Summary:

- Strong DTC growth driven by subscriptions, advertising, and price increases.

- Weakness in domestic park business due to high interest rates, expected to recover with interest rate cuts.

- Growth forecast for FY24 and beyond, with a calculated fair value of $110 per share based on DCF analysis.

HAYKIRDI

I reiterated a ‘Strong Buy’ rating on Disney (NYSE:DIS) in my previous coverage published in May 2024, highlighting the growth potential in its streaming business driven by bundles, subscriber growth and advertising business. The company released its Q3 results on August 7th, reporting a 15% growth in DTC (Direct-To-Consumer) revenue and some softness in their domestic park business. While the current high interest rate is detrimental to its park demand, I believe the headwind is temporary. Therefore, I reiterate a ‘Strong Buy’ rating with a fair value of $110 per share.

Strong DTC and Weak Park Growth

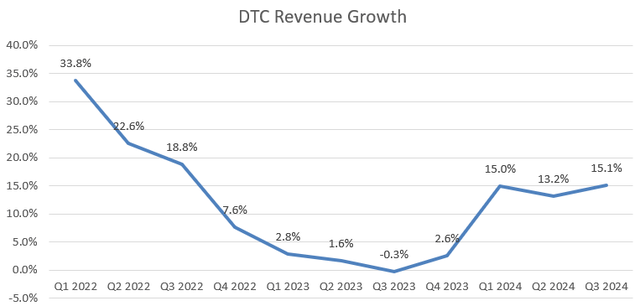

My biggest takeaway from the quarter is the growth momentum of Disney’s DTC business. As depicted in the chart below, their DTC revenue grew by 15.1% year-over-year.

The strong DTC growth is driven by:

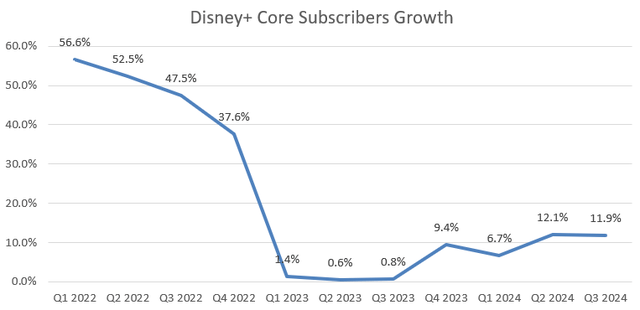

- Strong subscription growth: As shown in the chart below, the number of Disney+ core subscribers grew by 11.9% year-over-year, driven by the company’s efforts to crackdown on password sharing; streaming bundle offerings, as well as international expansions. As discussed in my previous coverage, the streaming bundles enable Disney to reach a broader customer base and offer more options to its customers.

- Strong Ads Growth: As communicated over the earnings call, the number of domestic streaming advertisers grew by more than 20% in Q3, driven by automation and programmatic advertising business. In my previous article, I analyzed Disney’s potential for advertising growth, noting that the company’s impressive streaming content and ad-supported services could attract customers who are sensitive to monthly subscription fees.

- Price Increase: Starting from mid-October, Disney will raise the price for Disney+, Hulu and ESPN+, with an increase of $1 or $2 more per month. Notably, Hulu will see a $6 increase per month from mid-October. While the price hike might face the pushback from their customers, it is expected to boost revenue growth in the near term.

- An important takeaway from the quarter is the weak growth in domestic park business, caused by the weak consumer sentiments and high interest rates. As disclosed over the earnings call, 60% of the Experiences business comes from domestic park and cruise ships. Disney experienced a flat attendance growth for the quarter, and the management expects flat revenue growth in the upcoming quarter. I think the weakness of the park business makes sense, as the park business is quite discretionary, and customers may cut spending on such experiences when cash flow is tight. However, once the Fed begins to cut interest rate, I believe the park business will recover, as demand from families wanting to visit Disney parks remains strong.

Growth Forecast and Valuation

For FY24’s growth, I am considering the followings:

- Entertainment: I anticipate its DTC business will continue growing in the mid-teens, driven by various streaming bundle services, ads growth as well as international expansion. The traditional cable business is facing structural challenges as customers switch to online streaming services. As such, I forecast Disney will grow its Entertainment business by low-single-digit in FY24.

- Sports: ESPN business grew by 5% in Q3, and the growth is across both the domestic and international markets. I assume Disney will grow its Sports business by 5% in FY24, primarily driven by subscriber and pricing growth.

- Experiences: As discussed previously, the domestic park and cruise business are facing growth challenges in FY24 amid the high interest rates. I don’t expect the business to recover before the interest rate cut. As such, I model only 1% year-over-year growth for the Experiences business in FY24.

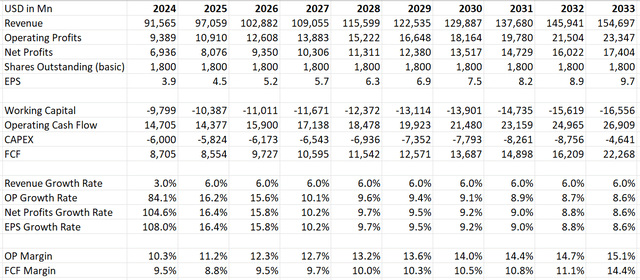

As such, I calculate that Disney’s revenue is going to increase by 3% in FY24.

For the growth rate from FY25 onwards, I assume the Entertainment business will grow by 6% (the cable business decline will begin to stabilize), Sports by 5% (Subscriber and pricing growth), and Experiences by 6% (aligned with historical trend). Therefore, I anticipate 6% normalized revenue growth from FY25.

Disney has been making significant efforts to reduce operating expenses. In addition, the company is controlling the content spending, which will contribute to lower amortization costs. I calculate Disney can expand its margin to 15.1% by FY33, assuming a 10-50bps from gross profit expansion; 20bps from SG&A leverage and 10-50bps from lower amortization and restructuring costs.

The DCF summary:

The WACC is calculated to be 10% assuming: risk-free rate 4.2% ((US 10Y Treasury Yield)); equity risk premium 7%; cost of debt 7%; debt balance $46 billion; equity $108 billion; tax rate 25%; beta 1.15 (SA).

The fair value of Disney’s stock price is calculated to be $110 per share after discounting all the future free cash flow.

Downside Risks

Disney has more than $47 billion of debts on their balance sheet, with a gross debt leverage of 4.4x at the end of FY23, which is a quite high leverage level. As discussed in my previous article, the company has committed to investing in their CAPEX to expand their park and cruise business. However, considering the softness of domestic park and cruise demands, their management might need to reassess their investment plans in the near future.

Conclusion

I think the softness in Disney’s Park business is temporary and will probably start to recover when the Fed starts to cut interest rate. The revenue growth and margin expansion of its DTC are very encouraging. I reiterate a ‘Strong Buy’ rating with a fair value of $110 per share.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of DIS either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.