Summary:

- Disney’s direct-to-consumer business showed improvement with a 15% YoY growth in revenue and a significant improvement in operating margin.

- Subscriber growth, price increases, and advertising revenue are contributing to the positive performance of the Direct-to-Consumer segment.

- DIS announced a $3 billion share buyback plan and expects $8 billion in free cash flow in FY24, supporting their strong financial outlook.

HAYKIRDI

Disney (NYSE:DIS) reported their earnings on February 7th after market close, with a notable reduction in their Direct-to-Consumer business. I presented my ‘Buy’ thesis in my previous article, indicating that their Direct-to-Consumer segment is on the path to generating real profitability. I am impressed by their $3 billion share buyback plan in FY24. Therefore, I upgrade Disney to a ‘Strong Buy’ rating with a fair value price of $125 per share.

Direct-to-Consumer Improvement and Subscriber Growth

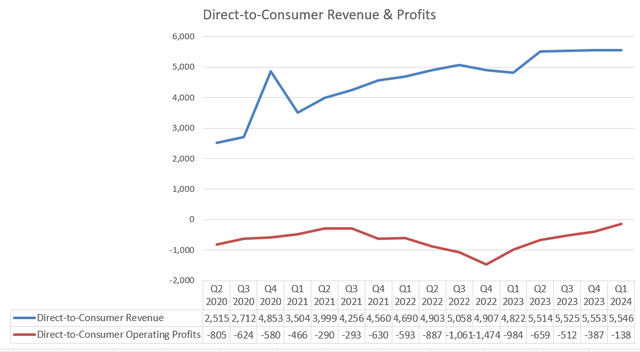

In Q1 FY24, Disney delivered a 15% year-over-year growth in Direct-to-Consumer revenue, and their operating margin improved to only -2.5% in the quarter, a significant improvement from -20.4% one year ago. As illustrated in the chart below, the Direct-to-Consumer business has begun to improve its margin since Q4 FY22 when the company started to control costs and reduce content spending, as I pointed out in my previous article.

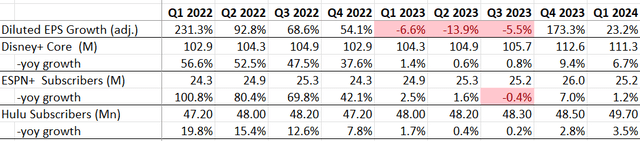

There are several factors contributing to their revenue growth and margin improvement in the quarter. Firstly, their Direct-to-Consumer business is benefiting from subscriber growth. As shown in the table below, Disney+ core subscribers grew by 6.7% year-over-year. Other than some subscriber acquisition costs, the incremental costs are marginal, as Disney has already built up their streaming platform and IT infrastructures.

Secondly, the continuing price increase is expected to improve their Disney+ core ARPU. The company anticipates ARPU to increase in Q2 due to the continued benefit of price increases. This price increase will likely contribute to their margin improvement.

Finally, advertising revenue is starting to contribute to their P&L. Their ad-supported Disney+ offering has been experiencing strong growth momentum, and Disney successfully expanded the service outside the U.S. with launches in EMEA and Canada. They disclosed over the earnings call that they gained over 1,000 global advertisers in Q1.

Regarding capital allocation, they announced a $3 billion stock buyback program, which may be a move to fend off activist investors. Regardless of the underlying reason, the stock repurchase will benefit their equity shareholders.

Regarding the balance sheet, the company ended up with $7.1 billion in cash and $47.6 billion in total debts, with their gross debt leverage still above 4x. However, as they are guiding $8 billion of free cash flow in FY24, their debt level doesn’t pose significant liquidity risk for investors.

Other Key Messages

ESPN Stand-Alone Streaming Launch: Their management indicates that the stand-alone ESPN streaming service will be launched in the fall of 2025, creating a one-stop sports destination. The ESPN streaming service will be bundled with Hulu and Disney+. In my opinion, these bundled services would be quite powerful, enabling subscribers to have a one-stop entertainment streaming experience. Only Disney can make this happen in the world. Additionally, when they launch the stand-alone ESPN streaming service, it won’t incur additional operating expenses or capital expenditures for the company, as many resources and infrastructures could be shared among these streaming services.

Equity Stake in Epic Games: Disney announced their $1.5 billion investment in Epic Games, the publisher of the well-known video game “Fortnite.” Disney intends to collaborate with Epic Games on all-new games and entertainment universes. The deal makes total sense to me, as Epic Games is a quite successful game publisher, and the collaboration would enable Disney to strengthen its existing entertainment business. As Disney disclosed in the announcement, Disney mobile games have 1.5 billion global installs, and nine Disney game franchises have each grossed more than $1 billion in sales. It appears that Epic Games would strengthen Disney’s existing game ecosystem. However, overall, it is a quite small deal, and I don’t expect the deal to affect Disney’s financials materially in the near future.

FY24 Outlook

Disney continues to expect $8 billion of free cash flow in FY24, with adjusted EPS growing at least 20% year over year. One of the main assumptions is the continued growth of their Direct-to-Consumer business. They expect Disney+ Core subscriber net additions of between 5.5 and 6 million and ongoing positive momentum in ARPU in Q2.

The free cash flow target is quite reasonable, thanks to their massive margin improvement. Disney would benefit from both reduced content spending and SG&A cost reduction. They plan to spend $25 billion on content in FY24, versus $27.2 billion in FY23. Disney has already grown to a certain stage where they don’t need to increase their content spending at the same rate as their topline growth, as I analyzed in my previous article.

Additionally, subscriber growth, ARPU improvement, price increases, and advertising revenue growth would continue to drive topline growth. The bundle subscription service is quite powerful for Disney to win more subscribers and gain market share, as the bundle can create more value for subscribers.

Valuation

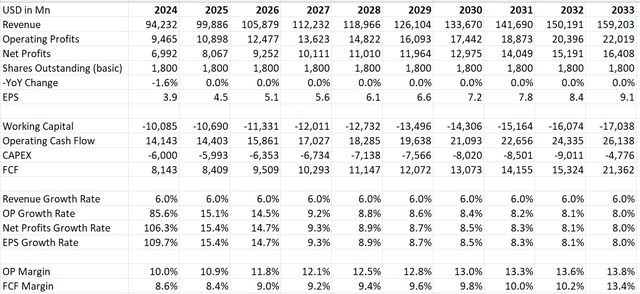

As they plan to buy back $3 billion of their own stock in FY24, the shares outstanding would be reduced by 1.6% based on today’s stock price. I maintain that the 6% organic revenue growth aligns with their historical average.

Given their strong margin and free cash flow improvement in the quarter, I recalculated the operating leverage and estimated that their operating expenses need to grow less than 5% annually to support the 6% topline growth. As such, I’ve used a 30-40 basis points margin expansion in the model based on the operating leverage.

Disney DCF – Author’s Calculations

All the other assumptions remain intact compared to the previous model. The fair value is estimated to be $125 per share.

Key Risks

Disney is facing pressure from activist investors like Nelson Peltz. According to media reports, CEO Bob Iger stated that the “last thing” the company needs is activist investors like Nelson Peltz interfering in the business during an interview after the earnings release. Additionally, Disney’s announcement of share repurchases and a dividend increase are likely efforts to fend off activist investors ahead of their April 3rd shareholder meeting. It appears that Iger and Nelson Peltz may not have a good relationship, as Iger mentioned during the CNBC interview after their earnings, “I have not spoken to Mr. Peltz in a while. I have no plans to speak to him.”

Conclusion

The Direct-to-Consumer business continues on its path toward positive operating margin, driven by ongoing content cost control, price increases, subscriber growth, and advertising growth. Therefore, I upgrade Disney to a ‘Strong Buy’ rating with a fair value price of $125 per share.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of DIS either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.