Summary:

- Disney’s Q4 and full fiscal year results were exceptionally well-received by the market, but I remain skeptical.

- FY 2025 outlook is nothing to brag about, and DIS is very generously priced on a free cash flow basis.

- On top of that, margin improvements are unlikely to persist for long, which is quite concerning for long-term investors.

- All eyes are still on the direct-to-consumer segment, which is already showing signs of weakness.

hapabapa

Disney (NYSE:DIS) just reported its Q4 and full fiscal year results, and the stock price reaction clearly illustrates the wave of optimism surrounding the business.

Although the topline and earnings figures were just barely above the estimates, the optimistic outlook for FY 2025 and the progress made in the direct-to-consumer space were enough to lift investors’ spirits and result in the stock skyrocketing by more than 10% in early trading hours.

Seeking Alpha

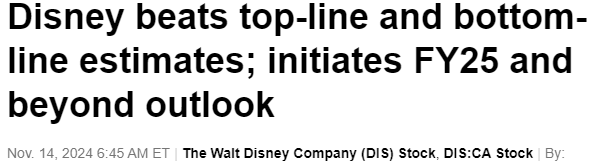

On the surface, it appears as if the stock could finally break away from its disastrous performance over the past five years, which saw DIS delivering a negative 30% total return, at a time when the S&P 500 has doubled. An outcome that was relatively easy to predict back in 2019, as long as one wasn’t falling victim to the exciting narrative created by Disney’s management.

With that in mind, we should take a closer look at Disney’s most recent report and evaluate the results within the context of the current share price and all the risks and uncertainties regarding the company’s future profitability.

Priced-In Already

As I said above, on the surface, the fourth quarter was very strong and seems to justify a strong share price response as well. Revenue growth accelerated to 6% on a quarterly basis and earnings per share have nearly doubled to $0.25, from $0.14 in the same quarter a year ago.

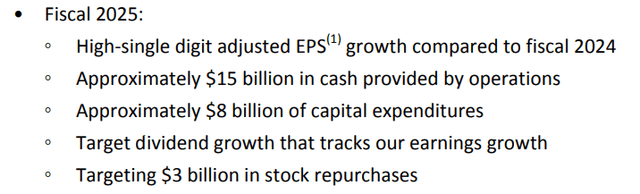

The outlook for FY 2025 gave investors more reason to rejoice with EPS expected to grow in the high-single-digit, an expected dividend increase, and an ongoing share repurchase commitment.

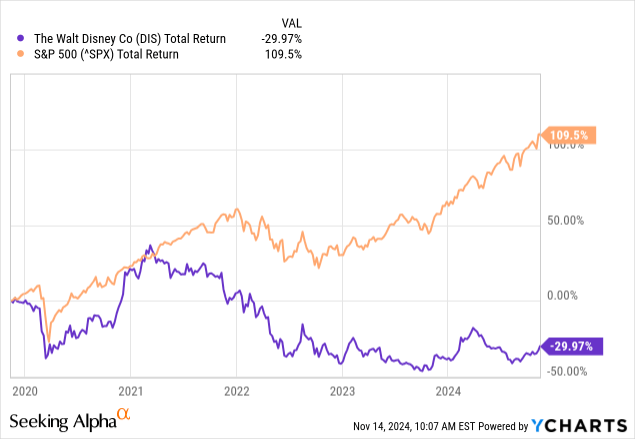

If we take a closer look at the company’s free cash flow, however, we could see that FY 2025 would not see a meaningful improvement. Quite the opposite, given the notable increase in capex, free cash flow is expected to be modestly down next year.

Prepared by the author, using data from SEC Filings

This is not good news for potential shareholder returns, as Disney currently trades at a free cash flow yield of just slightly above 4%, which is extremely low for a company that is expected to grow at low-single-digit and at a time when 10-year bond yields are also above 4%.

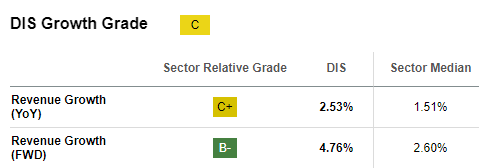

Seeking Alpha

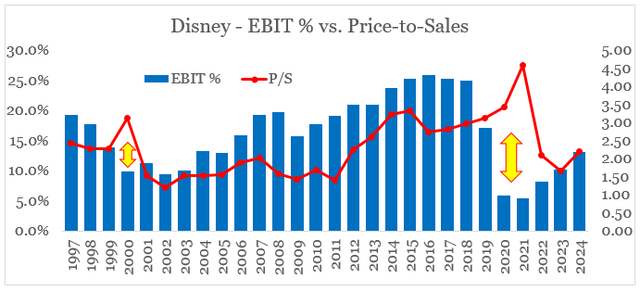

Profitability improvement was also a key area for investors as the operating margin reached 13%. Based on the long-term graph between Disney’s EBIT margin and the stock’s price/sales multiple, we could see that this development is already priced in.

Prepared by the author, using data from SEC Filings and Seeking Alpha

The more important issue, however, is whether or not this margin improvement could continue beyond the near term.

A Closer Look At Profitability

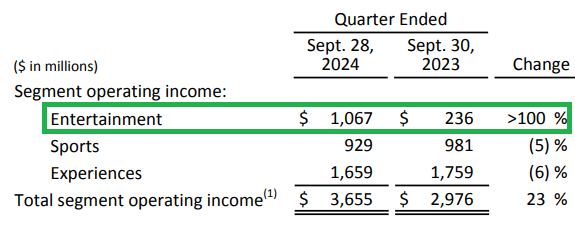

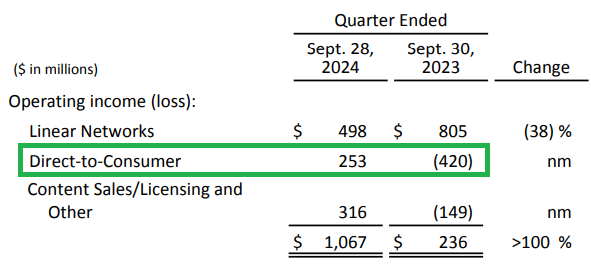

The main reason for Disney’s operating income increase during the quarter and the whole fiscal year was the Entertainment segment, with Sports and Experiences being in negative territory year-on-year.

Disney Earnings Release

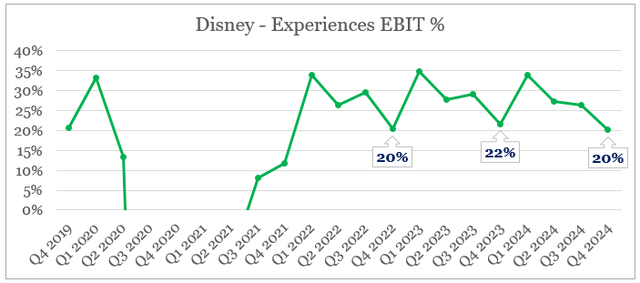

Margins in the Experiences segment seem to have peaked already in the previous fiscal year. As we can see from the graph below, the fourth quarter marks a seasonal low for margins in anticipation for the strong Holiday season. In the fourth quarter of this fiscal year margins stood at 20%, which is lower than the comparable period from the prior year.

Prepared by the author, using data from earnings releases

Within Entrainment, the direct-to-consumer sub-segment, which swung to profitability at last, was the main reason why overall operating income increased. Content sales & licensing also contributed to the profitability increase.

Disney Earnings Release

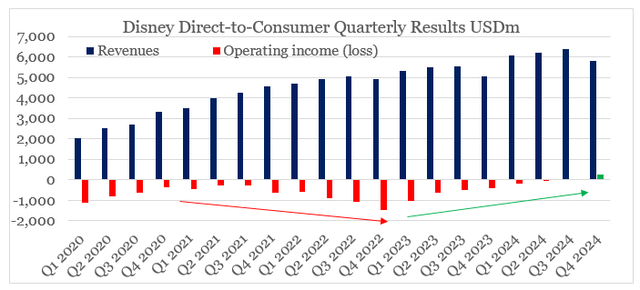

The quarterly trend in DTC segment profitability is indeed encouraging and by looking at the graph below we could see why some market participants are getting excited about Disney’s prospects.

Prepared by the author, using data from earnings releases

In reality, however, extrapolating this trend beyond the very near term is quite risky. The most recent quarterly improvement in DTC segment operating results was primarily due to increases in retail pricing, subscriber growth, and increase in advertising revenue.

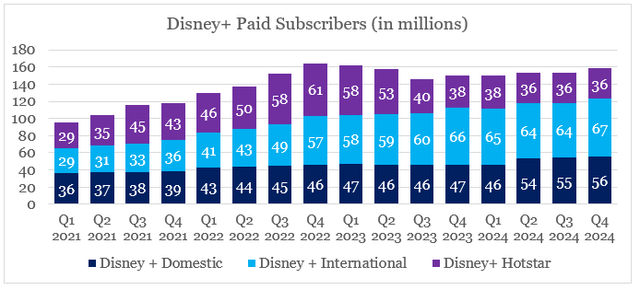

Year-on-year growth in both Disney+ domestic and international segments seems to have stalled.

Prepared by the author, using data from earnings releases

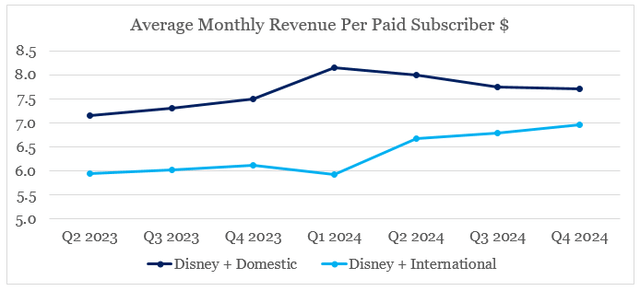

Average revenue per paid subscriber in the U.S. has also been under pressure, and price increases within international have been offsetting that.

Prepared by the author, using data from earnings releases

It seems that an increasing number of subscribers are opting for low-priced options, and this trend is concerning as we enter the Holiday season.

Domestic Disney+ average monthly revenue per paid subscriber decreased from $7.74 to $7.70 due to a higher mix of subscribers to ad-supported and wholesale offerings, partially offset by higher advertising revenue.

Source: Disney Q4 2024 Earnings Transcript

Conclusion

In spite of the strong improvement in earnings, Disney’s share price offers limited upside from here. Margin improvements are already priced in, and FY 2025 would offer limited upside in cash flow. On top of all that, margin improvements are on shaky grounds and might not last beyond the short term. With all that in mind, I remain skeptical that DIS could outperform the market, but short-term momentum does not justify a sell rating either.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Please do your own due diligence and consult with your financial advisor, if you have one, before making any investment decisions. The author is not acting in an investment adviser capacity. The author's opinions expressed herein address only select aspects of potential investment in securities of the companies mentioned and cannot be a substitute for comprehensive investment analysis. The author recommends that potential and existing investors conduct thorough investment research of their own, including a detailed review of the companies' SEC filings. Any opinions or estimates constitute the author's best judgment as of the date of publication and are subject to change without notice.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Looking for better positioned high quality businesses in the media space?

You can gain access to my highest conviction ideas in the sector by subscribing to The Roundabout Investor, where I uncover conservatively priced businesses with superior competitive positioning and high dividend yields.

As part of the service I also offer in-depth market analysis, through the lens of factor investing and a watchlist of higher risk-reward investment opportunities. To learn more and gain access to the service, follow the link provided.