Summary:

- Bob Iger’s plan to reduce Direct-to-Consumer losses appears to be working but there is a long way to go yet.

- Disney’s Parks, Experiences and Products segment continues to perform strongly.

- Near-term weakness in advertising revenues and the potential for a recession to reduce Parks customer visitation and spend are obvious concerns.

- Taking a medium-term view, there appears to be more than sufficient share price upside to compensate for near-term risks, and DIS stock remains a Buy.

Bastiaan Slabbers

Introduction

The Walt Disney Company (NYSE:DIS) is rarely out of the spotlight these days. The DIS 2Q23 result released on 10 May 2023 has already been overshadowed by recent news that the company has scrapped plans to build a new corporate campus in Florida and is also closing down the Star Wars Galactic Starcruiser Hotel in Orlando. It’s become the norm with DIS that almost every big announcement that the company makes triggers a raft of negative commentary about ‘woke ideology’ – personally I doubt that this outpouring of negative sentiment is having a material impact on Disney’s operational performance or share price, but I’m certain that many will disagree.

In this note I will focus mainly on the 2Q23 materials and consider whether or not the stock is still worthy of the Buy rating that I published in late February 2023. With an abundance of Seeking Alpha research already available to readers regarding the Disney Media and Entertainment Distribution (‘DMED’) segment, I’ll deliberately skew the content of this update towards the Disney Parks, Experiences and Products (‘DPEP’) segment.

Disney Parks, Experiences and Products

Readers of my previous research on DIS will be familiar with the emphasis that I place upon the Disney Parks, Experiences and Products (‘DPEP’) segment when it comes to valuing the overall enterprise. The Disney Media and Entertainment Distribution (‘DMED’) segment is going through a monumental transition, with Linear Networks in structural decline and a far from clear end-game for Direct-to-Consumer (‘DTC’). Whilst we are several quarters away from arriving at a point where investors can start to feel confident about their ability to estimate sustainable DMED earnings, I see DPEP as a relatively stable business that can form a solid foundation for valuing the overall DIS group and supporting a robust investment case. DPEP is a highly seasonal business, and so it makes sense to look at operating performance relative to the prior corresponding period (‘pcp’) rather than sequentially. Exhibit 1 shows revenue and operating income for 2Q23 versus 2Q22.

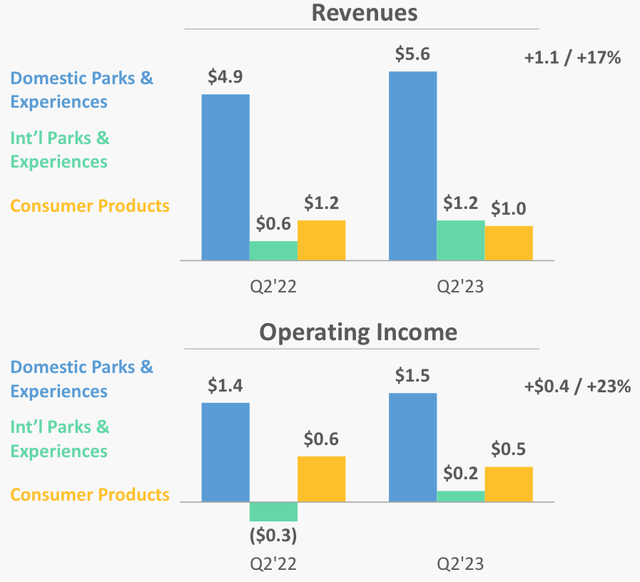

Exhibit 1:

Source: DIS 2Q23 Presentation, slide 9.

Domestic Parks & Experiences – observations/comments:

- Strong revenue growth of +14% did not fully feed through to operating income growth of +10%.

- Attendance was up by a solid +7%, but per capita guest spending of +2% is a bit disappointing given the underlying inflationary influences. Operating income for parks and resorts actually fell versus pcp due to increased costs, in part driven by wage and other inflation.

- Whilst I’m not impressed by the fall in operating income for domestic parks and resorts, it remains the case that 2Q23 operating income for this part of the business was still >50% above 2019 levels (as per CFO Christine McCarthy’s commentary in the 2Q23 management speech, refer to page 12).

- Hotels occupancy increased from 84% in 2Q22 to 89% in 2Q23.

- Identifying the underlying trend in operating income versus pcp is made difficult by the fact that 2Q22 included a real estate related gain and 2Q23 included the recovery of the cruise business. Unfortunately, the results materials do not quantify either of these two factors and the Q&A session did not draw out any further detail.

International Parks & Experiences – observations/comments:

- Revenue more than doubled from pcp levels and operating income improved from a loss of -$268m in 2Q22 to a profit of $156m in 2Q23.

- The improvement in operating profit was attributed to better results from Disneyland Paris, Shanghai Disney Resort and Hong Kong Disneyland Resort.

- Management Q&A commentary regarding Shanghai leaves me thinking that Shanghai’s 2Q23 result may be above normal levels due to a temporary boost from pent up pandemic related demand.

- Although Hong Kong’s results have improved, I note that this business is still making losses. There is insufficient information available to form a confident opinion regarding the future profitability of the Hong Kong resort.

- Hotels occupancy improved to 72%. Relative to the domestic hotels this is a rather weak outcome. An eventual upward recovery in occupancy can be anticipated but I do not have a good sense as to how much of a drag the Hong Kong resort will continue to be.

- As with the domestic business, management flagged increased cost in the international segment, both from new guest offerings but also inflation.

Consumer Products – observations/comments:

- Weakness in merchandise licensing operating income was driven by lower revenue from merchandise for the Star Wars, Spider-Man, Frozen and Avengers franchises.

- Revenue fell by -14% relative to pcp, with a sharper fall of -23% at the operating income level.

- Consumer Products performed very strongly throughout the pandemic and it is looking increasingly likely that future earnings may be somewhat softer. Cost-of-living pressures may lead to consumers cutting back on purchases of DIS branded merchandise.

Capital expenditures for the DPEP segment have consistently run above the corresponding depreciation charge since 3Q21. In the last twelve months to 2Q23, capital expenditures for DPEP were ~$200m above depreciation expenses. The gap between the level of capital expenditure and depreciation has fallen from the highs seen in mid-late FY22 but I take comfort from the continued substantial investment in DPEP’s operations. Management have flagged lower DPEP capital expenditure in FY23 than originally planned, but this is due to the timing of projects rather than a change in view regarding the potential for fresh investment to drive future revenue growth. I continue to make a negative adjustment to my sustainable earnings calculation for DPEP to account for the gap between capital expenditure and depreciation.

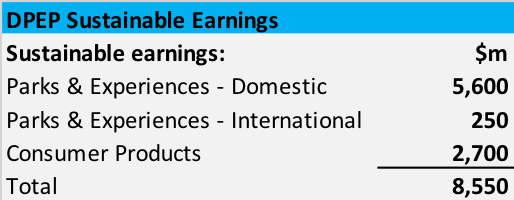

Exhibit 2 shows the updated sustainable earnings base for DPEP that I landed at for this valuation assessment. Relative to my previous numbers, I have increased DPEP sustainable earnings by $100m pa.

Exhibit 2:

Source: author calculations based on DIS annual and quarterly reports.

Disney Media and Entertainment Distribution

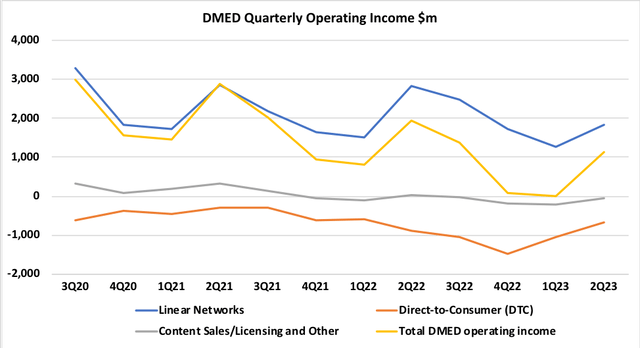

Exhibit 3 plots the components of DMED’s operating income results over the last twelve quarters. The structural decline in Liner Networks operating income is quite clear and shows no sign of easing up. In addition to the expected structural decline, Linear Networks is currently under additional pressure due to cyclical weakness in advertising markets. Sports advertising is reported to be holding up, but if we head into a US recession even this market is likely to start to struggle.

Exhibit 3:

Source: author calculations based on DIS quarterly reports.

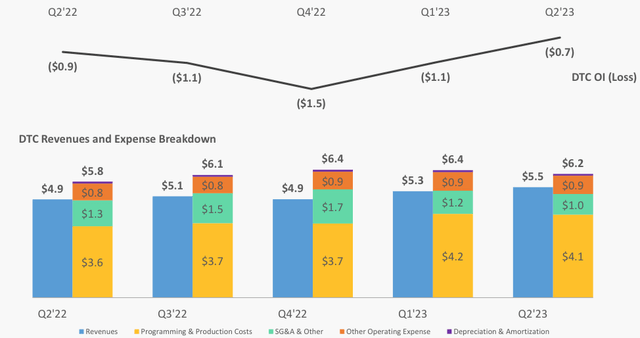

Exhibit 4:

Source: DIS 2Q23 Presentation, slide 6.

As highlighted in Exhibit 4, losses in DTC remain painful for shareholders but have recovered materially from the loss of almost -$1.5bn posted in 4Q22. The $400m sequential improvement in operating losses relative to 1Q23 was mainly driven by higher revenue and lower SGA expenses, with programming and production costs only marginally lower. We shouldn’t get overly optimistic about the improved 2Q23 result as the CFO flagged an expected increase in operating losses in 3Q23 due to marketing expenses that were anticipated for 2Q23 being delayed until 3Q23.

Pricing changes in DTC appear to be having a net positive impact so far. Further pricing model changes will come later in the year, and CEO Bob Iger flagged a higher price for ad-free tiers. Tension between pricing increases and customer retention is likely to emerge at some point and may be exacerbated by customers tightening up on discretionary spending as cost-of-living pressures intensify in the coming months. A reduction in programming and production costs would help to improve DTC’s results; Iger has stated the intention to rationalize the volume and cost of content but I think that the market will need to see progress on that front before starting to contemplate the possibility that DMED is on a path towards reasonable rates of return.

Summary & Conclusion

Given the high degree of uncertainty regarding the level of sustainable earnings that DMED can be expected to generate, I find DIS a difficult stock to value. Until there is more clarity regarding DMED, I will continue to use the investment framework outlined in my DIS June 2022 Seeking Alpha note; firstly, I consider the value that can be attributed to components of the company that I regard as stable (in the context of generating sustainable earnings over time). I place DPEP along with corporate costs and assumed ongoing restructuring expenses in this ‘stable’ bucket. I then work out what implied value the market is placing on the less stable components of the business (this bucket includes DMED, which is the primary source of uncertainty in regard to sustainable earnings) and determine whether or not that implied value is reasonable. Using this approach, in February 2022, with the stock trading at ~$100 per share, I upgraded DIS to a Buy rating.

After reviewing the 2Q23 materials, I have refreshed my valuation and investment framework for DIS as follows:

- A modest increase to the value that I am willing to attribute to DPEP.

- Improved confidence regarding the ability of DIS to deliver bottom line benefits from its cost-out program.

- No change in view regarding the high level of uncertainty faced by DMED.

- Near-term earnings downside risks relating to the negative impacts of a recession on advertising revenue and DPEP visitation.

- Concerns regarding the potential for a lengthy legal conflict between DIS and the state of Florida.

DIS is currently trading at ~$88 per share, some 12% lower than the level at which I initiated a Buy call in February 2023. On balance, after the share price fall, I now see greater potential share price upside but also higher near-term downside risks. I am a medium-term focused investor, and from that perspective, the increased near-term downside risks are not material enough to offset the increased value upside. I therefore conclude this review with a continuation of my Buy call (based on a share price of ~$88 per share).

Analyst’s Disclosure: I/we have a beneficial long position in the shares of DIS either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

This writing is for informational purposes only. All opinions expressed herein are not investment recommendations, and are not meant to be relied upon in investment decisions. The author is not acting in an investment advisor capacity and is not a registered investment advisor. The author recommends investors consult a qualified investment advisor before making any trade. This article is not an investment research report, but an opinion written at a point in time. The author's opinions expressed herein address only a small cross-section of data related to an investment in securities mentioned. Any analysis presented is based on incomplete information, and is limited in scope and accuracy. The information and data in this article are obtained from sources believed to be reliable, but their accuracy and completeness are not guaranteed. Any and all opinions, estimates, and conclusions are based on the author's best judgment at the time of publication, and are subject to change without notice. Past performance is no guarantee of future returns.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.