Summary:

- Walt Disney is increasing subscription prices for Disney+ and Hulu, which could drive its DTC business to profitability within a year.

- The company has experienced subscriber losses again in FQ3, particularly in its Disney+ hotstar service in India.

- Despite these challenges, cost-cutting measures and subscription price increases support Walt Disney’s earnings growth and make it an attractive investment in the streaming market.

ratpack223/iStock via Getty Images

Walt Disney (NYSE:DIS) could be turning a corner soon in terms of improving the profitability picture of its streaming business. The streaming company recently announced that it will increase subscription prices for its Disney+ and Hulu streaming plans and earlier this year put into motion an aggressive cost-cutting plan that is set to help Disney boost its earnings potential, especially in the direct-to-consumer business. While Walt Disney continues to face headwinds regarding its subscriber growth, especially regarding Disney+ Hotstar in India, I believe cost reductions and subscription price increases could fundamentally support Walt Disney’s earnings growth in the near future. Since the company’s valuation multiplier factor has fallen to just 17.5X recently, I believe the risk profile is now favorable for investors that seek out a streaming play!

Previous rating and reasons for rating change

I previously rated Walt Disney a hold due to headwinds in the company’s direct-to-consumer business which encapsulates all of its streaming services Disney+, ESPN+ and Hulu: A Subscriber Exodus Is A Real Problem. However, the streaming business could achieve an inflection point within the next year as Disney announced that it will increase prices for its main streaming plans which is set to be a tailwind for the company’s earnings growth. For this reason, and because of a lower valuation multiplier, I am upgrading Walt Disney to buy.

Subscriber losses are still a concern

In FQ3’23, Walt Disney’s revenues increased 4% year over year to $22.3B, but the company nonetheless fell short of revenue expectations, in part because of continual subscriber losses.

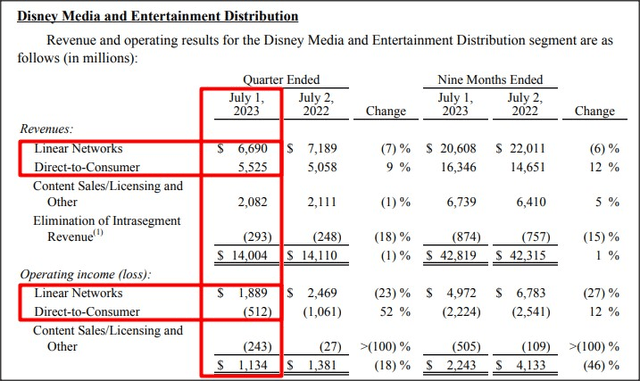

While Walt Disney’s consolidated top line was still growing in the mid-single digits in FQ3, the company’s Media & Entertainment business remains in a challenging situation: total revenues declined 1% year over year to $14.0B. While Linear Networks revenues are falling (due to a declining importance of Pay T.V.), the direct-to-consumer business is offsetting decelerating growth in Walt Disney’s cable business: direct-to-consumer segment revenues increased 9% year over year to $5.5B. While the segment is seeing solid revenue growth, Walt Disney must improve the segment’s profitability… and the company has proposed a number of actions lately to achieve this milestone.

Unfortunately, Disney reported a third consecutive quarter of subscriber losses for its core Disney+ streaming service in FQ3’23: the number of Disney+ subscribers dropped 7% quarter over quarter to 146.1M. Disney+ subscribers topped out in the fourth-quarter of FY 2022 which is when the company counted 164.2M customers as subscribers. Since then, Walt Disney has lost a massive 18M subscribers, mostly in its Indian streaming service, Disney+ Hotstar, which suffered a setback after losing the streaming rights to the popular and lucrative Indian Premier League cricket tournaments.

Disney+ Hotstar lost 12.5M subscribers in Walt Disney’s third fiscal quarter. Total Hulu subscribers increased by 100 thousand in FQ3’23 to 48.3M while ESPN+ subscriptions fell by 100 thousand subscribers to 25.2M. In other words, subscriber headwinds still exist.

Nearing an inflection point

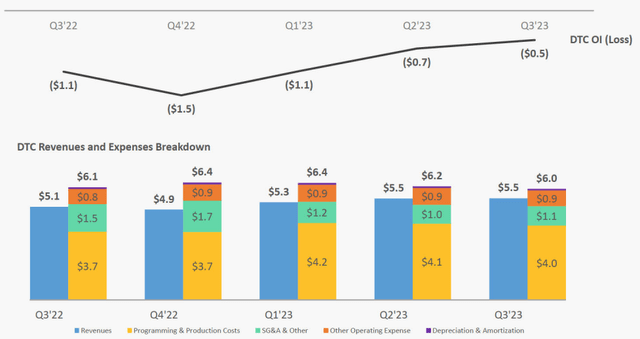

Walt Disney’s direct-to-consumer business is not profitable and the streaming company generated consistent operating losses in the last year, suggesting that Disney, despite its large amount of subscribers has not reached critical scale yet. The direct-to-consumer business made a loss of $512M in FQ3’23, compared to a $1.1B loss in the year-earlier period.

However, going forward, Walt Disney could see a profitability boost as the company focuses on cost-cutting and increasing subscription prices. Disney already said that it wants to cut $5.5B in expenses earlier this year and the streaming firm is set to raise subscription prices for its core ad-free subscription plans Disney+ and Hulu by $3 per-month.

The new streaming prices for Disney+ and Hulu will be $13.99 and $17.99 per-month, meaning Disney will raise its prices for its most popular plans by 20-27%. Domestic Disney+ subscribers totaled 46M at the end of FQ3’23 which means that the company could see a significant earnings tailwind in the coming quarters due to its price increases.

If only half of Disney+’s 46M domestic subscribers went along with the $3 per-month subscription price increase, the streaming firm would be able to boost its profits, on an annual basis, by $828M… which would be enough to drive the DTC business to profitability within a year. Disney also said that it will crack down on password sharing practices, following Netflix’s move. Netflix has had success in limiting this practice and has been able to charge extra money for shared accounts, so Walt Disney has yet another lever here to improve DTC operating performance going forward.

Valuation Disney vs. Netflix

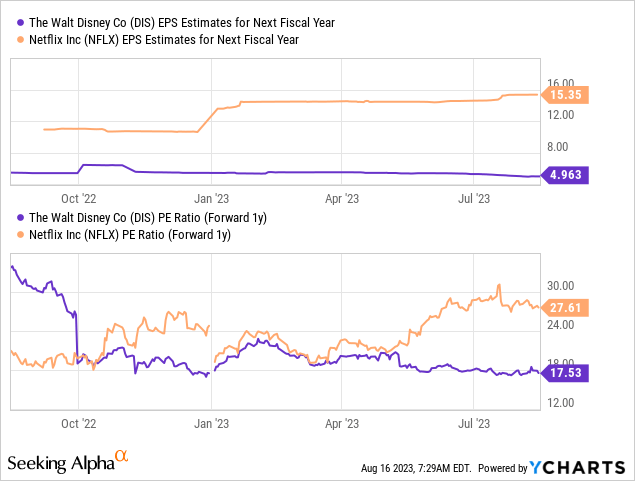

Both Disney and Netflix have very unique streaming offers and both companies have considerable subscriber bases worldwide. Netflix had 238.4M subscribers internationally at the end of the second-quarter compared to 219.6M for Disney (across all streaming offers).

Walt Disney is currently expected to grow its EPS 35% in FY 2024 compared to a growth rate of 29% for Netflix. Walt Disney is trading at a P/E ratio of 17.5X while Netflix remains widely overvalued, in my opinion, with a P/E ratio of 27.6X. Disney has higher short-term EPS growth potential given the large increase in subscription prices, but shares are also significantly cheaper than Netflix’s, on a forward earnings basis. If I had to choose between those two companies, I would pick Disney as the company is nearing an inflection point (profitability in the DTC segment) which could drive a revaluation of Disney’s shares.

Risks with Disney

Persistent losses in the DTC segment, despite subscription price increases and a crackdown on password sharing, would be very disappointing and likely fly in the face of my buy rating. However, Disney narrowed its losses in the DTC segment three quarters in a row and the trend is therefore positive even before subscription price increases kick in. Another risk is decelerating revenue growth as the streaming market is now very competitive with many media companies offering their own subscription offers.

Closing thoughts

Although Walt Disney kept losing subscribers in the last quarter, especially with regard to Disney+ Hotstar in India, I believe the streaming company has a credible pathway to achieve positive operating income in the important direct-to-consumer business within the next year… which is the reason for my upgrade. The increase in subscription prices, cost-cutting measures and a Netflix-like crackdown on the password sharing practice have the potential to drive the DTC business to profitability and allow a re-rating of Disney’s shares. Considering that shares of Disney, based off of P/E, are also significantly cheaper than Netflix’s, I believe DIS is a strong streaming bet with an attractive risk profile!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of DIS either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.