to long-term problems.

- ESPN will transition to streaming. But ESPN will not be giving up linear.

- Disney Free Cash Flow increased roughly $3 billion YTD.

RinoCdZ

The Walt Disney Company (NYSE:DIS) has made solid progress since the coronavirus shutdowns really threw the company a unique set of challenges. Additionally, the last article continued the coverage of a successful board fight (another challenge or distraction and expense management did not need), which meant that the company had a united experienced team. But the (upcoming) fiscal third quarter events will last one quarter, whereas the long-term outlook for a growing, cash-generating giant headed by an experienced team remains (along with a far higher stock price). It is far more important for this management and board as a team to implement the plan they have in mind while course-correcting as needed.

Bad News First

Management is basically expecting a down quarter for the Direct-to-Consumer, or DTC, business. Anytime an announcement like that happens, Mr. Market has a predictable reaction that looks like “losses everywhere forever.” But no one ever stated that the path to profitability was straight up with no challenges along the way.

” On that note, we are forecasting a loss for Entertainment DTC in the third quarter, the vast majority of which is due to Disney+ Hotstar’s ICC cricket rights. We also do not expect to see core subscriber growth at Disney+ in the third quarter but anticipate sub-growth will return in Q4. As Bob mentioned, we continue to expect our combined streaming businesses to be profitable in the fourth quarter and expect further improvements in profitability in fiscal 2025.”

This quote is from Hugh Johnson, Senior EVP and CFO, during the fiscal second quarter conference call. The market reacted clearly to the projected third quarter news, while omitting that there would be a return to profitability.

As a side issue, one would think that Disney is only streaming. But the truth is that Disney is far more than that, as will be discussed later.

Where The Focus Should Be

While the fiscal third quarter news was a disappointment, the year-to-date trend is anything but a disappointment.

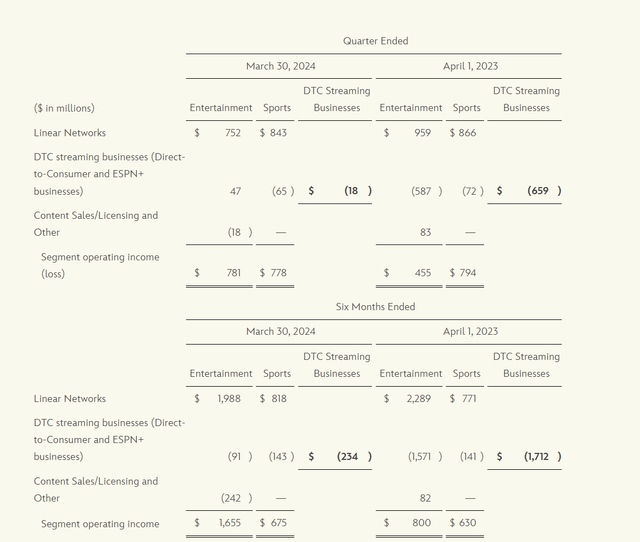

Disney Sports, and Entertainment Comparison By Business Segment (Disney Second Quarter 2024, Earnings Press Release)

Notice that even with the loss shown for sports streaming, the DTC segment of the business shows dramatic improvement of roughly $600 million in one quarter and roughly $1.5 billion in six months.

Clearly, Mr. Market is getting carried away with details while missing the total picture.

But this is just the kind of stuff that proxy fights and other management distractions get started over. Clearly management already had a solution that led to the improvements shown above, while the opposition in the proxy battle cited the losses and challenges that management clearly has a solution to already. As the last article noted, a win by the opposition for board seats likely would have divided the board and quite possibly obstructed the progress shown above. To say that would be bad for the stock price is an understatement.

Sports

In the conference call, management mentioned that there is an ongoing transition of sports to the Internet. But it was also mentioned that there is no intention to give up the Linear part of the sports business.

That would make good business sense because the sports business clearly has a future in Linear as well, for now. That declining business can be managed to provide cash for as long as it lasts that can be reinvested in growth areas. There is no reason to completely cut that business off (and the cash that comes with it).

Meanwhile, investors can expect an increasing sports presence on the Internet in the future.

Entertainment Overview

Currently, the market is clearly overreacting to some third quarter issues that management took the pain to announce. But, a management that announces an issue will also likely resolve it to the satisfaction of the market eventually. That generally means more profitability in the future because problems announced usually have a solution underway by the time they are announced.

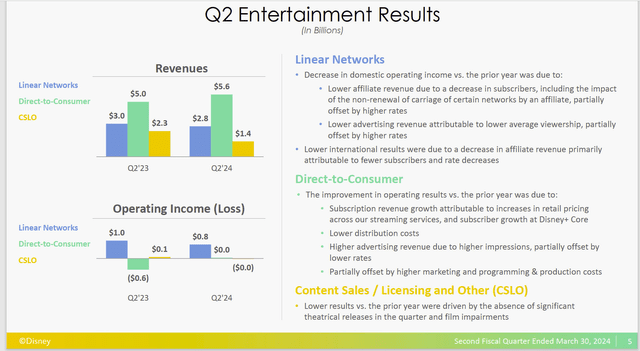

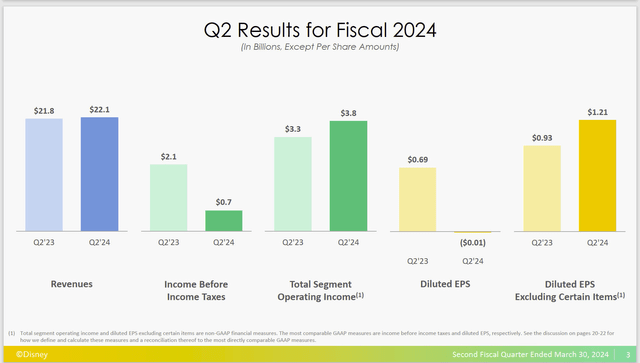

Disney Revenue And Operating Income Results (Disney Second Quarter 2024, Earnings Conference Call Slides)

Putting the entertainment division back together (for an overall picture) means that management is going to overall create a growth situation, probably through streaming, to more than offset the steady decline of the Linear business.

To me, that means the predicted third quarter will not be so bad that the comparison with the previous year will go “off the rails.” The main story of overall division improvement is likely to remain on track. A loss in the third quarter for streaming does not mean a return to repeated giant losses and negative cash flow in the future. In short, management “has got this.”

Cash Flow

As the company continues to recover, the improvement in cash flow has been tremendous, as shown below.

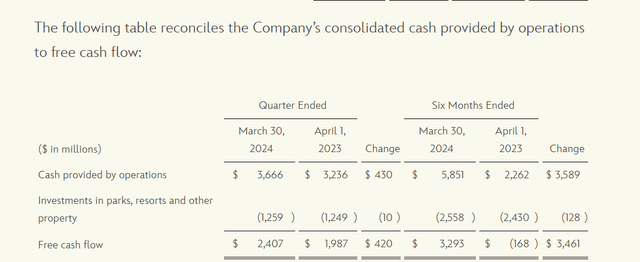

Disney GAAP Cash Flow And Non-GAAP Free Cash Flow Calculations (Disney Second Quarter 2024, Earnings Press Release)

Notably, the cash flow picture remains a resounding success as the recovery continues from the coronavirus challenges. Startup charges are clearly fading while the DTC losses are rapidly declining. As a result, free cash flow is now heading towards a number the market expects, rather than being soaked up by recovery charges from the shutdown in 2020. Meanwhile, a roughly $3.5 billion free cash flow improvement should have gotten a big positive reaction from Mr. Market.

Large companies often take years to get where they are going. This management had to contend with changes in its markets while the company shut down operations due to the coronavirus. Therefore, stumbles along the way as operations were reactivated while management dealt with ongoing market changes at the same time were to be expected.

Now that the cash flow picture appears to show a return to normal. Disney, as an entertainment giant, should be expected to generate a lot of free cash flow when run correctly. That assumption now appears to be becoming reality, as the latest results demonstrate. All that has to happen now is more growth of that free cash flow in the future through continued execution of the management strategy.

Parks And Experiences

Clearly, the worries that were part of the last fiscal year have faded into the past as this area of the company reported growth results. This could well serve as an example of what to expect with the current fears about DTC.

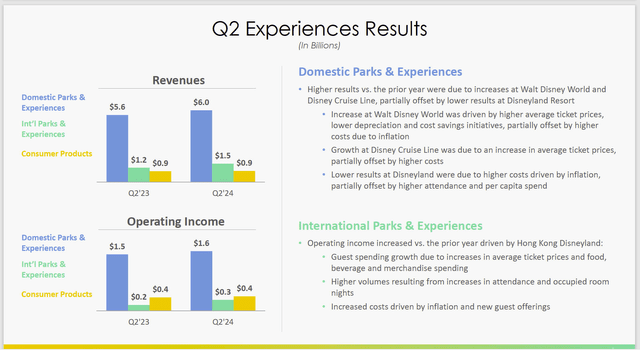

Disney Quarterly Comparison Of Experiences Division (Disney Second Quarter 2024, Earnings Conference Call Slides)

Disney continues to grow this segment successfully. Long-time readers may remember fears about less than full parks and the lack of success of a price increase. All that now appears to have been a transitory situation, as the numbers above show.

Clearly, the diversification of the company is mitigating the expected challenges of DTC in the third quarter. Expected division results here will help to mitigate any unfavorable news elsewhere.

Conclusion

The fiscal second quarter results tend to back my original assumption that the proxy battle was about issues already resolved. Therefore, the best group of people to resolve challenges before the company was the management-backed board and management, with CEO Bob Iger at the head of that management.

The all-important DTC is showing tremendous financial improvement over the previous fiscal year. The EBITDA improvement shown above likely added at least $1 billion to free cash flow all by itself. The announcement that DTC will show a loss in the third quarter does not mean that the continued dramatic progress will continue. Management did not state that the loss would be a return to the huge losses shown in the previous fiscal year.

Instead, management stated, “a loss,” which was left with undefined boundaries. Management also followed that statement up with guidance for a profitable fiscal fourth quarter.

Meanwhile, management reported plenty of good results elsewhere.

Disney Second Quarter 2024, Earnings Comparison Summary (Disney Second Quarter 2024, Earnings Conference Call Slides)

As the results above clearly show, an impairment charge made the GAAP earnings comparison negative. There were also one-time expenses from the proxy battle. The impairment charge was non-cash and the proxy battle expenses will not be recurring.

More importantly, the earnings excluding certain items show growth exceeding 30%. The “certain items” were largely due to an impairment charge, which was non-cash. The impairment charge does not reflect the earnings improvement shown by the company, nor is it repeating. This is the kind of earnings growth that shareholders had come to expect before the pandemic. Should management continue this kind of improvement, the stock price will have been likely at bargain levels.

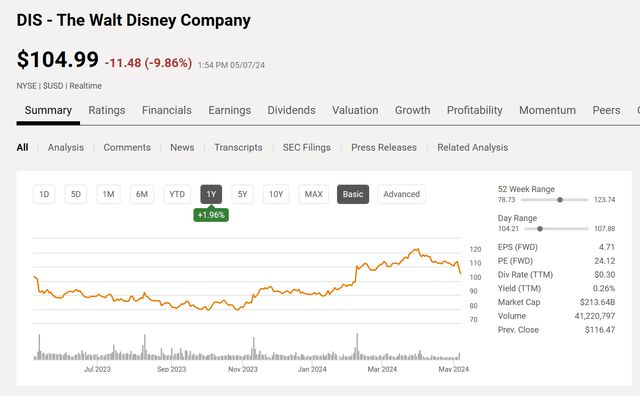

Disney Common Stock Price History And Key Valuation Measures (Seeking Alpha Website May 7, 2024)

Clearly, the Disney common stock price is having a combination of “sell on the news” combined with some fears about a DTC third quarter loss. But that makes this a likely strong buy opportunity because the recovery back to the clearly profitable “old days” remains on track.

Management has been posting positive comparisons on each earnings report for some time. Cash flow has steadily improved as restart costs have faded, while revenue has increased as business returns to normal.

I firmly believe that Bob Iger, CEO, has the board’s backing for a well-thought-out long-term strategy which he will adjust as market conditions dictate. I also believe that Bob Iger, CEO, needed a united board that was familiar with the company.

Disney management and its board now have everything they wanted. The promises made appear to be coming true. If that is the case, Disney is likely to be headed for a period of long-term growth with the cash generation to go with it. This would be an investment I would consider buying and holding until the story changes.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of DIS either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Disclaimer: I am not an investment advisor, and this article is not meant to be a recommendation of the purchase or sale of stock. Investors are advised to review all company documents and press releases to see if the company fits their own investment qualifications.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

I analyze oil and gas companies, related companies, and Disney in my service, Oil & Gas Value Research, where I look for undervalued names in the oil and gas space. I break down everything you need to know about these companies — the balance sheet, competitive position and development prospects. This article is an example of what I do. But for Oil & Gas Value Research members, they get it first and they get analysis on some companies that is not published on the free site. Interested? Sign up here for a free two-week trial.