Summary:

- Disney is scheduled to release its Q2 2023 results later this week, amid pressure to deliver on the promises of the new CEO.

- A number of factors are pointing to a strong and a better than expected quarter, but long-term problems remain.

- The macroeconomic environment is also supportive for Disney’s Parks, Experiences and Products segment.

Drew Angerer

The Walt Disney Company (NYSE:DIS) is scheduled to release its second quarter 2023 results this Wednesday and the expectations of a successful turnaround are running high.

Although making predictions on noisy quarterly results is a futile exercise, Disney now appears in a very good position to deliver better than expected results for the past 3-month period. Down below I will go into more detail on all that, but regardless of the share price reaction long-term investors should keep their eyes firmly on the problems that I have been highlighting since 2019.

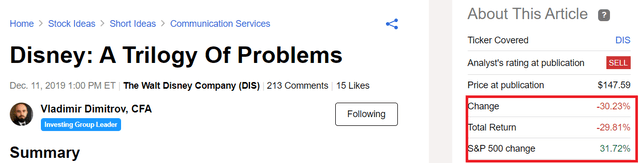

Back then, DIS share price was trading almost 50% higher from its current levels and bearish opinions were scarce. To be fair, even I had a hard time conceiving a scenario that DIS could actually fall by 30% at a time when the broader equity market delivers a positive 30% return (without taking into account the dividends).

But Disney’s management seems to have realized the grave mistake they have made of doubling down on a very poor strategy of prioritizing quantity of content over quality.

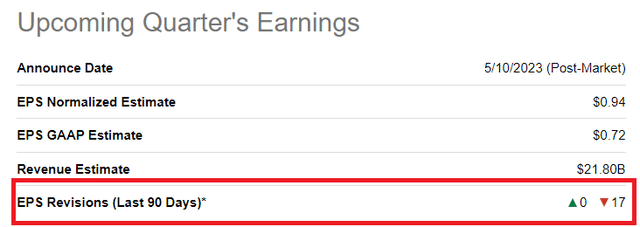

Now that Bob Iger is back with the intention to fix these problems and steer Disney in the right direction, we could see a renewed business momentum at least in the short-run. Analysts on the other hand have been adjusting their expectations with a total of 17 EPS revisions in the past 90-day period.

Addressing The Profitability Issue

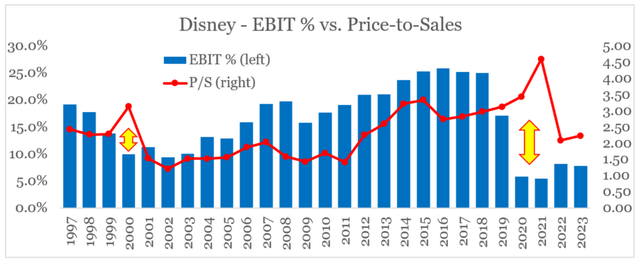

The issue of profitability and margins was one of my main concerns around Disney back in 2019 and the management seems to be finally accepting the reality and addressing the issue.

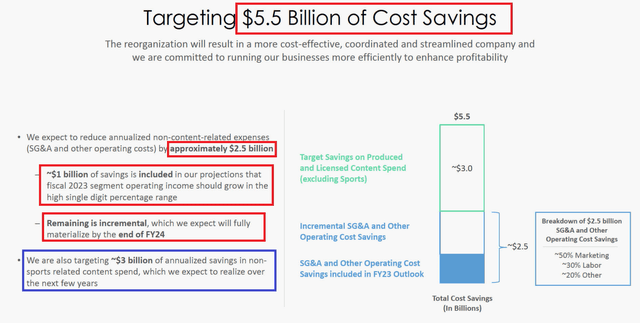

With the new CEO, the company is now having an ambitious target of $5.5bn cost-savings. From these roughly $2.5bn will be related to selling, general and administrative expenses with $1bn expected to be realized during this fiscal year.

This plan includes a reduction in Disney’s workforce by around 3% or roughly 7,000 employees.

To help achieve this, we will be reducing our workforce by approximately 7,000 jobs.

Source: Disney Earnings Transcript Q1 2023

Although the larger proportion of these layoffs would be realized during the second half of the fiscal year, Disney’s management is making very good progress already.

During the quarter, investors should also expect more news on the $3bn content spend reduction plan, which is a sharp U-turn on company’s recent strategy to prioritize quantity.

Thus, even though the quarterly results might not be very far off from the current expectations, the management has a significant opportunity to deliver quickly on its cost-reduction plan and provide a better than expected guidance for the rest of the fiscal year.

Such a scenario could result in a reduction of the gap between Disney’s EBIT margin and its Price-to-Sales multiple.

prepared by the author, using data from SEC Filings and Seeking Alpha

Past The Peak Losses In DTC

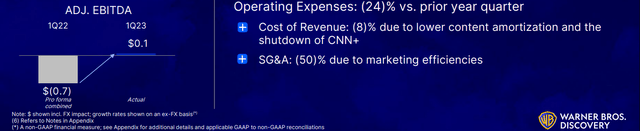

As usual, the other key area of focus during the quarterly earnings would be the direct-to-consumer business.

The recent disappointing results by Paramount Global (PARA) and problems related to Warner Bros. Discovery’s (WBD) drop in DTC distribution revenues are pointing to a challenging environment.

The woes, however, are likely to be limited to individual business models as Paramount’s streaming business is far smaller than that of Disney and is more likely to be affected by short-term swings.

While Paramount reported a 39% increase in direct-to-consumer revenue, the unit’s operating income fell amid higher costs to support the growth of Paramount+. And the company’s TV ad revenue fell by double digits amid a weaker market, though affiliate and subscription revenue also slipped, hurt in part by foreign exchange.

Source: Seeking Alpha

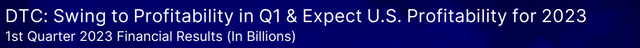

WBD on the other hand has been making good progress in terms of profitability of its DTC business.

Warner Bros. Discovery Investor Presentation

The integration and scaling of WBD’s streaming businesses is progressing well and with a stronger focus on quality of content and keeping fixed costs under control, the company is on track to achieve sustainable profitability on an annual basis.

Warner Bros. Discovery Investor Presentation

Given Disney’s dominant positioning in streaming, it is more likely to be in a situation similar to that of WBD as opposed to the smaller peer – Paramount+.

The recent trend in Disney’s DTC profitability also indicates that the company is likely past the peak losses during the last quarter of fiscal 2022.

prepared by the author, using data from SEC Filings

Momentum in Parks

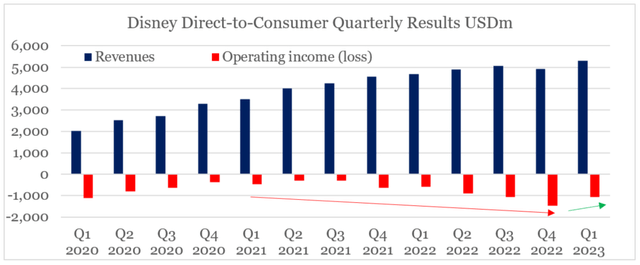

In addition to the cost-cutting efforts and the lower losses in the DTC segment, Disney would also benefit from the current momentum in its Parks, Experiences and Products segment.

As we saw during the last quarter, the company registered a record high operating income as demand remained strong and price increases took place.

Turning to Parks, Experiences and Products, we are thrilled with the results we achieved this quarter with operating income increasing 25% versus the prior year to over $3 billion, reflecting increases at our domestic and international parks and experiences businesses.

Source: Disney Earnings Transcript Q1 2023

The post-pandemic momentum of the business unit could be seen in the graph below and as long as consumer spending is strong, Disney could enjoy a major tailwind on its back.

prepared by the author, using data from SEC Filings

The problem of course is that a recession is highly likely in the second half of calendar 2032 and the annual change in Personal Consumption Expenditures is slowly decreasing even in the face of the higher inflation.

FRED

Conclusion

After years of struggles, Disney finally appears to be in a good spot to turn the business around and capitalize on the supportive macroeconomic environment. The three key areas outlined above, create the necessary conditions for the company to deliver a strong quarter and provide a better than expected guidance for the rest of 2023. Having said that, investors should remain focused on the long-term issues at the company and take into account the risk of a recession in the coming months.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Please do your own due diligence and consult with your financial advisor, if you have one, before making any investment decisions. The author is not acting in an investment adviser capacity. The author's opinions expressed herein address only select aspects of potential investment in securities of the companies mentioned and cannot be a substitute for comprehensive investment analysis. The author recommends that potential and existing investors conduct thorough investment research of their own, including a detailed review of the companies' SEC filings. Any opinions or estimates constitute the author's best judgment as of the date of publication and are subject to change without notice.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Looking for better positioned high quality businesses in the media space?

You can gain access to my highest conviction ideas in the sector by subscribing to The Roundabout Investor, where I uncover conservatively priced businesses with superior competitive positioning and high dividend yields.

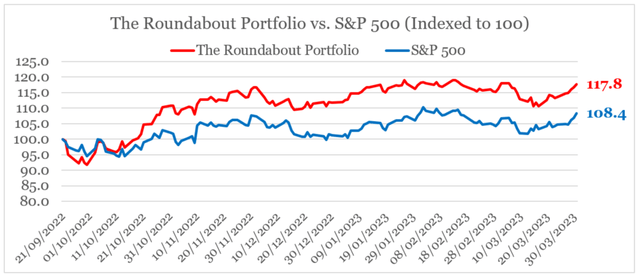

Performance of all high conviction ideas is measured by The Roundabout Portfolio, which has consistently outperformed the market since its initiation.

As part of the service I also offer in-depth market analysis, through the lens of factor investing and a watchlist of higher risk-reward investment opportunities. To learn more and gain access to the service, follow the link provided.