Summary:

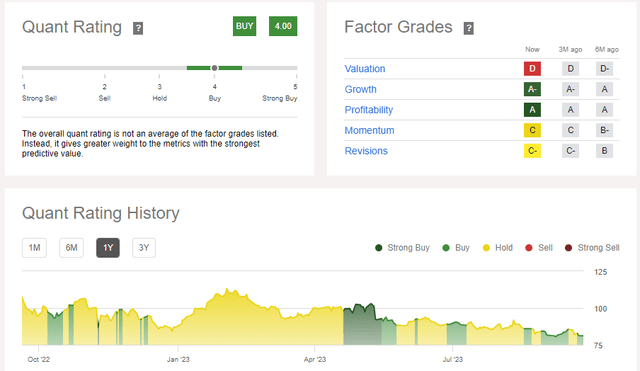

- Disney stock price has been performing poorly recently, leading to concerns about the stock’s medium-term prospects.

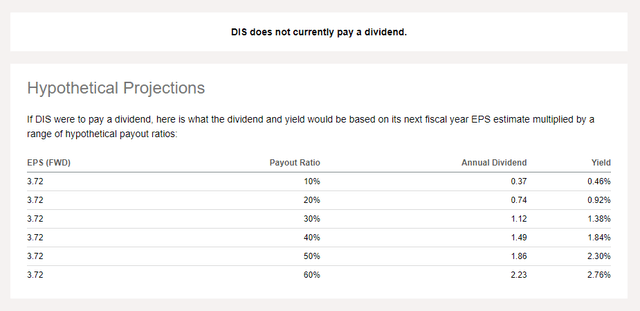

- The company’s brand and unique assets can translate into long-term strength, but the lack of a dividend makes waiting out difficult issues risky.

- The article provides a way to create a synthetic dividend strategy on Disney using covered calls (and potentially cash-covered puts).

- Reinvesting the proceeds from this strategy in DIS over an extended period can help you compound gains and provide a margin of safety not otherwise available.

Joe Raedle/Getty Images News

Synthetic dividend can seem like quite an ominous term that might make you blush and fill you with anxiety. There’s ample reason to fear the derivatives necessary to achieve such an end, just like you should be terrified of an airplane with a bad pilot. But just like airplanes, they can dramatically increase efficiency when used within the confines of reason and demonstrated safe practices. Like an airplane, you might find no other way to travel after using one.

With ample thoughtfulness and thorough consideration, conservative investors have much to gain through the reasoned and disciplined use of derivatives. It is one of the primary ways to achieve alpha over your competition without adding the usually copious amounts of risk required to achieve that end without sophisticated financial tools.

Disney (NYSE:DIS) is a cherished American company with a brand that has a special place in the hearts of billions. Lately, though, it’s pretty hard to deny that the company has been more Goofy than Mickey regarding stock price, as you can see below. And unlike many mature companies with cherished histories and brands that invoke nostalgia, Disney does not pay dividends. This is a significant disadvantage, particularly when you’re undergoing a period of difficulty for the stock.

The stock has been simultaneously embroiled in the culture and streaming wars, and the effect has not been the best for shareholders. Recently, the firm announced a dramatic investment to boost the income and attractiveness of the company’s parks and experiences offering. It will be doubling spending on parks over the next decade, concentrating on its international offerings.

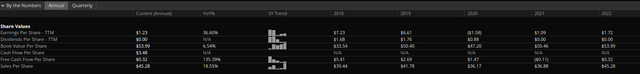

If you pair this with a synthetic dividend you create through the use of covered call options, you are actually getting an even better deal than if the company was paying a dividend. Economically speaking, you are getting an effective dividend, but it is superior to a real dividend since the payout ratio is zero. This means you get a cash flow without the company needing to divert cash flow away from investing, which is good in Disney’s case since its cash flow per share has fallen over the past five years, as you can see above.

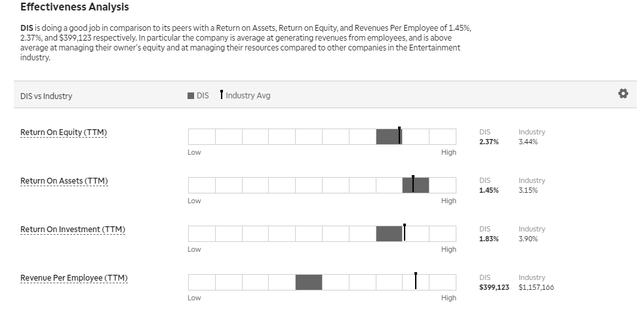

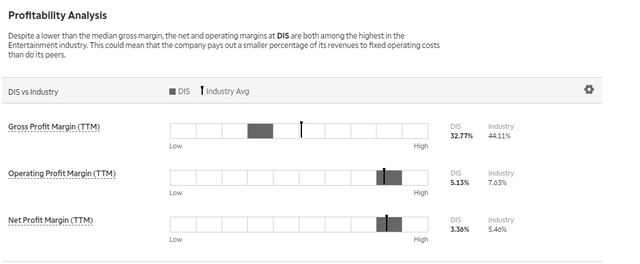

Seeking Alpha Contributor Howard Jay Klein made some great points about the recent announcement of the significant investment in parks and why investors should maintain skepticism. You can see above that Disney lags in financial effectiveness. As you can also see below, the firm lags behind its peers in profitability.

So, you have a manager who is asking for the benefit of the doubt in a company that is struggling, and I frankly wouldn’t want to keep buying more or open a new position given the risks. However, given its economic profile, if I already have a long-term position I’d like to keep for the future, the synthetic dividend using covered calls is too good a strategy to pass up.

Why is the cash from covered calls better than an actual dividend? Now, the firm is allocating capital toward reinvesting in its higher margin, better-performing segment without sacrificing return to give capital back to shareholders. Suppose the capital investment in parks is ultimately unsuccessful.

In that case, you can acquire more shares and a more prominent position on that weakness while the company’s long-term strengths eventually come into play. If it is successful, you’ve upped your exposure to that success by reinvesting money and boosting your exposure. Disney’s thick derivatives markets help make it easier to execute the strategy.

The firm has solid long-term assets, but it’s hard to capitalize on that without compounding. I don’t want to be exposed to these risks outright, but if I’m compounding by reinvesting my synthetic dividend, I am making those risks work for me in the long term. There are significant headwinds and challenges for this company. A synthetic dividend mitigates risk.

- Lawsuits and political disputes can potentially damage the brand and alienate customers.

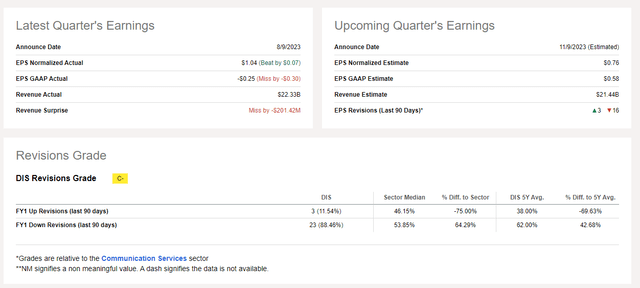

- Earnings revisions are mostly moving downward.

- Diminishing returns in streaming and an environment of extreme competition make initial optimism on Disney Plus wear off.

- Management and succession challenges in Disney as Bob Iger’s leadership transition continues.

- Recent stumbles on parks and experiences concerning being detached from the mass market could continue plaguing the company, casting a shadow on the recent massive investment.

- Disney has raised prices to such an extent that it will likely be unable to continue doing so without cannibalizing demand, making it vulnerable to an unforeseen rise in costs.

- While the investment may eventually provide a respectable or even lucrative return to shareholders, it necessarily means any future dividend will be a lower priority than without the massive expenditure.

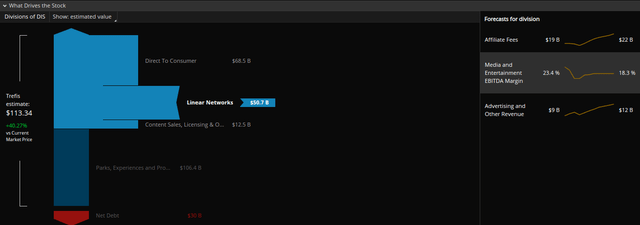

- Disney is having acute problems in the linear TV business, and the media side of the business is generally languishing.

If you’re not getting paid to wait for management to resolve their issues, and if it isn’t helping you achieve compounding, these issues are even more frustrating. Indeed, I’d go so far as to say there are too many risks in this stock despite “good bones” that I probably wouldn’t want to own Disney unless I had a dividend that was being reinvested to take advantage of share weakness.

Remember, Disney had a dividend before COVID, a vital part of the stock’s value proposition. With a recent doubling of spending on parks, it’s unlikely that a dividend will return, and without compounding, being exposed to these risks is a lot less appealing since you’re not getting the same benefit you would if you were reinvesting at low price levels.

For example, I am a long-term holder in RTX (RTX). I recently discussed why, despite their GTF engine issue, which requires grounding thousands of planes and reassembling engines, it is a gift since I have such a long time horizon. It allows me to lower my cost basis and boost my effective yield. Without the dividend, the risks expose you to price weakness as the company navigates considerable challenges that weigh heavily on earnings.

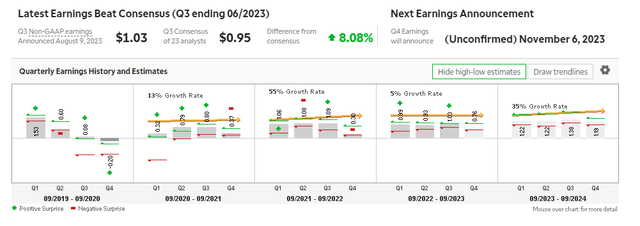

Still, some enticing earnings growth is projected this fiscal year, so using the price weakness to build your position will likely increase your alpha if you are disciplined. I will also discuss significantly mitigating the risk of using a covered call, getting assigned, and missing on a stock’s upside. You can avoid this fate with diligence and discipline.

Many headwinds have vexed the happiest place on Earth, and without getting paid a dividend to wait for management to resolve the issues and right the ship, the headwinds can get particularly frustrating. However, with a dividend being reinvested, periods of long-term price weakness become vital to the investor building a more prominent position and achieving wealth through compounding.

I will also confess I don’t hold the highest level of trust in Bob Iger for a simple reason: he got me into the Mudrick Capital SPAC to take Tops Baseball Cards public, and that epically failed. It’s not personal because I know Bob Iger is a great manager, and I do have faith that he will eventually be able to do something positive for shareholders at Disney. However, if you use covered calls to generate a synthetic dividend, I think the troubled stock is a better proposition.

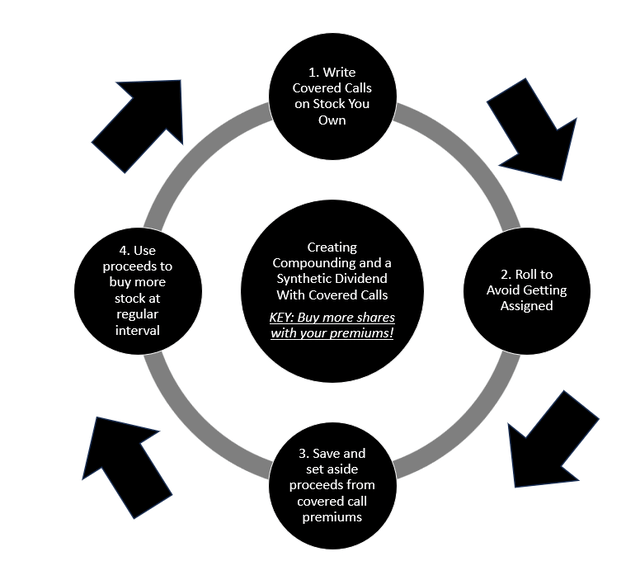

Using Covered Calls to Achieve Compounding

Writing covered calls is considered one of the most straightforward derivatives strategies and one of the lowest risks. Essentially, your main risk is getting assigned, that is, having your shares “called” at the strike price of your contract. Even this risk can be successfully managed with diligence through a rolling process. But first, I want to clarify a critical difference between the strategy I am advocating and a standard covered call strategy.

In a regular covered call strategy, people often say you are mitigating your downside because any losses you experience on the stock will be reduced by the premium you collect for the call option you have sold. However, we are after compounding, not just a quick buck. This means this is not a one-and-done trade; it is a consistent process you should keep up for years for the benefits to accrue.

One of the keys to avoiding unnecessary transaction costs is to “roll the contract.” This involves monitoring your position, and when it gets close to the strike price, buy-to-close your existing amount of outstanding calls. Then, sell a new set of calls on your underlying stock at a higher or lower strike price and a new maturity that gives you more time value in your premium.

- Rolling Out: this would extend the maturity of your covered call. So, you would buy-to-close February call options you had sold previously and replace them with March options as an example. The premium will be higher the further you extend because of the time value.

- Rolling Up: this is rolling your contract up in strike price. So, if a stock suddenly moves up and you want to prevent your position from being assigned at a strike price that is getting close, you buy-to-close your existing position and sell new calls at a higher strike price. If you simultaneously extend the expiry, then it’s called rolling “up and out.”

- Rolling Down: this is the opposite of rolling up. So, if your stock is declining in value, you can close your contracts and sell new ones at a strike with a higher premium close to the recently diminished share price.

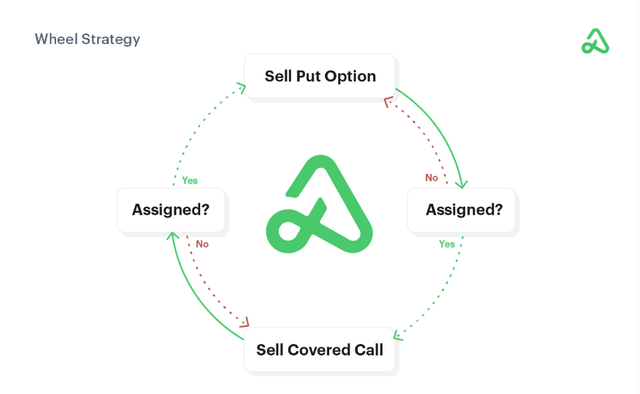

You could also use the wheel strategy if you have a lot of cash in your account. This is a bit more complex, and instead of avoiding assignment, you use the cash after you are assigned to write cash-covered puts, either collecting the premium or getting put the shares and writing more covered calls.

Either a straight-covered call strategy works or a wheel strategy. Regardless of which strategy you use, the important thing is that you reinvest the proceeds in Disney stock. This way, any further weakness becomes an opportunity instead of a headache.

Risks and Where I Could Be Wrong

Disney is a very popular stock with thick derivatives markets. However, using derivatives in any capacity can always be risky if you don’t have the expertise and confidence necessary. So, if you don’t have experience with derivatives and are not confident with rolling covered calls (or with the wheel strategy), don’t do it! In addition to the many risks particular to the Disney stock, which I’ve primarily focused this article on, derivatives are subject to an entirely different set of risks, some of which have nothing to do with the underlying stock at all:

- Liquidity Risk

- Execution Risk

- Getting Assigned

- Tax consequences

- Missing out on stock price gains

So, there are quite a few ways this strategy can go wrong. If you are not diligent and can’t monitor your position like a hawk, then don’t even think about this strategy. Disney’s stock has a lot of risks, and there are many reasons to be skeptical. This strategy ultimately mitigates the risk of being exposed to Disney’s price without compensation. Ultimately, this strategy only makes sense for long-term Disney shareholders. If you’re swing trading, using the proceeds to reinvest for compounding doesn’t make sense.

Conclusion

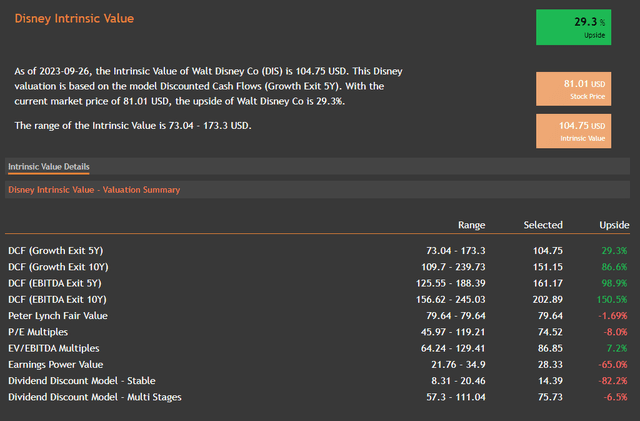

Just because a stock’s near and medium-term risk outlook is muddled or negative doesn’t mean you have to miss out on long-term value. Disney has its fair share of problems but is also very undervalued and is making a massive investment that could pay off. However, without the added margin of safety and benefits of compounding that reinvesting a dividend provides, it’s a much more expensive mistake if that massive investment doesn’t pay off.

Disney is undervalued right now, but I wouldn’t want to expose myself to considerable risks facing the stalwart entertainment company without capitalizing on the weakness over a longer term. The term “synthetic” often denotes inferiority regarding food or other areas where imitation can be subpar. However, when referring to a synthetic dividend, it is superior economically because management is not foregoing investment elsewhere to compensate shareholders.

Therefore, if you have the confidence and experience with derivatives necessary to implement a synthetic dividend on Disney, I think it will be a fortuitous way to mitigate risk and boost long-term returns. This strategy makes holding Disney much more tolerable if things continue to be bumpy.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.