Summary:

- Despite decent financial results in the first half of fiscal year 2023, Disney’s recent box office disappointments, reports of low theme park traffic, and controversial content decisions raise concerns about its future performance and current valuation.

- Disney lost 4 million streaming subscribers in Q2, with the majority of losses from India, and also experienced a decline in North American subscribers, which could be an early warning sign of future issues.

- The company’s increasing ideological content and lack of diversity of viewpoints within leadership could potentially hurt the brand, as evidenced by recent controversies and potential backlash from more conservative customers.

JHVEPhoto

Investment thesis

While Disney (NYSE:DIS) reported some overall decent results in terms of earnings in the first half of the fiscal year 2023, some recent box office disappointments, reports of light traffic at its theme parks recently, as well as a few other factors put its ability to maintain the earnings trend for the rest of the year in doubt. This raises questions about its current valuation, which is already ahead of the overall market. The seeming gathering clouds of controversy over some of Disney’s content decisions also threaten to negatively impact its future outlook. It may already be impacting its financial performance, which we might see reflected in coming quarters.

In my view, Disney lacks the culture at the top to first and foremost admit to the nature of the problem, identify the nature of it correctly, and then address it. It is arguably a widespread problem in the corporate world. Disney may have fallen into the culture war trap and the impending release of the Snow White movie may make things worse. I therefore see Disney stock as currently overpriced, despite trading at less than half of its all-time high stock price and there seems to be far more downside risk to its already overpriced stock price than there are likely to be upside positive surprises. While I generally tend to hunt for investment opportunities where stock prices are well off their recent or all-time highs, Disney is a definite pass for me.

Recent financial results are decent, but box office, online subscription, and theme park traffic numbers suggest troubles ahead

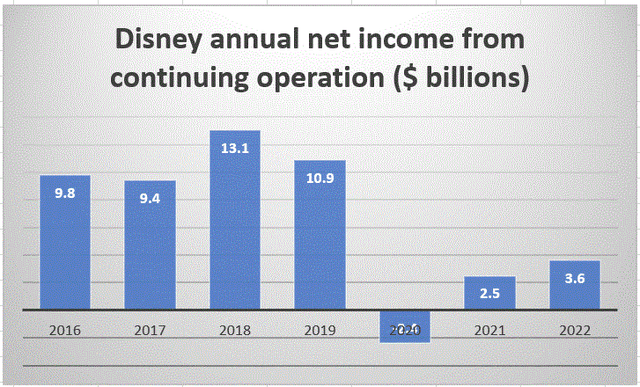

Looking at annual net income data, it seems that Disney has not recovered to pre-pandemic levels in terms of income from continuing operations.

For the fiscal year 2023, for the first six months, to the end of March, Disney saw an increase in net income from continuing operations of 57%, for a total of $2.55 billion, which seems encouraging in terms of the overall trajectory. It suggests that it may be on track to have a better year this year, perhaps heading back towards the profits it saw pre-pandemic.

The recent box office performance of its newest releases, as well as news coming out of softening interest from tourists to visit its theme parks may suggest that the second half of this fiscal year might bring some unpleasant surprises. A recent string of arguably poor performances this summer in cinema ticket sales seems to establish itself as a new trend. The Little Mermaid mostly tanked in Asia, where it seems that Disney’s deviation from casting an actor of European descent in a European folk tale did not agree with prevailing social viewpoints. It is unclear whether it can break even, given various estimates out there, but breaking even seems to be the best that Disney can hope to achieve. Elemental also failed to gain traction and it seems it might be set to lose significant amounts of money. The new Indiana Jones adventure movie seems to have failed to live up to expectations and is also estimated to probably lose money. The Flash is also poised to perform poorly from a financial point of view. The overall performance of Disney at the box office this summer, is in contrast to some impressive performances some months back with the likes of Avatar which earned $2.3 billion gross at the box office, with over half a billion dollars in estimated profits.

It should be noted as well that Disney lost 4 million streaming subscribers in Q2, compared with the previous quarter. It is unclear what this may say about longer-term trends. Most of the loss in subscribers was an India issue, which will not have a massive impact on its financial performance, given the low cost of a subscription in that market. Disney also lost customers in North America, which is officially attributed to the rise in the cost of subscriptions. I am somewhat skeptical of this theory. The monthly cost is not very high, therefore an increase in monthly subscription costs, equivalent to perhaps a cup of coffee, should in theory have little effect on subscription volumes. Other factors, such as competition in the streaming business, as well as perhaps some parents no longer feeling comfortable with the content being offered, might be a factor. If the latter is true, it might just be an early warning sign of things to come.

Disney content increasingly wades deeply into ideological divides, with no evident off-ramp available, even if it wanted to change course

With all the talk of demographic diversity being of paramount importance to success in the business boardrooms, as well as in government, it seems diversity of views as a strength has fallen to the wayside. A diversity of demographics should in theory also provide a certain range of diversity of views, but in my view, all the recent controversies, where companies managed to upset their customer base stem from a lack of diversity of views at leadership levels. In other words, they are taking on progressive positions, with no nay-sayers available in the room to raise concerns.

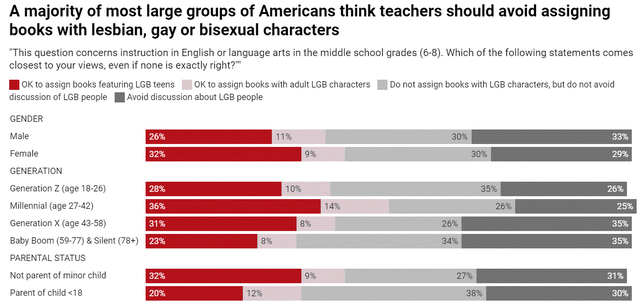

As the chart shows, only 20% of parents of a minor child agree with the idea of providing material to kids in middle school that features LGB teens. Looking at this poll, and then examining the decision of Disney to include an LGB teen character in its movie Strange World, one has to wonder whether Disney’s leadership has ever even discussed such data, before producing the film. I guess that they did not, but I could be wrong. It should be noted that aside from the movie itself losing money, it could also be the movie that perhaps raised alarm bells for more conservative parents. Even if they are not boycotting, they might now filter through Disney movie reviews more diligently and opt not to go, if they find certain objections.

Disney may be playing the long game, betting that society will keep moving in a more liberal direction and they will shortly be in a good position to reap the benefits, even though its leadership is fully aware that it may be rough going for the next few years. While it is possible, I doubt it. It is more than likely that its leadership at the top is operating in an echo chamber, with no available voices in the room to raise any questions about Disney’s current path, and its possible pitfalls.

The lack of diversity of views tends to be prevalent throughout the corporate world in my opinion, and it may not be all about keeping people with opposing views out. It is a widespread problem, with Academia being the root cause.

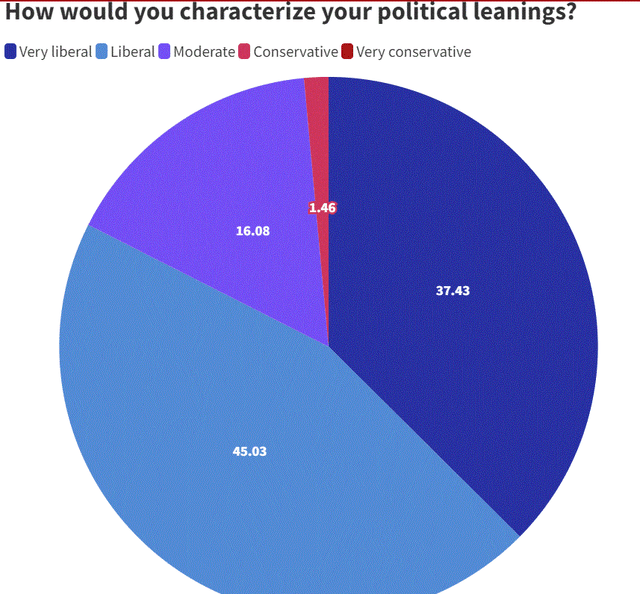

Harvard Academia political leanings (The Harvard Crimson)

As we can see, less than 2/100 academics at Harvard identify as being Conservative. Chances are that even such endangered specimens are more likely to be found in the Chemistry or Physics department than they are to be found in a liberal arts department. So, if Disney were to actively try to seek out some conservative talent, able to effectively counter the overwhelming ideological dominance of the left within its top leadership and management, it would probably be hard to find, which is true for most other companies as well.

At this point, some may wonder why I chose to dwell so much on this subject of diversity of viewpoints, within the context of my analysis of Disney’s potential further slide on a downward trend. I perhaps understand the importance of diversity of views in leadership positions as well as within society to a greater extent, since I witnessed an entire economic, ideological & political system, comprising multiple regimes, collapse, and implode on itself, arguably precisely due to a lack of diversity of viewpoints. I see no reason to assume that a similar lack of ideological diversity might not also hurt a company like Disney. Perhaps more so in the case of a company like Disney that is involved in entertainment, than perhaps a steel company or a manufacturer of household appliances.

First tacit acknowledgement by Disney that it may have a significant PR problem

The latest controversy around Disney’s content is a leaked image from its production set of the upcoming remake of the classic story of Snow White. What is notable about the past few days, is Disney’s reaction, initially denying that the photo was in fact from the set. It seems to be the first semi-acknowledgment that its current direction may be at odds with segments of its customers. Even if this is so, Bud Light and other recent similar controversies have shown that once committed publicly to a certain ideological preference, it is hard to backtrack, without facing blowback from the other side. This is precisely why caution should have been exercised in moving so far in one direction and committing to promoting a very progressive viewpoint, without seemingly any consideration of potential negative consequences, which is when the value of a nay-sayer in the room may have been priceless.

Investment implications

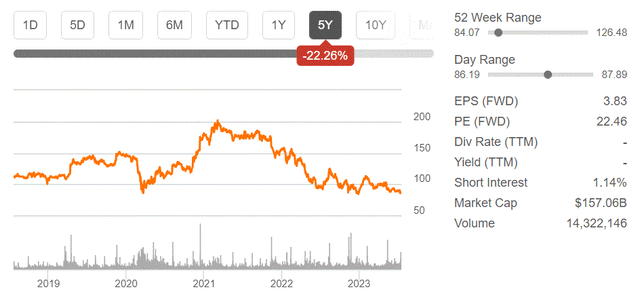

Though I usually hunt for investment opportunities, where a company that otherwise has a good fundamental position, as well as positive trends going in its favor, is down significantly from all-time highs, I do not see value in investing in Disney’s stock at its current price.

Disney stock price chart (Seeking Alpha)

Disney passes my first criteria with flying colors in this regard to being a beaten-up stock, but that is where the potential interest in looking for a bargain investment entry point stops. Even though it is down so sharply, with a forward P/E of almost 23x, it still seems on the expensive side for a company that is not expected to see spectacular growth in profitability, even under the most optimistic hypothetical scenarios out there.

If the second half of the fiscal year 2023 will see a similar profitability trend that we saw in the first half, we could be looking at a massive improvement compared with last year’s earnings result. We could see net earnings of about $5 billion. It could be argued that Disney is gradually but surely headed toward a return to the levels of profits we saw before COVID in the $10 billion/year range. If one finds this thesis to be viable, it might be worth taking the risk and investing in Disney stock at the current prevailing price.

With seemingly more Disney movies losing money than making money this summer, and some reports of theme park traffic running at a thinner pace than last year, or before the pandemic, it is increasingly unlikely that Disney will be able to beat last year’s earnings by much, if at all. The Disney + subscription decline in North America in Q2 is also something that could emerge as an early warning sign of the Disney brand gradually losing its appeal with some customers.

If it is the case that Disney does not beat last year’s earnings,, it trades at a P/E ratio of 38x which is much higher than the forward P/E ratio I cited. What this means is that even though the stock is down so much from its all-time highs, it may still be trading at a very high level of valuation compared with the overall stock market. The S&P 500 Index for instance is trading at a P/E of 26x currently. It is hard to justify Disney trading above the market index average, given that there are growing signs that it may financially underperform expectations in the second half of this year, and there may be more disappointment to come next year. On the other hand, I fail to see where an upside surprise might come from.

Beyond this year’s arguably rocky outcome of Disney’s content release, we have the online public feedback to the release of a picture from the set of Snow White, which will be one of Disney’s first tests at the box office next year. Based on public & media reactions, it may end up being a much greater controversy than any previous Disney movie. The MSM currently likes to focus on the issue of the seven Dwarves, but it seems there may be many angles to this movie, where public criticism may have the potential to not only make the movie a flop but also produce a ripple effect against other Disney movies, services & products. It is a risk that should not be underestimated. The start of public blowback may not be as visible as the Bud Light saga was, for it may not be heralded by Kid Rock using some Disney merchandise for target practice. It might just be a rather quiet, gradual melting away of consumer demand. Some early signs suggest that it may already be happening to some extent. If so, it could get worse, while Disney’s leadership is unlikely to effectively understand thus manage the problem.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.