Summary:

- Disney is a short-term Buy due to management’s profit strategies, including ad-supported tiers and subscription fee increases; expect 12-month alpha despite long-term innovation and brand challenges.

- Streaming services aim for profitability by 2024 end; parks and cruise investments show recovery post-COVID-19; DIS faces competition and creativity issues, affecting long-term growth.

- The Company’s current valuation is attractive, with a P/E ratio of 25; EPS growth estimates suggest a potential stock price increase to $120 in 12 months and $170 by 2029.

RinoCdZ

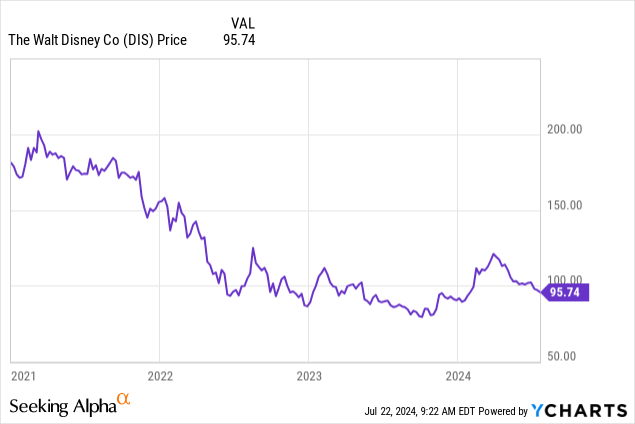

I last covered Disney (NYSE:DIS) in May; at the time, I put out a Hold rating, and since then, the stock has lost approximately 7% in price. I expressed concerns in my previous thesis about Disney’s valuation. However, I have adapted my model for this analysis, and I am now instigating 12-month and 5-year price targets. Based on my analysis, Disney is a Buy at this time and could achieve substantial 12-month alpha; however, over the long term, I think that the possibility of it achieving alpha is greatly reduced, primarily a result of innovation challenges I have highlighted previously, but also because of market saturation. That being said, Disney’s management is executing profit-driving strategies across each of its operating segments, and I think this bodes well for DIS shareholders in the medium term.

Operational Analysis & Financial Implications

While it is certainly true that DIS is struggling with innovation at the moment, management is definitely working hard to maximize profits. Disney aims for its combined streaming offerings to reach profitability by the end of 2024, and Disney+ and Hulu combined were profitable last quarter.

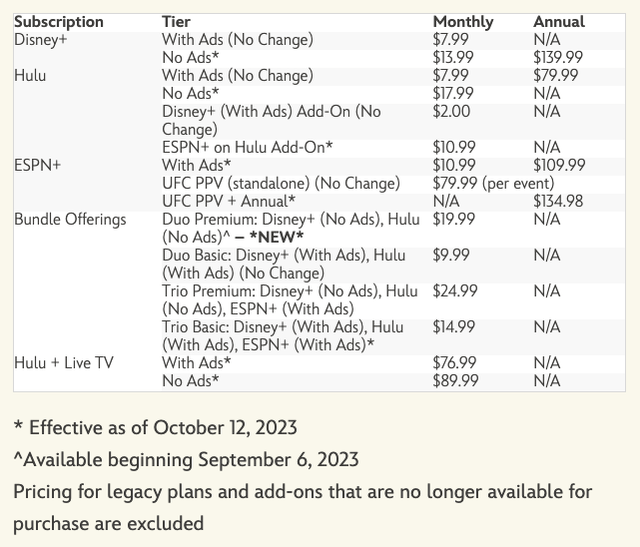

Furthermore, management is strategically introducing an expansion of its ad-supported tiers, which has contributed to both increased subscriber growth and average revenue per user; management mentioned this in the Q2 earnings call. What will also heavily contribute to this is that Disney is raising the subscription fees for Disney+ and Hulu. The monthly fee for Disney+ without ads will increase from $7 to $14 in October 2024 – this should push more subscribers to the ad-supported tiers, which have proven to be more profitable per user due to the additional advertising revenue they generate.

Essentially, CEO Bob Iger has shifted the company’s focus from rapid expansion of its streaming services to making them profitable. However, the company is still recovering from the COVID-19 lockdowns, which significantly impacted the finances of the business. I think this has created an extended value opportunity – while I am not particularly bullish on Disney over the long term, after the recent 7% decline in price, I think there is 12-month alpha to be made.

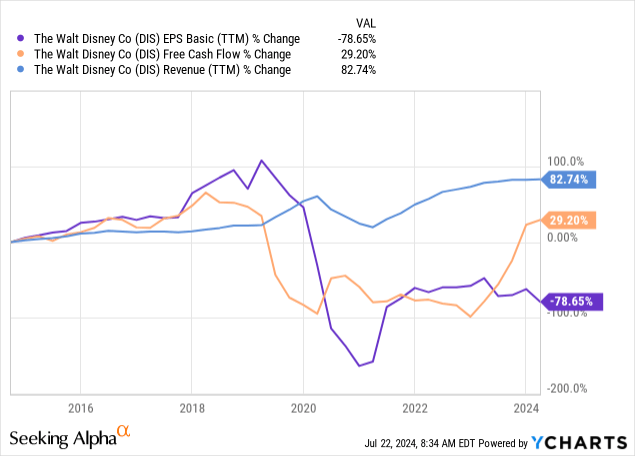

Iger’s emphasis on profitability is undoubtedly warranted – Disney’s streaming division has been incurring substantial losses, which in 2023 totaled over $11B since 2019, with a recent quarterly loss of $512M. The parks and experiences also suffered substantial losses around the time of the pandemic, with operating profit falling by $3.7B in Q3 2020 and overall losses in the billions during the crisis. The period also significantly impacted box office earnings as major films from Pixar, Marvel, and LucasFilm were delayed. Furthermore, the surge in streaming DIS experienced during the period did not fully compensate for the losses in its theatrical releases. Further issues continued to compound, including the suspension of live sports, affecting ESPN. As a result of these severe challenges, DIS has still not fully recovered, with 10Y basic EPS still down by 78.65%, despite a stronger recovery in free cash flow and relatively stable revenue growth, given the severity of the pandemic’s implications. High levels of SBC, depreciation and amortization, and asset writedowns have particularly allowed for the free cash flow recovery. In my opinion, the depression in net income is still being over-accounted for in the valuation, which I will discuss in more detail in the following section, “Financial & Valuation Analysis”.

I mentioned in my previous thesis the long-term innovation challenges Disney is facing, and I think these still remain. This analysis and representation of the current price opportunity does not mean I believe in the long-term ethos of the company enough to consider it worthy of generating 5 to 10+ year alpha. I retain my previous stance that I think Disney is going to struggle over a long time horizon to attract and sustain the same large audience due to too heavy a focus on legacy content. Furthermore, I think competition in the market is intensifying, and larger, newer conglomerates like Apple (AAPL) (also arguably facing innovation challenges) and Amazon (AMZN) are beginning to dominate sections of the digital entertainment market. In my opinion, this short-to-medium-term alpha opportunity, which is being instigated by Iger and management, is unlikely to last with the current content strategy. Management’s current focus on short-to-medium-term profitability is similar to squeezing the last drops from an already-pressed lemon. In order to create sustainable success and long-term growth, I think Disney must cultivate new and innovative ventures that can create enduring revenue expansion.

A failure to achieve a strategic innovation strategy could also have severe long-term implications on Disney’s theme parks by making them less attractive to new generations who are not as enthusiastic about the content they are being raised on. However, in the medium term, Disney has outlined a plan to invest ~$60B over the next decade in its theme parks and cruise lines, nearly doubling its previous investment. In Q2, DIS increased its capex by 8% to $2.6B, focusing on park improvements and cruise ship fleet expansion. Management is heavily investing in attractions related to popular IPs – the focus on theme parks is already paying off, with record quarterly earnings from the segment reported in the final quarter of 2023.

Management’s emphasis on expansion and growth is great – however, now I think the company needs to ensure that the IP it is attaching to these infrastructure build-outs retains the same magic that Disney has been loved for over generations. In my opinion, if Iger and management can instigate a stronger creative culture, the stock could not only deliver short-term alpha but potentially substantial long-term alpha, too.

Financial & Valuation Analysis

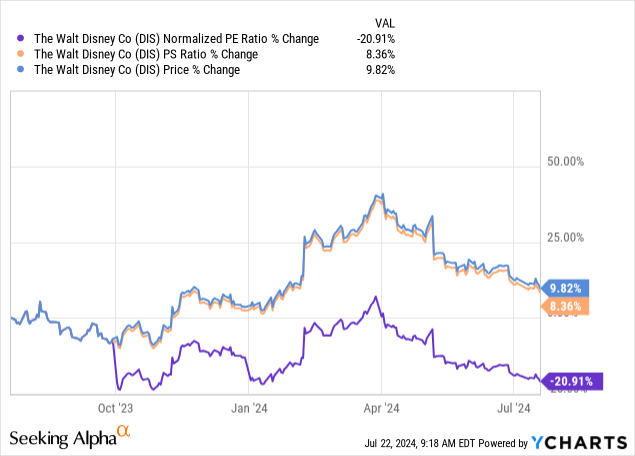

Disney’s price highly correlates with its PE ratio under a shorter ~1Y timeframe. DIS has grown its earnings recently at a much more rapid rate than its revenues; I believe this is an opportunity because while the PS ratio expanding indicates a richer valuation appearing, this indicates growing market sentiment that isn’t keeping up with the growth in earnings yet. This year, I believe we have begun to see the beginning of an uptrend in price resume after a significant downward trend beginning circa 2021. In my opinion, these valuation metrics indicate a Buy.

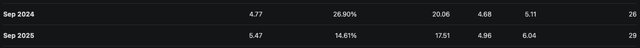

Earnings estimates have begun to look more positive, especially for this year; 26 Wall Street analysts have the consensus that DIS will achieve 27% normalized EPS growth for FY 2024. Furthermore, the consensus for FY 2025 is circa 14.5% growth for normalized EPS.

I think now is an opportunity to invest – the company’s PE ratio without NRI is just 25, which is just above its 10Y median of around 22; I find this notable because DIS is still recovering its earnings, so a reasonably strong PE ratio without NRI at this time bodes well for the future, which is already made evident by the fact that Disney has a forward PE ratio of just 17. Furthermore, DIS is a company that carries a lot of expensive assets on the balance sheet, including substantial PPE. As such, I think its PB ratio on a forward basis of just 1.72 is particularly notable, as it is 29.31% lower than its 5Y average.

Based on the current profitability strategy being instigated by management and the current sentiment in the market on DIS, I think the PE ratio without NRI could be approximately 22 on a TTM basis in 12 months. If management manages to achieve the Wall Street EPS estimate of $5.47 in September 2025, that could mean that the stock will be worth approximately $120 in around July 2025 if the market prices the EPS growth into the stock slightly early. This would mean a CAGR of approximately 26.5% from the present stock price of $95.

However, over 5 years, I think it is likely that the company will begin to produce substantially less short-to-medium-term profits from its current operational shifts. As a result, I predict sentiment will begin to wane somewhat, and I think the PE ratio without NRI could contract toward 18.5. I also think an EPS without NRI CAGR of roughly 14% is reasonable to forecast for DIS from September 2024 to September 2029. As a result, September 2029’s EPS without NRI would be $9.18. Therefore, I have a 2029 price target of approximately $170 for July 2029 if the market prices in the EPS growth slightly early. This marks a 12.5% CAGR from the current stock price of $95.

Risk Analysis

Disney’s efforts of profit expansion are admirable at the shareholder level for medium-term gains, but there are also reputational shifts that accompany such a strategy. For example, Disney could become renowned for attempting to monetize fans as much as possible, which could make customers question their loyalty to the brand. In addition, I think it is likely to alienate certain markets of customers. Those who previously could only just afford Disney theme parks are unlikely to attend if the costs become too high, especially during this time when inflation is so high in the United States.

Furthermore, while management is making a good strategic long-term investment in theme park expansion, I think there are issues that could compound related to the creative IP attached to the theme parks, which I mentioned above in my operational analysis. It must be recognized that Disney is currently experiencing a large strategy shift, and a bolder creative direction for the business may be what is necessary to retain customer satisfaction over the long term. I was further concerned about Disney’s overall brand when I realized it had partnered with the sports betting market through a strategic partnership with Penn Entertainment. This is part of ESPN’s ESPN BET offering – while this might create cash inflows for DIS which are substantial, I am concerned that this kind of offering completely counteracts the family-friendly brand Disney is founded on. In my opinion, Disney is currently weak in marketing, branding, and perceptual direction. I think, along with its innovation strategy, this needs to be revamped and restructured.

Conclusion

In my opinion, DIS is a Buy at the moment because I expect it to deliver 12-month alpha based on higher EPS growth this year and a potential undervaluation at the moment. However, I believe management is facing long-term headwinds related to its innovation efforts, as well as branding weaknesses. I think that many DIS investors may begin to question their holding around September 2025, when growth rates begin to look lower and more settled moving forward compared to 2024. I also think the valuation is unlikely to be very appealing in 12 months’ time when also considering 5Y EPS CAGR estimates. As a result of these concerns, I think if my price target of ~$120 is achieved in less than 12 months, selling is warranted to lock in profits and reallocate the capital elsewhere.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AMZN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.