Summary:

- Disney lacks a strategic direction for fostering innovation, reminiscent of Walt Disney’s creativity, and management seems more focused on stock performance than innovation.

- Although Disney’s current financial profile suggests medium-term stability, the stock appears overvalued based on P/E and intrinsic value measures.

- Compared to Paramount and Sony, Disney is lagging creatively, as these competitors have produced more compelling content recently.

Eric Broder Van Dyke

In December 2023, I rated Disney (NYSE:DIS) as a Buy, leading to a 14.35% stock growth. Now, with changing market dynamics, a closer examination of Disney’s future growth potential is necessary.

Assessing The Future Of Disney’s Entertainment Value

There has been much debate over whether Disney’s future can be as significant as it once was when Walt Disney was at the helm. In many respects, the lifeblood of the creative process has passed, but his legacy remains, and I don’t think this should be overlooked. Great business leaders and innovators can’t live forever, but the quality and ethos they instilled in their companies can last many generations.

I think Disney has failed in recent years to think differently and produce works of true ingenuity and creativity. There have also been rational concerns about the company taking too significant a political stance, with content and marketing being defined as “woke” by much of its audience. With that being said, Disneyland, Disney World and Disney Cruises still have exceptional reviews, and the Disney+ platform has a 4.4-star score from 3.9 million reviews.

I believe the success of Disney Parks hinges largely on its on-screen entertainment, which will be my primary focus in this analysis. While I appreciate its theatre shows and exhibitions, I aim to analyze Disney’s creative talent, best represented by its films and animations.

According to IMDB, the highest-grossing Disney screen productions in recent years are:

- Avengers: Endgame (2019) — Grossed approximately $2.8 billion worldwide.

- Avatar: The Way of Water (2022) — Grossed over $2.3 billion worldwide.

- Star Wars: The Force Awakens (2015) — Grossed over $2 billion worldwide.

- Avengers: Infinity War (2018) — Grossed over $2 billion worldwide.

- Spider-Man: No Way Home (2021) — Grossed nearly $1.9 billion worldwide.

You may have noticed that all of these are reproductions of previous hits. I mentioned in my last analysis that Disney could use much deeper investment into creative talent because I think it is failing to attract the right innovators. It has found its legacy content to be de facto higher revenue generating than new content. This attracts a certain type of creative, in my opinion, namely, ones who want to capitalize off of previous narratives by optimizing them rather than pioneer and innovate. That’s fine for a while and arguably will generate more money in the short-to-medium term for the company than investing heavily in innovative projects, but over the long term, I believe that the market for Disney titles will begin to dwindle if it hasn’t developed its talent for innovation properly.

Disney has made a significant amount of very high-caliber acquisitions, including Lucasfilm, Marvel and Pixar. However, I think the management has missed something critical in maintaining long-term growth. In my opinion, the greatest element of the entertainment business is that quality and “magic” always get noticed if marketed properly. Unfortunately, Disney is repurposing legacy “magic” instead of cultivating and hiring the talent to consistently produce fresh content.

Here are the highest-grossing new original content Disney has produced, as sourced from Box Office Mojo:

- Frozen (2013) — Grossed approximately $1.28 billion worldwide.

- Zootopia (2016) — Grossed approximately $1.02 billion worldwide.

- Coco (2017) — Grossed approximately $807 million worldwide.

- Moana (2016) — Grossed approximately $643 million worldwide.

- Ralph Breaks the Internet (2018) — Grossed approximately $529 million worldwide.

There are clearly some very valuable success stories here, in particular with Frozen, which must be given its due for being exceptionally popular and meaningful to many. However, the revenues generated indicate the problem Disney’s management is faced with. I think that Disney is too afraid to take bold bets that might periodically deflate the stock price for the sake of long-term growth. I also, contrary to my last report on the company, wonder whether the management is properly equipped to actually lead a strategic pivot that reinvigorates the brand for a modern audience. Let’s not forget just how revolutionary and enigmatic Mickey Mouse was for its time. I haven’t seen anything of that quality generated by Disney in its modern era. Potentially, I think the real issue here comes down to the fact that management might be too focused on financial returns and not enough on creativity. In other words, as Jeff Bezos would say, are the management mercenaries or missionaries? Or to put it more bluntly, are Disney’s exec team trying to flip the stock or build groundbreaking entertainment at whatever cost? Ironically, as Jeff Bezos taught, chronicled in his collective writings published in Invent and Wander, it’s the missionaries who usually end up making the most cash in the long run.

Financial Considerations

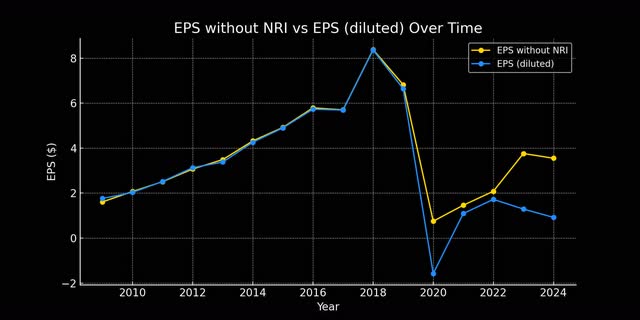

Disney’s earnings suffered during COVID-19 due to park closures and higher operational costs. However, the company has rebounded well, demonstrating medium-term stability despite pandemic challenges. Here is a detailed breakdown of how COVID-19 caused this decline:

Impact on Theme Parks and Resorts: Extended closures and limited capacity at Disney’s theme parks, resorts, and cruise lines severely impacted revenue from this high-margin segment. Health and safety measures also increased operational costs, reducing profitability even when the parks were open.

Higher Operating Costs: COVID-19 safety protocols led to production delays and higher costs. Additionally, significant investments in expanding streaming services and content creation drove up operating expenses.

Reduced Advertising Revenue: Advertising revenue dropped as companies cut ad spending during the economic downturn, affecting networks like ABC and ESPN.

Impairments and Write-Downs: Impairments were recorded for businesses severely impacted by the pandemic, including international channels. Additionally, there were closure-related write-downs and restructuring costs that further contributed to the decline in net income. Investors should note that these impairments result in a one-time charge against earnings, categorizing them as non-recurring losses. Consequently, these adjustments help provide a clearer picture of the firm’s profitability by excluding non-recurring items from the Earnings Per Share (‘EPS’) calculation.

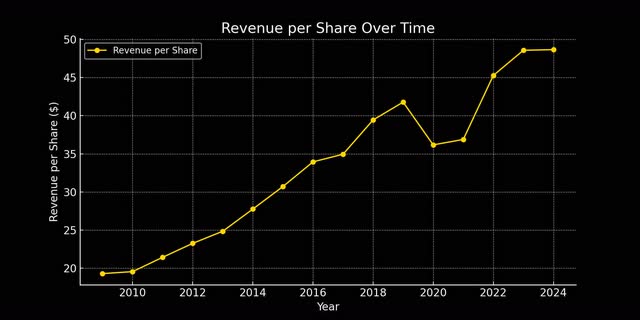

However, since then, the results have been very good, and the company has pulled back closer to pre-pandemic levels in terms of earnings. Additionally, the company’s revenue remained much more stable during the pandemic. This stability was primarily because people were spending more time at home, leading to higher subscription revenue. There was also increased demand for Hulu and ESPN+ during this period. The company continued to release new original content, helping to attract and retain customers, and introduced Premier Access on Disney+, allowing subscribers to pay an additional fee to watch new movie releases at home, generating additional revenue.

For detailed reference of these comments, please refer to Disney’s Annual Report 2020, its Q4 FY2020 Earnings Report, Disney’s 10-K Report 2020, and its Q1 FY2021 Earnings Report.

It is essential to acknowledge that Disney is currently experiencing robust growth, recovering well from the pandemic-related downturn caused by uncontrollable macroeconomic factors. While the medium-term outlook for Disney is promising, the company must strategically enhance its innovation efforts to ensure sustained long-term success, as detailed in my operations analysis above.

Value Analysis

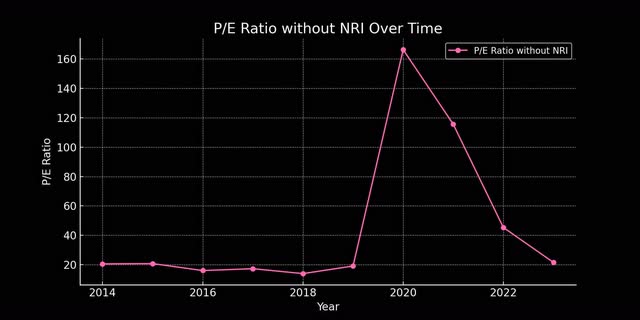

The chart below illustrates Disney’s P/E ratio trends, highlighting the irrational exuberance of 2020. Currently, Disney’s stock, though more reasonably valued, appears overvalued, with a P/E ratio of 29 as of May 2024.

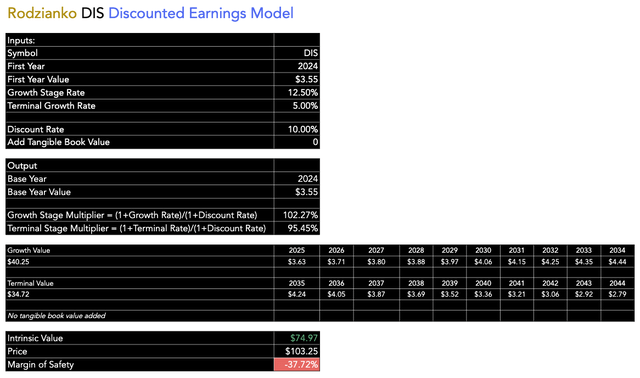

Additionally, readers may want to know what I consider to be the “intrinsic value” of Disney stock. Well, at this time, I think that an EPS without non-recurring items annual growth rate of roughly 12.5% over the next 10 years is conservative and reasonable for Disney to achieve. I then think a 5% EPS without non-recurring items annual growth rate is also conservative and reasonable for Disney to achieve in the 10 years following this, 2034-2044. In my discounted earnings model, I have incorporated a 10% discount rate, which I consider the market standard annual return expectation. The indicated fair value from this model, which I believe does not integrate a potential future reinvigoration of talent and innovation at Disney, is approximately $75. The stock price at the time of this writing, May 20, 2024, is $103.25. That is a -37.72% margin of safety.

I consider the above model to be a highly defensive method of valuation, as Disney is a company where sentiment rests above intrinsic value for extended periods. It is meant as a reference point rather than as definitive.

Competition Analysis

My above analysis shows two points of significant concern for investors. The first is a potential overvaluation at this time, both based on historical sentiment as elucidated by P/E multiples and also based on my discounted earnings model, both of which use P/E without non-recurring items data. The second is that the company seems to be struggling with maintaining massive innovation, and its largest source of revenue comes from content and experiences related to legacy narratives. While it has had some significant success with original titles, I think it is important for us to briefly weigh up Disney against the current competition:

1. Warner Bros. Discovery (WBD)

Top Recent Original Titles:

- HBO Max Originals:

- House of the Dragon: A prequel to Game of Thrones that has garnered significant viewership and critical acclaim.

- Succession: A drama series about a powerful family that owns a global media conglomerate.

- Euphoria: A teen drama series known for its striking visuals and strong performances.

2. Netflix (NFLX)

Top Recent Original Titles:

- Stranger Things: A sci-fi horror series set in the 1980s that has become a cultural phenomenon.

- Bridgerton: A period drama series based on Julia Quinn’s novels, known for its diverse cast and lavish production.

- The Witcher: A fantasy series based on the book series by Andrzej Sapkowski, which has been very popular with audiences.

3. Comcast (NBCUniversal) (CMCSA)

Top Recent Original Titles:

- Peacock Originals:

- Bel-Air: A dramatic reimagining of the classic sitcom The Fresh Prince of Bel-Air.

- Dr. Death: A true-crime drama series based on the podcast of the same name.

- Saved by the Bell: A reboot of the classic ’90s sitcom that has received positive reviews.

4. Sony Pictures (SONY)

Top Recent Original Titles:

- Sony’s PlayStation Productions:

- The Last of Us: An adaptation of the critically acclaimed video game series, highly anticipated by fans.

- Spider-Man: Into the Spider-Verse: While not a TV series, this animated film has been incredibly successful.

5. Paramount Global (formerly ViacomCBS) (PARA)

Top Recent Original Titles:

- Paramount+ Originals:

- Yellowstone: A drama series starring Kevin Costner, which has been a major hit and spawned spin-offs.

- Star Trek: Discovery: A revival of the classic Star Trek franchise, contributing to the growth of Paramount+.

- 1883: A prequel to Yellowstone, focusing on the origins of the Dutton family.

As we can see, there is a lot of very strong talent in the industry associated with very reputable production houses, and while I think content like the Mandalorian is a stand-out for Disney, in my opinion, it is difficult to compare much of what Disney has produced in recent years to the prowess that comes with Taylor Sheridan’s creations, including Yellowstone and 1883. In addition, Spider-Man: Into the Spider-Verse has taken animation to a very new and modern area, which is the kind of innovation I am looking for from Disney. In my opinion, if you watch entertainment regularly as I do, the creative talent from the five major competitors I have listed here often dwarfs a lot of the recent releases from Disney. I am not discrediting some of the great work Disney has done, but I do believe at this time, its historical creativity under Walt Disney was orders of magnitude more impressive.

Consider the following table, which shows the relative valuation for each of the companies over the past 8 years; the table is of P/E ratios without non-recurring items:

| 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | |

| DIS | 16.03 | 17.30 | 13.96 | 19.12 | 166.33 | 115.55 | 45.33 | 21.56 |

| NFLX | 287.91 | 153.57 | 99.87 | 78.35 | 88.94 | 53.60 | 29.64 | 40.47 |

| CMCSA | 19.42 | 8.43 | 13.30 | 16.55 | 24.80 | 16.85 | 12.50 | 11.02 |

| SONY | 22.62 | 24.66 | 12.77 | 8.07 | 13.13 | 14.52 | 19.88 | 16.26 |

| PARA | 15.48 | 12.11 | 7.67 | 8.38 | 8.87 | 8.67 | 9.87 | 28.44 |

*Please note that WBD is not included because it is currently trading at a loss, and I do not have access to the P/E without non-recurring items data as a result.

Key Elements

I don’t believe that Disney has enough of a strategic direction that is focused on generating a culture of innovation akin to the creative genius of Walt Disney. I feel there is some bias with the management team to “flip the stock” rather than innovate at all costs. In the long term, I think this will discredit Disney’s brand if it doesn’t address the underlying issue.

Based on the current financial profile, the investment seems stable for the medium-term future. However, I believe the stock is overvalued by P/E and intrinsic value measures.

When compared to other leading entertainment studios, I think evidence mounts that Disney is falling behind creatively right now. For example, I think Paramount and Sony have developed more compelling content in recent years.

Conclusion

While Disney maintains medium-term financial stability, its overvaluation and lack of innovative direction pose long-term risks. Compared to competitors, Disney’s recent output falls short, necessitating a strategic pivot to regain its creative edge. Investors should be cautious of current valuations and monitor Disney’s innovation strategies closely.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.